Melt Up!

Melt UP!

Suddenly stock markets metastasize into a frenetic melt-up mode.

In the US, the S&P 500, the S&P 400 Mid-caps and the small cap Russell 2000 set new record highs.

The German Dax and the French CAC also carved fresh landmark highs.

In Asia, Australia’s S&P ASX, and India’s Sensex shared a similar feat. Ironically just a few months back the Indian economy seemed as staring into the abyss—to borrow from German Philosopher Friedrich Nietzsche[1]. How confidence changes overnight

And knocking at the door of historic highs are New Zealand Exchange 50 Gross, South Korea’s KOSPI, Taiwan’s TWSE, Hong Kong’s Hang Seng, and Malaysia’s KLSE

Media explains the melt up as a function of the debt ceiling deal and extended US Federal Reserve ‘credit easing’ stimulus. From Bloomberg, “U.S. stocks rose, sending the Standard & Poor’s 500 Index to a record, as speculation grew that the Federal Reserve will maintain the pace of stimulus after Congress ended the budget standoff.”[2]

Thus the common denominator in explaining the melt-up has been the market’s worship of debt expressed via the orgy of the speculative hunt for yields in the asset markets, particularly the stock markets.

Will the global melt-up influence the Phisix, the likely answer is yes. But….

How the FED Alters the Priorities of US Corporations

Goldman Sach's chief US equity strategist, David Kostin has been quoted as attributing the current US stock market surge on P/E multiple expansion, “The S&P 500 has returned 22% YTD driven almost entirely by P/E multiple expansion rather than higher earnings.”[3]

This means record US stocks has hardly been about earnings growth but of the aggressive bidding up of the equities.

More signs of the yield chasing frenzy.

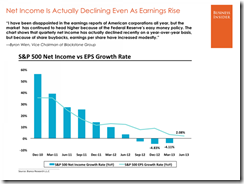

In addition, as pointed out above by Blackstone Group’s Byron Wien[4], S&P 500’s net income has been on a decline since 2010. This decline has been accompanied by a slowing of earning per share growth (y-o-y).

Yet, the modest gains in the growth rate of the S&P’s EPS have mainly been bolstered by share buybacks.

And as previously pointed out[5], a substantial portion of corporate share buybacks has been financed by bonds which remains a present dynamic[6].

In other words, the FED’s easy money policies, including the “UNTaper” have been prompting many publicly listed companies to shore up or ‘squeeze’ earnings growth via debt-financed corporate buybacks meant to raise prices of their underlying stocks.

Share buybacks has essentially substituted the capital or investment based expansion or the organic earnings growth paradigm. Said differently, publicly listed corporations have joined the herd in the feverish speculation on stocks rather than investing in the real economy.

This also means that the yield chasing mentality has infected the corporate board rooms, where corporate models appear to have been reconfigured to focus on the immediate attainment of higher share prices.

And a recent research paper has underscored such changes. Stern School of Business John Asker, Harvard’s Joan Farre-Mensa and Stern School of Business Alexander Ljungqvist finds[7], (bold mine)

Listed firms invest substantially less and are less responsive to changes in investment opportunities compared to matched private firms, even during the recent financial crisis. These differences do not reflect observable economic differences between public and private firms (such as lifecycle differences) and instead appear to be driven by a propensity for public firms to suffer greater agency costs. Evidence showing that investment behavior diverges most strongly in industries in which stock prices are particularly sensitive to current earnings suggests public firms may suffer from managerial myopia.

So short-termism, mainly brought about by the Fed’s policies, has afflicted many of the publicly listed firm’s priorities. Many executive officers and shareowners have presently elected to use the unsustainable speculative financing model of boosting earnings that yields temporal benefits for them.

This essentially defies Ben Graham’s 1st rule of margin of safety where companies should stick to what they know or ‘know your business’ and to avoid to making ““business profits” out of securities—that is, returns in excess of normal and dividend income” as I showed last week[8].

Yet all these will depend on the persistence of easy money regime, the suppression of the bond vigilantes and the sustainability of debt financed buyback model.

So while most publicly listed US companies have yet to immerse themselves into Ponzi financing, sustained easy money policies have been motivating them towards such direction.

A Dot.com Bubble Déjà vu? Google as Symptom?

The scrapping for yields has impelled many to jump on the IPO bandwagon despite poor track record of newly listed companies.

According to the Wall Street Journal, 19 out of 28 or 68% of the technology issues which debuted this year has been unprofitable over the last fiscal year or during the past 12 months, which has been the highest percentage since 2007 and 2001. Yet punters wildly piled on them.

The same article notes of intensifying signs of mania “The excitement over companies’ potential rather than their present results is the latest sign in the stock markets of a rising tolerance for risk. The U.S. IPO market, often seen as a gauge of risk appetite because the stocks don’t have a track record, is on pace to produce the most deals since 2007, according to Dealogic”[9]

And Art Cashin UBS Financial Services director of floor operations at a recent CNBC interview expressed worries over a remake of the dotcom bubble, “The way people are treating technology companies, it's starting to feel a bit too much like 1999 and 2000”[10]

1999, 2000 and 2007 signifies as the zenith of the dotcom (1999-2000) bubble and the US housing bubble (2007)

Has Google been leading the way?

Google’s [GOOG] stock breached past the US$ 1,000 levels (particularly $1,011.41) with a breath-taking 13.8% gap up spike last Friday.

At market cap of over $335 billion, Google surpassed Microsoft [MSFT] and is now the third largest company after Apple [APPL] and Exxon Mobile [XOM][11].

Since Google is a member of the S&P 500[12], Friday’s quantum leap materially contributed to the new record of the major S&P bellwether (SPX).

And as shown in the same chart, the S&P 400 mid cap and the small cap Russell 2000 flew to the firmament last week.

Three of the 5 largest S&P companies are from the information technology. In addition, technology comprises the largest sectoral weighting at 17.7% on the S&P, followed closely by financials 16.5%, and from a distance, Healthcare 13.2%, consumer discretionary 12.3% and the others.

Should the technology mania persist, this will be reflected on the relative strength of sector, as well as, through a bigger share of the same sector in the S&P 500’s sectoral weighting.

Surprise 3rd quarter revenue growth of 23% from advertising part of which came from the mobile platform and Wall Street “emotion” has been attributed to Google’s spectacular price spike.

This Yahoo article[13] says that part of adrenaline rush on Google’s share prices has been to due low exposure on stocks by institutional investors (bold mine)

Google is higher today because it reported strong numbers, but it's not a 10% better company today than it was 24 hours ago. Wall Street is in a manic phase at the moment. For all the terrific things about Google's third-quarter, the best thing about the report was that it came on a day when institutional investors are feeling like they have far too little exposure to stocks. The average hedge fund was up less than 10% through September and there weren't many people expecting this race to new highs on the S&P500 (^GSPC) on the heels of debt ceiling debacle.

In short, more signs of frantic yield chasing.

Google’s reported 3rd quarter earnings of $10.74 per share[14], which came ahead of consensus estimates of $10.34.

While I am a fan of Google’s products, I hardly see value in Google’s stocks.

Yahoo data[15] shows that Google has a trailing PE (ttm or trailing twelve months intraday) at 27.52, forward PE (fye or fiscal year end: December 2014) at 19.42, Price/book (mrq or most recent quarter) 3.75 and enterprise multiple of enterprise/ebitda (ttm or trailing twelve months) at 16.14.

The above multiples exhibit how richly priced GOOG has been

The same applies to the general stock market

Based on the prospects of continued declining earnings growth rate and based on the trailing PE[16], as of Friday’s close, the Dow Industrials has a ratio of 17.24, from last year’s 14.47, the S&P 500 at 18.32 from 17.03 a year ago and the Nasdaq 100 at 20.88 from last year’s 15.24.

Most shockingly, the small cap Russell 2000 has a PE ratio of 86.58 from 32.69 a year ago! The Russell PE ratio more than doubled this year. Wow.

While I have not encountered GOOG resorting to share buybacks yet, GOOG’s increasing recourse to debt to finance[17] her operations has hardly been an attraction.

What perhaps may justify GOOG’s current prices is the prospect of success from its upcoming products such as the driverless cars, Google Glass and the cloud based planning applications called the “Genie” targeted at the construction industry[18].

But this would be audacious speculation.

And overconfidence has become a dominant feature.

Aside from stock market bulls brazenly hectoring and scoffing at the bears, market participants have been conditioned to see stock markets as a one way street.

For instance, record stocks which brought about the biggest single-day decline in U.S. equity volatility since 2011 rewarded the bullish option traders who aggressively doubled down on bets that the bull market in stocks would survive the default deadline[19].

The consensus has been hardwired to see any stock market decline as opportunity to “double down”.

For the bulls, risks have vanished. The stock market’s only designated direction seems up, up and away.

Yet the bullish consensus seems oblivious to the reality of the deepening dependence the stock market (and even housing) has been to the Fed’s credit easing measures. They are ignoring the fact that corporate business models have been evolving towards speculation, rather than to productive investments. Expanding price multiples, declining net income and EPS growth rate, increasing dependence on buybacks and debt financing for speculation are symptoms of such transition.

Aside from corporations, the convictions of bullish market participants are being reinforced by evidences of more aggressive actions.

While I don’t expect the FED to take the proverbial punch bowl away, everything depends on the actions of the bond vigilantes. For now, the bond vigilantes have been in a retreat. The hiatus by the bond vigilantes provides room for the bulls to magnify on their advances. Question is for how long?

If QE 3.0 in September of 2012 pushed backed the bond vigilantes for only 3 months, will the euphoric effects of the UNtaper, Yellen as Fed Chairwoman, debt ceiling deal last longer?

The French Disconnect

As I pointed out above, the UNtaper-debt ceiling deal has incited many markets to a melt-up mode which media rationalizes as “recovery”.

The French stock market, which is also at record highs, serves as an example.

The CAC 40 has been rising since the last quarter of 2011. Yet during 2012-2013, as the CAC rose, the French economy vacillated in and out of negative growth rates or recessions. While economic growth statistics reveal of a recent recovery, sustainability of the recovery is unclear.

French industrial production was down 1.6% in August[20], Unemployment rate is at the highest level since 1998 at 10.9% at the second quarter[21]. August loans to the private sector have been trending downwards since May[22]. Fitch downgraded France last July[23]. [note to the aficionados of credit rating agencies, French downgrade coincided with higher stocks]

Yet the CAC continues to trek to new highs. What gives?

Notes on the Debt Ceiling Deal

Furloughed Federal employees will receive a back pay[24]. This means government shutdown for furloughed employees extrapolates to a paid vacation.

The bi-partisan horse trading resulted to insertions of various goodies (Pork) for politicians. This includes $174,000 death benefit for Sen. Frank Lautenberg’s widow[25]

The US treasury will be authorized to suspend the debt ceiling as I earlier posted[26]. A limitless borrowing window will be extended until February 7, 2014[27].

This marks the second time when the debt ceiling has been unilaterally suspended. The first occurred this year from February 4, 2013 to May 18, 2013[28].

What seems as an increasing frequency of the suspension of the debt ceiling (twice this year) may presage a permanent one.

A day past the US debt ceiling deal, US debt soared by a record $328 billion. This has shattered the previous high of $238 billion set two years ago as the US government reportedly replenished its stock of “extraordinary measures” used to keep debt from going past he mandated level[29]. This brings US debt to $17.075 trillion Thursday.

Two days after, US debt further expanded by $7 billion to $17,082,571,268,248.24[30].

Debt levels growing at a rate far faster than the rate of economic growth is simply unsustainable.

Since 2008, US Federal has grown past $ 7 trillion whereas the economy grew by nearly $1 trillion[31].

There is always a consequence to every action, so will the above.

Yet this is what equity market praises.

[1] Friedrich Nietzsche CHAPTER IV: APOPHTHEGMS AND INTERLUDES Beyond Good and Evil, p 107 planetpdf.com

[2] Bloomberg.com S&P 500 Surges to Record on Fed Bets After Debt Deal, October 18, 2013

[3] Zero Hedge Goldman: Entire S&P Move Higher Is Due To Multiple Expansion; Shiller P/E Says 30% Overvalued So... Buy

[4] Business Insider Net Income is Actually Declining even as Earnings Rise, Wall Street's Brightest Minds Reveal THE MOST IMPORTANT CHARTS IN THE WORLD, October 9, 2013

[5] See Phisix: Rising Systemic Debt Erodes the Margin of Safety October 14, 2013

[6] Reuters.com Bond-backed stock buybacks remain in vogue September 6, 2013

[7] John Asker, Joan Farre-Mensa and Alexander Ljungqvist Corporate Investment and Stock Market Listing: A Puzzle? April 22, 2013 Social Science Research Network

[8] See Phisix: Rising Systemic Debt Erodes the Margin of Safety October 14, 2013

[9] The Wall Street Journal Market Pulse In Latest IPOs, Profits Aren’t the Point October 11, 2013

[10] CNBC.com Cashin: Tech valuations remind me of dot-com bubble October 17, 2013

[11] FoxNews.com Boom: Google Zooms 13% to a Record High; Market Cap Tops $335B October 18, 2013

[12] S&P Dow Jones McGraw Hill Financial S&P 500 Indices Fact Sheet

[13] Jeffe Macke Is Google Worth $1,000 a Share? Yahoo.com October 18, 2013

[14] Google Investor Relations Google Inc. Announces Third Quarter 2013 Results

[15] Yahoo Finance, Google Inc. (GOOG) Key Statistics

[17] 4-traders.com Google Inc (GOOG)

[18] Businessinsider.com Google's Secret Project 'Genie' Could Transform The Construction Industry October 18, 2013

[19] Bloomberg.com VIX 21% Tumble Means Shorts on Volatility Double Money October 17, 2013

[20] Tradingeconomics.com FRANCE INDUSTRIAL PRODUCTION

[21] Tradingeconomics.com FRANCE UNEMPLOYMENT RATE

[22] Tradingeconomics.com FRANCE LOANS TO PRIVATE SECTOR

[23] Bloomberg.com France Loses Top Credit Rating as Fitch Cites Lack of Growth July 13, 2013

[24] Fox News.com Senate budget deal provides back pay for furloughed federal workers October 16, 2013

[25] Abcnews.com $174,000 to a Senator’s Widow and Other Surprises in the Fiscal Compromise Bill October 16, 2013

[26] See Quote of the Day: There is now No Limit in government borrowing October 18, 2013

[28] The Foundry Debt Ceiling with $300 Billion in New Debt, Heritage Foundation, May 19, 2003

[29] Washington post U.S. debt jumps a record $328 billion — tops $17 trillion for first time October 18, 2013

[30] Brilling.com U.S. NATIONAL DEBT CLOCK

[31] Lance Roberts The Long Game Of Hiking The Debt Ceiling STA Wealth October 11, 2013