Nineteenth century statesman Lord Palmerston famously said that “nations have no permanent friends or allies, they only have permanent interests.” As anyone who has ever opened a history book knows, Russia’s permanent interest has always been access to warm-water seaports. So perhaps we can just reduce the current showdown over Crimea to this very simple truth: there is no way Russia will ever let go of Sevastopol again. And aside from the historical importance of Crimea (Russia did fight France, England and Turkey 160 years ago to claim its stake on the Crimean peninsula), there are two potential reasons for Russia to risk everything in order to hold on to a warm seaport. Let us call the first explanation “reasoned paranoia,” the other “devilish Machiavellianism.”

Reasoned paranoia

Put yourself in Russian shoes for a brief instant: over the past two centuries, Russia has had to fight back invasions from France (led by Napoleon in 1812), an alliance including France, England and Turkey (Crimean War in the 1850s), and Germany in both world wars. Why does this matter? Because when one looks at a map of the world today, there really is only one empire that continues to gobble up territory all along its borders, insists on a common set of values with little discussion (removal of death penalty, acceptance of alternative lifestyles and multi- culturalism...), centralizes economic and political decisions away from local populations, etc. And that empire may be based in Brussels, but it is fundamentally run by Germans and Frenchmen (Belgians have a hard enough time running their own country). More importantly, that empire is coming ever closer to Russia’s borders.

Of course, the European Union’s enlargement on its own could be presented as primarily an economic enterprise, designed mainly to raise living standards in central and eastern Europe, and even to increase the potential of Russia’s neighbors as trading partners. However, this is not how most of the EU leaders themselves view the exercise; instead the EU project is defined as being first political, then economic. Worse yet in Russian eyes, the combination of the EU and NATO expansion, which is what we have broadly seen (with US recently sending fighter jets to Poland and a Baltic state) is a very different proposition, for there is nothing economic about NATO enlargement!

For Russia, how can the EU-NATO continuous eastward expansion not be seen as an unstoppable politico-military juggernaut, advancing relentlessly towards Russia’s borders and swallowing up all intervening countries, with the unique and critical exception of Russia itself? From Moscow, this eastward expansion can become hard to distinguish from previous encroachments by French and German leaders whose intentions may have been less benign than those of the present Western leaders, but whose supposedly “civilizing” missions were just as strong. Throw on top of that the debate/bashing of Russia over gay rights, the less than favorable coverage of its very expensive Olympic party, the glorification in the Western media of Pussy Riot, the confiscation of Russian assets in Cyprus ... and one can see why Russia may feel a little paranoid today when it comes to the EU. The Russians can probably relate to Joseph Heller’s line from Catch-22:“Ju st because you're paranoid doesn't mean they aren't after you.”

Devilish Machiavellianism

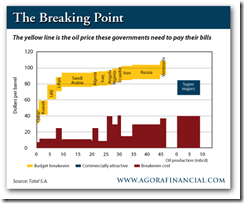

Moving away from Russia’s paranoia and returning to Russia’s permanent interests, we should probably remind ourselves of the following when looking at recent developments: 1) Vladimir Putin is an ex-KGB officer and deeply nationalistic, 2) Putin is very aware of Russia’s long-term interests, 3) when the oil price is high, Russia is strong; when the oil price is weak, Russia is weak.

It is perhaps this latter point that matters the most for, away from newspapers headlines and the daily grind of most of our readers, World War IV has already started in earnest (if we assume that the Cold War was World War III). And the reason few of us have noticed that World War IV has started is that this war pits the Sunnis against the Shias, and most of our readers are neither. Of course, the reason we should care (beyond the harrowing tales of human suffering coming in the conflicted areas), and the reason that Russia has a particular bone in this fight, is obvious enough: oil.

Indeed, in the Sunni-Shia fight that we see today in Syria, Lebanon, Iraq and elsewhere, the Sunnis control the purse strings (thanks mostly to the Saudi and Kuwaiti oil fields) while the Shias control the population. And this is where things get potentially interesting for Russia. Indeed, a quick look at a map of the Middle East shows that a) the Saudi oil fields are sitting primarily in areas populated by the minority Shias, who have seen very little, if any, of the benefits of the exploitation of oil and b) the same can be said of Bahrain, where the population is majority Shia.

Now of course, Iran has for decades tried to infiltrate/destabilize Shia Bahrain and the Shia parts of Saudi Arabia, though so far, the Saudis (thanks in part to US military technology) have done a very decent job of holding their own backyard. But could this change over the coming years? Could the civil war currently tearing apart large sections of the Middle East get worse?

At the very least, Putin has to plan for such a possibility which, let’s face it, would very much play to Russia’s long-term interests. Indeed, a greater clash between Iran and Saudi Arabia would probably see oil rise to US$200/barrel. Europe, as well as China and Japan, would become even more dependent on Russian energy exports. In both financial terms and geo-political terms, this would be a terrific outcome for Russia.

It would be such a good outcome that the temptation to keep things going (through weapon sales) would be overwhelming. This is all the more so since the Sunnis in the Middle East have really been no friends to the Russians, financing the rebellions in Chechnya, Dagestan, etc. So having the opportunity to say “payback’s a bitch” must be tempting for Putin who, from Assad to the Iranians, is clearly throwing Russia’s lot in with the Shias. Of course, for Russia to be relevant, and hope to influence the Sunni-Shia conflict, Russia needs to have the ability to sell, and deliver weapons. And for that, one needs ships and a port. Ergo, the importance of Sevastopol, and the importance of Russia’s Syrian port (Tartus, sitting pretty much across from Cyprus).

The questions raised

The above brings us to the current Western perception of the Ukrainian crisis. Most of the people we speak to see the crisis as troublesome because it may lead to restlessness amongst the Russian minorities scattered across Eastern Europe and Central Asia, and tempt further border encroachments across a region that remains highly unstable. This is of course a perfectly valid fear, though it must be noted that, throughout history, there have been few constants to the inhabitants of the Kremlin (or of the Winter Palace before then). But nonetheless, one could count on Russia’s elite to:

a) Care deeply about maintaining access to warm-water seaports and

b) Care little for the welfare of the average Russian

So, it therefore seems likely that the fact that Russia is eager to redraw the borders around Crimea has more to do with the former than the latter. And that the Crimean incident does not mean that Putin will try and absorb Russian minorities into a “Greater Russia” wherever those minorities may be. The bigger question is that having secured Russia’s access to Sevastopol, and Tartus, will Russia use these ports to influence the Shia-Sunni conflict directly, and the oil price indirectly?

After all, with oil production in the US re-accelerating, with Iran potentially foregoing its membership in the “Axis of Evil,” with GDP growth slowing dramatically in emerging markets, with either Libya or Iraq potentially coming back on stream at some point in the future, with Japan set to restart its nukes ... the logical destination for oil prices would be to follow most other commodities and head lower. But that would not be in the Russian interest for the one lesson Putin most certainly drew from the late 1990s was that a high oil price equates to a strong Russia, and vice-versa.

And so, with President Obama attempting to redefine the US role in the region away from being the Sunnis’ protector, and mend fences with Shias, Russia may be seeing an opportunity to influence events in the Middle East more than she has done in the past. In that regard, the Crimean annexation may announce the next wave of Sunni-Shia conflict in the Middle East, and the next wave of orders for French-manufactured weapons (as the US has broadly started to disengage itself, France has been the only G8 country basically stepping up to fight in the Saudi corner ... a stance that should soon be rewarded with a €2.7bn contract for Crotale missiles produced by Thales and a €2.4bn contract for Airbus to undertake Saudi’s border surveillance). And, finally, the Crimean annexation may announce the next gap higher in oil prices.

In short, buying a straddle option position on oil makes a lot of sense. On the one hand, if the Saudis and the US want to punish Russia for its destabilizing actions, then the way to do it will be to join forces (even if Saudi-US relations are at a nadir right now) and crush the oil price. Alternatively, if the US leadership remains haphazard and continues to broadly disengage from the greater Middle East, then Russia will advance, provide weapons and intelligence to the Shias, and the unfolding Sunni- Shia war will accelerate, potentially leading to a gap higher in oil prices. One scenario is very bullish for risk assets, the other is very bearish! Investors who believe that the US State Department has the situation under control should plan for the former. Investors who fear that Putin’s Machiavellianism will carry the day should plan for the latter (e.g., buy out-of-the-money calls on oil, French defense stocks, Russian oil stocks).