The Keynesians have no equivalent of this slogan: "There is no such thing as a free lunch." This is a powerful slogan. So is this one: "You can't get something for nothing." So is this one: "If it sounds too good to be true, it probably is." So is this one: "Honesty is the best policy." But, above all others, we have this one: "Thou shalt not steal."The Keynesians have this slogan: "I'm from the government, and I'm here to help you." The entire case for Keynesianism is based on this slogan.This is why it pays to defend freedom. Even when the overwhelming majority of voters do not want to hear the arguments, we should keep making them. We should keep pointing out that there will be horrendous negative repercussions for violations of the principle of voluntary exchange. We don't get a hearing, except during crises. I have good news. There will be plenty of crises in which we will get a hearing.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, February 02, 2016

Quote of the Day: The Entire Case for Keynesianism is Based on this Slogan

Tuesday, August 05, 2014

Why Asia is in Trouble: Corporate Savings Under Assault

Investors have long criticized many of Asia’s corporate giants for hoarding billions of dollars. Now those cash piles are under attack from governments that want them put to better use driving economic growth.Last month, Korea announced that as part of a $40 billion economic stimulus package, it would impose a tax on companies that keep piling up savings instead of paying them out to workers or shareholders.In Japan, Prime Minister Shinzo Abe has pushed companies to raise payouts to shareholders and workers, and Beijing has ordered state-owned behemoths to boost their dividends to the government to help pay for expanded social-welfare programs.The International Monetary Fund took aim at the issue this month in its latest report on Japan, calling on Friday for better corporate governance to help “unstash Japan’s corporate cash.” The IMF estimates Japanese companies are sitting on record amounts of cash, equivalent to more than 9% of gross domestic product.The idea is that by unleashing these corporate cash lodes onto shareholders and employees, they will either invest it more profitably in other parts of the economy, or simply spend it – either of which is better for growth than having it sit in the bank.

Unfortunately economic thinking has now deteriorated to the point that one of the major economic fallacies the classical economists refuted is now presented on a daily basis in universities, colleges and the media as an irrefutable fact. The result is that governments the world over are implementing policies that direct economic activity to increased consumption at the expense of gross investment. As the Austrians are forever pointing out, it is gross investment, expenditure on all future-goods factors, that maintain the capital structure: not net investment or consumer spendingWe are thus left with the conclusion that fighting a recession by encouraging consumption will prolong and perhaps even deepen it. One thing is certain from an Austrian perspective: if the critical point is reached where increased consumption spending continues to drive down gross investment then real wages must eventually fall if the phenomenon of permanent widespread unemployment is to be avoided.

Thursday, May 30, 2013

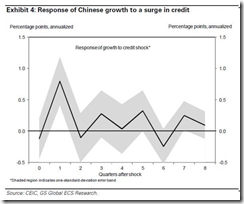

China Bubble: Diminishing Returns of Credit

China’s economy is proving less responsive to credit, escalating pressure on Premier Li Keqiang to strengthen the role of private enterprise.The government’s broadest measure of credit rose 58 percent to a record 6.16 trillion yuan ($1 trillion) in January-to-March, when gross domestic product gained 7.7 percent, compared with 8.1 percent a year earlier. Each $1 in credit firepower added the equivalent of 17 cents in GDP, down from 29 cents last year and 83 cents in 2007, when global money markets began to freeze, according to data compiled by Bloomberg.The diminishing returns to lending heighten focus on the need for what the International Monetary Fund said yesterday are “decisive” policy changes in the world’s second-largest economy. Without a refocus away from state-approved projects, Li and President Xi Jinping risk overseeing both a further slowdown in growth and an increase in non-performing loans.The article reveals of the Chinese government’s entrenched adaption of Keynesian policies which views credit as an indispensable macro tool used to attain economic growth.

Monday, November 26, 2012

Vietnam’s Keynesian Property Bubble Bust

Office and retail rents in Vietnam’s two largest cities have slumped as a wave of supply entered the market at a time when slowing economic and retail-sales growth curbs demand for commercial real estate. The Hanoi market added more office and retail space since the start of 2011 than in the previous four years combined, according to property broker CBRE.The average asking rent for top-grade central business district office space in Hanoi was about $47 per square meter per month in 2009, more than double the levels for the same grade space in Bangkok and Kuala Lumpur at that time, according to data from the Vietnam unit of Los Angeles-based CBRE. The rate was 11 percent lower at $42.01 per square meter in the third quarter…

Real estate loans totaled 203 trillion dong ($9.7 billion) as of Aug. 31, of which 6.6 percent were classified as bad debt, Minister of Construction Trinh Dinh Dung told the National Assembly on Oct. 31, citing a State Bank of Vietnam report. A broader category of real estate-related loans, including property-backed debt, account for 57 percent of total outstanding borrowing, or about 1,000 trillion dong, he said…Many of Vietnam’s 1,300 state-owned enterprises are reportedly facing losses because of their recent forays into property, said Alfred Chan, director of financial institutions at Fitch Ratings in Singapore.“It is not obvious, if you were just to look at the disclosure, what the potential risks to the banking sector are if you just look at the real estate sector,” Chan said. “Some of this exposure could well come from non-real estate companies that have ventured into that sector.”Non-performing loans at banks are “significantly understated” and could be three or four times higher than official estimates, Fitch Ratings said in a March report.The central bank chief, Nguyen Van Binh, said in April the level of bad debt at some lenders may be “much higher” than reported. Bad debts in Vietnam’s banking system may have accounted for 8.82 percent of outstanding loans at the end of September, Nguyen Van Giau, head of the National Assembly’s economic committee, told legislators in Hanoi Nov. 13.

Easy money policy fueled a boom which got reflected on the stock market, the property sector and the inflation index. This bubble has been abetted by speculations by state owned enterprises. Some of which had been justified as infrastructure spending. The boom led to higher interest rates which eventually popped these politically induced malinvestments.

Tuesday, November 20, 2012

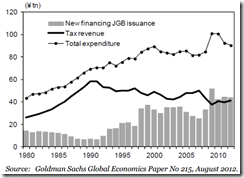

Japan’s Announces Fiscal Stimulus: 1 trillion Yen (US 12.3 B)

The Japanese government will spend 1 trillion yen ($12.3 billion) on a second round of fiscal stimulus as it tries to revive an economy at risk of sliding into recession.The government will tap reserve funds from this fiscal year’s budget, Chief Cabinet Secretary Osamu Fujimura told reporters in Tokyo today. The latest measures follow the announcement of 750 billion yen of stimulus last month.

Opposition leader Shinzo Abe, the leading contender to become prime minister after a Dec. 16 election, has called for unlimited easing and an increase in the central bank’s inflation goal to as much as 3 percent from 1 percent. His comments last week triggered the biggest two-day decline in the yen against the dollar in a year as investors speculated that more aggressive monetary loosening is looming.

Between 1992 and 1999, Japan passed eight stimulus packages, totaling roughly $840 billion in today's dollars. During that time, the debt-to-Gross Domestic Product (GDP) ratio skyrocketed, the country was rocked by massive corruption scandals, and the economy never recovered. All Japan had to show for it was a mountain of debt and some public works projects that look suspiciously like bridges to nowhere.

Friday, November 09, 2012

Uh Oh. China’s New Set of Policymakers could be Harvard Trained Keynesians

Li Yuanchao serves the Chinese Communist Party as head of its organization department. For a few months in 2002 he had a different overseer: Larry Summers.Li controls the patronage system of the 82 million-member party that this month is unveiling its next generation of leaders, overseeing an apparatus that names cadres to posts in state-owned companies including China Mobile Ltd. (941) and acting as career manager for thousands of rising officials. He took part in an executive training program at Harvard University when former U.S. Treasury Secretary Summers was the school’s president. Li reminded Summers of that when the two met in 2010 in Beijing.Li is the most prominent graduate of a program that has brought rising Chinese leaders to Harvard’s Cambridge, Massachusetts campus for more than a decade. The initiative underscores the fact that even as the U.S. and China are at odds over issues ranging from the value of the yuan to Syria, top politicians in China are increasingly drawing on their U.S. experiences in setting policy for the world’s second-biggest economy, said Anthony Saich, a professor at Harvard’s Kennedy School of Government who oversees the program.

Other graduates of the program at the Kennedy School’s Ash Center for Democratic Governance and Innovation include Commerce Minister Chen Deming and Zhao Zhengyong, the governor of Shaanxi province. They get face time with some of Harvard’s most famous professors. In one program, officials attend a series of seminars Saich calls “star turn.”Want to learn about how a country uses soft power? Joseph Nye, the political scientist who coined the term, holds a seminar on that. What about the U.S. presidency? Roger Porter, who served in three U.S. administrations, including as assistant to the president for economic policy under George H.W. Bush, meets with the students. Economics? Summers will lecture on the U.S. or global economy “or whatever’s on Larry’s mind at any particular time,” Saich said.Harvard’s Kennedy School has been expanding its offerings to Chinese officials and executives at state-owned enterprises since the first program -- for senior leaders at the vice- minister level -- began in 1998, sponsored by Hong Kong’s New World Development Co. About 150 officials have been through the program since its inception, with 20 each year at most, Saich said.

Harvard also attracts other relatives of China’s top leaders. Chen Xiaodan, the granddaughter of top planning official Chen Yun and daughter of China Development Bank Corp. Chairman Chen Yuan, graduated from the business school with an MBA this year, school records show. Xi Mingze, Xi Jinping’s daughter, is an undergraduate at Harvard College…

There are 686 full-time students from China enrolled at Harvard for the 2012-2013 academic year, more than from any other foreign country, and almost half of them, 331, are in the Graduate School of Arts and Sciences, according to the Harvard International Office website. The Harvard Kennedy School of Government, where Li and Bo attended, has 32 Chinese students, according to the site.Harvard’s links to China go back at least to 1879, when Ko Kun-Hua, a Chinese language teacher, was hired, according to the university website. Ko died of pneumonia less than three years after arriving and his books became part of the Harvard Yenching Library, which now has more than 1 million volumes.

And this also implies that the same political economic formula that has been a drag to the US (debt based consumption system) will likewise be the strategy used on China: a seemingly crafty move by US politicians through the Harvard nexus.

I am obliged to confess I should sooner live in a society governed by the first two thousand names in the Boston telephone directory than in a society governed by the two thousand faculty members of Harvard University.

Wednesday, October 03, 2012

Signs of Dancing on the Grave of Keynesianism

3) Last month, a school district in California sold $164 million worth of bonds at 12.6% interest; this is more than Pakistan, Botswana, and Ecuador pay in the international bond market.4) Based on the Treasury’s most recent statistics, US government interest payments to China will total at least $26.055 billion this year. The real figure may be much higher given that China has been purchased Treasuries for decades, back when interest rates were much higher. They’re still getting paid on those higher rates today.Even still, this year’s interest payment to China totals more than ALL the silver that was mined in the world last year.5) In August 2008, just before the Lehman Brothers collapse, the number of employed persons in the United States was 145.47 million persons. Over the subsequent years, the employment figure dipped to as low as 139.27 million. Today it stands at 142.1 million.Even if this is considered recovery, to ‘rescue’ those 2.8 million jobs, it took the federal government an additional $6.421 trillion worth of debt ($2.3 million per job), and a $1.9 trillion (203%) expansion of the Federal Reserve balance sheet.6) Meanwhile, despite trillions of euros in debt and bailouts, the unemployment rate in the eurozone just hit a record high of 11.4%… and a second Spanish bailout is now imminent.7) Inflation in Zimbabwe (3.63%) is lower than inflation in the UK (3.66%, August 2011-July 2012).8) Last week, the French government reached a ‘historic’ budget compromise, shooting for a budget deficit that’s ‘only’ 3% of GDP. This is based on an assumption that the economy will grow by 0.8%.In other words, France’s official public debt (which is already at 91% of GDP) will increase by 2.2% of GDP next year amid flat growth. And this is what these people consider progress.

It's because too many politicians believed that a free lunch was possible and a new economic paradigm had arrived. But we've heard that one before — like the philosopher's stone that could turn lead into gold. Prosperity without work is a dream of the ages.

Tuesday, October 02, 2012

Quote of the Day: Dancing on the Grave of Keynesianism

The Keynesians seem to be dominant today. They are dominant because they have been brought into the hierarchy of political power. They serve as court prophets to the equivalent of the Babylonians, just before the Medo-Persians took the nation.They are in charge of the major academic institutions. They are the main advisers in the federal government. They are the overwhelmingly dominant faction within the Federal Reserve System. Their only major institutional opponents are the monetarists, and the monetarists are as committed to fiat money as the Keynesians are. They hate the idea of a gold-coin standard. They hate the idea of market-produced money….The welfare-warfare state, Keynesian economics, and the Council on Foreign Relations are going to suffer major defeats when the economic system finally goes down. The system will go down. It is not clear what will pull the trigger, but it is obvious that the banking system is fragile, and the only thing capable of bailing it out is fiat money. The system is sapping the productivity of the nation, because the Federal Reserve's purchases of debt are siphoning productivity and capital out of the private sector and into those sectors subsidized by the federal government…I offer this optimistic assessment: the bad guys are going to lose. Their statist policies will bring destruction that they will not be able to explain away. Their plea will be rejected. "Give us more time. We just need a little more time. We can fix this if you let us get deeper into your wallets."In the very long run, the good guys are going to win, but in the interim, there is going to be a lot of competition to see which group gets to dance on the grave of the Keynesian system.Get out your dancing shoes. Keep them polished. Our day is coming.

Monday, July 16, 2012

Contagion Risk: Watch for China’s Catastrophic Deleveraging

Dee Woo at the Business Insider has an insightful analysis on why we should continue to keep vigil on China’s banking and financial system. (bold emphasis mine)

China’s policy makers have been caught in a dangerous bind.

1. The frustrated and aggressive central bank

If one wants to know how bad the health of China's economy has gone, look no further than the PBOC's composure, which seems rather frustrated and aggressive as of late. On 5th July, the central bank cut benchmark interest rates for the 2nd time in less than a month. This happened right after the fact that in December 2011, PBOC cut the reserve requirement ratio(RRR) by a 50 bp to 21%, it followed up with another 50 bp in February and another 50 bp in May to 20% currently.

On top of all the rate cuts, PBOC also made its biggest injection of funds into the money market in nearly six months. The PBOC injected a net 225 billion yuan ($34.5 billion) through the reverse-repurchase operations(repo) on last Tuesday and Friday, following a combined injection of 291 billion yuan in the previous four weeks.

2. The systematic short-circuit of debt financing's in order

So why PBOC is in such an urge to open the floodgate of liquidity? This economist will spare you the boredom of looking at the diagrams of China's economic misery: HSBC PMI, etc, since you can find those eye candies everywhere else on the web. Let me cut to the chase: However high it aims, PBOC's action in practice merely work as the band aid to the bleeding economy. But it won't be able to fix it. The central bank's aggressive pro-liquidity maneuvers at best serve to sustain the over-leveraged economy and avoid the systematic short-circuit of debt financing. Now allow me to divulge:

The main drivers of China's debt financing,China's state-owned banks, are starving for cash. According to Citigroup estimates, in 2011 seven of the biggest Chinese banks raised 323.8 billion renminbi ($51.4 billion) of new fund. Several financial firms are expected to raise another $17.7 billion in the next few months, with China’s fifth-biggest lender, the Bank of Communications, accounting for $9 billion. The unprecedented lending binge encouraged by the central government,increasingly rigorous requirement of regulatory capital and excruciating maintenance of excessive dividend payouts have rendered the most-profitable banks in the world--Chinese banks--in a rather precarious position.

GaveKal's data will illustrate this is no exaggeration: In 2010, China’s five biggest banks — the Big Four plus the Bank of Communications — paid more than 144 billion yuan in dividends while raising more than 199 billion yuan on the capital markets. The ballooning balance sheet caused by the loan frenzy and strict capital requirement make China's banks' cash-craving burning at both ends:this march, China’s big four— Industrial and Commercial Bank of China, the Bank of China, China Construction Bank and Agricultural Bank of China — have a combined 14 percent increase in total assets, to 51.3 trillion yuan, which is roughly the size of the German, French and British economies combined.

Meanwhile, under a new set of rules, the country’s biggest banks will need to increase their capital levels to 11.5 percent of assets by the end of 2013.Their core Tier 1 capital ratio will need to be at least 9.5 percent. These requirements are more stringent than the rules that apply to American and European banks. Hereby, we shouldn't be surprised why the world's most profitable banks are in the dire need of cash. It has to be PBOC who comes to the rescue.

Diminishing returns of China’s inflationism…

According to the great Ray Dalio's principles, the credit-fueled China's economy is so over-leveraged that a great de-leveraging is going to be the only way out. The pyramid of debt/credit is cracking and will collapse since the conditions of underlying economic agents are deteriorating.There's no mount of monetary band aids that can alter that destiny.

According to Fitch’s data, the ratio of total financing/GDP in China rose from 124% at end‐2007 to 174% at end‐2010, and rose by another 5pp to 179% in 2011.In 2012 the growth of broad credit will slightly decelerate but still outpace GDP. Clearly China is not suffering a liquidity crisis but the diminishing economic return on credit. According to Fitch, in 2012, each CNY1 in new financing will yield ¥0.39 yuan in new GDP versus ¥0.73 yuan pre-crisis.Returns would have to rise above ¥0.5 yuan for domestic credit/GDP to stabilize at 2011’s 179%.

The dilemma is that business entities will need more and more credit to achieve the same economic result, therefore will be more and more leveraged, less and less able to service the debt, more and more prone to insolvency and bankruptcy. It will reach a turning point when the increasing number of insolvencies and bankruptcies initiate an accelerating downward spiral for underling assets prices and drive up the non-performing loan ratio for the banks.

And then the over-stretched banking system will implode. A full blown economic crisis will come in full force. The chain of reaction is clearly set in the motion now. The question is when we will reach that turning point. What PBOC has done is only adding fuel to the fire because it is unable to tackle the root causes of China's economic ills.

Again interventionism will require more interventionism. Yet interventionism via inflation is a policy that will not and cannot last. Has China reached that moment?

More, insufficient savings to tap for bank recapitalizations…

Let's examine the structural reasons that China's domestic demand will have its work cut out to refill the tank space of the economic growth left out by collapsing investment and export:

1st, Contrary to what many choose to believe, China's trade surplus is not caused by Chinese consumers' high saving rate, but has much to do with their deteriorating disposable incomes which far lag behind GDP growth and inflation. According to the All China Federation of Trade Unions (ACFTU), workers' wages/GDP ratio have gone down for 22 consecutive years since 1983. It goes without saying that the consumption/GDP ratio is shrinking all the while.

Meanwhile, Aggregate Savings Rate has increased by 51% from 36% in 1996 to 51% in 2007. Don't jump to your conclusion yet that Chinese consumers has been over-tightening their purse strings. The truth is far away from conventional perceptions: according to Development Research Center of the State Council's report, that increase is mainly driven by the government and corporations and not by the household. For the past 11 years, Household Saving Rate has only increased from 19% to 22%. Even India's Household Saving Rate of 24% is higher than China's right now.

All the while, government and corporations' saving rate has increased from 17% to 22%, which accounts for nearly 80% of the increase on Aggregate Savings Rate. For the past decade, Government's fiscal income is growing faster than GDP or Household Income. In 2009, the fiscal income was 687.71 billion yuan, and achieved an annual growth of 11.7% while GDP growth was 8.7%, Urban household disposable income growth was 8.8% and agriculture household disposable income growth was 8.2%. It is obvious that the state and corporations has taken too much out of national income and hence they continue to weaken the consumers rather than empower them.

All inflationism is deceptively about self-serving politics…

The biggest problem for China is the state, central enterprises and crony capitalists wield too much power over national economy, have too much monopoly power over wealth creation and income distribution, and much of the GDP growth and vested interest groups' economic progress are made on the expanse of average consumers stuck in deteriorating relative poverty. If these problems aren't solved, the faster the Chinese GDP growth, the less Chinese consumers will be able to support the over-capacity expansion, the more export momentum China will need to sustain its growth. This is a vicious circle of global imbalance. Even the revaluation of RMB can't break it.

Read the rest here

To recall the admonitions of the great Professor Ludwig von Mises against Keynesian policies…

The boom can last only as long as the credit expansion progresses at an ever-accelerated pace. The boom comes to an end as soon as additional quantities of fiduciary media are no longer thrown upon the loan market. But it could not last forever even if inflation and credit expansion were to go on endlessly. It would then encounter the barriers which prevent the boundless expansion of circulation credit. It would lead to the crack-up boom and the breakdown of the whole monetary system.

Be careful out there.

Saturday, July 14, 2012

Warren Buffett Sees Rising Municipal Bankruptcies

Obama crony Warren Buffett predicts that municipal bankruptcies will increase

From Bloomberg,

Warren Buffett, the billionaire chairman of Berkshire Hathaway Inc. (BRK/A), said municipal bankruptcies are set to rise as there’s less stigma attached after three California cities opted to seek protection just weeks apart.

The City Council of San Bernardino, California, a community of about 210,000 east of Los Angeles, decided July 10 to seek court protection from its creditors. The move came just weeks after Stockton, a community of 292,000 east of San Francisco, became the biggest U.S. city to enter bankruptcy. Mammoth Lakes, California, also sought the shelter this month.

“The stigma has probably been reduced when you get very sizeable cities like Stockton or San Bernardino to do it,” Buffett, 81, said in an interview today on “In the Loop with Betty Liu” on Bloomberg Television. “The very fact they do it makes it more likely.”

Cities and towns across the U.S. have been strained by rising costs for labor, including pensions and retiree health benefits, while the longest recession since the 1930s crimped sales- and property-tax revenue.

I don’t think “stigma” has anything to do with the real issue of the unsustainable financial and economic conditions of the excessively (welfare and bureaucracy) bloated public sector, driven by Keynesian policies. As per Herb Stein’s Law, if something cannot go on forever, it will stop.

So goes with Munis.

Friday, July 13, 2012

Quote of the Day: The Salad Days of the Keynesian public sector economy are over

The salad days of the Keynesian public sector economy are over, so argues author Patrick Buchanan at the Lewrockwell.com

In the Reagan-Clinton prosperity, officials earned popularity by making commitments that could be met only if the good times lasted forever. They added new beneficiaries to old programs and launched new ones. They hired more bureaucrats, aides, teachers, firemen, cops.

Government's share of the labor force soared to 22.5 million. This is almost three times the number in the public sector when JFK took the oath of office. These employees were guaranteed job security and high salaries, given subsidized health care, and promised early retirement and pensions that the private sector could not match.

The balance between the private and public sectors shifted. As a share of the U.S. population, the number of taxpayers fell, as tax consumers – the beneficiaries of government programs and government employees who run those programs – rose.

The top 1 percent now pays 40 percent of the income tax. The top 10 percent pays 70 percent. The bottom half, scores of millions of workers, pay nothing. They ride free.

This could not go on forever. And when something cannot go on forever it will, by Stein's Law, stop. The Great Recession brought it to a stop. We have come to the end of the line.

U.S. cities depend on property and sales taxes. But property tax revenue has fallen with the collapse of the housing market. Sales tax revenue has fallen as a result of the recession that has kept the consumers out of the malls.

Revenues down, cities and counties face a choice. Raise taxes, or cut payrolls and services. But if taxes rise or workers are laid off and services decline, Americans in our mobile society move across city and state lines, as they are moving from California to Colorado, Nevada and Arizona.

This does not end the crisis, it exacerbates it.

Bankruptcy not only offers cities relief from paying interest to bondholders, it enables mayors to break contracts with public service unions. Since the recession began, 650,000 government workers, almost all city, county or state employees, have lost their jobs. Millions have seen pay and benefits cut.

The salad days of the public sector are over. From San Joaquin Valley to Spain, its numbers have begun to shrink and its benefits to be cut.

A declaration of bankruptcy by a few cities, however, has an impact upon all – for it usually involves a default on debts. This terrifies investors, who then demand a higher rate of interest for the increased risk they take when they buy the new municipal bonds that fund the educational and infrastructure projects of the solvent cities.

Cities and counties have no way out of the vicious cycle. Rising deficits and debts force new tax hikes and new cuts in schools, cops and firemen. Residents see the town going down, and pack and leave.

This further reduces the tax base and further enlarges the deficit.

Then the process begins anew.

This is what is happening in Spain and Greece, which have reached the early 1930s stage of rioting and the rise of radical parties.

Since the New Deal, Keynesianism has been our answer to recession. As the private sector shrinks, the pubic sector expands to fill the void until the private sector returns to health. Only Keynesianism is not working.

Sunday, July 08, 2012

China’s Property Controls: Mistaking Forest for Trees

Once again China’s confused policies

From Bloomberg,

China must “unswervingly” continue its property controls and prevent prices from rebounding, Premier Wen Jiabao said yesterday, after the central bank cut interest rates and triggered a surge in property stocks.

Local governments that introduced or covered up a loosening of curbs on residential real-estate must be stopped, Wen said during a visit to Changzhou city in eastern Jiangsu province, according to the official Xinhua News Agency. Restricting speculative demand and investment in property must be made a long-term policy, he said.

Wen’s comments underscore the government’s determination to maintain restrictions on housing purchases even as it cuts interest rates and boosts infrastructure spending to reverse a slowdown in the world’s second-biggest economy. China’s new-home prices rose for the first time in 10 months in June, according to SouFun Holdings Ltd. (SFUN), owner of the nation’s biggest real- estate website.

“We must unswervingly continue to implement all manner of controls in the property market to allow prices to return to reasonable levels,” Wen was quoted as saying when he met residents and local government officials in charge of affordable housing. “We cannot allow prices to rebound, or all our efforts will come to naught,” he said…

All financial institutions must continue to strictly implement a differentiated housing credit policy to continue curbing property-buying for speculation and investment purposes,” it said in its statement announcing the interest- rate cut.

China started imposing restrictions on home purchases two years ago as prices surged after the government started a stimulus package to shield the economy from the impact of the global financial crisis. Measures included raising down-payments and mortgage-rate requirements, limiting purchases in some cities and trialing a tax on homes in Shanghai and Chongqing.

Property controls are still in a “critical period” and the task remains “arduous,” Wen said yesterday. Cases of illegal acquisition of property-rights must be investigated, he said.

Property Tax

The government must “promote the study and implementation of changes to the property-tax mechanism, and to speed up the establishment of a comprehensive long-term mechanism and policy framework for controlling the property market,” Xinhua cited Wen as saying.

This is an example of the left hand doesn't know what the right hand is doing.

Premier Wen also mistakes forest for trees. Property prices are symptoms and not the source of the bubble. In reality the repeated campaign of monetary policy accommodations compounded by ‘investment spending’ fiscal policies or the Keynesian policies of perpetuating unsustainable quasi-booms has been the culprit

Another manifestation of such bubble conditions has been through China’s version of Shadow banking system which has ballooned to 1.7 trillion which has financed the property bubble.

Yet depending on the debt level conditions, recent rate cuts could reinvigorate speculations in the property sector, if not spillover or get diverted to other sectors of the economy, perhaps in the stock market, commodities or industries that may benefit from “inland development strategy” or euphemism for new pet projects of China’s political authorities.

The inconsistencies of China’s policies will only deepen the uncertainty and of the growing risks of the implosion of China’s bubble economy.

Friday, April 13, 2012

China’s Tiger by the Tail

Apparently China’s policymakers remain staunch devotees of Keynesian economics and promoters and practitioners of boom bust cycles.

The Bloomberg reports,

Policy makers have cut the amount banks must keep in reserves twice since November to free up cash for lending, in a bid to insulate the world’s second-largest economy from the effects of a global slowdown. Interest rates haven’t been reduced since 2008.

New local-currency lending was 1.01 trillion yuan ($160.1 billion) in March, the People’s Bank of China said on its website after the market closed. That compared with the median 797.5 billion yuan estimate in a Bloomberg News survey of 28 economists and 710.7 billion yuan the previous month. M2 money supply climbed 13.4 last month, accelerating from a 13 percent growth in February, the central bank said.

Instead of allowing the markets clear on the outstanding imbalances brought about by previous policies, China’s policymakers have decided to keep riding the tiger's tail.

According Mises Institutes Vice President Joseph Salerno,

It has now become clear that the Chinese government has made its choice to avoid a “hard landing” by attempting to ride the unloosed inflationary tiger for as long as it can. But its strategy of massviely expanding fictitious bank credit unbacked by real savings will cause added distortions and exacerbate unsustainable imbalances in China’s real economy. As the Austrian theory of the business cycle teaches, this will only postpone the needed recession-adjustment process and will precipitate a “crash landing” that may well shatter China’s burgeoning market economy. This would be a tragedy of the first order for the entire global economy.

As pointed out many times here, the recourse towards inflationism by China’s political authorities has been seen as necessity for the survival of the incumbent command-and-control structure of China’s political institutions. A financial and economic bust will only magnify the growing forces of malcontents which Chinese authorities have fervently been trying to contain.

And given the enormous scale of malinvestments, like her Western contemporaries, China’s authorities will likely push for more inflationism until economic realities prevail or until real savings get depleted.

Reports the Wall Street Journal,

China’s real-estate sector is enormous—accounting directly for 12% of gross domestic product, according to estimates by the International Monetary Fund—and changing fast. To capture developments in the sector, data are collected from more than 80,000 real-estate developers and reported up through the county, city, and province statistical system….

A key concern for investors is China’s overhang of unsold property. A trip around virtually any Chinese city reveals hosts of half-finished tower blocks waiting to be completed and sold. Analysts fear that excess supply could put a dent in prices, and reduce the real-estate investment that is a key contributor to China’s domestic demand.

Official data show 2.98 billion square meters of residential property under construction at the end of February. Wall Street Journal calculations show that is more than two square meters for every person in China and enough to satisfy demand for almost the next three years without a single extra apartment being built.

So unproductive grand projects already highlighted by ghost cities and malls as seen in the video below (hat tip Bob Wenzel) will mount, as scarce resources will continue to get funnelled into projects that consumes capital.

Bottom line: A Tiger by the Tail by the great Friedrich von Hayek represents an allegory of the allures of inflationism

An excerpt from the synopsis of Hayek’s work by Professor Salerno,

In brief, Hayek argues that all depressions involve a pattern of resource allocation, including and especially labor, that does not correspond to the pattern of demand, particularly among higher-order industries (roughly, capital goods) and lower-order industries (roughly, consumer goods). This mismatch of labor and demand occurs during the prior inflationary boom and is the result of entrepreneurial errors induced by a distortion of the interest rate caused by monetary and bank credit expansion. More importantly, any attempt to cure the depression via deficit spending and cheap money, while it may work temporarily, intensifies the misallocation of resources relative to the demands for them and only postpones and prolongs the inevitable adjustment.

The policies of permanent quasi booms or ‘extend and pretend’ policies will eventually get exposed for the fiction they sell—through a colossal bust or “a tragedy of the first order for the entire global economy”.

For now, profit from political folly.

Nonetheless it would be best keep vigilant over developments in China.

Friday, February 10, 2012

Which Country Has Been The Most Aggressive Inflationist?

Not the US.

In terms of expanding the central bank's balance sheet, the answer is China. Writes Dr. Ed Yardeni,

The Keynesians have spread fiscal recklessness throughout the world, and want to make sure that China participates. In any event, the Chinese are better at monetary than fiscal policy recklessness. No central bank on earth has pursued quantitative easing for as long or on a bigger scale as has the People’s Bank of China (PBoC). The PBoC’s assets have increased by 170% over the past five years to a record $4.44 trillion in December. That compares to $2.87 trillion at the Fed and €2.74 trillion at the ECB. The PBoC accomplished this feat by accumulating foreign exchange reserves, which accounted for a record 83% of the central bank’s assets at the end of last year, up from 40% at the start of 2002.

From Bianco Research

It’s why China’s economy is highly vulnerable to a systemic bust.

Wednesday, December 21, 2011

Quote of the Day: Keynesian Nostrum

Keynesianism is not a panacea because Keynesianism has dominated public policy making for half a century and has left us in such a state of public debt. Keynesianism broke the old time fiscal religion of balanced budgets and fiscal responsibility, and changed not only attitudes of economists and policy makers, but also eroded whatever institutional constraints existed on public spending that had existed. Keynesianism cannot work to solve our current problems because Keynesianism is responsible for our current problems. Keynesianism provided an illusion of short term prosperity, but the reality of long term stagnation. Of course, the revealing of the illusion can be put off, as I have pointed out before, if there is the discovery of new opportunities for gains from trade, and/or gains from innovation.

But the governmental habit of spending is still there and the bill has to be paid as some point. Keynesianism is a disease on the body politic because it caters to the natural propensity of politicians to focus on short run, and to concentrate benefits and disperse costs.

That’s from Professor Pete Boettke.

Keynesianism has functioned as the intellectual pillar of the 20th century welfare-warfare based political economy. Yet in applying Keynesian prescriptions to Keynesian generated predicaments would tantamount to “doing things over and over again and expecting different results”. Albert Einstein, who was attributed with the quote, call this insanity. However, modern politicians and their allies seem to know only one option thereby insisting on the same route which brought us to our present conditions.

Monday, November 14, 2011

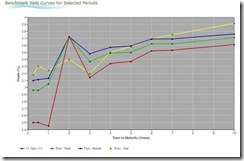

China Manipulates Yield Curve to Engineer a Boom

Learning from the West, China’s political authorities has clearly been assimilating Keynesian policies of promoting permanent quasi booms, but this time through the manipulation of interest rates…

From Bloomberg,

China’s long-term bonds are offering investors the biggest yield advantage over shorter-maturity notes in six months as Premier Wen Jiabao relaxes lending curbs to combat a slowdown in Asia’s biggest economy.

The gap between the government’s one-year note yields and 10-year securities widened to 102 basis points on Nov. 11 from 62 at the start of the month, Chinabond data show. That’s the most since May 4. The difference in U.S. Treasuries with similar maturities rose four basis points since October to 204, while the so-called yield curve for Indian bonds shrank two to 19, according to data compiled by Bloomberg.

“The curve will continue to steepen because long-term yields priced in too much concern of a slump,” said Wang Mingfeng, a Beijing-based bond analyst at Citic Securities Co., the nation’s third-biggest brokerage by assets. “There won’t be a hard landing, and the loosening measures may lead to a rebound in growth in the second quarter.”

Wen said Oct. 25 that policies will be “fine tuned,” a turnaround after interest rates were increased five times and lenders’ reserve-requirement ratios raised on nine occasions since September 2010 to tame inflation. The central bank has since lowered the yield on one-year bills for the first time since 2008 and injected 163 billion yuan ($25.7 billion) into the financial system…

Here is how China’s yield curve looks like (as of November 11, from Asian Bonds Online)

A steep yield curve induces borrow short-lend long dynamic or maturity transformation which carries the risk of maturity mismatching that could lead to a systemic bust or insolvency.

Yet, to stave off a hard landing, China has recently been expanding loans to reflate the economy (from the same Bloomberg article)

Some 587 billion yuan of loans were granted in October, the most in four months, the People’s Bank of China reported Nov. 11. That exceeded all 18 economist estimates in a Bloomberg News survey.

“This is a meaningful pickup in new loans which suggests selective easing has already started,”Qu Hongbin, a Hong Kong- based economist with HSBC Holdings Plc (HSBA), wrote in a research note. “China has no risk of a hard landing.”…

Add to expansion of loans, China may also be hiking government expenditures… (from the same Bloomberg article)

As much as 1 trillion yuan of public funds will be injected into the economy in December, ensuring abundant liquidity for lenders and making a cut in reserve-ratio requirements unlikely this year, according to Chen Jianheng, a bond analyst at China International Capital Corp. The finance ministry typically does most of its spending at the end of the year, he said

At the end of the day, the same noxious practices of Western contemporaries haunt China’s political stewards. The implication of which would likely be the same consequence—boom bust cycles.

Over the years, politicians have been doing the same thing and expecting different results.

Politics indeed signifies insanity.