The purpose of studying economics is not to acquire a set of ready-made answers to economic questions, but to learn how to avoid being deceived by economists.—Joan Robinson

In this issue:

Phisix: Philippine 4Q 6.9% GDP: A Story of Government Pump and Mounting Excesses

-Statistics Isn’t Economics

-6.9% GDP: All Growth Eggs in One Basket, The Construction Show!

-6.9% GDP: What Happened to the Consumer Boom Story?

-6.9% GDP: Where Was Investments?

-Slump in Construction Material Prices in the Face of a Construction Boom?

-Has 4Q GDP Been All About Government Construction Projects?

-Record Phisix: Intensifying Deliriums over G-R-O-W-T-H!

Phisix: Philippine 4Q 6.9% GDP: A Story of Government Pump and Mounting Excesses

In the following exegesis of 4Q GDP, I piece together data from different government agencies and use economic theory to see how consistent and compatible the flowery growth statistics have been with real events.

Statistics Isn’t Economics

It must be known statistics isn’t economics.

Aggregate numbers represent as segments of economic history. These numbers hardly accurately capture in quantitative context the complex multi-dimension human activities. They are not theory.

As the great Austrian economist Ludwig von Mises explained[1],

Experience of economic history is always experience of complex phenomena. It can never convey knowledge of the kind the experimenter abstracts from a laboratory experiment. statistics is a method for the presentation of historical facts concerning prices and other relevant data of human action. It is not economics and cannot produce economic theorems and theories. The statistics of prices is economic history. The insight that, ceteris paribus, an increase in demand must result in an increase in prices is not derived from experience. Nobody ever was or ever will be in a position to observe a change in one of the market data ceteris paribus. There is no such thing as quantitative economics.

Yet statistics are favorite tools used by politicians to attain political objectives.

As Scottish poet novelist and literary critic once Andrew Lang wrote, politicians use statistics in the same way that a drunk uses lamp-posts—for support rather than illumination.

Like drunks, G-R-O-W-T-H statistics have been used to incite hysteric pump and push of financial asset prices with arrant disregard of risks.

Nonetheless, my interpretation of 4Q GDP will be founded from two frameworks: One, the law of demand: “The law of demand states that, other things remaining same, the quantity demanded of a good increases when its price falls and vice-versa”.

Second the price system as defined by the great Austrian economist Nobel Prize winner, Friedrich von Hayek[2]:

The price system is just one of those formations which man has learned to use (though he is still very far from having learned to make the best use of it) after he had stumbled upon it without understanding it. Through it not only a division of labor but also a coördinated utilization of resources based on an equally divided knowledge has become possible…The most significant fact about this system is the economy of knowledge with which it operates, or how little the individual participants need to know in order to be able to take the right action. In abbreviated form, by a kind of symbol, only the most essential information is passed on and passed on only to those concerned. It is more than a metaphor to describe the price system as a kind of machinery for registering change, or a system of telecommunications which enables individual producers to watch merely the movement of a few pointers, as an engineer might watch the hands of a few dials, in order to adjust their activities to changes of which they may never know more than is reflected in the price movement.

In short, the pricing system signals the decentralized interactions or coordination process in the marketplace that summarizes the intertemporal balance of supply and demand.

Prices are sine qua non for economics.

Now to the data.

6.9% GDP: All Growth Eggs in One Basket, The Construction Show!

On the left is the expenditure side of the accounting calculation of the 4Q GDP.

The NSCB recaps this as: On the demand side, Household Final Consumption Expenditure (HFCE) together with the sustained investments in Fixed Capital Formation and the remarkable performance of external trade all contributed to the healthy growth of the economy in the fourth quarter and for the full year 2014.

While it is technically true that HFCE did contribute to 4Q performance, it is hardly in the conditions as “framed” above which I explain below.

Fixed capital investments had almost entirely been about construction. Notice too of the absence of mention of the big decline of capital formation. Without the construction booster, capital formation would have declined even more (discussed below)!

Also, the “remarkable” external trade did NOT contribute to growth based on accounting computation of GDP. While exports grew by 15% relative to imports 5.3%, it is not the percentage that makes for the GDP computation. The fact that nominal export data (748,063) remains LESS than imports (813,848), where NET exports posted -65,785, external trade accounted for a reduction and NOT an addition to the accounting GDP*.

Aside from construction, it is the Government Final Consumption Expenditure (GFCE) that had been instrumental in delivering the 4Q figures.

*Expenditure GDP= HFCE + GFCE + Capital Formation + (Exports-Imports)+ statistical discrepancy

On the right side represents calculation of the GDP by industry.

The NSCB concludes: The robust performance of Industry sector particularly by Manufacturing and Construction and supported by the Trade, Real Estate, Renting & Business Activities, and Transport, Storage & Communication, boosted the fourth quarter performance and paved the way for the annual GDP to post a growth of 6.1 percent

I marked in the red box, the share contribution of these sectors to the overall GDP. Those green numbers reveals which sectors outperformed the GDP. Also, capturing additional share of the GDP pie means that these sectors accounted for critical weights to the 4Q performance.

Four sectors virtually gained GDP share at the expense of the rest. The construction sector added .7% share in 4Q. This represents a fantastic surge in the sector’s GDP share. The other three posted modest gains, namely, public administration and real estate garnered .13% a piece, while manufacturing added .1%.

So from the industry perspective, 4Q GDP has essentially been a construction act, with cameo roles played by the real estate, government and manufacturing.

The numbers from the NSCB speak for themselves.

And to what I consider as main bubble industries, real estate, construction and financial intermediation, their cumulative share of GDP rose to 40.37%.

So from the general standpoint, Philippine 4Q GDP has almost been an all (growth) eggs in one basket. That basket is the construction sector.

6.9% GDP: What Happened to the Consumer Boom Story?

It has been assumed that domestic consumers played a key role in 4Q GDP performance.

Yet all it takes is to scrutinize the HFCE data presented by the National Statistical Coordination Board to expose on the difference between what seems and what has been.

Technically yes, consumers supposedly contributed. But what the NSCB didn’t publicly say has been that consumption growth rates have been struggling. Ever since the 3Q 2013, consumption growth has been on a steady decline.

HFCE posted marginal gains 4Q, i.e. 5.1% from a revised 3Q 5.0%. This is marked by the blue trend line on the left box. The original 3Q data has been at 5.2% as I previously shown in my 3Q analysis. So if we plot the original data, the 4Q HFCE reveals a decline instead of a gain. Through data revision, decline transformed into G-R-O-W-T-H. This marks a fantastic example of what the late economist Ronald Coase warned about, if you torture data long enough, it will confess (to anything).

As for revisions, what happens, for instance, if next month the 6.9% 4Q GDP will be revised downwards by 2% to 4.9%? There will probably be a riot in the mainstream.

Well but that’s what the NSCB just did to the mining industry. Mining industry’s 3Q growth has been sharply degraded from 7.8% to 5.2% as shown above data from the NSCB, and as previously shown in my 3Q GDP analysis. Because the mining industry’s contribution to the overall GDP (4Q .63% share) has been inconsequential, there has been no furor over such data changes.

Yet the above represents statistically significant changes. If an investor of the mining industry bases one’s decisions on official data then economic calculations would have been severely distorted by the dramatic alterations in government statistics.

Of course, headline GDP will hardly experience big downside revisions as this will have enormous political, bureaucratic and market implications. But the above incident puts a question on the reliability or integrity of the GDP numbers.

As I have been saying here, since governments make the data they can say whatever they want. And it would be a mistake to swallow hook, line and sinker on the veracity of these numbers.

The origin of the GDP has been due to the political desire to finance wars[3]. And because GDP numbers have substantial political, economic and market implications, there will always be a strong predilection by political leadership to exert influence on them.

Now back to the HFCE.

It would be fruitless to pettifog over statistics as to whether 4Q increased or decreased. Yet the NSCB’s data on the trade industry should reveal of the actions of consumers from the government’s perspective.

Having peaked in 4Q 2013, the growth rate of the retail industry has been in a slomo decline. The zenith of retail growth rate appears to coincide (on a one month lag) with the peak of the HFCE in Q3 2014.

But surprise, the retail growth rates in 4Q 2014 plummeted from 6.1% in 3Q to 4.1% 4Q or by 2%! In percentage terms that would be tantamount to a 33% decline—a crash!

Since retail trade constitutes 78% of the 4Q GDP trade output, overall trade growth rates has sharply slowed to 5.3% 4Q from 6.4% 3Q. So retail performance contradicts any positive spin of a robust growth in consumer spending via the 4Q HFCE.

The irony has been that the downdraft in consumer activity has been happening during what used to be a seasonally strong quarter due to Christmas holidays!

And another paradox, even as retail activities significantly ease, there has been spike in wholesale trade output. Wholesale output has zoomed to the highest level since 2013!

Has importers and manufacturers been engaged in channel stuffing or forcing wholesalers to acquire more inventories than required?

And what has the ballooning divergence between wholesale and retail trade tell us? It tells us that if retail activities don’t improve significantly soon, there should be a huge inventory build-up on the wholesalers. If the goods are perishable, then this will translate to losses soon. If goods are non-perishable, then the accrual of surplus inventories should imply of a big slowdown in wholesale trade activities which should be transmitted to consumer goods imports or consumer based manufacturing.

So today’s growth halleluiah may transform into an economic storm overtime.

And data from the Philippine central bank, the Bangko Sentral ng Pilipinas, seem to uphold the ongoing substantial slowdown in consumer spending. Banking loans to the trade industry has exhibited a notably substantial decline from 3Q through the 4Q (see right window).

In addition, statistical inflation seem to confirm the ongoing cascade in consumer spending as statistical inflation rate has been on a downtrend, as shown in the lower pane (data from the BSP and tradingeconomics.com)

The law of demand tells us that ceteris paribus (given all things equal), as the price of price of a product increases, quantity demanded falls. So from the law of demand, we can glean that the previous bouts of the high inflation has harried domestic consumers to incite them to reduce demand, therefore, statistical CPI has been falling. And such reduced consumer activities has been reflected on 2 year trends of HFCE and retail trade GDP, as well as, BSP loans to the retail industry.

But it appears that prices have not fallen enough to spur demand.

This is the establishment’s 4Q 6.9% GDP!!!

As a reminder, the above comes from government data, not mine. Anyone can just go the website, plot the data covering the extended time series in a spread sheet, convert them to charts, and see what’s been going on from their perspective.

It has also been a puzzle how accurate those HFCE numbers have been given the sharp decline in the government’s CPI measures, aside from the slump in the growth rate of retail output. In other words, the HFCE growth rates hardly seem as compatible with the ongoing deterioration of the other consumer data series. Since HFCE constitutes over 70% of GDP, all it takes is for government statisticians to pump this category in order to post growth!

As a side note, BSP consumer loans have sizzled during the 2H 2014 even as retail activities have slowed (upper right chart). But most of the gains from the loan growth have been about auto loans which accounts for 34% of the latest BSP data on consumer loans. Credit card loans which posted an upside spike in November have also subsided in December. Since only a few segment of Philippine economy has access to consumer banking credit facilities, apparently the loan growth hasn’t prompted a rebound on consumer demand.

And what about the supposed bonanza on consumers from collapsing oil prices?

Let us say Pedro has a budget of 100 pesos for energy products. Assuming products of energy prices collapsed by 50% and quantity demanded remains the same, Pedro will have 50 pesos to spend on non-energy products. Popular wisdom says this will be spent. What this shows is a shift from “need” expenditures to “want” expenditures. Said differently Pedro’s has more disposable money.

But in the real world there are other options than spending. Disposable money may be saved or used to pay down debt. Importantly, if Pedro’s overall income doesn’t grow, then there will be NO additional growth in spending potential. It is income growth that gives consumers additional spending power.

In essence, having more disposable income means more about “utility” or satisfaction experienced by the consumer of a good.

On the supply side, the loss of energy suppliers will be offset by the gains of non-energy producers (if spent) or by banks (if saved). But again if these beneficiaries choose to pay off debt or save on the added earnings rather than invest, then there will hardly be any growth from the industry side which should transmit to as income growth to the consumers. Again it is income growth that gives consumers additional spending power.

The above theory supported by empirical data as provided by government, says that consumers hardly benefited from collapsing oil prices as of the 2H of 2014. Yet this goes against popular wisdom.

In addition, an even more disturbing sign from 4Q 6.9% GDP—as manifested by the brewing divergence of retail and wholesale trade—has been that of the swiftly widening imbalance between demand and supply.

Think of it. Domestic consumers have been dramatically slowing even as the supply side mostly via property sector (casino-hotel, shopping mall, housing, vertical condos) has been building massive capacity in anticipation of the opposite—perpetual robust consumer spending.

Sometime soon economic reality will force the establishment to acknowledge such mounting malinvestments. The ordinal flow of the cycle will be excess capacity, financial losses then credit problems.

6.9% GDP: Where Was Investments?

I have noted above that in the NSCB press release government placed a positive spin on fixed investments but omitted the negative contribution by capital formation.

Here is the NSCB’s take on investments: Investments in Construction rebounds Investments in construction posted a significant growth of 21.9 percent, a turnaround from a decline of 4.3 percent a year ago. The growth was boosted by increased investments in the Private Construction which registered a growth of 25.7 percent from a decline of 2.2 percent in 2013. Likewise, Public Construction grew by 5.1 percent from a decline of 12.6 percent last year. Investments in Durable Equipment down For the fourth quarter of 2014, Investments in capital formation for Durable Equipment contracted to 0.6 percent from the double digit growth of 23.2 percent recorded last year. Increased investments were registered in twelve (12) out of the twenty (20) types of fixed asset investments. The following subsectors contributed to the decline in investments: Air Transport, negative 66.4 percent from 429.2 percent; Office Machines & Data Processing, negative 14.2 percent from 90.0 percent; and, Telecommunications & Sound Recording/Reproducing Equipment, negative 1.2 percent from 10.7 percent. Meanwhile, the following subsectors posted positive growths: Road Vehicles, 17.9 percent from 12.5 percent; Other General Industrial Machineries, 25.0 percent from 24.0 percent; and, Agricultural Machineries, 53.3 percent from 7.4 percent.

So while 60% of investment categories posted gains, it has been investment in construction that has provided the fulcrum for the 4Q 6.9% GDP.

Yet capital formation was a negative contributor to 4Q GDP. That’s because gains, like in the Agricultural machineries segment represents a paltry share (.5%) of the durable equipment expenditures which has not been enough to negate the sharp decline by Air Transport.

And the downtrend can hardly be seen as an anomaly. Capital formation and its main subsectors, fixed capital and durable equipment has been on a downtrend since Q1 2013. Q3 2014 posted a rebound that seemed to account for a dead cat’s bounce, as durable equipment has led to capital formation to a second and bigger negative output in 2014!

This is the establishment’s 4Q 6.9% GDP!!!

Yet any sustainable real economic growth should be driven by investments.

As I previously wrote[4],

Because investments drive growth. Business spending represents future income, earnings, demand, consumption, jobs, wages, innovation, dividends, capital gains or what we call as growth.This also means that if the downturn in investments represents an emergent trend, then current rebound may just be temporary and would hardly account for as resumption to “high trajectory growth”.

Apparently investments have gone nowhere, yet the so-called boom.

From the expenditure side, 4Q GDP shows that capital formation has been negative, external trade has also been negative but only HFCE (household) and GFCE (government) expenditures delivered not only positive but a boom.

Yet as pointed above the HFCE’s performance has been diminishing.

So 4Q GDP seems indeed a puzzle.

Slump in Construction Material Prices in the Face of a Construction Boom?

Consumer spending has been down, investment has been down, so what fueled 6.9% 4Q GDP? Well as noted above it’s now a winner take all Philippine statistical economy in favor of construction…

Last December I noted of this striking economic data issued by the National Statistics Office.

This represents the Wholesale Price Index of construction materials. Basically, the data points to a collapse in construction material prices in the 2H of 2014. This hasn’t been an anomaly. Rather the above seems like a disturbing trend.

December’s NSO data exhibits a first negative year on year growth. On a month on month basis, the negative growth has been a two month dynamic.

I can’t resist but to republish the NSO’s description of the fantastic collapse in wholesale prices[5] (bold mine): Year-on-Year Compared to a year ago level, the Construction Materials Wholesale Price Index (CMWPI) in the National Capital Region (NCR) posted a negative rate of 0.1 percent in December. Last month it was recorded at 0.8 percent and in December 2013, 2.4 percent. The downtrend was due to 14.9 percent decline in fuels and lubricants index. Slower annual increments were also noted in the indices of cement at 2.3 percent and tileworks, 2.7 percent. The rest of the commodity groups either had higher annual mark-ups or retained their last month’s rates with the indices of asphalt and machinery and equipment rental still registering a zero growth. The annual average growth of the CMWPI in 2014 rose to 1.9 percent. It was 1.8 percent in 2013. Measured from their 2013 rates, the annual average of the following indices increased during the year: sand and gravel, 4.3 percent; concrete products, 2.4 percent; hardware, 2.3 percent; plywood, 2.7 percent; lumber, 5.1 percent; G.I. sheet, 3.9 percent; glass and glass products, 2.2 percent; electrical works, 3.2 percent; plumbing fixtures and accessories, 6.1 percent; painting works, 1.2 percent; and PVC pipes, 3.0 percent. However, the annual average growth of fuels and lubricants index further dropped by 1.0 percent. The rest of the commodity groups had lower annual average increments during the year with the indices of asphalt and machinery and equipment rental having a zero growth…Month-on-Month On a monthly basis, the wholesale prices of selected construction materials in NCR further went down by 0.8 percent in December. This was attributed to the decreases registered in the indices of fuels and lubricants at -7.0 percent and cement, -0.2 percent. Higher monthly growths were, however, seen in the indices of hardware and reinforcing steel at 0.2 percent; plywood, 0.5 percent; plumbing fixtures and accessories, 0.6 percent; and PVC pipes, 0.1 percent. Movements in the other commodity groups either remained at their last month’s rates or had a zero growth. A series of price rollbacks was observed in gasoline, diesel and fuel oil during the month. Likewise, prices of cement were on the downtrend. On the other hand, higher prices were noticed in plywood, steel bars, PVC pipes, plumbing fixtures and accessories like faucet, kitchen sink and angle valves.

While it may be true that collapse in oil prices might have some influence in the collapse in wholesale prices of construction materials, this should lead to declines ONLY on fuel related products.

But as noted above, decline in prices also affected many other commodity groups while some of the higher prices such as in the case of accessories, which are most likely from imports, may have been a result of a weak peso.

For instance, cement and construction equipment rentals have shown nearly zero growth amidst the reported 4Q credit fueled construction frenzy!

Yet the law of demand tells us that all things being equal as price of a product decreases, quantity demanded increases. This means that the construction boom should have at least neutralized the decline in wholesale prices of construction materials which hasn’t been the case according to the government statistics.

So forces that may have shaped the collapse in the wholesale prices of construction materials:

- demand slowdown (this has not been the case according to the 4Q GDP)

- surge in supply

- NSO data has been inaccurate

- 4Q GDP has been inflated

Let me use cement as an example.

Cement sales according to a news report posted 9.6% gains in 2014, where fourth quarter figure reportedly posted the highest growth. In 2013 cement sales grew by 6% from 2012, so in percentage terms growth rate of cement sales jumped by 60%. Nice.

Meanwhile cement sales in 1H posted 6% growth which implies that 2H sales boomed by over 13%. Cement sales seem to bolster government data on the second half construction activities. Ironically booming cement sales resulted to slight gains in annual prices and even negative prices month on month on December.

The only thing that explains the price activity of cement has been a surge in supply. Either from imports and domestic production, slumping prices of cement sales postulate to a massive capacity build up on expectations of a sustained construction boom that has forced down prices of cement.

While these figures would look good today, what happens when a construction slowdown occurs? What happens to the excess supply? Yet how much of the current supply has been financed by leverage?

Has 4Q GDP Been All About Government Construction Projects?

The article gives us a clue that a lot of construction activities have been due to “ongoing public-private partnership projects” and “infrastructure disbursements” that had been “channeled mostly to ongoing reconstruction and rehabilitation efforts in communities devastated by typhoon Yolanda”[6].

4Q GDP data reveals that both private and public construction activities have recently zoomed. Private construction activities have been on a spurt, where the rate of growth has almost reached the fiery pace during Q1 2013. On an annual basis, private construction growth activities in 2014 posted a 12.9% growth rate. This has surpassed 2013 growth rates at 9.3%. Public construction growth has turned positive in Q4 but the upside failed to reverse the earlier contraction which has led to a negative annualized growth of 1.5% in 2014 versus 14.9% in 2013.

Meanwhile real estate, renting and other business category has also rebounded from the 3Q 2014, this has been mostly due to “renting and other business activities” which accounts for 43% of the category’s weightings. On the other hand, the growth rate by “real estate” segment has been on a material decline. Annual growth by this sector has slumped from 18.3% in 2012-13 to 8.1% in 2013-14 with most of the big decline posted in 2H 2014.

The moderating growth rate of real estate in the face of skyrocketing private construction activities seem to validate that most of the 4Q GDP growth must have likely been from private contractors and private operators (Public-Private partnership) of government projects.

So the 4Q 2014 boom has mostly likely been from the cronies and from government spending on infrastructure projects. As explained before[7], infrastructure projects are no free lunches. They would have to be paid for by taxes, debt or inflation and all these come at the cost of productive activities. This means current boom will be ephemeral unless there will be an uptick in the private sector, which as shown above hasn’t been the case.

Moreover, the material decline the growth rates in “real estate” outside renting, extrapolates to slower private construction activities that cater to the marketplace. Government projects have been underwritten by political goals.

The seeming divergence in the construction boom favoring the political projects has most likely abetted the downside pressures on prices of construction materials.

This may partly explain for instance, the zero growth in the rental prices of construction equipment. There seems to be no sudden deluge of imports or of domestic production via manufacturing of construction equipment to warrant zero growth in the light of a construction fever.

In addition, my warnings over slowing credit activities in response to or in the face of a flattening yield curve appear to have arrived[8]. BSP’s December data on the banking system’s credit activities has revealed a broadbased slowdown[9]! See right chart.

Also, on a year on year basis though domestic liquidity bounced slightly (9.6%) from last month’s (9.2%) lows, on month on month liquidity continues to contract[10]!

So both banking and liquidity have been manifesting a decline. Yet the fascinating 6.9% GDP.

Bank credit to the construction industry has nearly halved from the nearly 60% growth rates to just 27.6% in December. Has the construction industry been generating sufficient cash flows or do they have adequate retained earnings to self–finance the current boom? If not, then how have the current projects been funded? From private placements, domestic bonds, intercompany borrowing, borrowing from international markets or affiliates abroad, equity sales, etc…? Or is it that construction activities are bound to slow too?

Real estate, manufacturing, trade (as pointed above) and even financial intermediation has shown noteworthy decline in credit appetite. Among the bubble sectors, it has only been the hotel industry which has defied the overall downtrend.

For an economy that has become heavily dependent on debt, will slowing loan growth rates pave way for “higher” or “lower” growth trajectory?

I say lower growth and bigger credit risks.

Bank Loan growth vis-à-vis GDP performance has previously diverged where growth rate of bank loans swelled as GDP rates declined.

In 4Q the diverging trend appears to have reversed. But numbers alone don’t account for the real activities. As shown above, except for the construction industry which has now become the cornerstone of the Philippine economy, the domestic consumer, investments and even private sector real estate projects seem as materially slowing.

Again this is from government data.

Nonetheless credit intensity or the amount of debt used to generate GDP remains very significant (middle table). This is especially true for the bubble industries where credit to gdp ratio has considerably been more than 1.5.

And based on BSP data, the cumulative share of credit by the bubble sectors, particularly the construction, real estate, trade, hotel and financial sectors has ballooned to 50.35% of the total loans by the domestic banking system to the general industry in 2014. This compared to 49.61% in 2013 and 47.47% in 2012. In 2014, if we exclude the hotel, GDP by the same sectors, as noted above, commanded a 40.37% share.

What this illustrates has been the growing concentration of resource allocation as manifested by credit activities towards a few sectors thereby increasing their credit risks.

And this explains the flattening yield curve.

The deepening degree of the leverage in the system has upped the demand for short term relative to longer term loans. The flattening of the yield curve will reduce the incentives by banks to extend credit.

Thus the lower pace of credit growth will reduce demand. And by reducing demand, this will translate to lower statistical growth.

But the buck doesn’t stop here.

And given the huge amassment of supply side capacity, a prolonged slowdown will raise credit risks, which will have a feedback loop with growth that will manifest itself in the yield curve, systemic liquidity and eventually prices of risks assets.

But of course those headline GDP have been taken in face value by the consensus. It has been there to confirm the biases of the faithful who will hardly exert an effort or an inch to plumb into the details of the statistics which they have imbued as the gospel truth.

Yet underneath the hood of those government statistics have been red lights flashing all over.

Take a look at what’s been happening in 4Q.

The Negatives:

Slumping CPI

Sinking growth rates of bank credit

Contracting liquidity

Plummeting retail GDP

Negative Capital Formation

Tanking construction prices

Flattening yield curve

Slowing growth rate of “real estate” GDP

The Positives:

Construction growth fever which has most likely been centered on government projects.

Soaring stock markets that has largely been engineered by serial last minute pumps (last week posted 3 astounding marking the close on January 26, 28 and 30.

Statistical GDP at 6.9% heavily centered on a construction binge.

Yet the consensus has been screaming G-R-O-W-T-H!

Little has been understood that 4Q GDP has been a government PUMP underpinned by mounting imbalances.

Record Phisix: Intensifying Deliriums over G-R-O-W-T-H!

A short note on record Phisix.

The Phisix has posted record after record closing, again on a series of last minute pumps. It appears that Philippine stocks have reached a stage where convictions of a one way street have become too heavily entrenched to almost religion like attachment or devotion. Risk and valuations has been entirely expunged out of existence.

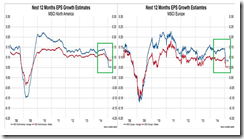

As I recently noted, media recently commented that corporate earnings growth in 2014 has only been 6% and projected earnings growth for 2015 at 16%.

Yet in 2014, Phisix generated 22.76% or the market paid a 3.79% premium for every 1% earnings growth. Yet the bizarrely, the conservative forecast of 8,000 for the yearend. It is as if the quoted experts don’t really believe in what they are saying.

The Phisix ended January up a stunning 6.35%! Annualized this would translate to 76.2% or Phisix 12,740.

As of January’s close, and if current returns are annualized, the markets are presently paying for a 4.76% (76.2/16) premium for every percentage of the 16% expected corporate earnings growth for 2015!!!

Let me just put some back of the envelop numbers here. If realized, the compounded yield of the 6% and 16% will be 22.96%. So if applied to a stock with Php 10 earnings, at the yearend, eps will be Php 12.296. Say the stock’s PER is 30 which makes prices at Php 300 at the start of 2014. If we apply 22.76% (2014 actual) and 76.2% (current annualized rate) to the base number, at the end of 2015, the stock’s price will be Php 649 or a 116% return over two years. So from 30 PER, the same stock will have 52.78 PER at the close of 2015!

That’s how delirious the markets have become. Again valuations have become inexistent as with risk. All that matters now is momentum or having more greater fools to buy stratospheric stock market prices from current wave of buyers. All these in the shibboleth of G-R-O-W-T-H!

We have seen this in 2013. By May, the Phisix was up 25% or a nosebleed rate of 5% per month. The rate of Phisix climb has become near vertical as seen via a 65% degree slope as with today.

Yet at the end of the year, the Phisix ended up only up by 1.33%.

Record stocks comes in the face of mounting risks from almost every corner of the globe; namely from the growing risk of a Greece exit ‘Grexit’, the rise of anti-EU politics (aside from Greece, Spain’s Podemus), an intensification of the standoff between US-Russia over Ukraine that risk an outbreak of a military conflict, the meltdown of junk bonds in the US possibly triggered by collapsing oil prices or even by emerging markets, oil prices and record low yields in the US have been nostalgic of 2008 scenario, a meltdown by key emerging economies (leading candidates, Argentina, Venezuela, Brazil, Mexico, Russia, Kazakhstan, Belarus the GCC and more) that could spread, a China credit bubble implosion, a failure or even a reversal of ECB and BoJ’s QEs, the possible leash effect from the SNB’s unexpected abandonment of franc-euro cap on emerging Europe and on financial institutions in developed economies that has portfolios anchored on the cap and lastly credit problems within ASEAN—Would you believe that a week back Malaysia’s PM had to deny on air that a crisis has been brewing?, This week Singapore’s central bank, the MAS made an emergency easing! In short, Singapore’s central bank just panicked over growing credit risks in their domestic system!

All it takes is for one Bear Sterns to usher in a Lehman moment or the Bear Stern equivalent during the Great Depression, the Austrian bank, the Creditanstalt.

As a final thought, if the BSP, suddenly cuts rate for one reason or another, say below inflation target, or external based alibis, then this proves that 4Q 6.9% GDP 2014 has all been a Potemkin Village.

[1] Ludwig von Mises 5. Logical Catallactics Versus Mathematical Catallactics XVI. PRICES Human Action p.348

[2] Friedrich A von Hayek "The Use of Knowledge in Society", Library of Economics and Liberty econlib.org

[3] See Phisix: 2Q GDP Outperforms at 6.4% as Investments Plummets! September 1, 2014

[4] See Phisix: 2Q GDP Outperforms at 6.4% as Investments Plummets! September 1, 2014

[5] National Statistics Office Construction Materials Wholesale Price Index in the National Capital Region (2000=100) : December 2014 Philippine Statistics Authority January 13, 2015

[6] Manila Standard Cement sales climb 9.6% to 20.2m tons January 27, 2015

[7] See Phisix: The Showbiz Political Economy and the Showbiz Financial Markets April 28, 2014

[8] See Phisix: The October Syndrome is Back! Philippine Casinos as the Causa Proxima? December 15, 2015

[9] Bangko Sentral ng Pilipinas Bank Lending Growth Decelerates in December January 30, 2015

[10] Bangko Sentral ng Pilipinas Domestic Liquidity Growth Slightly Faster in December January 30, 2015

.png)

.png)

.png)

.png)

.png)

.png)

.png)