Professor Don Boudreaux is puzzled and saddened by people’s unwavering faith in reprobate politicians,

Successful politicians – and particularly those who are successful on national stages – are, with exceptions too few to matter, master con artists.

Whatever is the reason why so many grown people respect holders of political office is, as it has always been, beyond my comprehension. I just don’t get it. Practitioners of no other profession are accorded more honor, respect, and (most importantly) power while at the same time being held to such low standards of ethical behavior. Actions that, when committed by the family dog, properly elicit scolding or muzzling or even eviction from the premises are, when committed by an elected official, greeted with oohs, aahhs, applause, and re-election to powerful office.

I share the same frustrations too.

Thanks to the principles of liberty, I have been enlightened that people who mattered most are those who put to risks their personal savings and capital and commit tremendous efforts to serve the consumers. Such people represent genuine public service.

Yet these wealth generating class of people are often unfairly painted as immoral or unethical by politicians, by their lackeys and their media mouthpieces.

Moreover, there has been little realization that while there will always be crooked people, corrupt and perverted behaviour are often an offshoot to arbitrary laws, excessive interventionism and burdensome taxes. Many unscrupulous actions are consequences of stifling regulations. And these have been the primary reasons for the proliferation of informal economies or black markets.

And in contrast, politicians who live by the forcible appropriation of people’s efforts, have ironically, been portrayed as having the moral high ground over the productive economic class.

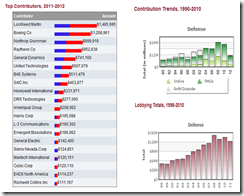

Many don’t understand that the precept of “it is not what you know but who you know” has been grounded on the politicization of the marketplace. Where entrepreneurs, business people and corporate managers have been frequently harassed or intimidated by onerous regulatory and tax requirements, political “connections” become a byword for the protection of one’s properties and the facilitation one’s economic interests.

And analogous to Stockholm Syndrome, where hostages develop personal attachments with their captors, the populace yield or surrender to the “realities” of interventionism. Thus, the popularity of those who possess social and political control over others—or the politicians and the political class because of the unwarranted dependency relationship built from oppressive politics.

Of course the indoctrination factor through mass media, and the state captured private (crony) institutions have been party to the promotion of interventionism, the latter serves as a reason for the existence of revolving door relationships with crony institutions.

In the Philippines many aspire to be lawyers, that’s because lawyers are perceived to be a heartbeat away from politics. And politics has been seen by many, if not most, as a paragon of public service and career success which is entirely a popular delusion.

People hardly understand the system of ethics from which democratic politics operates on.

Basically, in arguing for the protection of society’s welfare, politicians take away people’s freedom, which is used as basis for the second step, the arrogation of people’s property. Then, the state through incumbent political leaders redistributes plundered resources to their wards and gives some of the plundered resources back to the taxpayers (e.g. welfare, public infrastructures) and claim the moral high ground of being ‘compassionate’. Yet most of such actions have been meant at securing votes to keep them in office.

I am reminded by the pungent Bennett Cerf quote in Nathaniel Branden’s book Judgment Day: My Years With Ayn Rand

You have to throw welfare programs at people — like throwing meat to a pack of wolves — even if the programs don't accomplish their alleged purpose and even if they're morally wrong.

And of course, the rest of the taxed resources are kept for themselves in the form of salaries, perks, perquisites and other benefits (such as junkets), not to mention income from under the table transactions.

People hardly realize too that the political office have been magnet to people with sinister motivations. The great Friedrich von Hayek said the worst people usually get to the top of the political world.

Writes Doug French at the Mises Blog, (bold emphasis mine)

F.A. Hayek famously argued in The Road to Serfdom, that in politics, the worst get on top, and outlined three reasons this is so. First, Hayek makes the point that people of higher intelligence have different tastes and views. So, as Hayek writes, “we have to descend to the regions of lower moral and intellectual standards where the more primitive instincts prevail,” to have uniformity of opinion.

Second, those on top must “gain the support of the docile and gullible,” who are ready to accept whatever values and ideology is drummed into them. Totalitarians depend upon those who are guided by their passions and emotions rather than by critical thinking.

Finally, leaders don’t promote a positive agenda, but a negative one of hating an enemy and envy of the wealthy. To appeal to the masses, leaders preach an “us” against “them” program.

“Advancement within a totalitarian group or party depends largely on a willingness to do immoral things,” Hayek explains. “The principle that the end justifies the means, which in individualist ethics is regarded as the denial of all morals, in collectivist ethics becomes necessarily the supreme rule.”

The bottom line is that ignorance, indoctrination, propaganda, the belief in the politics of heaven (abundance) on earth (scarcity), the seduction of easy life from political redistribution, dependency on political relations as means to preserve one’s property, the popularity of social control or political power, traditionalism, peer pressures, and the Stockholm syndrome applied to political relations, among many others more, may have contributed to people’s undeserving faith in politicians.