Global regulators have been arguing over the kind of regulations required for crisis prevention.

From Bloomberg,

Capital standards designed to fortify the global financial system are eroding as European officials, beset by a debt crisis, rewrite the regulations and U.S. rulemaking stalls.

The 27 member-states of the Basel Committee on Banking Supervision fought over the new regime, known as Basel III, for more than a year before agreeing in December to require banks to bolster capital and reduce reliance on borrowing. Now, as they put the standards into effect in their own countries, European Union lawmakers are revising definitions of capital, while the U.S. is struggling to reconcile the Basel mandates with financial reforms imposed by the Dodd-Frank Act.

“The game on the ground has changed in Europe and the U.S.,” said V. Gerard Comizio, a former Treasury Department lawyer who is now a senior partner at Paul Hastings Janofsky & Walker LLP in Washington. “The realists in Europe realized that their banks cannot raise the capital they’d need to comply. U.S. banks have reversed course and are more assertively fighting against it. The future of Basel III looks less certain now than it did when it was agreed to.”

The Basel committee revised its capital standards and outlined new rules on liquidity and leverage after the 2008 crisis exposed the vulnerability of the banking system. Credit markets froze following the collapse of Lehman Brothers Holdings Inc., sending the world economy into its first recession since World War II. Basel III was meant to create “a much stronger banking and financial system that is much more resilient to financial crises,” said Mario Draghi, who will take over as president of the European Central Bank in November.

Not Binding

Basel standards aren’t binding, so each country needs to write its own rules putting the agreed-upon principles into effect. The European Commission proposed regulations to parliament last month that would translate Basel III into law. A majority of EU governments also must endorse them. U.S. regulators led by the Federal Reserve have to come up with their own version, though they don’t need legislative approval.

The proposed EU rules, submitted by financial services commissioner Michel Barnier, omitted a ratio designed to improve banks’ cash positions, deferred decision on a rule to limit borrowing, revised capital definitions and extended some compliance dates. In the U.S., regulators are stymied because the 2010 Dodd-Frank Act bars the use in banking rules of credit ratings, which Basel III relies on to determine risk.

First, regulators have been squabbling over proposed elixirs, when in reality they are arguing about treatments to the symptom rather than the disease itself.

All these web of proposed regulations, on top of existing maze, won’t stop the banking financed boom bust cycle. This is because the current central banking based monetary system has been engineered for bubbles.

As the great Murray N. Rothbard wrote

for it is the establishment of central banking that makes long-term bank credit expansion possible, since the expansion of Central Bank notes provides added cash reserves for the entire banking system and permits all the commercial banks to expand their credit together. Central banking works like a cozy compulsory bank cartel to expand the banks' liabilities; and the banks are now able to expand on a larger base of cash in the form of central bank notes as well as gold.

Two, regulators think that the action of bankers can be restrained by virtue of fiat. They are delusional. They forget that as humans, regulator-banker relationship will be subject to various conflict of interests relationships such as the agency problems, time consistency dilemma, regulatory arbitrage and regulatory capture aspects.

In reality, more politicization of the banking-central banking amplifies systemic fragility.

Yet amidst the publicized noble intentions, we can’t discount that the implicit desire by regulators for these laws have been to expand control over the marketplace and to protect the interests of certain groups (regulatory favored groups).

Three, as shown above opposing interests leads to conflicting design of regulations.

In a world of complexity, centralization is bound for failure.

Let me add that while many see capital adequacy laws as one way of restraining bubbles, such perspective do not account for the unseen or unintended consequences.

Expanding capital adequacy regulations or laws can have lethal effects on the economy: they destroy money.

As Professor Steve Hanke explains, (bold emphasis mine)

The oracles have erupted in cheers at the increased capital-asset ratios. They assert that more capital has made the banks stronger and safer. While at first glance that might strike one as a reasonable conclusion, it is not the end of the story.

For a bank, its assets (cash, loans and securities) must equal its liabilities (capital, bonds and liabilities which the bank owes to its shareholders and customers). In most countries, the bulk of a bank’s liabilities (roughly 90%) are deposits. Since deposits can be used to make payments, they are “money.” Accordingly, most bank liabilities are money.

To increase their capital-asset ratios, banks can either boost capital or shrink assets. If banks shrink their assets, their deposit liabilities will decline. In consequence, money balances will be destroyed. So, paradoxically, the drive to deleverage banks and to shrink their balance sheets, in the name of making banks safer, destroys money balances. This, in turn, dents company liquidity and asset prices. It also reduces spending relative to where it would have been without higher capital-asset ratios.

The other way to increase a bank’s capital-asset ratio is by raising new capital. This, too, destroys money. When an investor purchases newly-issued bank equity, the investor exchanges funds from a bank deposit for new shares. This reduces deposit liabilities in the banking system and wipes out money.

By pushing banks to increase their capital-asset ratios to allegedly make banks stronger, the oracles have made their economies (and perhaps their banks) weaker.

Prof. Tim Congdon convincingly demonstrates in Central Banking in a Free Society that the ratcheting up of banks’ capital-asset ratios ratchets down the growth in broad measures of the money supply. And, since money dominates, it follows that economic growth will take a hit, if banks are forced to increase their capital-asset ratios.

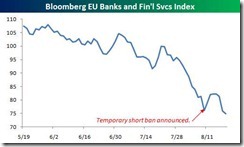

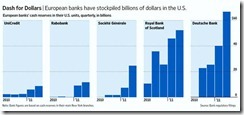

Professor Hanke goes to show how these regulations have impacted the Eurozone which has resulted to declining money supplies that has led to the recent market turbulence. Read the rest here

To add, adherence to math or algorithm based models has been one of the principal weakness of such regulations, writes Philip Maymin, (bold emphasis mine)

One might think that the ideal regulations would be those that find the right numbers for these portfolios, not too small and not too large—the Goldilocks of risk.

Surprisingly enough, it is not possible. It turns out that no algorithm for calculating the required risk capital for given portfolios results in lower systemic risk.

In Maymin and Maymin (2010), we prove why this is so, both mathematically and empirically. First, the math. Imagine that there are 1,000 securities whose returns are each independently distributed according to the standard bell curve of a normal distribution. Simulate five years of monthly returns for each security, and then calculate the volatility that each one actually realized. Because there are only sixty data points for each security, some securities will appear to have a little higher volatility than they truly do, and some will appear to have a little less. Out of the one thousand securities, how many would you guess exhibit less than 80 percent of their true volatility?

The answer is ten, and we show this with a formula in the paper. If we make the situation more realistic by relaxing the assumption about normality, the problem is exacerbated, and the ten securities with the lowest realized volatilities would deviate even further from their true volatility.

We also show empirically that the securities with historically low volatility tended to have almost twice as much subsequent risk, while those with historically high volatility tended to have almost half as much subsequent risk. For both the riskiest and least risky securities, therefore, historical risk is a statistical illusion.

Here's where the problem of objective regulations comes in. To see it, consider the perspective of a bank deciding what to invest in. It can invest in any of the 1,000 securities, but if it invests in the special ten that exhibit less than 80 percent of their true volatility, it will have to put up one-fifth less capital than otherwise. At least to some extent, those ten securities will be more favored than the others. What's worse, every bank will favor the same ten securities because the objective regulations are the same for everyone.

If those securities continue to rise, then no problem will be apparent. But if they should fall, then, suddenly, all banks will need to liquidate the exact same positions at a time when those positions are falling anyway. This sets the stage for systemic failure. Consider sub-prime mortgages as an illustration. These assets appeared to be historically low-risk and were, therefore, regulatorily favored. Banks invested more in them than they perhaps should have. For a while, as real estate prices continued their ascent, no problems surfaced. But once the market turned, banks began experiencing more losses on their sub-prime mortgage holdings than their regulatorily-mandated risk calculations had planned for. Banks needed to raise capital quickly and began doing two things: selling the sub-prime mortgages, dropping the prices even lower; and selling other assets. Because the banks all acted nearly simultaneously, and all in the same direction, the impact on the markets was both broad and deep, and systemic collapse became a real threat.

Bottom line: whack-a-mole stop-gap regulations meant to preserve the current fragile, broken and unsustainable paper money system founded on the cartelized system of welfare government-central banking-politically privileged "Too big to fail" banks will ultimately fail.

Paper money will return to its intrinsic value-ZERO.