The common feature for today’s global financial marketplace has been extreme volatility

Sharp price fluctuations are seen by scalpers and short term traders as wonderful opportunities. On the other hand, such landscape for me, exhibits signs of increasing market distress. From a trading perspective, this implies for a low profit-high risk engagement.

In short, when the risk is high or when uncertainty dominates, I opt to take a defensive posture. For me, it is better to lose opportunity than to lose capital.

The Philippine and ASEAN markets have not been spared of such volatility.

The local benchmark fell by a measly .07% this week. But this comes after the Phisix opened strongly on Monday, lifted by the late week rally of Wall Street from the other week. Unfortunately such one day rally failed to hold ground as the following sessions essentially more than erased Monday’s gains.

Global markets have closed mixed for the week.

Almost every major equity benchmark encountered a rollercoaster week. Like the Phisix most of the early gains came under pressure during the close of the week.

In the ASEAN region, there have been signs of rotation.

This year’s ASEAN laggards, Indonesia (+6.8% year-to-date) and Malaysia (+7.33% also y-t-d) ended the week strongly as ASEAN outperformers, the Philippines (+19.2%) and Thailand (+17.9%) retrenched.

This only goes to show that the destiny of the Phisix has been tied with that of the region. So any belief that the local benchmark may perform independently will likely be disproven.

Also given the rotational dynamics, we might see some “catch up” play or the narrowing of the recent wide variance between the laggards and leaders overtime. But this doesn’t intuitively mean that such gaps will close.

But the fate of ASEAN’s markets will ultimately depend on the unfolding events in the US.

US Markets and Economy as ASEAN’s Anchor

Yes there have occasional instances where the Phisix has diverged from US or world markets[1], but overtime, the mean reversion capabilities of the markets govern.

Thus, the exemplary performance of ASEAN markets can be traced to the buoyancy of the US markets.

For as long as the US remains firm, so will likely be the fortunes of ASEAN markets and vice versa.

The US markets has so far been resilient from the Europe’s crisis, partly due to the capital flight dynamics from the Euro into the US, and similarly from the slowdown from major emerging markets as the BRICs.

Nonetheless such sustainability must be questioned considering that much of the world’s major economies (developed and emerging markets) have been in a marked downtrend.

Unlike in 2008, there hardly will be any China and other major emerging markets to rely on to do much of the weightlifting. Many emerging markets, particularly the BRICs have been bogged down by their domestic quasi-bubble problems.

In addition, the US Federal Reserve continues to employ talk therapy (signaling channel or policy communications management) instead of undertaking real actions. Media continues to broadcast the prospects of a Bernanke Put (“bad news is good news”), as Fed officials continue to signal verbal support in projecting hope for the steroid addicted markets.

And importantly political gridlock and regime uncertainty has been worsening (taxmaggedon, fiscal cliff, debt ceiling, Dodd-Frank[2], Obamacare, the forthcoming national elections and lately even the controversial LIBOR[3] issue) will likely intensify the current business, economic and financial uncertainties.

And considering that the US markets and her economy has been bolstered by sustained injections of steroids, the lack of and the perceived dearth of policy palliatives, as evidenced by the decelerating money supply growth, will likely bring to the surface and expose most of the misallocated investments, which has been camouflaged by recent monetary policies.

Such dynamics will be manifested through an economic slowdown if not a recession—but again this would really depend on how Ben Bernanke and US Federal Reserve will react or respond to increasing evidences of a slowdown.

Lately even the New York Federal Reserve swaggered about having to boost to US stock markets[4], which they say without them would have been 50% lower!!!

Proof that low interest rates have hardly worked: record low mortgage interest rates[5] have been amiss in providing sustained recovery to US property markets[6].

Yet steroid addicted financial markets continue to look forward to the FOMC’s meeting during the end of July in the hope for another round of policy opiates.

Add to these the soaring costs of agricultural commodities (chart from US global investors)[7], which have been mostly attributed to weather or drought conditions.

This, I believe, has been exacerbated by easy money policies and other interventions (e.g. agricultural subsidies, tariffs and etc…) which should extrapolate to higher food prices.

So we seem to be witnessing incipient signs of stagflation as I have long been predicting.

[As a side note, a UBS analyst recently noted that the risks of hyperinflation has been greatest for the US and UK[8]. But he sees less than 10% chance for this to occur in the near future.

Yet he believes that hyperinflation results from “unsustainable deficits” which “occurs after central banks monetize a large amount of debt”. Thus hyperinflation is a fiscal phenomenon.

I’d still say that hyperinflation is a monetary phenomenon meant to address fiscal concerns. Yes hyperinflation signifies a means to an end approach.

In dire financial straits and in desperation due to the lack of access to domestic and overseas private sector financing, governments frenetically print money to preserve on their political entitlements and power.

At the end of day, all these unwieldy or unsustainable levels of debt expansion will be defaulted upon directly through restructuring, or indirectly through inflation, where hyperinflation may arise as consequence to policy miscalculation, if not deliberately.

And this is why the risks of hyperinflation shouldn’t be discounted[9] despite today’s low interest rate environment]

Also, Spanish bonds at record highs are manifestations of persisting and growing financial and economic stress in the Eurozone and of the extreme fluidity of current conditions, which will have an impact to the US and to the world.

Markets have never really anticipated this.

As Doug Noland of the Credit Bubble Bulletin rightly observed[10],

It was not that many months ago that Spain was viewed as part of a financially stable European “core.” Indeed, Spain (5-yr) CDS ended Q1 2010 at about 100 bps. Spain commenced 2010 with government debt at a seemingly healthy 54% of GDP. Few anticipated the incredible pace of fiscal deterioration. With the federal government on the hook for the EU’s 100bn euro bank bailout package, the IMF now projects Spain will end 2012 with debt at about 90% of GDP – and poised for continued rapid growth.

Who would expect that French bonds to dramatically narrow against German bunds, where “spreads on French debt have narrowed by 16 bps in the last month and are currently at their lowest levels of 2012”[11] as French government paper morph into a ‘safe haven’ from the Euro crisis?

That’s how swift and powerful events have been moving.

To consider, people stampeding into French bonds seem to have overlooked the many sins underpinning the French sovereign paper.

As the BCA Research explains[12]

The French public sector is not in good financial health and is in worse condition than that of Italy in many respects. Italy has run large primary surpluses through much of the last two decades, while France has run large deficits. The Italian debt/GDP ratio was rather stable, while France’s has been rising sharply. In fact, France has accumulated 60% more debt than Italy since 1999, and its debt service costs are rising. More worrisome is that France’s combined private and public sector debt load is higher than that of Italy, putting the French economy in a perilous situation. The only variable where France looks better is economic growth, but even this has mostly come from larger government spending, and in turn at the cost of escalating debt.

And considering the incumbent socialist administration’s penchant for more government spending, taxes and regulations[13] which again will translate to more debt, reduction of productivity and competitiveness and potential exodus of investors, today’s safehaven may become tomorrow’s epicenter for the progressing crisis.

So we are seeing existing policy error compounded by more policy errors that only aggravates such crisis conditions, from which the sentiment of financial markets shifts violently from one end to another.

Hence, while earnings report of US publicly listed corporations may seem buoyant which has given the impetus for the bulls to provide the recent strength to the US equity markets[14], all the above compounds to signify substantial headwinds that US financial markets (equities, bonds, commodities) will be faced with.

And to add, it would be big mistake to read current market activities as tomorrow’s outcome given the huge swings happening in the financial markets around the world. That’s how unstable and mercurial current conditions are.

China’s “Good News” Ignored by the Markets

Such unpredictability has been no different for China.

This week, there has been a torrent of supposed good news that should have reanimated, if not fired up, China’s financial markets.

China’s banking system has reportedly posted a big jump in loan growth or bank lending rose by 16% to 919.8 billion yuan (US$144.3 billion) last June[15]

While news say that this signifies a positive sign from government efforts, this seems largely unclear. I am not even sure if these have been contracted by the private sector. As in the recent past, most of the so-called stimulus has been directed to the overleveraged and overindebted State Owned Enterprises (SoE)[16] which only adds to the current juncture.

The property sector likewise reported a significant surge in bank loans from April to June, up by 20% from last year to the tune of 322.6 billion yuan ($50.64 billion)[17].

Reports also say that China will ease restrictions on her shadow banking system, as well as, double up investments on railway projects[18].

This goes in contrast to previous reports where 70% of China’s railways projects recently has been suspended as a result of ballooning deficit financing, as well as last year’s deadly train crash which has brought upon safety concerns and exposed corruption at the highest levels of the ministry[19]

The confusing signals from supposed government stimulus and support, as well as, positive developments seems to have been discounted by the China’s financial markets as both the major equity market bellwether, the Shanghai Composite (SSEC-top pane), and China’s currency the Yuan (CNY/USD-bottom pane) have not demonstrated auspicious responsiveness to such developments.

Unlike at the end of the 2012 where the SSEC hit a low but the yuan remain lofty, this time both the SSEC and the yuan have been treading downwards.

These are hardly reactions that could be reckoned as bullish.

In contrast these could be symptoms of deeper underlying malaise—a bursting bubble, punctuated by intensifying hot money outflows[20].

With scarcely any household savings to tap, most of the increases in savings are from government and corporations[21] there seems little room for bailouts without incurring risks of inflation.

So like the US, we have the same ingredients contributing to the current highly uncertain climate, ambivalent central bank (PBoC) and political stalemate which has been prompting for increasing manifestations of the unraveling of malinvestments that has been the driving force of the current slowdown.

The Asian Electronic Export Nexus

Many seem to have developed the hardened belief that domestic (or regional) markets have been made invincible by the recent events, particularly record high equities.

As I have been saying, today’s globalization has made the world much deeply interconnected through trade, capital, labor and even through the US dollar standard based banking system.

Embracing the idea of decoupling can be hazardous to one’s portfolio and detrimental to one’s emotions and ego.

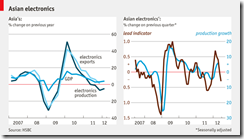

In terms of trade, a slowdown in world growth will have impact negatively on Asia’s electronic exports.

As The Economist recently commented[22]

THE electronics industry accounts for two-fifths of manufacturing output in Asia, according to calculations by HSBC. So when electronics grows quickly, Asia's GDP tends to speed up too, to the tune of almost 0.2 percentage points for each full-point increase in the electronics sector. Unfortunately this correlation also applies when things slow down (see left-hand chart). And recent signs are that Asia’s electronics industry is doing just that: HSBC’s lead indicator, which gives a rough two-month preview of future production, has slowed sharply in recent months, in contrast to the latest available output figures. One bright side, given the economic woes of Europe and America, is that Asian manufacturing is no longer as closely tied to Western markets as it was. Three of the five components that comprise HSBC's lead indicator measure conditions within Asia. So when the next rebound occurs, it is likely to be home-grown.

Again while it is true that Asia has been less dependent on the West, there is no guarantee that other sectors will not be affected from slomo diffusing or spreading of the global debt crisis.

A slowdown in electronic exports incidentally constitutes about half of Philippine exports[23]

So those dreaming of immunity from a global slowdown will likely be refuted.

Bottom line: The contagion risk is real.

Unless we see aggressive collaborative actions from major central banks (which may place a temporary patch or booster to the markets), or signs of economic stabilization from developed nations or from major emerging economies (whom are experiencing market clearing liquidations from domestic bubbles), we should expect global markets to remain sharply volatile and erratic in both directions but faced with greater probabilities of “fat tail” risks.

As a final note: I don’t expect the coming State of the Nation Address by the Philippine President to have lasting effects. They are likely to be meaningless feel good political rhetoric whose goals are for his party to seize the majority in the coming congressional elections in 2013.

Bubble policies and the effects thereof will continue to be main drivers of the asset markets.

Approach the equity markets with caution.

[1] See Phisix: Will the Risk ON Environment be Sustainable? June 24, 2012

[2] See Infographic: Dodd Frank-enstein, July 21,2012

[3] See Barclay’s LIBOR Scandal: Self Fulfilling Turmoil July 19, 2012

[4] See Bernanke Doctrine: New York Fed Boasts of Pushing Up the US Stock Markets, July 14, 2012

[5] Wall Street Journal Blog Vital Signs: Mortgage Rates Hit Record Low July 13, 2012

[6] Wall Street Journal Blog Vital Signs: Mortgage Rates Hit Record Low July 13, 2012

[7] US Global Investors America’s Competitive Spirit, July 20, 2012

[8] BusinessInsider.com UBS: The Risk Of Hyperinflation Is Largest In The US And The UK, July 17, 2012

[9] See Taking The Hyperinflation Risk With A Grain Of Salt?

[10] Noland Doug Risk On, Risk Off And The Spanish/Chinese Tug Of War, Credit Bubble Bulletin PrudentBearcom July 20, 2012

[11] Bespoke Investment Group EU Sovereign Spreads, July 20, 2012

[12] BCA Research, Watching France, July 10, 2012

[13] See Quote of Day: The Last Hurrah of Socialist Welfare States May 8, 2012

[14] See US Stocks Markets: Earnings Trump Economic Data, Leading Economic Indicators Fall, July 20, 2012

[15] Channelnewsasia.com China bank loans rise in June, July 12, 2012

[16] See China’s New Loans Unexpectedly Surged in May June 12, 2012

[17] Reuters.com China Q2 property loans rebound with sales, July 19, 2012

[18] See Will China Ease Banking Curbs? Has the Railway Stimulus been Launched?, July 17 2012

[19] Payne Amy Morning Bell: Transportation Secretary Wants Us to Be Like Communist China, Heritage Network, July 9, 2012

[20] Zero Hedge, Forget China's Goal-Seeked GDP Tonight; This Is The Chart That Keeps The PBOC Up At Night, July 12, 2012

[21] See Contagion Risk: Watch for China’s Catastrophic Deleveraging, July 16, 2012

[22] Graphic Details Chips are down, The Economist July 18, 2012

[23] RGE Analyst Blog Philippines: Reconciling Short-Circuiting Electronic Exports, Economonitor, February 17, 2012