Talk about central banking wizardry.

The Bank of England (BoE) will extend lending programs to small and business enterprises for another year even if such measure has initially failed.

The Bank of England will extend by one year its plan to provide cheap loans to companies and consumers and make credit available for small companies, enhancing a nine-month-old program to aid the economy.

The Funding for Lending Scheme will now last until January 2015, and will make lending to small companies more attractive and open to non-bank lenders, the BOE and the Treasury said in London today. The government says its program has lowered borrowing costs by about 100 basis points and provided 13.8 billion pounds ($21 billion) between its creation and December

“This is a big boost for the small and medium sized businesses that are at the heart of the British economy,” Chancellor of the Exchequer George Osborne said in an e-mailed statement. “This innovative extension will now do even more for small and medium sized businesses so that they can play their full part in creating new jobs.”

Osborne is expanding the program on the eve of economic statistics that may show Britain’s economy was close to an unprecedented triple dip in the first quarter. The announcement also precedes an audit of the U.K. by the International Monetary Fund, whose delegation visits London next month after the fund said Osborne should ease his austerity plan to aid growth.

Today’s extension to the FLS will allow banks to borrow 10 pounds next year for every 1 pound they lend to small companies in 2013, the Treasury said. If they wait to extend the loan until next year, the amount they can borrow under the plan is halved to 5 pounds for every pound loaned. Banks can borrow 1 pound for every pound loaned with the rest of the program.

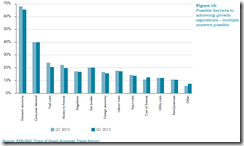

The premise here is that access to finance has been the key barrier besetting the Small and Medium scale businesses.

The main obstacle to small and medium scale businesses has been the domestic economy and domestic demand, this is according to the latest survey by the Federation of Small Businesses (FSB).

John Walker, National Chairman of FSB says another factor influencing the weak economy and demand has been inflation

Though our members are feeling more optimistic, the outlook remains challenging with domestic demand weak. Consumer spending has been subdued by inflation, eroding disposable incomes, with inflation expected to remain above the target level in 2013. In this quarter, members report that three cost elements – fuel costs, input prices and utility bills – are increasing their overheads and while down from 12 months ago, the last three quarters of 2012 showed these cost pressures persisting.

So this should be a great example of how inflationism distorts the economic calculation that leads to a stagnating economy amidst elevated inflation or stagflation

Over the same period, UK’s statistical consumer price inflation rate remains lofty despite the deleveraging by households and firms.

Yet as pointed out by the article, UK’s economy is facing the risks of a triple dip recession. (charts from tradingeconomics.com)

In short, all money printing by the BoE has failed to deliver what has been promised—a recovery.

While UK’s average housing prices have been down from 2007, they remain above the pre-bubble bust levels. This goes the same with housing pe ratios (chart from Nationwide.co.uk)

Another area which BoE’s QE has positively influenced has been the stock market.

UK’s FTSE 100 has been on the rise since 2011 (blue trend line), even as the economy fumbled from one recession to another. Another wonderful example of a parallel universe. The FTSE has been up 8.6% year to date as of yesterday’s close. (chart from Bloomberg)

In other words, all cheap credit and money has done has been to incentivize speculation (asset bubbles) at the expense of the productive sector of the economy.

Why invest in businesses when the costs of operating one have been unpredictable and when financial markets, especially backed by an implicit Bank of England Put, would give a better yield?

What this means is that the BoE’s FLS credit program hardly addresses the roots of the problems, which hasn’t been about credit. The BoE fails to see that her inflationist policies has functioned as one of the principal obstacles to economic recovery.

Yet like typical political authorities, who wants to be seen as “doing something”, the expedient action has been to do the same thing over and over again and expecting different results. Unfortunately, the outcome will likely go against their wishful expectations.