Sovereign Man’s Simon Black warns of the suggestions for a cashless Society: (bold mine)

Rogoff begins asking the question: “Has the time come to consider phasing out anonymous paper currency, starting with large-denomination notes?”He goes on to explain that getting rid of paper currency would provide two critical benefits:1) It would reduce crime and tax evasion;2) It would allow central banks to drop interest rates BELOW ZERO.I was stunned. Though given the status quo thinking we have to put up with today, I really shouldn’t have been.In fairness, Mr. Rogoff is an academic. It’s his job to dispassionately analyze data and render conclusions, whatever they may be. What’s scary is that some dim-witted politician will likely jump all over this.People have been deluded into believing that only criminals and tax cheats hold cash in large denominations. And the conclusion is that if we ban cash, criminals will simply quit their craft because they’ll no longer have an officially-sanctioned medium of exchange.This is total baloney, obviously. Banning cash doesn’t eliminate crime. It just creates a new cottage industry for cash alternatives.Drug deals can just as easily go down swapping share certificate of Apple. Or title to a new car. Any number of things.Perhaps the more important point, however, is the notion that eliminating cash frees up central bankers to force interest rates into negative territory.The contention is that the official data tells us that inflation is tame. Consequently, central banks should be free to expand the money supply and ratchet down interest rates even more.There’s just one problem: interest rates are basically at zero already.Technically a central banker could drop interest rates to below zero.But if they did that, who in his/her right mind would hold their savings at a bank where they would have to PAY THE BANK to make wild bets with their money?People would just go to physical cash instead.Solution? Eliminate cash! Then people would be forced to suffer NEGATIVE interest rates… and thus have a HUGE INCENTIVE to spend as much as they can as quickly as they can. Forget about putting something aside for a rainy day.But hey, at least the stock market would probably rise.Now, I highly doubt that physical cash is going to be sucked out of the system… tomorrow. But the War on Cash is very real indeed.As I travel around the world, I’ve seen with my own eyes– CASH has become the #1 hot button item for customs agents everywhere. They even have highly trained cash sniffing dogs now.It’s becoming more and more obvious that people should divorce themselves from this system and consider holding at least a portion of their savings in something other than fiat currency.And of all the options out there, it’s hard to beat the convenience and tradition of precious metals.

Indeed governments have increasingly been waging war on cash.

The latest: Israel’s government has recently declared limits on cash transactions.

From Reuters: Cash transactions between businesses will be limited to 5,000 shekels ($1,400) under an Israeli government plan to fight money laundering and tax evasion.

I have previously shown that various governments have waged war on cash like Mexico, Italy, Russia, Nigeria and Ghana or even in the US.

In the Philippines I had my share of nightmare with the domestic authorities at the domestic airport whom harassed me for bringing slightly excess cash (based on the mandated limits) for an outbound trip predicated on a regulation that I wasn’t even aware of then. As a side note, the slightly excess cash was meant as gift for my Mom who resides overseas!!

Money laundering or tax evasion has served as the stereotyped alibi or scapegoat for the war on cash. But such is a sign of desperation. Remember cash as currency or medium of exchange, are issued to the citizenry by the respective governments who wield the monopoly seignorage. So by waging war on cash, governments have not only assailed on their basic function, they reveal signs of dissatisfaction with current revenues from such seignorage privilege.

War on cash serves as an extension of financial repression policies.

The fundamental reason is that governments intend to capture even more of the public’s resources (directly and indirectly) to fund the interest of political agents and their private sector allies. It's is a sign of unmitigated greed imposed on society by force.

The real targets are really not money laundering or tax evasion but the cash holding society, particularly the informal economy. Again this is a sign of desperation.

Statist always conjure up reasons for state control over everything.They always point to so-called benefits without looking at the costs. But costs are not benefits.

For instance, the importance of cash came into the limelight when the western banking system nearly collapsed in 2008. In Europe, many took shelter by hoarding € 500 cash. So the assumption to migrate to a cashless society extrapolates that the banking sector and the governments are risk free.

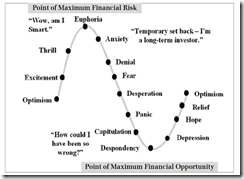

But this is something untrue. In fact both the government and banks are the major sources of risks. Just look at the massive build up of debt levels of major economies. What happens when all these unravels?

Yet the war on cash is also based on the mirage that growth in debt and transfer of resources will have little or even NO limits or repercussions. This is utterly wrong. The war on cash only allows the establishment to buy time before their unsustainable system implodes.