One of the foremost concerns of all parties hostile to economic freedom is to withhold this knowledge from the voters. The various brands of socialism and interventionism could not retain their popularity if people were to discover that the measures whose adoption is hailed as social progress curtail production and tend to bring about capital decumulation. To conceal these facts from the public is one of the services inflation renders to the so-called progressive policies. Inflation is the true opium of the people and it is administered to them by anticapitalist governments and parties. Ludwig von Mises

Remember what I have been saying about financial markets being dependent on policy steroids?

Here’s what I wrote during mid-September[1]

If team Bernake will commence on a third series of QE (dependent on the size) or a cut in the interest rate on excess reserves (IOER), I would be aggressively bullish with the equity markets, not because of conventional fundamentals, but because massive doses of money injections will have to flow somewhere. Equity markets—particulary in Asia and the commodity markets will likely be major beneficiaries.

As a caveat, with markets being sustained by policy steroids, expect sharp volatilities in both directions.

Global financial markets, from equities, commodities and currencies have been playing out almost exactly as I have described.

The difference is that instead of being driven by the US Federal Reserve’s credit easing policies, last week’s ferocious global stock market rally appears to have been impelled by the Eurozone’s bailout which came with both a 50% ‘voluntary’ haircut on Greek bondholders and the $1.4 trillion expansion of the European Financial Stability Fund (EFSF).

Insanity: Doing The Same Thing Over And Over Again

Some experts have even been so perplexed by the heft, scale and breadth of the market’s rally to even label this ‘crazy’[2]. However what is seen as ferly to others has long been understood by us as transitional episodes of boom bust cycles. And flouncing markets could even serve as an indicator of major trend reversals[3].

My problem then was that without concrete actions and commitments from policymakers, markets were functionally fragile or vulnerable to a crash.

The Eurozone’s bailout deal fundamentally confirms my earlier exposition on the mechanics of the proposed bailout[4]. But the deal covered more conditions, aside from the conversion of the bailout fund into an insurance-derivative mechanism, this included the ‘voluntary’ 50% haircut of Greece bondholders, the creation of a Special Purpose Vehicle (SPV) which allows private and other non-EU investors (such as the IMF or possibly China and other emerging markets) to participate in the financing of the bailout, bank recapitalization—where banks capital ratio would be increased to 9% by June of 2012, and importantly the continuation of the European Central Bank’s asset purchasing program.

The unfurled package has ostensibly been way beyond the markets expectations and had been warmly received. This exhibits the state of the current markets—deep addiction to policy steroids.

The deal’s insurance-derivative model provides guarantees to investors on the initial (20%?) tranche of debts issued by select EU governments that would allow four to fivefold increase of the debt issuance through leverage; where the details of which has yet to be threshed out[5].

There are valid reasons to be skeptical on the final mechanics of the supposed bailout scheme.

One, questions as to the actual available resources to implement these programs. For instance, the EFSF supposedly will be used as insurance to guarantee debt issuance AND also as last resort financing access to bank recapitalization, so how will the fund be apportioned? Are EU leaders assuming that these resources will only function as contingent resources? Wouldn’t this be too optimistic?

Next the supposed leveraging of debt issuance will likely come from already debt distressed nations.

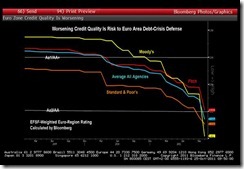

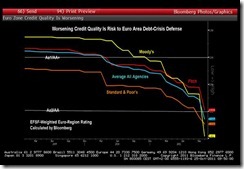

As the Bloomberg chart of the day rightly points out[6]

the average rating for the bloc, calculated by Bloomberg from the assessments of the three main evaluators, has worsened to 3.14, representing the third-best grade, from 2.12 in May 2010 when the European Financial Stability Facility was designed. The measure fell 0.23 point in the previous 15 months. The average is calculated by giving a numerical grade for each grading, where 1 is the highest, and adjusting it for each country’s share of the EFSF guarantee.

Seven of the 17 euro-sharing nations have had their ratings downgraded since the announcement of the facility, which maintains a top grade from Standard & Poor’s, Moody’s Investors Service and Fitch Ratings. As the contagion has spread to banks, prompting governments to work out recapitalization plans, further cuts, mainly for the top-rated countries, may reduce the strength of the fund.

So the EU bailout is essentially applying what Albert Einstein defines as Insanity: doing the same thing over and over again while expecting different results. More debt will be compounded on existing debt.

A major credit rating agency Fitch Ratings sees the proposed deal on Greece bondholders as a default that would not remove the risk of further downgrades for other sovereigns[7].

However my general impression behind all the ‘smoke and mirrors’ promoted as a comprehensive rescue strategy is that these measures fundamentally stands on the ECB’s monetization of government debt.

In short, the EU’s Bazooka bailout deal represents as an implicit license for or as façade to the ECB’s massive money printing program.

Global Market Responses

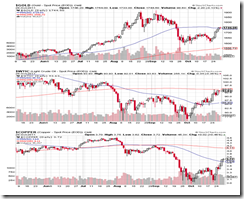

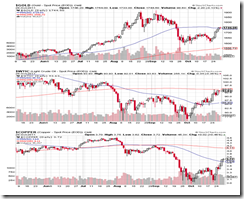

And the commodity markets appear to have responded to the grandiose measures in terms of increasing expectations of the inflationary implications

Gold has regained its bullish momentum (top most chart), while oil (WTIC) appears to be testing the 200-day moving averages where a breach would mean a reversal of the ‘death cross’. On the other hand, copper has reclaimed the 50-day moving averages.

The coming sessions will be very crucial as they will either reinforce the formative uptrend or falsify the recent recovery.

Importantly, as I have been repeatedly saying, I don’t see the imminence of a recession risk for the US economy for the simple reason that money supply growth has been exploding.

And a possible evidence of the diffusion of money supply growth has been the very impressive record breaking growth of US capital spending[8]. Capital spending growth should be seen as a leading indicator which should mean more improvement in the employment data ahead. Besides, record capital spending growth demolishes the popular mythical idea of a liquidity trap[9].

China remains as my focal point in my assessment of risk.

Again it is unclear whether China has merely been experiencing a cyclical slowdown or a bubble bust. Signs of piecemeal bailouts including the latest rescue of Ministry of Railways[10] could be signs of a popping bubble.

However signals generated from global equity markets seem to indicate that developments in both the Eurozone and the US could likely influence China, than the other way around.

Major global equity markets appear to have reaccelerated to the upside.

The US S&P 500 has broken above the 200-day moving averages, where a continuation of this upside momentum would extrapolate to the inflection of the ‘death cross’ into a bullish ‘golden cross’.

And it would seem that my hunch of a non-recession short-lived US bear market ala the Kennedy Slide of 1962 and 1987 Black Monday crash may come to fruition[11].

Meanwhile Europe’s Stoxx 50 appears to also trail the price actions of the US S&P 500 along with China’s Shanghai index whose recent bounce off the new lows has brought the index to test the 50-day moving averages.

Of the three major equity market bellwethers, the US seems to provide the market’s leadership, although it has yet to be determined if the momentum of China’s market can be sustained.

Overall, the impact of the collective inflationary policies being undertaken by the developed nations seems to permeate on both global equity markets and the commodity markets.

And in downplaying the predictive value of mechanical chart reading I recently wrote[12], (bold emphasis original)

The prospective actions of US Federal Reserve’s Ben Bernanke and European Central Bank’s Jean-Claude Trichet represents as the major forces that determines the success or failure of the death cross (and not statistics nor the pattern in itself). If they force enough inflation, then markets will reverse regardless of what today’s chart patterns indicate. Otherwise, the death cross could confirm the pattern. Yet given the ideological leanings and path dependency of regulators or policymakers, the desire to seek the preservation of the status quo and the protection of the banking class, I think the former is likely the outcome than the latter.

Events appear to be turning out in near precision as predicted

In addition, while the markets may have been discounting a QE 3.0 from the coming Federal Open Market Committee (FOMC) meeting this November 2nd, any surprise from team Bernanke could even escalate the current surge in the inflationary boom momentum.

Remember, US Federal Reserve Chair Ben Bernanke has repeatedly been dangling QE 3.0 or has been emphasizing that QE 3.0 remains an option[13], which could readily be redeployed as conditions warrant.

To add, except the US almost every major economy central banks have recently undertaken to expand on their respective versions of QE (chart from Danske Bank[14]). Aside from Bank of England[15] (BoE) whom earlier this month has announced the expansion of their QE policies, last week the Bank of Japan (BoJ) also increased their asset purchasing program[16].

Thus, the dramatic shift in sentiment to my interpretation epitomizes a transitional phase that can be analogized to the shifting in traffic light signal from red to yellow.

I would reckon the current climate as a gradual phasing-in or a cautious buy for risk assets.

[1] See Definitely Not a Reprise of 2008, Phisix-ASEAN Equities Still in Consolidation, September 18, 2011

[2] See Global Stock Markets: The Euro Bazooka Deal and the Boom Bust Cycle, October 28, 2011

[3] See Sharp Market Gyrations Could Imply an Inflection Point, October 16, 2011

[4] See More Evidence of China’s Unraveling Bubble? October 16, 2011

[5] See Euro’s Bailout Deal: Rescue Fund Jumps to $1.4 Trillion and a 50% haircut on Greece bondholders, October 27, 2011

[6] Bloomberg.com Euro Region’s Debt Quality Is Worsening at Record Pace: Chart of the Day, October 25, 2011

[7] Wall Street Journal Fitch: Greek Debt Deal a Default, October 28, 2011

[8] Wall Street Journal Blog Vital Signs: Capital Spending Hits Record, October 27, 2011

[9] See No Liquidity Trap, US Economy Picks Up Steam, October 27, 2011

[10] See China Bails Out the Ministry of Railways, October 25, 2011

[11] See Phisix-ASEAN Market Volatility: Politically Induced Boom Bust Cycles, October 2, 2011

[12] See How Reliable is the S&P’s ‘Death Cross’ Pattern?, August 14, 2011

[13] International Business Times, Market, FOMC Officials Suggest ‘Increasing Likelihood’ QE3 is Coming, October 26 2011

[14] Danske Research Preview: Bank of Japan Further easing likely, renewed intervention close, October 26, 2011

[15] See Bank of England Activates QE 2.0, October 6, 2011

[16] See Bank of Japan Expands QE, October 27, 2011