Which has been ASEAN’s best performing economy in 2012?

Well it’s not what the politically blinded domestic media and politicians think...

Instead Laos gets the credit, according to the Wall Street Journal, (bold mine)

To be sure, 8.3% growth isn’t exactly going to set investors’ hearts aflutter given that landlocked Laos has Southeast Asia’s smallest economy, and the opportunities for making money there are limited. Road and rail links are limited and the lack of a skilled labor makes Laos a tough bet for large manufacturing operations.But this year’s strong performance underscores the longer-term trend in a country that has consistently been one of Asia’s outperformers, including average growth of 7% a year over the past decade. Although nominally a Communist nation, Laos has liberalized its economy since the 1980s, and income levels have been rising.Much of the country’s growth these days is coming from mining, hydroelectric power and construction, all of which are relatively insulated from the turmoil in Europe and the related drop in export activity that has hurt some other Southeast Asian nations. Some economists fear Laos may be over-reliant on those sectors, despite their resilience this year.But Laos is expected to be accepted into the World Trade Organization on Friday, and over time that should help it attract more diverse drivers for the economy, including more of the manufacturing that has transformed other Southeast Asian nations. Leaders are especially hopeful Laos can lure some of the garment-factory investment that has helped create tens of thousands of jobs in nearby Cambodia.Either way, Laos is already seeing the impact of all the recent growth, with conspicuous consumption noticeably on the increase. Shiny new Cadillacs and Mercedes Benz cars – and even at least one Ferrari – are spotted on Vientiane’s streets. Sushi restaurants, boutique hotels and wine bars are proliferating.A. Barend Frielink, deputy country director for the Asian Development Bank in Vientiane, says he almost ran into a Bentley in town recently.“There is suddenly a lot of cash” in Laos, he said—so much so that economists don’t have a fully satisfactory explanation for all the spending. Partly it’s because Vientiane has undergone such a construction boom in recent years, with major projects to build new hotels and upgrade roads. Analysts have also pointed to gains from illicit drug trading and logging, though the economy has also earned a lot from its more legitimate sources of growth, including mining, that have helped spawn a larger consumer class.

Some important insights:

Geographical quirks such as being “landlocked” serves not as an obstacle to wealth generation brought about by voluntary trade or economic freedom.

Laos’ outperformance has principally been driven by policies of liberalization and the informal economy.

GDP per capita (US dollar) has been exploding since Laos 1980s when she began liberalization, chart from Tradingeconomics.com

And as consequence to liberalization policies and the prospective inclusion to the World Trade Organization (WTO), economic growth which essentially emanated from very small base should translate to further leaps in output expansion.

In addition, the Stock Exchange in Laos or the Lao Security Exchange (LSX) which began operations in 2011 had been up 16.7% on a year to date basis, as of last Friday’s close. The above chart from Bloomberg, exhibits the LSX since its inception.

Lastly, the mainstream’s ‘confusions’ about where cash or economic growth has been coming from, like the Philippines, has largely been due to the poor understanding of the informal sector.

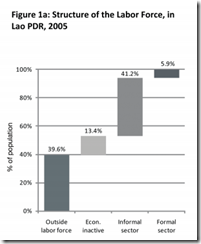

The IMF estimates the informal sector as accounting for 33.4% of the GDP of Laos (2002-2003).

I think the role of the shadow sector has been immensely underestimated.

The informal sector share of the labor force according to ASEANSEC.org accounts for over 40% in 2005.

For the mainstream, the informal economy functions like a vacuum or an unreal world or has been reduced to illegal transactions, which hardly has been accurate. Yes there are some immoral activities, but they account only for a fraction.

However in Laos, a large segment of the informal sector deals with agriculture related products, goods and or services.

The informal economy becomes a huge puzzle when reality and statistics via the expert’s econometric models do not add up.

They forget that a priori, the thrust for human survival is either through economic or political means (Franz Oppenheimer)

Economic means is when people intuitively will work to survive through the formal or through the informal shadow economy or through “politically illegitimated” trades.

Or the alternative, stealing or plunder which have mostly been coursed through the political route.

A social system that survives segments of unproductivity can only be made through redistribution or through parasitical relationship through coercive mandates.

[As an aside the problem of individual unproductivity can be handled through the family or the individual’s networks or the community, whereas the problems of aggression can be dealt with by domestic law]

So the above account simply shows that the average person in Laos has opted for the former which has brought them this newfound prosperity.

Whereas the political leaders of Laos has gradually been relenting to the forces of globalization as revealed by a surging merchandise trade as % of GDP which has passed the 2006 highs (chart from World Bank)

Finally the consensus also forgets that social policies (taxes, regulations, bureaucracy, interventions and etc…) have never been neutral, as these policies greatly affects of influences people’s incentives from which they operate on for survival.

The seeming advantage of natural resources, demographics and geographic factors are in reality subordinate to social policies that promotes private property rights principally channeled through voluntary exchanges and protected by the rule of law.

The old saw “money goes to where it is best treated” seems highly relevant to the economic freedom story of Laos