The Chinese financial and economic sphere operates on a bipolar world or might I say "parallel universe".

Today, Chinese PMI data reveals of better than expected growth. Chart above from AAstocks.com From Bloomberg:

Chinese manufacturing growth beat analyst estimates in November, indicating the nation’s economic recovery is sustaining momentum amid government efforts to rein in credit growth.The Purchasing Managers’ Index was 51.4, the National Bureau of Statistics and China Federation of Logistics and Purchasing said yesterday. That’s the same reading as October, which was an 18-month high, and exceeded 24 out of 26 estimates in a Bloomberg News survey. A number above 50 signals expansion

This comes even as the Chinese government has compelled for a reduction in sectors with glut in capacity...

China in July ordered more than 1,400 companies in 19 industries to cut excess production capacity and the Communist Party’s reform document said local officials will be evaluated on controlling overcapacity.The Hebei provincial government said last month it demolished iron and steel furnaces and Xingtai Longhai Iron & Steel Group Co., a unit of China’s biggest producer, Hebei Iron & Steel Group Co., has halted production because of operational difficulties, according to Shenzhen stock exchange filings from customer Hangzhou Boiler Group Co.

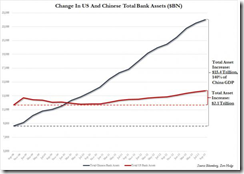

It is important to point out that the Chinese political economy has largely been state driven. Many of what seems as private enterprises are really a spin off of local government units which has contributed to the ballooning of China's shadow banking industry.

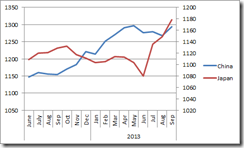

Yet Chinese industrial production growth varies from the PMI data.

While the PMI has been surging, after a big upside move in July from the earlier stealth stimulus applied by the government, Chinese industrial production has been static from August to October. So confidence shown in the PMI data seems as having been overstated (so far).

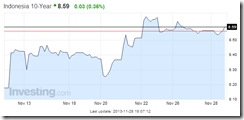

Meanwhile sanguine expectations in the manufacturing sector seems incompatible with soaring costs of credit. Yields of Chinese 10 bonds has been spiraling higher. Yields have reached 4.71% until last Friday’s last minute decline.

Spiking interest rates are having real economic impact. From another Bloomberg article:

Chinese companies’ borrowing costs are climbing at a record pace relative to the government’s, increasing the risk of defaults and prompting state newspapers to warn of a limited debt crisis.The extra yield investors demand to hold three-year AAA corporate bonds instead of government notes surged 35 basis points last week to 182 basis points, the biggest increase since data became available in September 2007, Chinabond indexes show. That exceeds the similar spread in India of 120 basis points. The benchmark seven-day repurchase rate has averaged 4.47 percent in November, the highest since a record cash crunch in June and up from 3.21 percent a year earlier.

Even the state run media recently warned of a potential crisis. From the same article

Borrowing ratios at some Chinese corporations are already relatively high, and rising interest rates may cause a “partial debt crisis to explode,” the China Securities Journal said in a front-page commentary yesterday. The central bank should take a “mild” approach to deleveraging as the economy is still delicately balanced, said the Economic Information Daily.

Hmmm. "Partial debt crisis to explode"

Curiously higher rates has partly altered borrowing patterns by Chinese enterprises, as more companies shift to foreign currency denominated debt.

From the Wall Street Journal:

Asia's market for foreign-currency loans is booming.Banks across the region are lending record sums in the U.S. dollar, the yen and the euro—the so-called G3 currencies—even as economic growth slows and bad debts continue to rise in places like China and South Korea.Loans in these currencies amounting to $133.4 billion have been issued this year in Asia, excluding Japan, 54% more than a year earlier and more than in all of 2011, the record year for such loans, according to Dealogic, a data provider.Companies in Asia typically borrow in foreign currencies for capital expenditures, transactions linked to commodities or to fund cross-border acquisitions.

In short, despite deteriorating credit conditions Chinese credit markets continue to blossom. The recourse to foreign debt exposes the Chinese economy not only to credit risks but to currency risks as well.

So far Chinese financial markets have ignored signs of escalating credit risks. The Shanghai index has been rapidly recovering.

The Yuan is at record highs while default risks has plummeted back to the ‘normal’ levels.

Interesting because like almost everywhere the risks from the frenzy in credit accumulation has largely been ignored.