One potential ‘black swan’ event in the Philippine setting could be triggered by publicly listed San Miguel Corporation [PSE:SMC].

While some in the mainstream media have rightly pointed to SMC’s huge repayment schedule for 2014 and 2015 as the key source of concern, for me this would be secondary.

Based on the 2012 annual report[1], San Miguel’s maturing net long debt schedule for 2013 was Php 3.279 billion, for 2014 Php 66.987 billion, in 2015 Php 69.953 billion, 2016 Php 29.843 billion, 2017 28.767 billion and in 2018 (and after) Php 25.388 billion.

Others have argued that SMC has sufficient assets to cover such liabilities. But as I have pointed out in the past[2], SMC’s assets have been based on “market observable prices”. This means that boom time prices have bloated SMC’s assets and equity valuations. I have also noted that SMC has even disclosed that changes in interest rates and foreign exchange rates would have material impact on these metrics.

In short, presumptions of the consistency of boom time prices in the face of an adverse event would signify unrealism

This would be no different from those who use PE ratios to value securities during major inflection points. As in the case of the 2007-2008 financial crisis, when the falling S&P 500[3] came to grip with the onset of an economic recession, earnings (the denominator in the P/E ratio) dramatically fell relative to stock prices, the result had been a surge in the PE ratio (revealed by the red ellipse). Consequently, the S&P collapsed to reflect on the new recession-crisis environment or the new reality.

The other point is the quality of SMC’s assets. Have these assets been unencumbered by debt? Not in the case of Petron and Philippine Air Lines.

My main concern would be the SMC’s deepening dependence on short term debt in financing of her operations. SMC seems to be operating a Ponzi financing scheme dynamic, as theorized by neo-Keynesian Hyman Minsky, by relying entirely on debt and or asset sales to finance her ballooning liabilities or what I call as debt in-debt out[4].

SMC’s annual total borrowings have almost doubled in 2012 from 2007[5] (left window). In 2013, total borrowings have reached 2012 levels as of the 3rd quarter alone. Yet total annual borrowings (blue trend line) have mostly been in short term borrowings (red trend line).

If we get the net position for both long and short term borrowing and payment (right window), we find that in 2010 and 2011, long term borrowings funded the firm’s marginal debts and other expenditures. These added to SMC’s long term debt position. Meanwhile short term borrowing dominated SMC’s financing operations in 2012.

As of the 3rd quarter of 2013, SMC has relied on long term financing. But again, even when long term debt provided the kernel of SMC’s funding, short term debt played a very substantial role in bridge financing of the operations of the company.

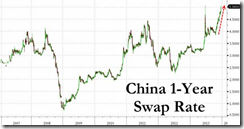

The key question is what happens if there will be a spike in short term domestic interest rates? (like last week) Will domestic banks continue to finance SMC’s short term funding requirements? For one reason or another (possibly due to exogenous factors), when a margin or collateral call on the banking system occurs, where will SMC get her financing? How will SMC manage to rollover short term debt? Will her short term liabilities, largely unseen by the public, be exposed and incite a contagion?

SMC’s short term debt churning approaches the proximity of 10% of the Philippine banking resource system. And if we add the long term debt this will pass the 10% mark if SMC’s total annual borrowing will exceed Php 1 trillion in 2013.

An environment of increasing interest rates will only amplify SMC’s rollover, counterparty and credit risks that could lead to a Minsky moment.

The Minsky moment[6] signifies the climax of the credit cycle, as per Hyman Minsky’s financial instability theory[7], where spiralling debt leads to cash flow problems and eventually a collapse in asset values.

“If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem” was a quote attributed to industrialist J Paul Getty. If we rephrase this in terms of San Miguel’s case, If you owe the bank Php 1,000 that's your problem. If you owe banks Php 1 trillion, that's the banking system's problem.

Should interest rates continue to rise, will San Miguel’s Minsky Moment occur in 2014?

[update: I adjusted for the font size]

[update: I adjusted for the font size]

[1] PSE.com.ph San Miguel Corporation 2012 Annual Report (SEC Form 17-A), June 4, 2013 p 103

[2] see Phisix: What The Third Visit To The Bear Market Territory Means December 16, 2013

[3] Chart of the Day S&P 500 Price to earnings ratio (PE ratio)

[4] See Why San Miguel Corporation Looks Vulnerable September 23, 2013

[5] San Miguel Corp San Miguel Corporation 2010 Annual Report (SEC Form 17-A)

[6] Wikipedia.org Minsky moment

[7] Hyman P. Minsky The Financial Instability Hypothesis Levy Economics Institute May 1992