The emerging market Bank run has now spread to political crisis stricken Ukraine.

From Bloomberg:

Ukraine’s deadly clashes prompted OAO Sberbank to stop offering loans to individuals in the country less than one year after it opened 50 branches there, Chief Executive Officer Herman Gref said.Russia’s biggest bank, which closed three branches in downtown Kiev this week as violent clashes killed at least 77, has also witnessed a “run on” its automatic teller machines in the country, Gref told reporters in Moscow today. The hryvnia, which is managed by Ukraine’s central bank, plunged almost 8 percent against the dollar this year and non-deliverable forward rates show it will slump another 11 percent in three months….Growing pressure on the currency could lead individuals to rush to pull money from Ukrainian bank accounts, Dmitri Barinov, a money manager overseeing $2.5 billion of debt at Frankfurt-based Union Investment Privatfonds, said Feb. 18.

Political instability has been blamed on the “bank run” while ignoring the fact that Ukraine has been in a recession even prior to the current political crisis.

The World Bank during the 2nd quarter of 2013 outlook even notes of the Ukraine’s government’s spendthrift ways even during the recession. (bold mine)

Weak economic performance resulted in a significant budget shortfall in the second half of 2012. Actual revenue of the central budget was UAH 33 billion (2.5 percent GDP) lower than initial budget plan because both real GDP growth and inflation were lower than the forecast on which the budget was based. Meanwhile, expenditures remained inflated due to a hike in social spending (by over 2 percentage points of GDP) introduced in Spring 2012. Fiscal deficit (general government definition) reached 4.5 percent GDP in 2012. In addition, structural deficit of the state-owned company “Naftogaz” was not addressed.

I also pointed out that this has not just been the government, but the private sector sector has been engaged in a debt financed-borrowing spree.

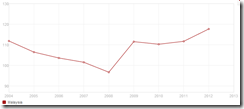

Ukraine’s credit as % to gdp as of 2012 (based on World Bank Data)

Ukraine’s banking sector credit as % of gdp as of 2012.

As you can see Ukraine’s debt levels in both dimensions has more than doubled since 2005.

What the credit inflation has done? Well it has inflated two incredible stock market bubbles in a span of about 5-6 years (2007-12).

Like the first stock market bubble collapse, the second coincided with a recession. The imploding stock market bubbles has now segued into a currency meltdown.

The question unaddressed is how much of money has been lent by the banks to the private sector that had been funneled to inflate such stock market bubbles? How much had been borrowed in foreign currencies?

To what degree have Ukraine’s banks have been affected by deterioration in loan quality?

So given Ukraine’s Wile E. Coyote moment, 'bank runs' would seem as natural consequence as bank assets deteriorate in the face of fractional reserve banking, a recession, escalating shortage of liquidity and debt deflation.

And banks can hardly rely on the public sector support because Ukraine government has been cash strapped, she desperately sealed a financing deal with Russia in December 2013

In short Ukraine’s economic crisis, primarily due to inflationism or bubble blowing policies, set stage for this political crisis. The likely ramification from the Ukraine's economic crisis is that more bank runs will occur.

I don’t deny that politics have become a factor. But this is a consequence rather than the cause.

Ukraine’s economic crisis has only deepened the polarization of Ukraine’s fragmented society via partisan politics. Geopolitics may even have been involved here. Some have even alleged that the US has been operating behind the scenes in fomenting another Orange revolution

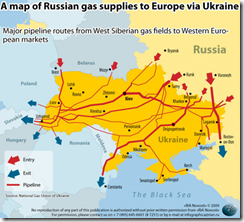

Because of Russia’s intensive exposure in Ukraine in terms of culture (Russian population in Ukraine) and embedded interests in the energy sector, aside from perceived threats from a supposed US ‘encirclement strategy’ of Russia, where a new US friendly government in Ukraine will be enticed to join NATO.…Russia has reportedly declared that she is “prepared to fight a war over the Ukrainian territory” using the Russian population as cover.

So Ukraine’s crisis can easily metastasize into a international geopolitical crisis.

What is likely to aggravate the political conditions will be sustained economic uncertainty brought about by Ukraine’s earlier bubble blowing policies amidst heated tensions from culture based politics inflamed by geopolitical interventions.

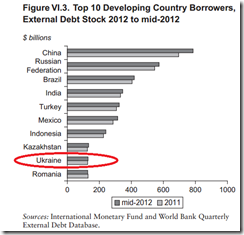

Anyway the above charts from the World Bank demonstrates why relative debt position seem irrelevant in the measuring of credit risks.

Ukraine’s debt in terms of nominal USD stock has been lower than many developing nations or emerging markets equivalent. This can also be seen in terms terms of % of gdp but at a much lesser scale. Yet Ukraine’s government recognized her near bankruptcy last year.

Debt tolerance has been always based on independent valuations from creditor’s perception of the capacity and willingness of debtors to settle indentures which differs from country to country. When a critical mass of creditors begin to call on the loans, the crisis becomes apparent--one symptom "bank runs".

Going back to the bank run, again if Ukraine’s economic crisis intensifies then more bank runs should be expected.

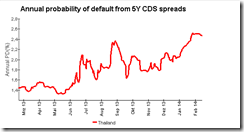

Yet increasing accounts of emerging market bank runs such as in Thailand, Kazakhstan and now Ukraine, aside from China’s continuing bailouts of delinquent financial institutions demonstrates why the EM crisis have not been over. And as reminder, all these has transpired in a span of two weeks.

And contra the bulls, this may just be the tip of the iceberg.