``The most enthusiastic supporters of such unlimited powers of the majority are often those very administrators who know best that, once such powers are assumed, it will be they and not the majority who will in fact exercise them." Friedrich von Hayek, The Constitution of Liberty

Trick or treat.

The way we celebrate Halloween will similarly be parlayed into the political sphere next week.

One of which would have an important bearing in the global financial markets.

While everyone will likely be focused on the US Midterm elections, what would seem crucial would be the US Federal Reserves’ formal announcement of its next phase of ‘credit easing’ policies: Quantitative Easing 2.0.

But we will deal with both.

US Midterm Elections: A Rebalancing Act

We shouldn’t expect much from the US Midterm elections. From our perspective, what is likely to change will only be the redistribution of the political power, from a lopsided stranglehold of Congress by the Democratic party into a more balanced exposure with that of the Republicans, that should serve as a control from an abuse of political power.

As political analyst Stratfor’s George Friedman rightly describes[1],

The Democrats will lose their ability to impose cloture in the Senate and thereby shut off debate. Whether they lose the House or not, the Democrats will lose the ability to pass legislation at the will of the House Democratic leadership. The large majority held by the Democrats will be gone, and party discipline will not be strong enough (it never is) to prevent some defections.

In other words, Democrats would likely lose their capability to highhandedly ram down the throats, or railroad unpopular ‘socialist’ policies to the American public, similar to the Obamacare, where polls say that a majority, or 53% of the public, has favoured its repeal[2]. And obviously such a backlash is likely to get translated into votes.

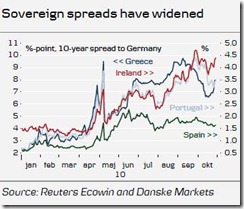

Figure 1: Every Action Has A Consequence; A Likely Political Comeuppance (chart from Danske Bank)

Apparently, the Democrats haughtily put into motion President Obama’s former Chief of Staff Rahm Emmanuel inglorious advise[3],

``You never let a serious crisis go to waste. And what I mean by that it's an opportunity to do things you think you could not do before”.

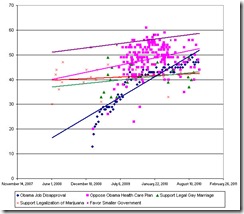

And since every action has consequences, the unintended ramifications from these unilateral political actions, perhaps construed as an abuse of power, could likely be a political comeuppance next week. Moreover, there are many signs where public sentiment appears to have shifted incrementally towards accepting more libertarianism[4].

And another very important setback for the incumbent party has been the failed effects of the cumulative stimulus programs in bolstering the US economy, which has been predicated on mainstream economics.

And one of the repercussions from this failure has been the spontaneous emergence of Tea Party Movement groups[5] in 2009, which amazingly has expanded swiftly and now accounts for anywhere 15-25% of the US population according to some estimates[6].

Tea Party groups basically protest on the burgeoning role of government interventionism in the US political economy.

Yet like anywhere else, under a democracy, people will likely be voting, not for idealism or ideology or platform, but against what they would perceive as either proponents of injustice or fear. In short, elections are mostly about symbolisms based on sentiment or voter emotions.

So whether it is the Philippines or in the US, journalist Franklin Pierce Adams (1881-1960) observations should resonate emphatically ``Elections are won by men and women chiefly because most people vote against somebody rather than for somebody.”

And one reason why I think there wouldn’t be much change even with a prospective rebalancing of political power, or political gridlock as many have labelled them, is that many who run for office only piggyback on so-called principles only when public sentiment supports them.

Eventually once elected into office, these principles usually get sloughed off when personal conveniences weigh in.

And recent history has shown this.

The passage of the Emergency Economic Stabilization Act of 2008[7] should serve as a good example. The bill was initially rebuffed at the first vote at the US House of Congress on September 29th, but following the paroxysm in the financial markets possibly in response to this, the House reversed and ratified it, on October 3rd, in a bipartisan support. Ironically, this law serves as one of the main anchors for today’s monumental swing in political sentiment.

Also, political competition represents mostly a zero sum game where one gains at the expense of another. As Henry Louis Mencken rightly pointed out ``Under democracy one party always devotes its chief energies to trying to prove that the other party is unfit to rule - and both commonly succeed, and are right.”

The implication is that a house divided could translate to more political horse trading and backroom dealing, where the administration may either lean towards more a centrist stance or risk a political impasse from maintaining the present hardcore path of left leaning policymaking.

And unlike the past, where both the Congress and the Executive branch had been controlled by a single party, which seem to have made the Democrats think that they had a blanket mandate to foist laws as they see fit, the reconfiguration of power will likely make prospective policies more public sentiment sensitive.

And I’d like add that those who think that political ‘pragmatism’ equates to politics as operating in a fixed state will likely be been proven wrong again, if current polls will be actualized into votes, this Tuesday.

People’s dependence on government isn’t a constant for the simple reason that economic laws ultimately shape politics.

And where redistributive policies or programs would have reached its limits or to paraphrase Milton Friedman, there is no such thing as a free lunch, politics will have to come home to roost to face the new reality.

The recent lifting of the legal retirement age in France, in spite of the crippling protests and riots[8], should serve as a vivid example of the unsoundness of the welfare state system. Eventually, unsustainable systems crumble under their own weight, regardless of what people think.

Pragmatism isn’t about the false belief of sustained public’s acceptability of free lunch policies, on the contrary, pragmatism is about understanding the limits of redistribution operating under the ambit of the natural laws of economics.

Political Gridlock And The Financial Markets

And how should a divided government fare for the financial markets?

Based on past performance, they would seem favourable.

According to Danske Bank research team writes[9], (bold emphasis mine)

Interestingly, periods with the White House controlled by a Democrat and Congress controlled by the Republicans – a situation that is likely to be in place from 20 January 2011 - have seen the best average equity market performance. One important caveat is, however, that this result is heavily influenced by the fact that the period 1995-99, during which President Clinton faced a Republican-controlled Congress, coincided with the technology equity market boom.

When looking solely at the party controlling Congress, equities have performed better during periods of Republican control than in periods of Democratic Congress majority. This could indicate that from the point of view of investors, a Republican-controlled Congress is generally seen as less likely to put through legislation that is hostile to business, both in terms of tax policies, but also in terms of regulation issues. In the current situation, with financial sector regulation issues likely to remain high on the agenda in 2011-12, a Republican-controlled Congress could be seen as less likely to enact further measures to tighten regulation.

We can only conclude that the financial market conditions and the economic environment will likely be dependent on the kind of relationship that would emerge and cultivated from political diversity.

Nevertheless our caveat remains, past performance are not reliable indicators of the future, and that many other factors may influence the hue of US politics.

But if the chances of reduced government intervention in the economy are increased from a political gridlock, then the new political arrangement would likely boost business confidence, and thus becomes a positive influence, rather than undermine it.

And only the politically blind and those addicted to unsustainable inflationary big government would see this as some fictitious horror tale.

And as before, they will always miss out being right.

[1] Friedman, George U.S. Midterm Elections, Obama and Iran Stratfor.com October 26, 2010

[2] Rasmussen Reports, Health Care Law, October 25, 2010;

thehill.com POLL: Dislike of healthcare law crosses party lines, 1 in 4 Dems want repeal, October 6, 2010

[3] Wall Street Journal OpEd, A 40-Year Wish List, January 28, 2009

[4] See US Politics: A Libertarian Renascence?, October 29, 2010

[5] Wikipedia.org Tea Party Movement

[6] Examiner.com Video: Tea Party struggling in its efforts to find leadership, April 12, 2010

[7] Wikipedia.org Emergency Economic Stabilization Act of 2008

[8] Wall Street Journal Editorial, Dissecting French Schizophrenia, October 29, 2010

[9] Danske Bank, Much ado in the week ahead, Weekly Focus October 29, 2010