I keep pointing out how high energy (and commodity) prices have been partly due to the geographical access restrictions imposed by governments on investors.

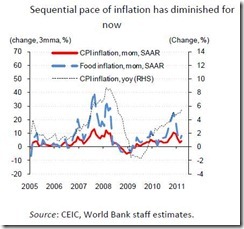

This is aside from the tsunami of money being printed around the world by central banks led by the US Federal Reserve.

Likewise, the artificially low interest rates being used to promote spending that has been stoking new bubble cycles.

Yet the allure of high commodity prices has now been changing some government’s receptiveness to investors by virtue of resource nationalism

From the Wall Street Journal, (bold highlights mine)

The government-led ouster of the CEO of Brazilian mining giant Vale SA follows a string of moves by national governments to intervene in their countries' highly profitable and highly coveted natural-resources concerns.

Some of those moves have included rejections of efforts by foreign companies to gain big stakes in local mining and resource companies. Big miners who have sought global acquisitions, including BHP Billiton, Rio Tinto PLC and Xstrata PLC, had no new comment on the trend following the change at Vale, where Brazilian President Dilma Rousseff forced out CEO Roger Agnelli. The big miners said they didn't expect the Vale move to alter their investment or expansion plans, which have already factored in the rising tide of nationalism and efforts by governments to extract higher taxes.

Indeed, many miners are pulling back or reducing the target size of foreign acquisitions to avoid defensive moves by governments. In some cases, they are abandoning huge exploration projects, which are costly and may end up benefiting the local governments rather than shareholders or customers...

Commodity-rich Latin America has been a leader in extending government control over natural resources, such as oil and other raw materials, in recent years. Venezuela and Bolivia nationalized oil and gas assets, while Ecuador started taxing what it considered windfall oil profits at a 70% rate. After Brazil discovered enormous deep-water oil fields off Rio de Janeiro, the South American country rewrote the rules for rights auctions to give its state oil company, Petroleo Brasileiro SA, the lion's share of the business. In many cases the moves were a turnaround from the 1990s, when the mostly cash-strapped nations opened up their industries to foreign investment, prompting a boom in exploration.

But the protectionism extends to other countries. BHP Billiton, the world's largest miner, has already seen several of its mining projects thwarted by foreign government. Last year, Canada nixed BHP's planned $38 billion acquisition of Potash Corp., and Australia put up so many blocks between a planned joint iron-ore venture with Rio Tinto months earlier, the two miners quit that project.

Resource nationalism only adds to the supply imbalances which should mean lesser supplies and subsequently further upward price pressures.

Such actions are being prompted by expectations of governments to generate more revenues with the ultimate end of having more money to spend on political projects. They are doing this in the name of nationalism.

Yet because of the higher costs of doing business or a higher hurdle rate, aside from questions of security of ownership (property rights), investors naturally would back out or become reluctant to invest. This essentially defeats government’s agenda.

In addition, the lack of investments extrapolates to the promotion of unemployment and lost opportunity to grow.

Any local investments will not be sufficient. That’s why they have not been accessed.

Besides, local investments are likely to be “politicized” which means that only the political class and their economic patrons would become the beneficiaries.

And because the resources are there, illegal extraction would occur and proliferate. Subsequently, black markets will blossom.

And illegal activities will lead to more violence, more corruption and more environmental degradation.

All these because government wants more revenues for increased spending.

They blame capitalist for greed, what ya call this?