The global financial markets and the local equity market have, so far, been confirming my divergence theory.

There are two implications:

One, market correlations has been continually changing. There is no fixed relationship as every political-economic variable has been fluid or in a state of flux.

This only demonstrates the apriorism of the inconstancy and complexity of the market’s behavior, which strengthens the perspective or argument that historical determinism (through charts or math models) can’t accurately predict the outcome of human actions. Even LTCM’s co-founder Myron Scholes recently admitted to such shortcomings[1].

And importantly, the activist policies by global political stewards, aimed at the non-repetition of the events that has led to the global contagion emanating from the Lehman bankruptcy episode of 2008 (which could also be seen as actions to preserve the status quo of political institutions founded on the welfare state-central banking-politically endowed banking system), have been driving this dynamic.

In short, political actions continue to dominate the marketplace[2].

Thus this transition phase has led to the distinctive performances in the relationships among market classes which can be seen across global markets.

Gold as THE Safe Haven

In today’s market distress, market leadership or the flight to safety dynamics has changed as noted last week. The US dollar which used to function as the traditional safehaven currency as in 2008 has given way to the gold backed Swiss franc and the Japanese Yen. This comes in spite of repeated interventions by their respective governments.

Another very significant change in correlations has been that of the US treasuries and gold prices.

Again, while US treasuries had been traditional shock absorber of an environment dominated by risk aversion, this time, it’s not only that gold’s correlation with US Treasuries has significantly tightened, most important is that gold has immensely outperformed US Treasuries since 2009, as shown above[3].

Gold’s assumption of the market leadership points to a vital seismic transition taking place.

Let me repeat, since gold has not been used as medium for payment and settlement, in an environment of deleveraging and liquidation, gold’s record run can’t be seen as in reaction to deflation fears but from expectations over aggressive inflationary stance by policymakers.

Arguments that point to the possible reaction of gold prices to ‘confiscatory deflation’, as in the case of the Argentine crisis of 2000, is simply unfounded; Gold priced in Argentine Pesos remained flat during the time when Argentine authorities imposed policies that confiscated private property through the banking system, but eventually flew when such policies had been relaxed and had been funded by a jump in money supply via devaluation[4].

Gold’s recent phenomenal rise has been parabolic! Gold has essentially skyrocketed by $1,050+ in less than TWO weeks! Gold prices jumped by 6% this week. The vertiginous ascent means gold prices may be susceptible to a sharp downside action (similar to Silver early this year) from profit takers.

Nonetheless gold’s relationship with other commodities has also deviated.

The correlations between gold and energy (Dow Jones UBS Energy—DJAEN) and industrial metals Dow Jones-UBS Industrial Metals—DJIAN) has turned negative, as the latter two has been on a downtrend.

However the Food or agricultural prices (represented by S&P GSCI Agricultural Index Spot Price GKX) appear to have broken out of the consolidation phase to possibly join Gold’s ascendancy.

The breakdown in correlations do not suggest of a deflationary environment but rather a ongoing distress in the monetary affairs of crisis affected nations.

The Continuing Phisix-ASEAN Divergences

The same divergence dynamics can be seen in global stock markets.

While markets in the US (SPX), Europe (STOX50) and Asia Ex-Japan (P2Dow) have been sizably down, the Philippine Phisix (as well as major ASEAN indices) appears to defy these trends or has been the least affected.

One would further note that Asian markets, despite the similar downtrends has still outperformed the US and Europe, measured in terms of having lesser degree of losses.

A broader picture of this week’s performance reveals that the ASEAN-4 has been mixed even in the face of a global equity market meltdown.

Thailand and the Philippines posted marginal gains while Malaysia was unchanged. Topnotch Indonesia suffered the most but still substantially less than the losses accounted for by major bourses.

Vietnam, which has been in a bear market, saw the largest weekly gain which may have reflected on a ‘dead cat’s bounce’, whereas Singapore endured hefty losses which also reflected on the contagion of losses from major economy bourses.

The above chart signifies as more evidence that has been reinforcing my divergence theory.

Yet growing aberrations are not only being manifested in stock markets but also in the region’s currency.

Previously, a milieu of heightened risk aversion entailed a run on regional currencies.

Today, the seeming resiliency of the ASEAN-4’s equity markets appears to also be reflected on their respective currencies.

Three weeks of global market convulsion hardly dinted on the short term uptrend of ASEAN-4 currencies seen in the chart from Yahoo Finance in pecking order Philippine peso, Indonesia rupiah, Thai baht and the Malaysian ringgit.

And when seen from the frame of the Peso-Phisix relationship, the recent selloffs share the same divergent (the actions of major economies) outlook.

The Phisix (black candle) appears to have broken down from its short term trend (light blue trend line), so as with the US-dollar Philippine Peso (green trendline) which had a breakout (breakouts marked by blue circle/ellipses) during the week.

Since I don’t subscribe to the oversimplistic nature of mechanical charting, but rather see charts as guidepost underpinned by much stronger forces of praxeology (logic of human action), we need to look at the bigger picture.

The sympathy breakdown by the Phisix, the other week, has not been supported by the broad market.

Market breadth continues to suggest that present activities have been characterized by rotational activities and consolidations rather than broad market deterioration.

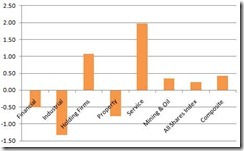

Weekly advance-decline spread, which measures market sentiments has improved from last week, even if the differentials posted slight losses (left window).

Foreign buying turned slightly NET positive (right window).

One would further note that sectoral performance had been equally divided.

Services led by PLDT [PSE: TEL] along with the Holding sector, mostly from Aboitiz Equity Ventures [PSE: AEV] and SM Investments [PSE: SM] provided contributed materially to the gains of the Phisix.

The Mining industry closed the week almost at par with the performance of the local benchmark, while Financial Industrial and the property sectors fell. Again signs of rotations and consolidations at work.

These empirical evidences seem to suggest that the short term breakdown by the Phisix and the Peso may not constitute an inflection point. This will continue to hold true unless exogenous forces exert more influence than the current underlying dynamics suggests.

Money Supply Growth Plus Policy Activism Equals Low Chance of a US Recession

As I repeatedly keep emphasizing, it is unclear if such divergence dynamics could be sustained under a contagion from full blown recession or in crisis, because if it does, this would translate to decoupling.

In other words, divergence dynamics is NOT likely immune to major recessions or crisis until proven otherwise.

Yet despite many signs that appear to indicate for a sharp economic slowdown which many have said increases the recession risks in the US or the Eurozone, very important leading indicators suggest that this won’t be happening.

Importantly, the deep-seated bailout culture (Bernanke Put or Bernanke doctrine) practiced by the current crop of policymakers or the ‘activist’ stance in policymaking would likely introduce more monetary easing measures that could defer the unwinding of the imbalances built into the system.

In other words, I don’t share the view that the US will fall into a recession as many popular analysts claim.

For one, excess reserves held by the US Federal Reserves appears to have topped out (WRESBAL-lowest pane).

And this comes in the face of the recent surge in consumer lending (Total Consumer Credit Outstanding; TotalSL-highest pane). Also we are seeing signs of recovery in Industrial and Business Loans (Busloans-mid pane).

So, perhaps the US banking system could be diverting these excess reserves held at the US Federal Reserve into loans. And once this motion intensifies, this will first be read as a “boom”, which will be followed by acceleration of consumer price inflation and an eventual “bust”.

Yet it’s plain nonsense or naive to say that monetary policies have been “impotent”.

First, ZERO interest rates, which has been and will be used as the deflationary bogeyman, are exactly the selfsame excuse needed by central bankers to engage in activist policymaking (print money).

Policy ‘impotence’ would happen when inflation and interest rates are abnormally high.

Second, growing risks of recessions or crises has been the oft deployed justification to impose crisis avoidance or ‘stability’ measures. Crisis conditions gives politicians the opportunity to expand political control or what I would call the Emmanuel Rahm doctrine or creed.

The debt ceiling deal had been reached from the same fear based ‘Armaggedon’ strategy. And so has the Troubled Asset Relief Program (TARP) under the Emergency Economic Stabilization Act of 2008[5] where the ensuing market crash from the failed first vote led to its eventual legislation.

Morgan Stanley’s Joachim Fels and Manoj Pradhan thinks that the current predicament has likewise been a policy induced slowdown.

Mr. Fels and Pradhan writes[6],

There are three main reasons for our downgrade. First, the recent incoming data, especially in the US and the euro area, have been disappointing, suggesting less momentum into 2H11 and pushing down full-year 2011 estimates. Second, recent policy errors - especially Europe's slow and insufficient response to the sovereign crisis and the drama around lifting the US debt ceiling - have weighed down on financial markets and eroded business and consumer confidence. A negative feedback loop between weak growth and soggy asset markets now appears to be in the making in Europe and the US. This should be aggravated by the prospect of fiscal tightening in the US and Europe.

While we see this as being policy induced, where I differ from the above analysts is that they see these as policy errors, I don’t.

I have been saying that since QE 2.0 has been unpopularly received, extending the same policies would need political conditions that would warrant its acceptabilty. Thus, I have been saying that current environments has been orchestrated or designed to meet such goals[7].

Fear is likely the justification for the next round of QE.

As I recently quoted an analyst[8],

But the political imperative will be to do something… anything… immediately, to ward off disaster.

Importantly, a survey of fund manageers sees a jump of expectations for QE[9].

Expectations of QE3 have doubled: 60% now see 1,100 points or below on the S&P500 Index as a trigger for QE3, up from 28% last month, and global fiscal policy is now described as restrictive for the first time since March 2009.

And we seem to be seeing more clues to the US Federal Reserve’s next asset purchasing measures.

Late last week, the US Federal Reserve has extended a $200 million loan facility via currency swap lines to the Swiss National Bank (SNB), as an unidentified European bank reportedly secured a $500 million emergency loan[10]. This essentially validates my suspicion that the so-called currency intervention by the SNB camouflaged its true purpose, i.e. the extension of liquidity to distressed banks, whose woes have been ventilated on the equity markets.

Moreover a Wall Street Journal article[11] implies that the solution (panacea) to the European banking woes should be more QEs.

Foreign banks that lack extensive U.S. branch networks have a handful of ways to bankroll U.S. operations. They can borrow dollars from money-market funds, central banks or other commercial banks. Or they can swap their home currencies, such as euros, for dollars in the foreign-exchange market. The problem is, most of those options can vanish in a crisis.

Until recently, that hasn't been a problem. Thanks partly to the Federal Reserve's so-called quantitative-easing program, huge amounts of dollars have been sloshing around the financial system, and much of it has landed at international banks, according to weekly Fed reports on bank balance sheets.

So rescuing the Euro banking system would mean a reciprocal arrangement since these banks, under normal conditions would be buying or financing the US deficits via the treasury markets. So by extending funding through the currency swap lines, the US Federal Reserve has essentially commenced a footstep into QE 3.0.

Third, suggestions that grassroots politics would impact central bank policymaking is simply groundless. The general public has insufficient knowledge on the esoteric activities of central bankers.

Henry Ford was popularly quoted that

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

That’s why the US Federal Reserve has successfuly encroached on the fiscal realm via QE 1.0 and 2.0 with little political opposition. The current political opposition has been focused on the fiscal front yet the debt ceiling bill sailed through it. Yet in case the public’s outcry for the fiscal reform does intensify, any austerity will likely be furtively channeled to central bank manueverings.

Thus, with foundering equity markets, rising credit risk environment which risks undermining the US-Euro banking system, a higher debt ceiling, and a sharp economic slowdown, the current environment seems ripe for the picking. It will be an opportunity which Bernanke is likely to seize.

The annual meeting of global central bankers at Jackson Hole, Wyomming hosted by the Kansas City Fed meeting next week could be the momentous event where US Federal Reserve Chair Ben Bernanke may unleash his second measure “another round of asset purchases” which he communicated[12] last July 13th. This follows his first “explicit guidance” outline for a zero bound rate which had recently been made into a policy[13] (zero bound rate until mid-2013)

All these seamlessly explains the newfound gold-US treasury ‘flight to safety’ correlations.

Global financial markets addicted to money printing has been waiting for the “Bernanke Put” moment. For them, current measures have NOT been enough, and they are starving for another rescue.

[1] See Confessions of an Econometrician August 19, 2011

[2] See Global Equity Meltdown: Political Actions to Save Global Banks, August 14,2011

[3] Gayed Michael A. Gold = Treasuries, Ritholtz.com, August 18, 2011

[4] See Confiscatory Deflation and Gold Prices, August 15, 2011

[5] Wikipedia.org First House vote, September 29 Emergency Economic Stabilization Act of 2008

[6] Fels, Joachim and Pradhan, Manoj Dangerously Close to Recession, Morgan Stanley, August 19, 2011

[7] See Global Market Crash Points to QE 3.0, August 7, 2011

[8] See The Policy Making Moral Hazard: The Bailout Mentality, August 20, 2011

[9] Finance Asia Investors slash equities, pile into cash amid growth fears, August 18, 2011

[10] See US Federal Reserve Acts on Concerns over Europe’s Funding Problems, August 19, 2011

[11] Wall Street Journal Fed Eyes European Banks, August 18, 2011

[12] See Ben Bernanke Hints at QE 3.0, July 13 2011

[13] See Global Equity Meltdown: Political Actions to Save Global Banks, August 14, 2011