Here we go again. Authorities of the US Federal Reserve in an implicit pabulum about “exit strategy”.

From Yahoo news:

The Federal Reserve will keep buying bonds indefinitely to try to keep long-term borrowing costs low. It's just not clear how long indefinitely will be.Minutes of the Fed's last policy meeting show that officials were divided about when to halt the purchases.Some of the 12 voting members thought the bond purchases would be needed through 2013. Others felt they should be slowed or stopped altogether before year's end. This group worries that the bond buying is keeping rates so low for so long that it could ignite inflation or encourage speculative buying of risky assets.The Fed last month ended up approving open-ended purchases of $85 billion a month in Treasurys and mortgage bonds to replace an expiring bond-purchase plan and maintain its level of purchases.The minutes covered the Fed's Dec. 11-12 meeting. In a statement after the meeting, the Fed said it planned to keep a key interest rate at a record low even after unemployment falls close to a normal level — which it said might take three more years…The minutes showed that "several" Fed policymakers thought the bond buying should probably stop well before 2013 ends.

They babbled about “exit strategy” in 2010. They tattled of withholding QE 3.0 in 2011.

At the end of the day: the US Federal Reserve ended up with the opposite: escalation of their balance sheet via increasing asset purchases (chart from Cleveland Federal Reserve).

That’s why I call them the Poker Bluffing Fed.

A ‘probable end’ to bond buying translates to higher interest rates.

This will mean more than just ideology, this entails how the Fed authorities views the world and their path dependent ways of implementing policies (solving problems) in accordance to such purview: particularly demand based management, the wealth effect and the portfolio balance channel.

Of course, higher interest rates will likely ruffle or pummel financial markets severely which monetary authorities have been so sensitive to protect.

These include the stock markets which has been Fed Chair Ben Bernanke’s once held basic creed for ‘smart’ central banking, and the bond markets where the US government—as well as global governments—and key US and international financial institutions have substantial exposures, if not deep dependency, on credit easing policies.

Just to give a few examples:

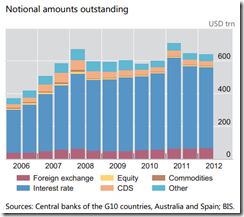

The opaque derivatives markets have been mostly anchored on interest rate based derivative contracts whose maturity has been shortening.

Notes the Bank of International Settlement:

Interest rate contracts have become increasingly short-term in recent years. Notional amounts of contracts with maturities of more than five years fell by 9% in the first half of 2012 to $117 trillion, or 24% of total interest rate contracts. By contrast, the volume of contracts with a maturity of up to one year went up by 4% to $207 trillion, or 42% of the total. In the mid- and late 2000s, longer-term contracts accounted for up to 35% of all interest rate contracts.

Higher interest rates would likely increase the counterparty and default risks for the humongous derivatives market.

The recovering US real estate market has also been latched to recent low interest and credit easing policies by the US Federal Reserve

Given that the Fed holds substantial mortgage securities and where the Government Sponsored Enterprises (GSEs) account for 99.5% of the mortgage market, a possible rise in interest rate will likely undermine their portfolio holdings (of the Fed and the GSEs) at the taxpayer’s expense (chart from Freddie Mac)

Also, given that the US Federal Reserve has financed practically 61% of US treasury debt in 2011, a desistance of support by the US Federal Reserve on US treasury debt enhances the risks of a debt default by the US government.

US Treasury securities held by the FED has been programmed to grow through the recently implemented QE 4.0 (chart from the St. Louis Federal Reserve)

Likewise, given that publicly held debt by the US will continue to expand, higher interest rates possibly means amplified credit and rollover risks for the US government. (charts from the Heritage Foundation)

Of course foreign currency swaps, the marked difference between total bank deposits and loans in the US banking system, devaluation as an official policy, and many other factors have become dependent on the backings and credit easing policies of the US Federal Reserve.

Thus the (possible histrionic) dissension among FED authorities may be interpreted as the following possibilities:

-trial balloon to see how financial market responds (yes commodities down, but stock markets losses were marginal so far),

-spur of the moment sentiment by Fed authorities that will easily shift once downside volatility resurfaces

-an attempt to manage or control “inflation expectations” via indirectly targeting commodity prices. Gold prices bore the brunt while the US dollar rallied from yesterday’s announcement. This could also be part of the surreptitious design to suppress gold prices

Yes current policies are unsustainable. But FED authorities are unlikely to tergiversate on the direction of policymaking which has been adapted by almost every central banker around the world since 2008.

To repeat, authorities of developed economies whom has embarked on credit easing policies via ZIRP and balance sheet expansions account for 95% of the USD 98.4 trillion global bond markets, where 45% of the share of the bond markets are government bonds.

The bottom line is that current credit easing policies have been deeply intertwined or embedded with the interests of the status quo or particularly the political-economic cartel of the welfare-warfare state, crony banks and central banking.

Authorities of the FED will most likely evade the responsibility from the financial market bloodbath or meltdown that may ensue once interest rate substantially rises. And like Pontius Pilate, they will likely be washing their hands and leave tightening to the marketplace.