My concluding statement in the epilogue section of last week’s reports looks prophetic. I wrote[1],

If the Philippine market does experience a convulsion in response to a possible deterioration of regional conditions, expect Typhoon Yolanda to be a favorite scapegoat.

Equity benchmarks of the region had been mostly lower this week, with Thailand’s SET and the Philippine Phisix posting losses of over 4%.

The Typhoon Yolanda Bogeyman

Yet some examples[2] of Typhoon Yolanda as post hoc scapegoat “Investors were on profit-taking mode following the downgrade of the country's economic outlook because of the impact of Typhoon 'Yolanda'” ; “adding to those worries was the gradual stream of reports indicating the cost of damage due to Typhoon Yolanda” and “Typhoon has provided overseas investors a good excuse to continue taking profit.”

The other issue rationalized as contributing to the loss in the Phisix has supposedly been concerns over the Fed’s “tapering”.

As an update, estimated damages tallied by the National Disaster Risk Reduction and Management Council has now reached P22,659,851,383.76[3]. This would represent 53.7% of the Php 42.2 billion economic costs by the reigning “most destructive” storm to hit the Philippines, Typhoon Pablo. Typhoon Yolanda currently ranks third after Typhoon Pablo (December 2, 2012) and Typhoon Pepeng (October 2-10, 2009). My guess is that we will know whether Typhoon Yolanda will surpass the degree of devastation by Typhoon Pablo possibly by next week which I believe should spotlight the peak of the damage assessments.

Despite the “Typhoon equals lower stocks” meme, as I have pointed out last week and two weeks back, empirical evidences exhibits a smidgen or an iota of causal relationship between Typhoons and the stock market performance or even the economy[4].

But obviously, conducting meaningful investigations to establish realistic representations has hardly been a concern for “experts”, instead the same “experts” simply feed on the public’s desire for popular convenient excuses regardless if such relationship stands on tenuous grounds.

In the context of behavioral science, ‘experts’ employ availability bias[5]—ranking of importance of information based on easiest to be recalled—to satisfy the demand for confirmation bias of the gullible public.

Nevertheless Typhoon Yolanda has snared the lead from Typhoon Uring (November 4-7, 1991) as the “deadliest” of all Typhoons to have hit the Philippines. As of the latest count, Typhoon Yolanda has claimed 5,235 lives with 1,613 missing[6]. If we add missing to the death count this adds to 6,848.

As far as Typhoon classification goes, “deadliest” has not necessarily equated to “destructive”, so far only Typhoon Yolanda has been running consistent on both categories.

More Politicization of Typhoon Yolanda

Last week, I also pointed out how the popularity addicted Philippine President scoffed at projections of 10,000 casualties from the storm saying that such estimates have been ‘too much’. At an interview with a foreign media outfit, he publicly insisted on a range of 2,000-2,500 as maximum fatality count. He even sacked the Police officer who gave the initial estimates.

Within the week, the National Disaster Risk Reduction and Management Council (NDRRMC) reportedly stopped the death count due to changes in “the policy on accounting”[7] as the death estimates surpassed the 4,000 level, but immediately reversed this on public clamor. The NDRRMC chief denied “receiving orders to stop releasing the death toll” or the involvement of politics[8].

Has insisting on a statistical threshold and the sacking of the Police officer not been an act of politics?

With the death count careening farther away from the President’s estimates and fast approaching the 10,000 estimates, will the Philippine President reinstate the Police officer and or make a public apology? How about if the deaths reach 10,000, will the President resign?

By publicly announcing a threshold level, not only does this reveal of the administration’s PR Public Relations gaffe, this unfortunate and sordid event exposes on the administration’s obsession for approval ratings, where as noted above, reports showed of an attempt at the suppression of the official death count via censorship.

This essentially highlights the administrations use of Joseph Stalin’s “a single death is a tragedy a million death a statistic”.

Where every death is a tragedy, even more tragic is the use of disasters to promote political self-interests.

And politicization hasn’t been exclusively the realm of the Presidency, this applies to other officials such as the Vice President as well as spouse of an incumbent official whom have reportedly used political “branding” in the distribution of relief goods[9].

ASEAN Currencies: Signs of Trouble Ahead?

Also in the closing segment of last week’s report I warned that instead of focusing Typhoon Yolanda we should rather be vigilant on the activities within the region

I would rather be watching two neighbors, Indonesia and China, who seem to be experiencing re-emergent signs of financial market ‘tremors’ which poses as potential risks for a shock…The last time the rupiah hit a milestone this coincided with the turmoil in the ASEAN financial markets.

Figure 1: ASEAN-4 Currencies

ASEAN currencies have been enduring re-emergent signs financial pressures see figure 4.

Within the week, the USD-Indonesian rupiah (via one year chart, see Figure 1) breached the September highs to set fresh milestone. Last Friday, the USD rupiah closed at a 5-year high.

The Philippine peso has also manifested signs of renewed weakening against the US dollar. The Peso fell .4% this week and closed Friday at June highs. The peso has been in consolidation since the Fed’s UN-taper from September through the first week of November.

The Malaysian ringgit and the Thai baht has equally been losing ground against the US dollar.

Going back to the Peso, the Bangko Sentral ng Pilipinas reported net foreign portfolio inflows in October at US$969 million which has been “much higher than the US$683 million recorded in September and US$40 million a year ago.”[10] Foreign money flowed into PSE-listed securities (52.6 percent), Peso GS (44.0 percent) and Peso time deposits (3.4 percent).

Figure 2: Net Foreign Portfolio Flows (BSP)

The data I accumulate via daily PSE quotes reveals of net selling (Php 7.545 billion) which varies from the BSP October figures. Given the benefit of the doubt that my data may not be reliable, it’s seems unusual to see the Peso firming by a marginal .75% in October when in September a much smaller portfolio inflow resulted to a 2.4% gain in the Peso. The red circle shows of the net foreign portfolio flow last October (Figure 2) at US $969 million as against the $682.72 million last September.

Aside from statistical reporting difference or anomalies, could this underperformance by the peso have been due to the BSP’s selling of US dollar Gross International Reserves in October (which resulted to a lower US $.1 billion to $83.4 billion[11]) or could the private sector residents accumulated on US dollars to enough offset these alleged substantial foreign net inflows?

The recent bout of infirmities in the peso has already began to hamper “earnings growth” conditions of many publicly listed firms such as San Miguel Corporation[12], Aboitiz Power[13] and parent Aboitz Equity Ventures[14], PLDT[15], JG Summit[16], Philex Petroleum[17], Cebu Pacific[18], Energy Development Corp[19] and Atlas Corporation[20]

Though the extent of impact varies from company to company, earnings impairment from foreign currency losses—due to one quarter of currency volatility—exposes on the vulnerabilities of these companies to currency risks due to foreign currency debts. As I have been pointing out, zero bound rates have impelled many publicly listed companies to increase leverage exposure, many of them on foreign exchange debentures.

The 64 billion peso question is what if the peso continues to fall further? How will these impact the earnings of these companies? Will the recourse be more borrowing to offset the losses and hope for a peso recovery? What if foreign liabilities become substantial enough to put credit quality on the line?

The ASEAN 4’s currency frailties signify just one of the aspects.

Bond Vigilantes Harries ASEAN Bond Markets

Figure 3: ASEAN-4 10 Year Local Currency Bonds

The global bond vigilantes have been romping at the ASEAN 4 except the Philippines.

The 5 year high in the rupiah has been reflected on Indonesia’s sovereign 10 year bonds whose yield fast approaches (24 basis points away from) the September highs.

Malaysia’s 10 year bond yield has just been 5 basis points away from the July high at 4.14%.

Yields of Thailand’s 10 year bonds have likewise been soaring and now signify just 19 basis points away from the August highs.

Philippine 10 year bonds remain in a temporary tranquil state.

Figure 4: ASEAN Debt Outstanding

And with ASEAN debt inflation as the principal engine of economic growth, rising rates will increase the cost of servicing debt, prove to be an obstacle to present debt based growth dynamic (by slowing expansion and diminishing demand) while at the same time increasing credit risks.

Let me cite an example. The third quarter rampage by the bond vigilantes in Thailand has tellingly slowed the Thai statistical economy which grew 2.7% on an annualized basis.

From the Wall Street Journal Real Time Blog[21]

The NESDB — the government’s economic planning agency — blamed the weaker-than-expected results on falling household spending and consumption after the expiration of the government’s First Car tax rebate last December resulted in a significant drop in auto purchases. Declining farm income and weaker consumer confidence also hurt consumption.Growth was also hurt by a slowdown in construction, a fall in machinery and equipment investment, a slow recovery in global demand for Thai goods and sluggish shrimp production owing to an unresolved spread of a disease among shrimp stocks.

Go look at the Thai bond yields during the 3rd quarter on figure 3. Rising yields and the falling Thai baht or the volatility spike in Thai’s financial market has apparently crimped on the Thai economy. The article omits mentioning this.

And ASEAN’s debt profile as shown in Figure 4[22] reveals that the region’s debt distribution has been asymmetric.

While Thailand and Malaysia have been both vulnerable to household debt, the risks to the Philippines have been in the financial sector which has been the primary source of funding for the government and non-financial institutions while household debt represents a speck of the overall.

As a side commentary, this is what the mainstream fails to see: How the banking and financial system in the Philippines have been ‘concentrated’ to a few, given the still low penetration levels of banking access and credit access in the household level, despite the so-called boom.

So when the Philippine government issues statistical growth, they tend to exaggerate economic activities in the formal sector as representative of the whole. These numbers hardly account for the huge part of the Philippine economy which remains informal.

Based on the definition of the informal sector by Wikipedia, “not taxed, monitored by any form of government, or included in any gross national product (GNP), unlike the formal economy”[23], this means that many segments of the Philippine economic data are subject to substantial statistical errors.

Meanwhile, Indonesia which presently has been the focal point of ASEAN’s weakness, oxymoronically has generally, the smallest exposure on debt.

Two insights we can see from the recent developments.

One the level of debt tolerance has not been relatively based, as fallaciously argued by some officials and mainstream experts defending the current credit boom, but on creditor—per country relationship basis.

Two, while Indonesia may function as catalyst for a potential crisis, Thailand and Malaysia appear to be even more vulnerable to a sudden shift in the confidence levels of creditors.

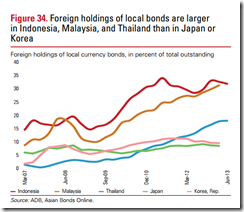

Figure 5 ASEAN LCY Bond Foreign Ownership

Figure 5 reveals how fragile or how ASEAN bonds are sensitive to foreign sentiment, given the substantial level of foreign ownership of local currency bonds. Foreign money accounts for nearly 30% of local currency bonds in Indonesia and Malaysia while Thailand has about 15%.

Given today’s global wild and rampant yield or momentum chasing activities, combined with massive cumulative build-up of economic distortions from central bank policies, sudden shifts in foreign sentiment may spur extensive dislocations in the marketplace again exposing all the amassed imbalances.

The Philippine contemporary, as previously discussed has been a relatively closed and illiquid market. As I wrote in September[24]

The investor profile of the domestic bond market reveals of a seeming proportional distribution of the outstanding bonds between the resident private sector institutions and various domestic government agencies. In other words, the Philippine government and their private sector allies have been able to ‘manage’ bond markets.

This doesn’t mean that closed and illiquid markets serve as free passes for bubbles. If ASEAN markets will undergo sustained turbulence, there will most likely be a spillover to Philippine bond and financial markets. Since the Philippine bond markets have been grotesquely mispriced, I expect the volatility in the bond markets to be magnified.

ASEAN’s financial turmoil will be evinced by extended episodes of liquidity shortages that will expose on accrued malinvestments concealed by the recent boom. Companies desperate for funding will frantically compete from the diminishing pool of supply amidst dramatically receding confidence and a shift to fear. Such dynamic will eventually force up domestic bond yields at a rate even faster than the more liquid counterparts.

Figure 6 Indonesia’s yield curve

Indonesia’s rapidly flattening yield curve seems like a good example see figure 6[25].

Above, I pointed on how Indonesia’s 10 year yield seems to be swiftly approaching September highs. But the flattening yield curve reveals that short term yields have been rising more hastily than the longer end. This is a sign of an advancing stage of a liquidity crunch. The liquidity crunch will be magnified when yield curve inverts. Inverted yield curves have usually been accurate indicators of recessions or crisis.

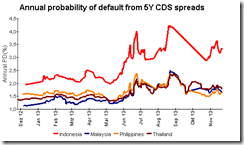

Figure 7: ASEAN Default Probabilities

Indonesia’s rising bond yields and speedily falling rupiah have also been reflected on the default risks via 5 year Credit Default Swaps (CDS) Probability of Default (PD)[26].

While Indonesia’s annualized probability of default 3.3% (based on recovery rate of 40%) is far from Argentina (15.6%) or Venezuela (12.8%), we seem to be seeing a formative upside move.

Meanwhile ASEAN’s bond vigilantes have yet to influence the CDS default probabilities of Thailand, Malaysia and the Philippines. Nonetheless ASEAN’s CDS probabilities remain elevated relative to the pre-Abenomics levels which demonstrate languishing concerns over financial stress.

ASEAN Stock Markets: Patterns and Pairs

This leads us to the stock markets.

Figure 8: Clustering Illusions? Phisix-SET and the Nikkei

I bring up again the peculiar similarities in figure 8 first between the Philippine Phisix (upper left window) and Thailand’s SETI (upper right window). Since the start of the year the Phisix-SET has acted in an uncanny resemblance with each other. This can be identified through their recent inflection points (green arcs). Well this week’s near identical fall 4+% seems even creepier.

A second bizarre pattern can be traced to the similitude of the Phisix-SET with Japan’s Nikkei 225 during the latter’s boom bust transition over a 10 year period (red rectangle). While the Nikkei’s pattern may not be as precise as the Phisix-SET, the Nikkei’s chart exudes of a full scale bear market that followed a manic boom.

The likeness of the Phisix-SET and the Nikkei can be seen via the major inflection points as highlighted by the green arcs.

While I hardly am a believer in chart patterns, my question is will a repetition of the Nikkei’s pattern be expressed via the Phisix-SET? Considering the similarities in the extensive build up of systemic debt (although distinctly distributed), I guess the answer will entirely depend on the bond vigilantes.

And compared to the earlier surges in ASEAN bond yields, where ASEAN stocks responded forcefully as seen via sharp volatilities, today’s stock market actions seem to be more subtle and partially different.

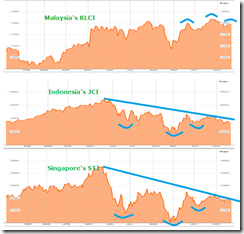

Figure 9 ASEAN stocks: Malaysia’s KLCI Indonesia’s JCI and Singapore STI

Aside from the seemingly steep deterioration in the nearly self-same Phisix-SETI, Indonesia’s JCI seems to be in a slow but steady decline see figure 9

ASEAN stocks go against Malaysia’s KLCI, ASEAN’s odd man out, which recently even etched record highs. Malaysia’s flagging bond markets and the falling ringgit have only dented the KLCE marginally.

Meanwhile the ASEAN developed economy equity market benchmark of Singapore, via the STI, uncharacteristically seems to approximate movements of Indonesia’s JCI. The inflection points of JCI-STI again reveals of the noteworthy similarities

So ASEAN equities appear to trade in pairs: Singapore’s STI-Indonesia’s JCI and Philippine Phisix-Thailand SETi

As a side note Singapore’s 10 year bond markets and currency, the Singapore Dollar, seem to also exhibit signs of relapse.

Will Malaysia’s KLCI lead the rest of ASEAN out of the woods? Or will the bond vigilantes spoil the KLCI’s party and bring her to tow the line along with the rest of her neighbors?

ASEAN’s Fed Taper Bugaboo

Aside from the Typhoon Yolanda bogeyman, I find comments by highly paid local “experts” attributing the relative underperformance of ASEAN equities on the Fed’s taper as signs of cluelessness.

When outgoing Fed chief Ben Bernanke surprised the markets heavily expecting a tapering with an UN-taper last mid-September[27], the rebound in ASEAN markets failed to keep pace with advances counterparts in the US, Europe and Japan and eventually faltered. Then tapering was off the table but ASEAN markets floundered and disappointed.

Figure 10: Yardeni.com Retail Investors Leads the Yield Chasing Momentum[28]

Recently incoming Fed Chairwoman Janet Yellen has signalled continuity of Bernanke’s dovish policies or the retention of easy money environment. This has been celebrated by stock market participants who pumped US stocks to a Wile E Coyote running off the cliff momentum[29]. Unfortunately ASEAN markets fumbled anew

Retail investors have been piling up on US stocks see figure 10

While there have recent been chatters over the Fed’s taper, “tapering” will hardly be a reality soon, particularly for a steroid asset bubble dependent economy. This also means the Fed’s taper has hardly been the current source of ASEAN’s sustained underperformance.

As far as June 2013[30], I have been saying that the Fed’s tapering signifies a “poker bluff”, as yields of US treasuries have been rising since July 2012. Even Mr. Bernanke’s QE 3.0 in September 2012 failed to stem the rising yields.

Here is what I wrote[31]

But treasury yields have been rising since July 2012. Treasury yields have been rising despite the monetary policies designed to suppress interest rates such as the US Federal Reserve’s unlimited QE in September 2012, Kuroda’s Abenomics in April 2013 and the ECB’s interest rate cut last May.Rising treasury yields accelerated during the second quarter of this year, which has now been reflected on yields of major economies, not limited to G-4.

Mr. Bernanke’s tapering bluff was called last September.

Aside from tapering expectations, rising rates of US treasuries (USTs) have been partly reflecting on a combination of the following factors

-inflationary boom gaining traction which has spurred accelerating demand for credit thus pushing up interest rates.

-erosion of real savings or the diminishment of wealth generators or growing scarcity of real resources due to the massive misallocation of resources prompted by central bank inflationist policies.

-diminishing returns of central bank policies where continued monetary pumping has led to higher rates.

-inflation premium, despite relatively low statistical CPI. Perhaps markets have been pricing inflation of asset bubbles

-growing credit risks of the US government

-Triffin Dilemma or Triffin Paradox[32] where improving US trade deficits have been reducing US dollar liquidity flows into the global economy.

As for the underperformance by ASEAN, such has been partly been in response to the above dynamics combined with the possible peaking of internally generated “homegrown” bubbles as manifested by the unsustainable convergence trade[33]

I even find signs of massive denials and intensifying desperation by experts to even seek a Manny Pacquiao victory in the hope that such would boost the domestic stock market[34].

Well the oversold markets will surely experience bounce. Mr Pacquiao’s victory or the coming announcement on Philippine GDP which I expect to be in line with the mainstream’s expectations given the late spurt of credit growth will have little do with it.

As shown above the actions of the Phisix appear to be anchored to the developments of her neighbors. This means that the region recovers and the Phisix will rise with the tide or a tsunami will sink all boats.

In my view risks seems very high and will continue to do so for sometime.

[1] see Typhoon Yolanda: From Natural to Man-Made Calamity; Spontaneous Order Thrives! November 18, 2013

[2] Interakyson.com PH stock market slips below 6,100-mark as profit-taking continues November 22, 2013; Inquirer.net PH stocks continue to decline November 22, 2013; Bloomberg.com Philippine Stocks Drop Most in Seven Weeks as Megaworld Slumps November 20, 2013

[3] GMANetwork.com NDRRMC: Damage from Yolanda continues to mount, nears P23B November 24, 2013

[4] See Typhoon Yolanda and the Phisix November 11, 2013

[5] Wikipedia.org Availability heuristic

[6] CNN.com Typhoon Haiyan death toll jumps to 5,235 in Philippines November 23, 2013

[7] Inquirer.net Gov’t stops ‘Yolanda’ body count at 4,011 November 20, 2013

[8] Yahoo.com NDRRMC chief: No order to suppress Yolanda body count November 22, 2013

[9] International Business Times Haiyan (Yolanda) Update: Philippine VP Jejomar Binay Panned For Allegedly Branding Name On Relief Goods November 14, 2013;

International Business Times World Haiyan (Yolanda) Update: Filipina Newsreader Korina Sanchez Slammed For Printed Slippers Donation November 16, 2013

[10] Bangko Sentral ng Pilipinas Foreign Portfolio Investments Yield Net Inflows in October November 14, 2013

[11] Bangko sentral ng Pilipinas End-October 2013 GIR Stand at US$83.4 Billion November 7, 2013

[12] Businessworld Online Forex losses weigh on San Miguel November 11, 2013

[13] Interaksyon.com Lower generation business margins pull down Aboitiz Power's 3Q profit October 30, 2013

[14] Inquirer.net Aboitiz reports 8% decline in net income October 30, 2013

[15] Businessworld Online PLDT profit growth sustained as of Sept. November 5, 2013

[16] Manila Bulletin Forex losses trim JGS’ net income November 11, 2013

[17] Businessworld Online Forex loss, spending weigh on Philex Petroleum’s bottom line October 31, 2013

[18] GMANetwork.com Cebu Pacific operator says net income plunge 71% on forex losses in first nine mos. November 12, 2013

[19] GMANetwork.com EDC's nine-month income weighed down by forex losses and lower revenues November 7, 2013

[20] GMANetwork.com Atlas Consolidated says lower metals prices, forex losses depress 9-month net income November 14, 2013

[21] Wall Street Journal Real Times Economic Blog Thai Economy Disappoints and More Risk Ahead, November 19,2013

[22] World Bank Rebuilding Policy Buffers, Reinvigorating Growth October 2013

[23] Wikipedia.org Informal sector

[24] See Phisix: Has ASEAN Bear Markets Been Signaling a Crisis? September 2, 2013

[25] Asian Bonds Online Indonesia LCY GOVERNMENT BOND YIELD MOVEMENTS

[26] Deutsche Bank Sovereign default probabilities online

[27] See Asian Markets Jump on the FED’s 'Untapering' or QE extension September 19, 2013

[28] Yardeni.com US Flow of Funds: Equities November 22, 2013

[29] See US Stocks on a Record Melt Up on Yellenomics and ECB’s QE! November 14, 2013

[30] See Why Bernanke’s Taper Talk is another Poker Bluff June 22 2013

[31] See How Rising US Treasury Yields May Impact the Phisix July 8, 2013

[32] See Will the Triffin Dilemma Haunt the Global Financial Markets? August 12, 2013

[33] See Phisix: The Convergence Trade in the Eyes of a Prospective Foreign Investor November 11, 2013

[34] See Phisix and the Manny Pacquiao Post Hoc November 23, 2013