The degree of market complacency remains alarming. The bullish view holds that Brazil, China and others retain sufficient international reserves to defend against crisis dynamics. But with EM currencies in virtual free-fall and debt market liquidity disappearing, it sure looks and acts like an expanding crisis. So far, it’s a different type of crisis – market tumult in the face of global QE, in the face of ultra-low interest rates and the perception of a concerted global central bank liquidity backstop. It’s the kind of crisis that’s so far been able to achieve a decent head of steam without causing much angst.—Doug Noland

In this issue:

Phisix 6,900: G-R-O-W-T-H Downgrades Have Begun! 1Q 2015 Consumer Real Estate and Auto Loans NPLs Zoom!

-GDP Masquerade: Let Those G-R-O-W-T-H Downgrades Begin!

-Decaying Headlines: Peso Volume Behind the Bids Defines the Fate of the PSEi!

-Apples to Oranges Comparison: Asian Crisis 2.0 versus Asian Crisis 1997

-First Quarter 2015 Consumer Real Estate and Auto Loans NPLs Zoom!

-Falling Peso: Why the BSP’s July GIR Statistics Mask the Brewing USD Supply Strain

Phisix 6,900: G-R-O-W-T-H Downgrades Have Begun! 1Q 2015 Consumer Real Estate and Auto Loans NPLs Zoom!

GDP Masquerade: Let Those G-R-O-W-T-H Downgrades Begin!

Let those G-R-O-W-T-H downgrades begin!

That’s essentially the ramification from post 2Q GDP announcement which I predicted to happen[1]

Simple math tells us that at 5.3% for 1H, it would NEED the next two quarters to attain an average of 6.7% just to reach an annual 6%, which has been the floor of most of mainstream expectations.

The next question is can an average of 6.7% be reached? How?

With 6.7% seemingly seen as a Herculean task, it would be natural for the consensus to go about downscaling G-R-O-W-T-H expectations.

So if these entities downgrade G-R-O-W-T-H, how will this affect headline bullishness?

The huge disparities between the GDP projections by these institutions and the government’s data simply implies that if the current dynamic of 5-6% rate holds for the next two quarters, then this would make the projections of these institutions look egregiously ludicrous, hence this week’s face saving adjustments. Two major US credit rating agencies just downgraded the GDP expectations for the Philippines for the year 2015.

First, it was the Moody’s. But Moody’s blamed the incumbent administration’s “fiscal underspending” that “repeatedly missed targets” for their downscaling of growth expectations. From the Inquirer, “the Philippines, will grow by 5.7 percent. The new projection is slower than Moody’s previous forecast of an expansion of 6.7 percent”[2].

Wow. That’s a full 1% off the initial target!

Next was the S&P. However, the S&P’s GDP markdown was sterilized by domestic media to diminish its adverse effect. Domestic media resorted to the ‘appeal to the majority’. They cited the reduction of GDP expectations by the S&P as a regional dynamic, therefore “move along, nothing to see here”.

From the Inquirer: The rating firm sees the Philippine economy growing by 5.6 percent in 2015 and 2016. S&P originally saw gross domestic product (GDP) rising by 6 percent for both years[3].

So S&P’s GDP expectations had been slashed by .4% too!

So BULLSEYE again!

It’s just amazing to see how absurdly overstated GDP estimates have been. This is especially applies to Moodys.

And this partly confirms my hunch that even with all their armies of so-called experts, these agencies have signified nothing more than ‘momentum chasers’ whom have been garbed or armed or equipped with quant models.

And all it takes for their (growth) projections would be signs of improvements in financial markets backed by domestic government numbers which they ingest into their econometric models, and which subsequently, the same models spew out their own figures for their risk-growth assessments.

And it’s why domestic media has been so sensitive to keep CONFIDENCE oozing by focusing and framing statistical reports on G-R-O-W-T-H. As I noted on the same outlook: “In today’s du jure political setting, the headline benefits of booming stocks equates to “confidence” on political actions of political administrations. And increased confidence means greater access to credit which should serve as wherewithal for political boondoggles. For the Philippines, remember, all those credit upgrades? Didn’t they come during the fourth year of the Philippine stock market boom? Or just in time as the Phisix hit the first record at 7,400?”

Now that the Philippine stock market have fallen too, along with their ridiculous original targets, hence the downgrade!

Just take a look at Moody’s ‘passing the buck’ on the administration’s supposed budgetary ‘underspending’. Had Moodys adequately comprehended on the populist, fragmented, divisive, corrupt and patron-client nature of Philippine political economy, as well as the latter’s operating environment that has been endemically plagued and hobbled by the Aegean stable of regulatory labyrinth, then they would have hardly expected any stellar 2Q GDP activities. In other words, any announcement of government spending will likely take an excruciating time window for performance.

But with a laughably rose colored glass of 6.88% 2Q projection, Moody’s have essentially been caught with their pants down! So in knee jerk reaction to their embarrassing miscalculation as represented by their outrageous miscall, they train their guns at the administration! Such is a wonderful epitome of ‘Genius’ of bullmarkets!

To consider, predicting GDP signifies as nothing more than a statistical guessing game: an informal bet, via declared projections, founded on statistical guesswork, directed at the statistical guesswork by the government.

In short, the mainstream institution’s econometric GDP models have been nothing less than of attempts to match the outcome of government aggregated surveys.

So, how accurate can this be? While the assumptions may be the same, the inputs are different! Perhaps this may work when both are surfing the same momentum wave. But how about during inflection points?

In gist, its accuracy is based purely on LUCK!

And all such frantic scrambling to meet government’s guesstimate just exposes on the blatant flaws of the obsession for statistical G-R-O-W-T-H.

Never mind if both quant and government’s data produces numbers that glaringly DEFIES economic reasoning. Never mind if numbers emanating from different government agencies contradict themselves. Never mind if government activities actually SUBSTRACTS on real growth activities since every political spending means money or resources forcibly taken out of the productive segments of the economy that gets employed into unproductive consumption activities. Never mind if government spending represents a redistribution scheme in favor of vested interest groups (cronies) at the expense of society.

The history of GDP tells us of its politicized origins: it was designed to finance wars. And the inclusion of government spending as part of the GDP has also been politically motivated.

According to economic historian Diane Coyle[4] (author of the book GDP: A Brief But Affectionate History): (bold mine) The decision to include government spending in GDP is mostly recent. It dates back to 1941 and the modern national income accounts. And there was no way at the time that the governments of the United States and United Kingdom were going to produce statistics suggesting that government spending on the military effort was making the country worse off. It just wouldn't have been a good thing to do. And the rationale for it was that for the first time in the post-war era, government started spending, collectively, much more money on behalf of their population through education systems or here in the United Kingdom it was the health system. So, that was when it first got included. The trouble is, GDP is a measure of economic activity at market prices; and there is no market in government services. So, how to value that was the question.

Why should GDP have no political context?

In other words, the contribution of government spending to the real economy is just a myth. It has been peddled to rationalize and to justify current redistribution activities via the “trickle down” policies.

In the fictional 1998 Japanese horror movie, the Ring, the villain ghost Sadako crawls out of TV to terrorize her victims. This fittingly analogizes with mainstream G-R-O-W-T-H models where prices in the general economy are stunningly considered IRRELEVANT! That’s of course with the exception of stocks and real estate prices!

And importantly, demand, supply, income, consumption and growth (among other basic economic variables) under the mainstream G-R-O-W-T-H models just pops out of the computer screens of mainstream analysts of all persuasions! So in the mainstream economics, Sadako lives!

That’s right. When the establishment shouts “G-R-O-W-T-H!”, then everyone else is expected to do the same! Of course, G-R-O-W-T-H entails the following: Buy stocks! Buy real estate! Buy bonds! Buy peso! G-R-O-W-T-H! G-R-O-W-T-H! G-R-O-W-T-H! Buy! Buy! Buy!

Yet if these agencies can miss out so so badly in predicting what the government does, then how do you think they can ably assess real risk conditions?

I may add, just how can these math models be able to capture manipulated surveys?

Of course, there may be other factors behind credit ratings changes and growth projections. These usually involve complex issues from many added variables which may include non-economic factors. For instance, how much underwriting business has been generated by these agencies from their previous self-determined upgrades? Have there been geopolitical horse-trading deals in exchange for credit upgrades? Perhaps ‘I scratch your back you scratch may back’ where credit ratings upgrades could have been made in exchange for expanded US military access and presence in the Philippines? Remember of the heavy US involvement in Mamasapano debacle that has been entirely whitewashed? How about earlier reports of US drone strikes at the South in 2012 which claimed several civilian lives?

With the huge variance between government G-R-O-W-T-H numbers and establishment expectations, then more downgrades should be expected.

G-R-O-W-T-H to justify BUY will receive less and less support.

Decaying Headlines: Peso Volume Behind the Bids Defines the Fate of the PSEi!

The headlines determine the bids on ALL Philippine assets.

Again as I presciently wrote[5]: The reason why the Philippine assets remain relatively sturdy has been because sellers have NOT yet been aggressive since the HEADLINES tell them so. The establishment believes that the boom can still be maintained even when the core has been eroding. They are relying on HOPE. And this is the reason behind the headline management. They manage statistics and the markets to keep intact what they see as ‘animal spirits’…But when reality eventually filters into the headline; perhaps as in the form of economic numbers or a surprise missed interest payment by a major company, or the appearance of a major global event risk, then bids will evaporate.

And given that the establishment has essentially indoctrinated its captive minority but moneyed audiences to believe that G-R-O-W-T-H signifies a ONE WAY street and where risks have been expunged out of existence, deterioration in the headlines will continue to be construed as an anomaly, will be blamed on external factors, and thus, will vehemently be denied.

And as part of the intense denial campaign, negative headlines will be sterilized, if not rationalized and fabricated as good news. For instance, the sustained misleading media sophistry on the falling peso. By selectively focusing US dollar revenues from OFW remittances, BPOs, export or tourism, the spin has been that the peso will benefit the economy. It’s utter baloney.

However, putting lipstick on a pig can only do little if headlines from corroding real economic conditions exert its presence.

Thus, skepticism will continue to swell as market prices and negative headlines reinforce each other.

Actions in financial markets continue to validate the increasing risk aversion on Philippine financial assets.

As of Friday, the USD-PHP climbed by .34% week on week to Php 46.89—a five year high! Year to date the USDPHP has been up 4.8%.

The pesos’ fall has not yet reached alarming levels similar to our neighbors. But that’s because, for now, the risks of a regional crisis have been severely denied and or downplayed. But it will be a different scenario once a crisis surfaces.

Moreover current domestic conditions as noted above have been shilled as a temporary condition.

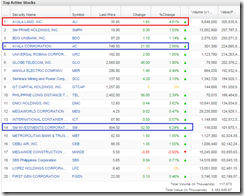

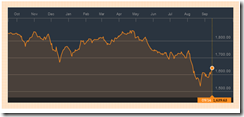

Despite the constant presence of index manipulators, the Phisix continues to reveal signs of intensifying weakness.

The Philippine benchmark closed the week down 1.99%. This week’s losses have compounded on the year to date deficit now at -4.41%.

Based on closing prices, momentum suggests that the PSEi looks likely headed to test the August 24 closing low at 6,790.

Interestingly, the PSEi now drifts at levels LOWER than during the 2H of 2014 when the orchestrated index pumping intensified. YET the lower the index, the greater the deficits in the books of these manipulators. It would not be far for one of them to surface in public soon. And this is the part which I eagerly await.

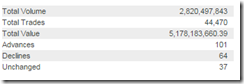

Peso volume in support of the bids at the present level of the PSEi seems in swift dissipation.

Substantially diminishing peso volume has accompanied two attempts to rally this week (left).

On Wednesday, September 9, where the Phisix closed up .74%, Peso volume posted only Php 7.6 billion. Php 7.6 billion accounts for the largest peso volume for the week! That’s seems as the max that the bids can muster!

Friday’s (September 11) .25% gain came only with Php 4.5 billion, the THIRD lowest volume for the year! And three of the lowest peso turnover occurred last week!

Ironically, index manipulators tried an afternoon delight pump on Friday only to be frustrated by a last minute dump! Apparently, manipulators didn’t have enough firepower to boost the index through the closing bell!

From last week’s activities diminishing volume in support of PSEi 6,900 have become ostensible.

Also because of the three lowest peso volume of the year, this week’s average daily peso volume has stunningly collapsed to January 2014 levels—a one year and seven month LOWS!

If the peso volume can hardly support the bids at current levels, then the PSEi will be greatly vulnerable to another major downside move! A temporary floor at vastly lower levels can most likely be activated by another negative headline or an event risk. This event risk, again, may emanate from either external or internal factors. All it takes for such a shock to occur is an appalling headline.

So index manipulators and the bulls will need a lot of fresh funding for two scenarios: at worst, to keep the PSEi at current levels, or at best, to push up the index. Without further wherewithal, the PSEi looks destined not only break the August 24 lows but also to test bear market levels at 6,480.

The rapidly diminishing peso volume means shrinking interests in local stocks. And declining appetite to hold stocks will be accompanied by other metrics too.

And true enough, the average total traded issues have collapsed to 1Q 2014 levels (left) while the average daily trades have backtracked to April 2015 lows (right).

Trading activities appear to be shriveling at a very swift pace.

Exacerbating this growing aversion towards stocks has been the worsening conditions in terms of market breadth affecting both the general market, and surprisingly, even PSEi issues!

Over at the general market, the margin between losing and gaining issues ballooned to 111 from last week’s 86 (left). Moreover, losers have dominated 6 out of 7 weeks with an average gap of 144 for the 6 weeks. That’s the fantastic stealth bear market in action!

And among the 30 PSEi issues, there were only 9 gainers for the week against 21 decliners!

Divergence seems now on path towards convergence.

There are now 18 PSEi issues in bear markets! Three comes from the top 10 while 7 from the top 15! (right) The bear market gangrene has been spreading fast!

One of the manipulator’s favorite issue, the Philippines’ largest real estate company, Ayala Land looks likely a new recruit for the bears! Once ALI joins the fold of the bears, expect all the remnants to enlist too.

So the ongoing collapse in peso volume and total number of trades, the decline daily average trades and the corrosion of market internals that has now become a scourge for both the broad market and the HEADLINE index simply affirms of the deepening symptoms of the shrinking liquidity dynamic, as well as, the amplification of risk aversion on Philippine risk assets!

When the PSEi hit 8,100, I warned that the contraction in liquidity (monetary surplus) will eventually take its toll on the stock market through a lagged effect.

Then I quoted Austrian economist Dr. Frank Shostak[6]: The effect of previously rising liquidity can continue to overshadow the effect of currently falling liquidity for some period of time. Hence the peak in the stock market emerges once declining liquidity starts to dominate the scene.

Well, the liquidity chicken has come home to roost! And record stocks served as the final icing or harbinger of self-decay.

The FED will meet to decide this week on the whether to increase interest rates by a slim margin 25 bps—or through Interest rate on Excess Reserves IOER?—or delay anew.

Since domestic media has attached so much of the peso and PSEi’s plight on the FED’s possible moves, it should be interesting to see how the FED’s decision will affect global and domestic markets.

Given what I see as the du jour central banking boilerplate of “I recognize the problem of addiction but a withdrawal syndrome would even be more cataclysmic.” I lean towards the FED’s moving of goalpost or a ‘one and done’ affair.

Like the BSP, the FED is trapped from their own policies.

Nonetheless, the peso volume behind the bids will ultimately define the fate of the PSEi! And yet as noted above, so far, the headlines determine the bids on ALL Philippine assets.

Apples to Oranges Comparison: Asian Crisis 2.0 versus Asian Crisis 1997

Current development places the interests of the establishment in jeopardy.

So media goes on to feather their nest by defending and protecting both their interests. They do this by putting up the schtick of a hunky-dory veneer. They summon economic shamans to use their magical spells as catharsis against ‘evil forces’. Such fiends would upset the politically correct and the self-righteous status quo and must be stopped.

So the economic medicine man declares that an Asian Crisis is “unlikely” because conditions today are different and because Asian economies are “stronger” today: “Asia today looks nothing like 1997,” DBS said in a report issued this week. The bank cited high levels of reserves and consistent current account surpluses, which offset the flight of investors’ capital[7].

As usual, economic shamans use statistical talismans to ward of economic and financial demons.

I have to unfortunately employ ad hominem here. Paradoxically, this is the same group that exactly two years ago or in September 2013 predicted an Asian crisis: “Current account deficits, capital outflow, collapsing currencies— is Asia headed for 1997 all over again? Absolutely,” Singapore-based DBS said in its research titled “Asia-vu 3: Are We There Yet?” released on Thursday. “How Asia’s march back to 1997 ends remains an open question. A crisis isn’t pre-determined— it depends on policy and on not letting things— leverage mainly— go out of hand,” it added.[8]

So the same group has flipflopped!

But they are right. We will not have a 1997 crisis. Reason? Because all crisis are UNIQUE!

As London Business School economics professor Richard Portes said at a post mortem 1997 Asian Crisis conference: ‘All Crises are the Same’ and ‘All Crises are Different’. This means that all crises share the same traits but has different operating circumstances.

But fundamentally, “All crises are ‘crises of success’ (Portes and Vines, 1997). The initial capital inflow that ultimately proves unsustainable (and perhaps unprofitable) is both a sign and - for a time - a cause of economic promise and success”[9]

Well this observation can be melded with mine: the obverse side of every artificial credit “success story” boom is a horrific bust “horror story”.

Let me use the mainstream’s definition of a crisis.

Here is how the IMF in 1998 identifies a crisis[10]: (bold mine) Crises of all types have often had common origins: the buildup of unsustainable economic imbalances and misalignments in asset prices or exchange rates, often in a context of financial sector distortions and structural rigidities. A crisis may be triggered by a sudden loss of confidence in the currency or banking system, prompted by such developments as a sudden correction in asset prices, or by disruption to credit or external financing flows that expose underlying economic and financial weaknesses. Crises may involve sharp declines in asset prices, and failures of financial institutions and nonfinancial corporations. Of course, not all corrections of imbalances involve a crisis. Whether they do or not depends, apart from the magnitude of the imbalances themselves, on the credibility of policies to correct the imbalances and achieve a “soft landing,” and on the robustness of the country’s financial system. These factors together determine the economy’s vulnerability to crises. Crises may then be considered to be the consequence of financial or economic disturbances when economies suffer from a high degree of vulnerability

I would do away with the ‘credibility of policies to correct the imbalances and achieve a “soft landing” for the simple reason that crisis are mainly the unintended consequences of bubble policies instituted to generate a political “success story” in the field of domestic economy. “Soft landings” means kicking the can down the road that eventually paves way for another crisis.

The critical question is (to borrow from the IMF): Has there been a “buildup of unsustainable economic imbalances and misalignments in asset prices or exchange rates, often in a context of financial sector distortions and structural rigidities” in Asia or in the Philippines?

Have these not accounted for as serious “misalignments in asset prices”?

How about the frenetic race by the supply side to build capacity in vertical real estate (housing and office), shopping malls and hotels mostly financed by the banking sector?

Have these not signified a “buildup of unsustainable economic imbalances”?

Didn’t the BSP chief warn twice last year, first in August where he said that the public should “avoid the pitfalls of “chasing the market””[11]?

Did he not then follow this up three months later with the admonition that “keeping rates low for too long could result in mis-appreciation of risks in certain segments of the market, including the real estate sector and the stock market as markets search for yield”?

Most importantly did he not emphasize that “when the tide turns, those projects that you may have “approved” based on a specific expected value may not provide you the “return” you anticipated”[12]?

What was he signaling then? Has “mis-appreciation of risks” been dissimilar to “misalignments in asset prices” and or a “buildup of unsustainable economic imbalances” in context? Or are they the same? If it is the latter, the BSP chief deep inside may know the real score.

As a side note, the BSP chief got it going then. Curiously, the sudden silence. Also, the abrupt desistance to tighten. Why? Because of a gag order from the Palace and or from cronies?

So just how will foreign exchange reserves protect against mispricing, maladjustments and malinvestments, or in IMF vernacular a buildup of unsustainable economic imbalances and misalignments in asset prices?

Entities who shout the statistical talisman chant of “forex reserves! forex reserves! forex reserves!” fail to see and realize that Saudi Arabia, China* and Malaysian reserves have been diving!

*I discuss China’s reserves at the last segment of this outlook.

How about debt?

Indonesia’s crashing rupiah has been contributing to the TRIPLING of the nation’s external liabilities!

From Bloomberg[13]: (bold mine) Investors selling the rupiah on concern Indonesia will suffer a debt crisis risk a self-fulfilling prophesy. The rupiah has slumped to its lowest level since the peak of the Asian financial crisis, when Indonesia was bailed out by the International Monetary Fund. Its nine-week decline is the longest since June 2004. That’s unfortunate timing for the nation’s government, banks and companies that owe a record $304 billion in foreign debt, almost three times the country’s $105.4 billion of international reserves, according to central bank data.

No buildup of unsustainable economic imbalances in Indonesia’s financial system?

It would be interesting to see an update on Malaysia’s foreign debt exposure.

Economics hasn’t been about static numbers. They are about people’s action in response to ever dynamic changes to mostly local conditions.

There has seemingly been no relief to the unabated ringgit-rupiah carnage. This week the tandem tanked by1.3% and 1.1%, respectively. Year to date losses have accrued to 23.5% and 15.6%.

What does the current development suggests? That the risks of an Asian crisis look “unlikely”? Or that the risk of an Asian crisis is nigh?

If the ringgit-rupiah meltdown won’t stop, then Asian crisis 2.0 looks likely a forthcoming reality in early 2016.

As I have previously noted[14] (with reference to Malaysia’s quagmire):

YET it’s not just been about the ringgit’s collapse. There is also the issue of precipitous currency volatility. Combined, these dynamics have already been contributing to the already slowing economy.

But the linkages don’t stop there. There will be an economic-financial feedback mechanism where an economic downturn will lead to financial losses and vice versa. The epiphenomenon will be the shrinkage of systemic liquidity. The process of which will be spotlighted by the following feedback loop: the emergence of cash flow problems to debt servicing problems and to constrictions on access to credit. Finally, liquidity shrinkage will lead to insolvency, and concomitantly, to liquidations.

In short, a currency crash will likely be transmitted to as a banking or debt crisis.

History provides clues. YET like a thumbprint, every crisis is unique. But ALL financial crises have been centered on a single factor: CREDIT overdose.

Finally it’s really astonishing to see how experts basically “fight the last war” or use past crisis as rigid paradigm in their assessment of current events. The allegorical equivalent of this is ‘angels dancing on the head of a pin’ or an enquiry which is of no value.

A regional crisis means a financial-economic maelstrom affecting several nations WITHIN a region.

In the previous case or in 1997, Thailand was the epicenter of the crisis. Thailand’s bubble implosion exposed similar imbalances within the ASEAN neighborhood. The trigger was capital flight. The cause was a credit bubble.

Contagion has usually been blamed for the spread of a crisis from one nation to the other. However, the contagion dynamic tries to illustrate a crisis from a political perspective: a culprit and their victims. But this is a myth.

As the late economist Anna J. Schwartz explained[15]: One myth is that the individual country’s loss of creditworthiness has a tequila effect. The supposed tequila effect is that other countries without the problems of the troubled country are unfairly tarnished as also subject to those problems. In this way, it is said, contagion spreads the crisis from its initial source to other innocent victims”

The reality is that “capital flight from countries with similar unsustainable policies is not evidence of contagion” instead capital flight happened “because of their home-grown economic problems”

In short, there will be NO contagion had there been limited malinvestments, misalignments, imbalances and maladjustments in the system.

In current day application, there will be NO weak peso if there have been NO home-grown economic problems. There will also be NO Asian crisis if most Asian nations have NO home-grown economic problems.

In sum, Asian (regional) crisis is about similar domestic imbalances (but differs in degree) that infects individual Asian (regional) economies such that when one blows up, the others with the same imbalances will blow up as well.

Which country will likely be the trigger? It could be China, Japan, Malaysia, Indonesia or even exogenous or ex-Asian forces. What can be seen, or what is known, is that if the current currency meltdown and or swift forex depletion won’t ease soon or if stock markets remain under pressure, then one or all of them could serve as trigger/s.

So incantations of statistical talisman would be tantamount to “whistling past the graveyard”. But as the prominent English writer and philosopher Aldous Huxley warned, facts do not cease to exist because they are ignored.

First Quarter 2015 Consumer Real Estate and Auto Loans NPLs Zoom!

The establishment wants the public to believe that Philippines IS immaculate and or IS impervious to the forces of malinvestments!

Yet ironically sins of omission and commission from trickle down policies of financial repression have been surfacing even from the government’s own data.

It was in the 1Q 2015 where land prices in Makati CBD and Quezon City skyrocketed.

It was also in the 1Q when the Phisix soared to a series of record highs which culminated in April 10, 2015.

Media reiterates the message about the G-R-O-W-T-H. But they hardly talk about how this has been financed or the conditions of the financing that has backed such G-R-O-W-T-H story.

Well the above is the banking system’s consumer 1Q loan data from the BSP. And it exposes a lot of skeletons in the closet.

The BSP remains in denial or has been covering up. So they embellish the consumer loan report by indicating that[16]: While consumer lending expanded, U/KBs and TBs kept the level of their non-performing CLs manageable. At end-March 2015, the banks’ non-performing CLs represented 4.9 percent of their total CLs, practically unchanged from the 4.8 percent recorded a quarter earlier.

Well the devil is IN THE DETAILs!

The banking system has reached a point where non-performing loans has either almost matched the pace of consumer loan growth or exceeded them!

As indicated from the table above from the BSP, on a year on year basis 1Q consumer loan growth was 26.89%, BUT NON PERFORMING LOANS have moved up sharply to grow by 19.93%!

Real Estate loans (REL) which accounted for 44.11% of consumer loans in 1Q 2015 grew by 25.86% over the same period. But here’s the zinger: REL’s NPLs jumped by a shocking 27.65% which is faster than overall REL loan growth and even the growth in performing loans at 25.8%!

A worst dynamic infects auto loans. Auto loans accounted for 26.22% of 1Q consumer loan portfolio. While auto loans growth spiked by 25.85%, NPLs…hold your breath…skyrocketed by a horrific 39.1%!!!!!!!!!!! Auto loan NPLs in 1Q had been 49.12% LARGER than loan growth or even performing growth in performing loans at 25.25%!!!

This is not just a 1q dynamic. NPLs of real estate and auto loans have been growing faster than the said industry’s loan portfolio since the 4Q 2014 (based on year on year) as indicated in my charts.

That’s right. The balance sheet impairments have arrived!

1Q 2015 spotlights the kernel of the consumer loan portfolio deterioration!

On a quarter on quarter basis, overall consumer loans grew by only 3.36% as of March 2015. But but but but….NPLs grew 6.08% which almost DOUBLED the former’s growth rate!!!!!!!!! NPL growth has signified 88% more than the performing loan growth at 3.22%!!!!!

Real estate loans. Real Estate Loan NPLs at 6.63% has almost DOUBLED the growth rate of REL loan portfolio growth 3.31% and performing loan growth at 3.21%!!!!!! Awesome!!!!!!!!!!!!!

Auto loans. The auto loans portfolio grew by only 6.32%. Performing loans grew by 5.84%,

But but but….auto loan NPLs grew faster by 16.89% or has nearly TRIPLED the growth rate of auto loans and of performing loans!!!!!!!!!!! Stupendous!!!!!

And the reason for the largely unchanged overall NPLs has been because credit card, salary loans and other loans offset the ongoing degeneration of auto and real estate loans.

So far, the latter three has camouflaged the headline statistics. But a continued decay in real estate and auto loans portfolios, which account for 70% share of consumer loans, will eventually affect the headline numbers.

I described the apples and orange comparison of the statistical NPL ratio and the warning signals emitted from these last June[17].

Total portfolio loan growth has been derived from newly acquired loans during the stated period. However, NPLs have emanated from loans acquired from the past that have gone sour during the abovestated reporting period. The BSP defines non-performing loans in different loan categories based on different periods

So what you have is a ratio that compares the results of aging loans with present (freshly acquired) loans. Thus, the current NPL ratios exhibits credit health in the context of quantitative rather than qualitative conditions. This shows again why politics have been about emphasizing on the form rather than of the substance.

For consumer NPL at 12.74% to rise faster than the statistical output, or household final consumption expenditure (8.2% current) already represents an alarm bell.

The point is that for as long as new loans outpace growth in NPLs then the statistical metric of loan coverage on NPLs will remain depressed even if NPLs have been growing.

And because NPLs have represented ageing loan portfolio performance, any slowdown in new loan growth will magnify NPLs. In addition, because of the furious pace of new loans growth rate, today’s big growth in loans will become tomorrow’s NPLs.

And that’s just from the statistical angle.

From an economic angle, for NPLs to grow in the face of lower growth then this should begin to hurt bank balance sheets which eventually should filter on the headlines.

The great thing is that consumer loans remains a speck to overall loans in the banking system.

To repeat, “And because NPLs have represented ageing loan portfolio performance, any slowdown in new loan growth will magnify NPLs.”

Bullseye!

Now here’s more, “In addition, because of the furious pace of new loans growth rate, today’s big growth in loans will become tomorrow’s NPLs.”

For as long as the real economy slows, the nasty side effects from NPLs as ageing loans will continue to compound on the banking system’s deteriorating health conditions. NPLs growth will most likely gain momentum.

The immensely downshifting real economy performance has begun to amplify tomorrow’s NPLs and convert them into today’s statistics. This is why the substantial leap in NPL growth numbers.

Yet the performance of last two quarters (in both quarter on quarter and year on year basis) suggests of a new trend underway.

And for NPLs to gain momentum means the banking system’s NPL ratios should also be expected to rise in tandem. Again, this will become a headline issue.

In 2013, I have noted that NPLs will reveal itself as a coincident indicator[18].

Non Performing Loans (NPLs) are coincident if not lagging indicators. NPLs are low because the current boom continues. NPLs become reliable indicators, when asset quality deteriorates or when the credit boom is in the process of reversing itself into a bust. Again they are coincident if not lagging indicators.

Coincident indicator it has been.

Ascendant NPLs, which will burden the banking system’s balance sheets, will eventually hamper credit flows to the real economy. And with heavy dependence by the formal economy on credit flows, the G-R-O-W-T-H from previous boom will substantially slow if not lead to a contraction. You read it right, contraction means RECESSION!

Yet the sagging health of consumer loans tells us partly WHY current liquidity has been slowing.

Non performing loans destroy money supply. And since the present rate of growth of consumer NPLs has now almost levelled with overall consumer loan growth, then this means money supply destruction from NPL growth has been offsetting new bank credit growth.

And soaring consumer NPLs also reveals to us why the Philippine government’s yield curve continues to flatten despite repeated interventions to steepen it.

As I wrote last December[19]:

Instead of an anomaly, the flattening of the yield curve is an indication of the business cycle in progress.

It has been a sign of monetary produced imbalances that has prompted credit markets to arbitrage on the asset liability mismatches via the spread differentials—whose windows have now been closing. It has been a sign of how credit expansion has engendered massive pricing distortions in the economy that has been demonstrated by inflationary pressures* which have now been reflected on the bond markets. And it has also been a sign that such credit expansion fueled boom has been backed by a lack of savings.

Current developments in the Philippine bond markets suggest that yields have been rising across the curve but the pressure of increases has been in the short (bills) maturities than the longer bonds…thus the flattening. The flattening of the yield curve thereby signals the ongoing tightening of monetary conditions. Rising short term yields are symptoms of emergent strains in the Philippine financial system.

Those short term rates continue to press higher despite attempts to suppress them. The Philippine government even conducted a bond swap to supposedly convert illiquid bonds to more liquid bonds as well as to “inject liquidity”.

But even with the swap, those short term rates continue to balloon.

Besides, bank balance sheets impact the yield curve and vice versa. Thus such feed backloop presaged the rise in NPLs as I noted last February[20].

And because of the previous torrid pace of the rate of growth of credit activities mostly from the banking system, “short-term loans growing more expensive” should imply a tightening of credit.

And such tightening extrapolates to likely increases in the incidences of Non-Performing Loans (NPLs) or expose on the deterioration of credit conditions in the banking system’s portfolio. The rise in NPLs will impact banking and financial system’s balance sheets. And this comes as loan conditions stagnate. Aggravating such conditions will be a downturn in other banking and finance activities anchored on sustained inflation of financial assets.

This is just consumer loans. The hidden NPLs on supply side loans will eventually surface.

Pieces of the jigsaw puzzle all falling into their proper places!

No homegrown problems?

Once the all these transforms into the headline expect additional pressures on all Philippine assets

Falling Peso: Why the BSP’s July GIR Statistics Mask the Brewing USD Supply Strain

The BSP announced the GIR reserves had been marginally lower this July.

The BSP says that GIR was “lower by US$0.07 billion than the end-July 2015 level of US$80.33 billion due mainly to the BSP’s foreign exchange operations and payments made by the National Government (NG) for its maturing foreign exchange obligation”[21]

An unstated reason why July GIR was lower by only $.7 billion was because June’s data was also revised down by $.96 billion from the preliminary data.

I wouldn’t further cavil at the accuracy of the current BSP statistics. Instead I show why these numbers should be doubted.

The swift downfall of the peso simply implies that the demand for the US dollar has been SUBSTANTIALLY GREATER than the demand for peso. Yet someone has to supply those US dollars.

So what are the sources? Well it’s the official, the formal banking and financial sectors, and the unofficial sources—the informal sector and or the black market.

I would add a “transit window” for official sources. By “transit” I imply of the uncaptured data “flows”—mostly from OFW and BPO remittances. These flows are USDs that didn’t get added into GIRs because they were soaked up by USD buyers in the real economy mostly through the formal financial system.

Again, SOMEONE has to supply the current acceleration in the demand for US dollars. The BSP numbers tell us that the banking and the informal system, so far, have enough USD supplies to have kept GIRs at current levels with minimal monthly decreases.

Or, the BSP numbers have been padded.

It’s why I don’t trust statistics. The numbers haven’t been congruent with economic reasoning. Instead, the numbers have been intended to portray a copacetic mask. It is showbiz intended to prop up the political regime.

Yet the rate of the pesos’ decline suggests that there hasn’t been sufficient supply of USD in the economy. If it has, then there will hardly be any be considerable move against the peso. Or simply stated, the peso won’t be under selling pressure.

Alternatively, this also means that given the ballooning demand for USD, whatever residual supply of the USD are swiftly being ingested by the system. This means a rapid building up of tension on US dollar supply.

So despite all the showbiz accounting appearance, eventually, the BSP may not be able to hide this. The USD supply strain will be manifested in the BSP’s GIRs.

Looking at the experience of our neighbor should serve as a great example.

China’s vaunted once $4 trillion forex reserves have been speedily retrenching. The Wall Street Journal reported that China’s GIRs dropped by a stunning record $93.9 billion last August!

So the cost of keeping the yuan’s soft peg has been the rapid erosion of foreign reserves! Reports suggest that the Chinese government has spent up to$200 billion defending the currency.

China’s government used the USD-yuan peg to paint a scenario of stability even when her bubbles have been deflating.

[As an aside, China’s experience shows that the pernicious after effects of bubbles can’t be shielded by forex reserves]

Moreover, this week alone the Chinese government imposed more capital/currency controls to stem capital flight. Through mostly administrative measures the Chinese government ordered “financial institutions to step up checks and strengthen controls on all foreign exchange transactions, according to people familiar with the matter and an official memo seen by the Financial Times” as well as “The Safe has ordered banks and financial institutions to pay particular attention to the practice of over-invoicing exports, used to disguise large capital outflows. The administration confirmed the existence of the memo, but declined to comment further”[22]

From China’s experience, we harvest a very important insight: The USDPHP’s movements, and NOT the BSP’s GIR historical accounting entries, will indicate whether there have been sufficient USD supplies in the Philippine system.

The lesson is: Market prices will eventually tell the REAL story of the peso dilemma.