These

survey numbers contradict real events.

Why?

Because

online job postings have been crashing in 2015 relative to 2014!

According

to online job agency, Monster.com, "The Monster Employment Index Philippines registered a -46%

year-on-year decline in online recruitment activities between

November 2014 and November 2015." (bold added)

It’s

not just November though, with the exception of December which has

yet to be posted, the entire 2015 have shown jobs growth numbers and

levels significantly well below the 2014!

And

it is NOT just Monster, two other employment indices which I monitor

have been exhibiting Monster’s dilemma.

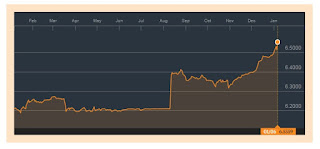

Firm

A, one of the top online job sites, which used to owned by one of the

largest publicly listed holding company, has exhibited a 35% collapse

in online job postings from a week ago since May, when I began tabulating their

numbers!

Firm

A’s September bounce, echoes with Monster’s data. And so with the

November thud!

Firm

B hasn’t been as lucky as Firm A.

Firm B’s job opening numbers has

virtually evaporated! Since April, Firm B’s online jobs have

crumbled by a shocking 80% as of a week ago! Competition and the overall low job postings, perhaps led to the erosion of its market share.

While

employment data is nuanced than job openings, job openings give us

an insight on the conditions of job markets. Job openings provide a

clue of the hiring process and employment conditions.

Perhaps

employers have resorted to the traditional medium of newspaper based

advertisement, which should be more costly, and more inefficient in

drawing audiences or candidate employees.

Or

perhaps employers have resorted to direct hiring via viral

networking, without media advertisements.

Or

perhaps job openings have really been dwindling.

Nonetheless

based on online job openings the government’s statistical numbers

have been unsubstantiated.

This

simply tells us that the government’s numbers may be about

statistical Sadakos. Or that their numbers that just popped out of

the computer screens to generate a showbiz statistical talisman impact.

Yet Monster’s

November job opening collapse was broad based! The decline included the top

growth industries…yes, mainstream's favorite BPOs too (down by double digit)!

As

in June’s data where Monster.com tries to spin the bad developments,

as

noted here:

Online

jobs continue to nosedive. Monster.com’s June data reveals that

online hiring plunged 32% year on year. Yet they call this “a

significant improvement in growth from -43% in May 2015”. Huh?

Officers

from monster.com must have been scathingly

pilloried by

the throng of believers who think that the Philippines have reached a

developed economy status to force the latter to utter such

balderdash.

Monster

officials say that current job collapse has “Partly

due to the halting investments ahead of the elections and the dry

spells of the El Nino, hiring has also begin to slow down”.

But

they remain optimistic. They noted that job openings “will

likely see a rebound in 2016, given the country’s strong private

consumption as well as higher government spending in order to drive

growth in the country”

If

there has indeed been “strong private consumption” then why would

election or political uncertainty serve as a roadblock for

investments?

Have

the business community become so fearful of the change in

administration for them not to take advantage of opportunities from

the meme of “strong private consumption”? Or why has the business community

become (in aggregate) suddenly blind or dense to profit

opportunities?

Yet

the BSP tells us of a starkly different story: the business community have

supposedly been more upbeat in Q3

and Q4. If so, why the lack of investments? Who has been telling the truth or who

has been lying?

Second,

how has

the dry spells of the El Nino affected investments or job openings?

Agriculture accounted for just 8.57% share of 3Q constant based GDP,

whereas the Service sector had the largest share at 59.01%. Has there

not been a consumer boom to offset dislocations from the weather?

And

if Monster’s numbers accurately reflect on economic activities, then why the slump in ALL sectors?

As

for government spending, hasn’t there been a boom in government

spending?

Growth in government spending numbers has

reportedly accelerated 19.3% in 3Q relative to 12.4% in 2Q and

4.5% in 1H. Yet where are the jobs? Why has the surge in

government spending coincided with a collapse in the job opening

markets? Even if we see things in terms of a time lag, the 2Q

government spending activities should have at least buoyed job

opening numbers. So why the vacuum?

Could it be because job growth has emerged only in firms of crony enterprises benefiting from government spending projects in the exclusion of the rest?

Yes

the government's record low unemployment and all time high employment rates paradoxically comes in the face of slowing

statistical GDP, manufacturing and export recession, “halting of

investments” and collapsing online job postings. That's government's economic logic for you: Low is high, down is up, few is many.

And you

see, where (the phony) boom has been seen by the public or impressed

upon the public as a politically correct theme, any negatives has

to be denied, censored or rationalized by the mainstream's spin doctors.

At

the end of the day, panics are created by reality overwhelming embedded or entrenched misimpressions, misperceptions and deceptions.