The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, August 02, 2020

The Historic Gold and Bond Bull-Market Tango

Friday, November 23, 2012

What the $4.2 million Gold Christmas Tree in Tokyo Implies

For those seeking a glow to their Christmas this year, a jewellery store in downtown Tokyo has just the answer: a pure gold revolving “tree” covered in Disney characters such as Mickey Mouse, Tinker Bell and Cinderella.The tree-like ornament is made of 40 kg (88 pounds) of pure gold, standing about 2.4 metres (7.9 ft) high and 1.2 metres in diameter. It is decorated with pure gold plate silhouette cutouts of 50 popular Disney characters and draped with ribbons made of gold leaf.The price tag? A mere 350 million yen ($4.2 million).

when the price of gold rises, wealth is simply being transferred from people who hold currency to people who hold gold. This wealth being transferred already exists. It is wealth held in the form of purchasing power

Tuesday, October 02, 2012

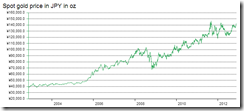

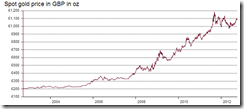

Charts: Gold versus Major Fiat Currencies

It must be emphasized that gold was not selected arbitrarily by governments to be the monetary standard. Gold had developed for many centuries on the free market as the best money; as the commodity providing the most stable and desirable monetary medium. Above all, the supply and provision of gold was subject only to market forces, and not to the arbitrary printing press of the government.

Sunday, November 06, 2011

Gold Prices Climbs the Wall of Worry, Portends Higher Stock Markets

The Occupy Wall Street crowd sees this as a problem with capitalism. I believe that they are correct in their target, but wrong in their diagnosis. This is not a problem of capitalism since Wall Street is a practitioner of monetarism. A real capitalist system works through real intermediation creating positive opportunities for productive enterprises (scarce money is actually vital here). Our current system of repo-to-maturity and gold leasing is nothing but empty monetarism’s habit of regularly forcing the circulation of empty paper. And when the system begins to doubt itself, as it did in 2008, the answer is always about finding a way to restart the fractional maximization process yet again, which means disguising the real risks inherent to that process. There is no real mystery as to why prices and values have seen such a divergence, and why that is a big problem to a system that depends on appearances. Jeff Snider

Dramatic fluctuations out of the interminable nerve racking geopolitical developments continue to plague global financial markets.

Yet despite the seemingly dire outlook, major equity market bellwethers seem to be climbing the proverbial wall of worry.

The price trend of gold, for me, serves as a major barometer for the prospective direction of stock markets, aside from, as measure to the current state of monetary disorder.

Gold’s significant breakout beyond the 50-day moving averages implies that gold’s bull run have been intact and could reaccelerate going to the yearend.

Thus, rising gold prices should likely bode well for global stock markets.

Seasonal Bias Favors Gold, Gold Mining Issues and Stock Markets

It is important to point out that gold’s statistical correlation with global stock markets may not be foolproof and or consistently reliable as they oscillate overtime. In addition, gold has no direct causal relationship with stock markets.

From a causal realist standpoint, the actions of gold prices shares the same etiological symptoms with stock markets—they function as lighting rod to excessive liquidity unleashed by central banks looking to ease financial conditions for political goals.

As shown above, all three major bellwethers of the US S&P 500 (SPX), China’s Shanghai index (SSEC) and the Euro Stox 50 (STOX50) seem to be in a recovery mode. This in spite of last week’s still lingering crisis at the Eurozone.

While I may not be a votary of statistically based metrics, seasonal patterns, mostly influenced by demand changes based on cultural factors, could have significant effects when other variables become passive.

In terms of gold prices, higher demand for jewelries from annual holiday religious celebrations, e.g. India’s Diwali and the wedding season, Christmas Holidays and preparations for China’s 2012 New Year of the Dragon[1], has statistically produced positive and the best returns of the year.

‘Statistical’ bias for a yearend rally in gold mining stocks (see lower right window) reveals that monthly returns for November has the largest gain of the year, with a potential follow through to December.

In addition, the stock market also has a seasonal ‘statistical’ flavoring with a potential yearend rally supported by additional gains from the first quarter as shown in the above chart by Bespoke Invest using the Dow Jones Industrials computed over 100 years in 2010[2]

Distinctions in the monthly returns involves many factors such as the tax milestones, quarterly "earnings season", "window-dressing" on the part of fund managers, index-rebalancing periods or many more[3] but these should never be seen as fixed variables as conditions ceaselessly changes.

Again statistics only measures and interprets history, but most importantly statistics does not take in consideration the actual operations of prospective human actions[4]. For instance, statistics can’t tell if policymakers will raise interest rates or hike taxes or print money and their potential effect on the markets.

Deeply Entrenched Bailout Policies—Globally

Nevertheless, given the current political climate, gold prices will mainly be driven by changes in the political environment. Seasonal effects will most likely be enhanced by political factors than the other way around.

In China, policymakers have reportedly been shifting towards an easing stance meant to address the current funding squeeze being encountered by small businesses.

Lending quotas of some China’s banks have reportedly been increased, where new lending may exceed 600 billion yuan ($94 billion) this month from 470 billion in September reports the Bloomberg[5].

These actions could have been driving the current recovery of the China’s Shanghai Index.

In Greece, political impasse has reportedly forced Greece Prime Minister George Papandreou to call for a referendum which initially rattled global financial markets[6].

In reality, Mr. Papandreou’s ploy looks like a brilliantly calculated move resonant of Pontius Pilate’s washing of his hand on the execution of Jesus Christ[7].

Given the recent poll results[8] which shows that the Greeks have not been favorable to government’s austerity reforms or bailouts but have also exhibited fervid reluctance to exit from the Eurozone (since Greeks has been benefiting from Germans), PM Papandreou saw the opportunity to absolve himself by tossing the self-contradictory predicament for the public to decide on.

In addition, realizing the potential risks, Germany’s Angela Merkel and France’s Nicolas Sarkozy interceded to prevent a referendum from happening, which I suppose could also be part of PM Papandreou’s tactical maneuver.

From these accounts, a vote of confidence over PM Papandreou’s government was held instead, where by a slim margin, PM Papandreou prevailed. The parliamentary victory thus empowers him to reorganize and consolidate power through a supposed Unity government[9].

In Italy, popular protests have been mounting against Prime Minister Silvio Berlusconi supposedly for his failure to convince investors and European allies that Italy can trim the Euro-region’s second biggest debt, which saw the Italy’s 10 year bond spiked to record high 6.4% on Friday[10].

PM Berlusconi recently rejected an offer of aid from the IMF, but instead, requested the multilateral institution to monitor her debt cutting efforts.

Yet given the current political maelstrom, European Central Bank (ECB) president Mario Draghi, who is also an alumnus of Goldman Sachs and who has just recently assumed office from Jean Claude Trichet surprised the financial markets with an interest rate cut citing risks of a Greece exit from the EU and from an economic slowdown brought about by the current financial turmoil[11].

Mr. Draghi’s actions seems like a compromise to the Global Banking cartel[12] where the latter has clamored for the ECB to backstop the bond markets by active interventions through quantitative easing (QE).

Obnoxious partisan politics seem to have provided a veil or an excuse for the ECB’s widening use of her printing press.

Yet ironically, attempts to portray the ECB as imposing disciplinary measures[13] on profligate crisis affected governments seem like a comic skit in the Eurozone’s absurd political theatre. The public is being made to believe that one branch of government intends to provide check and balance against the other.

In truth, the Euro-bank bailouts reallocates the distribution or transfers resources from the welfare government to the ECB and the Banking cartel in the hope that by rescuing banks, who functions as the major conduit in providing access to funds for governments, the welfare state will eventually be saved.

Yet instead of a check and balance, both the ECB and EU governments have been in collusion against EU taxpayers and EU consumers, to preserve a fragile an archaic government system that seems in a trajectory headed for a collapse.

The ECB’s asset purchases (upper right window) have been driving up money supply (upper left window) even as the EU’s economy seems faced with growing risks of recession—as evidenced by floundering credit growth in the EU zone. Yet contrary to Keynesians obsessed with the fallacious liquidity trap theory, inflation rate has remained obstinately above government’s targets which allude to the increasing risks of stagflation for the EU.

And further increases in inflation rates will ultimately be reflected and vented on the bond or the interest rate markets. These should put to risk both the complicit governments and their beleaguered financiers—the politically privileged banking system backed by the central banks—whom are all hocked to the eyeballs. Rising interest rates likewise means two aspects, dearth of supply of savings and diminishing the potency of the printing press. Yet to insist in using the latter option means playing with fires of hyperinflation.

And like in the US, the welfare warfare states have continuously been engaging in policies that would signify as digging themselves deeper into a hole.

Proof?

Inflationism as Cover to the Derivatives Trigger

It’s also very important to point out anew[14] that the US banking and financial system are vastly susceptible to the developments in the Eurozone. In short, US financial system has been profoundly interconnected or interrelated with the Euro’s financial system

Exposure of US banks to holders of Greek, Portuguese, Irish, Spanish and Italian debt in the first semester of 2011 has jumped by $80.7 billion to $518 billion mostly through credit default swaps where counterparty risks from a default could ripple through the US banking sector.

Yet about 97% of the US derivative exposure has been underwritten by JPMorgan, Morgan Stanley, Goldman Sachs, Bank of America Corp. and Citigroup Inc. The estimated total net exposure by the five government protected “too big too fail” banks to the crisis affected PIIGS are at measly $45 billion.

However, part of the hedging strategy by these banks and other financial institutions have been to buy credit insurance or Credit Default Swaps (CDS) of their counterparties which have not been included as part of these estimates. In addition, counterparties have not been clearly identified.

Because of this, European leaders have reportedly been extremely sensitive as not to trigger default clauses in CDS contracts that may put banks across two continents at risk.

Ironically, the institution that decides on whether debt restructuring triggers CDS payments, the International Swaps & Derivatives Association, or the ISDA, has these biggest government’s cartelized private banks sitting on the company’s boards.

So the big 5 essentially calls the shots in the derivatives markets or on when default clauses are triggered and when it is not.

At the end of the day, this eye-catching quote from the Bloomberg article[15] from which most of the discussion have been based on, seems to capture the essence of the policy direction today’s political system

U.S. banks are probably betting that the European Union will also rescue its lenders, said Daniel Alpert, managing partner at Westwood Capital LLC, a New York investment bank.

“There’s a firewall for the U.S. banks when it comes to this CDS risk,” Alpert said. “That’s the EU banks being bailed out by their governments.”

The point to drive at is that both governments, most likely through their respective central banks, will continue to engage in serial massive bailout policies to avert a possible banking sector meltdown from an implosion in derivatives.

Such dynamics lights up the fuse that should propel gold prices to head skyward. And the consequent massive infusion of monetary liquidity will only buoy global stock markets higher, for as long as inflation rates remain constrained for the time being.

Remember, central banks have used stock markets as part of their tool kit to manipulate the “animal spirits”[16] from which they see as a key source of economic multiplier from the misleading spending based theory known as the “wealth effect”, a theory that justifies crony capitalist policies.

Policies that have partly been targeted at the stock market and mostly at the preservation of the current unsustainable political system are being funneled into gold and reflected on its prices, which has stood as an unintended main beneficiary from such collective political madness.

Yet rising gold prices shows the way for the stock markets until the inflation rates hurt the latter. But again, not all equity securities are the equal.

I would take the current windows of opportunities to accumulate.

[1] Holmes Frank Investor Alert - 3 Drivers, 2 Months, 1 Gold Rally?, November 4, 2011, US Global Investors

[2] Bespoke Invest Seasonality Does Not Favor Stock Investments In February, February 1, 2011 Decodingwallstreet.blogspot.com

[3] Stockwarrants.com Seasonality

[4] See Flaws of Economic Models: Differentiating Social Sciences from Natural Sciences, November 3, 2011

[5] Bloomberg.com China Easing Loan Quotas May Cut Economic Risks, Daiwa Says, November 4, 2011

[6] See The Swiftly Unfolding Political Drama in Greece, November 2, 2011

[7] Wiipedia.org Pontius Pilate

[8] Craig Roberts, Paul Western Democracy: A Farce and a Sham, November 4, 2011, Lew Rockwell.com “A poll for a Greek newspaper indicates that whereas 46% oppose the bailout, 70% favor staying in the EU, which the Greeks see as a life or death issue.”

[9] See Greece PM Papandreou Wins Vote of Confidence, November 5, 2011

[10] Bloomberg.com Thousands Rally in Rome, Pressing Italy’s Berlusconi to Resign Amid Crisis, November 6, 2011

[11] See ECB’s Mario Draghi’s Baptism of Fire: Surprise Interest Rate Cut, November 4, 2011

[12] See Banking Cartel Pressures ECB to Expand QE, November 3, 2011

[13] Reuters Canada ECB debates ending Italy bond buys if reforms don't come, November 5, 2011

[14] See US Banks are Exposed to the Euro Debt Crisis, October 8, 2011

[15] Bloomberg.com Selling More CDS on Europe Debt Raises Risk for U.S. Banks, November 1, 2011

[16] See US Stock Markets and Animal Spirits Targeted Policies, July 21, 2010