Ahmadinejad has become a vital enabler of Netanyahu’s scare tactics. In reality, both are playing to domestic audiences. Netanyahu is fighting for a third term as Israel suffers from major economic problems. However, his nuclear alarms over Iran have succeeded in sidelining demands for a viable Palestinian state. No one at the UN paid any attention to Palestinian’s plaintive chirps.There was no mention that Israel’s threats to attack Iran, and its demands the US blitz Iran, clearly violate the UN Charter and international law. Iran’s claims the West and Israel were waging economic and computer war against it and murdering its scientists were shrugged off.Few seemed to take notice of Russia’s increasingly forceful comments that a US/Israeli attack against Iran or Syria could produce “consequences.” For those who enjoy worrying about a possible World War III,” this could be a good way to begin.What was again painfully clear is that the UN Security Council is an unfair outdated relic of World War II that needs be expanded and made more democratic – and moved to a neutral nation. The victors of World War II they make the real decisions.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Monday, October 01, 2012

How Actions of the UN Security Council Increases the Risks of World War III

Monday, September 17, 2012

Is a War in the Middle East War Imminent?

Warmongers have thrown up all sorts of excuses to justify military actions in the Middle East. These includes the recent religious bullying (through manipulation of public opinion) that has prompted for a wave of anti-US protests. The US government has reportedly even allied with Al-Qaeda to foment war in Syria, an ally of Iran.

Now drumbeats of war seems to be getting louder.

From the Telegraph,

Battleships, aircraft carriers, minesweepers and submarines from 25 nations are converging on the strategically important Strait of Hormuz in an unprecedented show of force as Israel and Iran move towards the brink of war.

Western leaders are convinced that Iran will retaliate to any attack by attempting to mine or blockade the shipping lane through which passes around 18 million barrels of oil every day, approximately 35 per cent of the world’s petroleum traded by sea.

A blockade would have a catastrophic effect on the fragile economies of Britain, Europe the United States and Japan, all of which rely heavily on oil and gas supplies from the Gulf.

The Strait of Hormuz is one of the world’s most congested international waterways. It is only 21 miles wide at its narrowest point and is bordered by the Iranian coast to the north and the United Arab Emirates to the south.

In preparation for any pre-emptive or retaliatory action by Iran, warships from more than 25 countries, including the United States, Britain, France, Saudi Arabia and the UAE, will today begin an annual 12-day exercise.

As American musician and composer Frank Zappa said,

Government is the Entertainment division of the military-industrial complex

Tuesday, February 28, 2012

Gold is Money: Iran Edition

Economic sanctions on Iran seems to be ushering in gold’s default role as money.

Earlier I pointed to a rumor where under economic sanctions from the US and Europe, Iran would circumvent these by using gold to trade with India.

Andrey Dashkov and Louis James at the Casey Research has an update

It proved to be nothing but a rumor, however: the sides decided to arrange the deal in a more tactical manner. India will partly cover the purchases with its own currency, and Iran will later use those funds to acquire imports.

But gold is not out of the equation yet. The US-initiated sanctions were effective, at least in the sense of making international institutions avoid the pariah nation. Reuters reported that Iran has failed to organize imports of even basic food staples for its population of 74 million. Prices on local markets rose sharply; and as the country nears parliamentary elections on March 2, the government is taking radical steps to provide citizens with basic necessities. One of those unconventional solutions was offering gold as barter for food.

"Grain deals are being paid for in gold bullion and barter deals are being offered," one European grains trader said, speaking on condition of anonymity while discussing commercial deals. "Some of the major trading houses are involved."

Another trader said: "As the shipments of grain are so large, barter or gold payments are the quickest option."

Trading in gold rather than a fiat currency is "cashless." That may sound as if there's no medium of exchange, but that is of course a misconception: gold is history's longest-standing medium of exchange.

As long as the sanctions remain in force and the Iranian government has limited access to international currency markets, gold will remain an obvious way to settle transactions. Decreasing oil imports to Japan, the world's third-largest importer, will impact the Iranian economy further, draining foreign currency inflows. Lacking foreign currency may push the country to continue using its foreign exchange reserves, or gold, to cover its international liabilities. Oil looks like a viable, though less convenient, alternative as well.

The Iranian economy is in a state of crisis, and due to the lack of trust in its currency, leaders are increasingly resorting to extraordinary offers to trading partners. The situation would clearly worsen if the country enters a state of war. While that's still speculation, imagine what would happen to the price of gold if a part of Iran's 29-million ounce gold reserve becomes a medium - not an object - of exchange in international trade.

That reduction in potential supply could be a game-changer, not only because of crisis-struck Iran, but because it could open the door for other countries to follow suit. The price of gold would likely respond very positively.

This scenario, while possible, may not happen very soon: large-scale trading in gold has occurred only rarely in recent years. Traces of deals are difficult to track down due to the anonymity of the yellow metal. This re-emphasizes our point regarding gold as money in extremis: when economic push comes to shove, gold will outlast any other medium of exchange in existence. As the evidence from Iran shows, even governments - the masters of the central banks - will resort to mankind's oldest form of money when pressed.

Which brings us to this evergreen conclusion: Gold is one of the best assets to own in both good times and bad. It can rise with inflation in a surging economy, and it can be practical for exchange when times are bad.

Gold isn't just a hedge; it's money.

The policies of inflationism, compounded by protectionism and imperial foreign policies account for as self-designed path towards the perdition of the current monetary standard. And if these conditions intensify, gold may redeem its role as money overtime.

In the meantime gold’s role in the financial system will deepen, expanding its functionality from hedge to collateral, and perhaps to become an integral part of financial securities, such as bond issuance backed by gold, and possibly in the fullness of time, towards a medium of exchange.

Tuesday, February 21, 2012

The Implications of Cuts in Saudi Arabia’s Oil Production and Exports

In the light of $100 oil, Saudi Arabia, the world’s largest oil producer and exporter has reportedly cut production.

The CNBC reports,

The world’s top oil exporter, Saudi Arabia, appears to have cut both its oil production and export in December, according to the latest update by the Joint Organizations Data Initiative (JODI), an official source of oil production, consumption and export data.

The OPEC heavyweight saw production decline by 237,000 barrels per day (bpd) from three-decade highs of 10.047 million bpd in November, the JODI data showed on Sunday.

The draw-down was sharper for the actual amount exported, declining by 440,000 bpd, or 5.6 percent, to come in at 7.364 million bpd, the data also showed. The level would still be similar to exports after a steep ramp-up last June.

In its monthly report on February 10, the IEA put Saudi Arabia’s production number for December slightly lower at 9.55 million bpd, a disparity of 260,000 bpd versus the JODI data.

The actions of the Saudi Arabian government have profound implications.

Could it be that Saudi Arabia has been responding to the threat of Shale oil revolution? Recently Saudi halted a planned $100 billion expansion of productive capacity.

And considering that Saudi’s fiscal budget breakeven level stands at an equivalent of $90 oil, with current prices only marginally above the critical threshold, Saudi’s political stewards seem to anxiously sense of the growing risks to political stability or a threat to their grip on power. Hence the move to reduce oil production aimed at the preservation of the status quo or the incumbent welfare state.

Chart from Energy Insights

It could also be that Saudi’s reserve and production may also have reached a “peak”.

Last year, Wikileaks reported that cable correspondence by key officials from Saudi Arabia suggested that the kingdom may have bloated their estimated reserves by nearly 40%. Thus cuts in exports and production have merely been exposing the chicanery of oil politics.

The bottom line is that Saudi Arabia seems desperate to see higher oil prices.

So aside from production cuts, the bias for inflationary policies, the other alternative would be to promote a war on Iran using the obsession “with the need to prevent Iran getting nuclear weapons” as cover. The same applies to other autocratic Middle East oil producing welfare states.

Thus political languages conveyed by political authorities can be deceiving as they may not reflect on the realities intended.

As George Orwell warned,

Political language is designed to make lies sound truthful and murder respectable, and to give an appearance of solidity to pure wind

Thursday, February 09, 2012

Graph of the Day 2: The Iranian Threat

From Lew Rockwell Blog

Saturday, January 28, 2012

Who Benefits from a US-Iran War?

Writes Professor Michael Rozeff at the lew Rockwell Blog

Which state, the U.S. or Iran, more likely wants a war with the other? It's the side that thinks it benefits from such a war. That side is the U.S. If this war begins, it will be entirely because the U.S. wants it and has decided that the time is right to instigate it or elicit actions from Iran that provide excuses for instigating it. Any U.S.-Iran war will be entirely the doing of the U.S.

Here's how we know this. Iran has nothing to gain because it will lose such a war, its power being so much less than the U.S. This is why Iran has tolerated, so far and to a remarkable degree, the intrusions of U.S. subversions and covert activities in Iran, the assassinations of scientists, the computer disruptions, the embargos, the sanctions, the U.S. warships, the U.S. threats, and the U.S. troops being placed nearby. By contrast, the U.S., in the view of the neoconservatives who are running foreign policy, stands to gain quite a lot, namely, undisputed hegemony over the Middle East, control of a country perched on central Asia, control of oil, support for Israel, and a rise in global dominance more generally. Therefore, when and if such a war starts, no matter by what incidents it is triggered, we can be 100% certain that the U.S. has caused and precipitated this war because it, not Iran, is the state that foresees the benefits of such a war.

There are costs, however, and these are restraining the U.S. from instigating this war at this time. These include war costs of several kinds, since Iran is not a pushover. Iran, if pushed into a war by the U.S., can respond in nearby regions, such as Iraq, Lebanon, Syria, Saudia Arabia, and the Persian Gulf. It can conceivably draw Russia into the war, or perhaps Pakistan. The U.S. will win a war with Iran, but it does not expect an easy win. If it did, it would already have started the war. The war on Libya was a recent warm-up exercise that shows what air power can do in this day and age, but Iran's forces are more formidable.

Like the Iraq war, developments won’t turn out as planned (e.g. Iraq war was thought to be short) and there could be unintended consequences such as more terror activities.

And so when might war break out between the U.S. and Iran? It depends on this balance of costs that the U.S. bears and that depends on actions by Iran. But this is all assuming rationality in the war-making process. It is possible at any time that a leader in Washington or in Israel will cast aside rational calculation and decide that now is the time or the time has come, or make a decision based on some trivial detail or happenstance or incident whose significance he or she mis-estimates. Similarly, it is possible that Iran's leadership will miscalculate or perceive themselves as being backed into a corner where war is the only way out.

The U.S. keeps raising the ante, and that dashes hopes for an eventual peaceful resolution. There is no way that Iran can appease the U.S. If it gives in on one thing, the U.S. will simply demand more and then more and more. The U.S. behavior toward Gaddafi shows what happens when a weak state attempts to cooperate with the U.S. Iran will not do likewise. Its leaders are on record as recognizing U.S. behavior going back for decades. They will not back down. The only hope for a continued standoff is, ironically, that Iran make itself strong enough to deter the U.S. and Israel.

I may add that a war with Iran benefits the US politicians by diverting people’s attention from the problems spawned by present interventionist policies, by rallying people to patriotism in order to get elected, justify the imposition of domestic fascist policies by expanding control over economy, rationalize higher taxation and protectionism, and most importantly, justify inflationary policies for the benefit of both the welfare-warfare state and their cronies.

The seeds to the war on Iran have already been sown. The economic sanctions imposed by Europe, possibly as part of the bailout package with the US, have provoked retaliatory economic policy response from Iran. And upping the ante may just be a trigger away (Middle East version of the Gulf of Tonkin Incident) from unleashing of a full scale war.

Wednesday, January 25, 2012

Iran to Trade Oil for Gold to Bypass Sanctions

Iran reportedly plans to skirt US and Euro sanctions by trading her oil for gold with India and China

From Debka.com (hat tip lewrockwell)

India is the first buyer of Iranian oil to agree to pay for its purchases in gold instead of the US dollar, DEBKAfile's intelligence and Iranian sources report exclusively. Those sources expect China to follow suit. India and China take about one million barrels per day, or 40 percent of Iran's total exports of 2.5 million bpd. Both are superpowers in terms of gold assets.

By trading in gold, New Delhi and Beijing enable Tehran to bypass the upcoming freeze on its central bank's assets and the oil embargo which the European Union's foreign ministers agreed to impose Monday, Jan. 23. The EU currently buys around 20 percent of Iran's oil exports.

The vast sums involved in these transactions are expected, furthermore, to boost the price of gold and depress the value of the dollar on world markets.

Iran's second largest customer after China, India purchases around $12 billion a year's worth of Iranian crude, or about 12 percent of its consumption. Delhi is to execute its transactions, according to our sources, through two state-owned banks: the Calcutta-based UCO Bank, whose board of directors is made up of Indian government and Reserve Bank of India representatives; and Halk Bankasi (Peoples Bank), Turkey's seventh largest bank which is owned by the government.

If the major reason the US pushed for the invasion of Iraq and the overthrow of the Saddam Hussein regime was because latter had pushed for Iraq’s oil to be paid in Euros is true, then Iran’s oil for gold trade will likely presage a shared fate with her neighbor.

The other aspect here is the potential use of gold as money for transactions outside the incumbent banking-financial and political system or in the informal economy.

But of course, governments have already been restricting international gold flows. For instance South Korean authorities recently arrested men who tried to smuggle out gold by hiding it in their rectums.

Interesting signs of times.

Update: A source suggests that the DEBKA files or the source of the quoted news is run by Council of Foreign Relations (CFR), believed to a conspiracy group whose aim has supposedly been to uphold the interests of some well connected elites via control of governments, and some other network of war hawks. CFR has called for a war on Iran.

The implication is that I am not sure whether the news cited above represents a propaganda or a reported fact.

Saber Rattling over Iran is only Part of the Big Oil Price Story

Dr. Ed Yardeni writes at his blog,

Despite Iran’s saber rattling, the price of oil hasn’t soared. The price of a barrel of Brent has been hovering around $110 since last summer. That’s even after President Barack Obama signed a bill imposing tougher sanctions on Iran at the end of last year. The price didn’t go up after the Iranians publicly threatened to close the Strait of Hormuz and warned Saudi Arabia not to fill any expected gap in oil demand when the world stops buying Iranian crude. According to a report in today’s Al Arabiya News, Iranian boats with men armed with machine guns on board were recently sent to the waters near the Saudi oil-production areas. Yet the price of oil hasn’t budged much from $110. Spain’s foreign minister said on Monday that Saudi Arabia has promised that it will make up for supplies of oil lost as a result of EU sanctions on Iran, and will do so at the same price.

If it weren’t for all the saber rattling, the price of oil would probably be falling.

Saber rattling over Iran represents only a fragment of the big picture. In other words, the Iran controversy does not capture the major elements of oil politics which drives oil prices.

In examining the political structure of major oil producing economies, we find that there is a watershed level for these welfare states to survive, for instance Saudi Arabia requires some $88 per barrel to buy off their people, Iran some $ 80 per barrel and etc…

In short, anytime oil prices go below these threshold levels, you can expect the “Arab Spring” revolts to make a rip-roarin’ comeback.

So as with the politics of subsidized renewable energy. Aside from environmental concerns, alternative energy requires elevated oil prices to remain an “attractive” alternative.

As this article from Scientific American says,

Today renewable technologies such as wind and solar are close to being competitive with fossil fuels. But we can say good-bye to that prospect if oil prices decline to $60 to $70 a barrel, which could easily happen in a recession, as we witnessed in October.

This means that many entrenched political groups (and their business allies or associates) are dependent on high oil prices.

From the above we come to the following conclusion

-Free markets don’t drive oil prices. Or that oil prices are greatly influenced by the political setting of mainly the oil producers (not on Iran alone).

-To maintain or preserve the current political environment, particularly welfare states of oil producing nations and the promotion of green energy, political measures would need to be resorted to in order to bring about the required oil threshold levels.

Such political measures will possibly include saber rattling (brinkmanship) politics, various market interventions by governments (to restrict supplies) as the Keystone Pipeline Controversy [also remember that 80% of oil reserves are held by governments or National Oil companies, so supply is very much sensitive to actions of political leaders since they control a significant majority of world's reserves], and importantly for global central banks to ramp up on money supply.

As you can see plainly looking at barrels consumed and barrels produced alone is grossly an insufficient way to study and assess oil economics. That’s because politics has an immense influence on how oil prices are being shaped.

Tuesday, January 24, 2012

Coming War on Iran: Europe Bans Oil Imports from Iran

The US has been tightening the screw around Iran’s neck.

And as earlier postulated, part of the bailout package of the Eurozone comes with conditions for Europe to apply sanctions on Iran. I seem to have been validated

From the Wall Street Journal

The European Union approved a ban on oil imports from Iran, overcoming misgivings about the economic hardship of its members to take its strongest measures yet to press Tehran into concessions on its nuclear program.

News of a coming embargo by Iran's largest oil-export market shocked the country's troubled economy. Iran's currency, the rial, fell 10% to a record low on Monday, while gold prices rose.

The ban is set to take effect on July 1, following a review to ensure the weaker EU economies can find, and afford, new sources of oil. The EU also agreed to freeze the assets of Iran's central bank, the conduit for the country's oil revenue, and ban trade with its petrochemical industry.

"Our message is clear. We have no quarrel with the Iranian people," the leaders of France, Germany and the U.K. said. "But the Iranian leadership has failed to restore international confidence in the exclusively peaceful nature of its nuclear program. We will not accept Iran acquiring a nuclear weapon."

Iran's Deputy Foreign Minister Abbas Araghchi said sanctions made Iran's conflict with the West tougher to resolve.

"The more they go down this path, the more obstacles we will have for reaching a final agreement," Mr. Araghchi told IRNA, Iran's official news agency.

The Obama administration applauded the EU decision on Monday and backed it up by blacklisting Iran's third-largest bank, Bank Tejarat, one of Tehran's few remaining conduits for trade with the West.

And instead of pressuring the leadership, as Presidential aspirant Ron Paul predicted, the average Iranians appear to be redirecting their frustrations at the US.

Again from the same article,

Iranians contacted Monday reacted with anger at news of the embargo, saying the people would suffer more than the government, amid rising inflation levels.

"These sanctions are affecting everyone's daily lives. I wish our government would put the good of 75 million people ahead of its pride and compromise," said an engineer in Tehran.

What the US (and Israel) would now be waiting for now is a Casus Belli (justification for acts of war: Wikipedia.org). And a beleaguered Iran may just oblige.

War is a diversionary ploy used by politicians to advance their self-interests.

I see the US political brinkmanship as an important variable to the coming US presidential election, and importantly, as pretext or justification to raise debt ceiling levels and to monetize US debts.

Saturday, January 21, 2012

Marc Faber Predicts World War III in 5 years

Dr. Marc Faber sees World War III that features cyber warfare coming anytime during the 5 year horizon.

From Business Intelligence,

He sees a shift in economic and military power from West to East and is increasingly convinced that the end game will be war. But, so far, he had avoided giving a time frame to the war scenario. Not any longer.

Dr. Faber was amongst 10 investment experts assembled by Barron's last week at the Harvard Club of New York for the Barron’s 2012 Roundtable. The members of the Roundtable discussed the economy, China, Europe, market volatility, investment picks and World War III.

"On an optimistic note, World War III will occur in the next five years," Faber announced to the other members of the Roundtable, in his characteristic contrarian manner.

"That means the Middle East will blow up," he said, without providing any details about specific countries.

When this happens, "new regimes there will be less Western-friendly," he reckons.

"The West has figured out it can’t contain China, which is rising rapidly and will have more military and naval power in Southeast Asia," he explains.

The only way for the West to contain China is to control the oil tap in the Middle East, Faber argued.

The prelude to war will be a "big bust that will see the end of credit expansion," he said in a recent interview. But before this happens, "governments will continue printing money which in time will lead to a very high inflation rate, and the economy will not respond to stimulus".

Cyber war?

"This war will be different from World War I where troops faced each other in trenches or World War II where tank divisions faced each other, he said. This will be Cyber War. A war where you can turn a switch and turn the London electricity supply off. This will be a war where you can stop airplanes from flying and bring the whole financial system of a country to a halt," Faber said in an August 2011 interview.

And during war times, "commodities go up strongly,” he argued.

"If you want to hedge against war, you don't want to own derivatives in UBS and AIG, but you have to own them physically, like farmland and agricultural commodities. That is something to consider for you as a personal safety and hedge. You have to own some commodities," he stressed.

But sees this as having a positive impact on equity prices,

Asked if war will be positive for stocks, Faber told the Baron's Roundtable it would be very positive for stocks and negative for bonds, "because debt will grow dramatically. There will be massive monetization of debt."

"When the U.S. entered World War II total credit equaled 140% of GDP, and there were no unfunded liabilities. Now total credit-market debt is 380% of GDP, and unfunded liabilities make that 800%," he added.

Speaking to CNBC Thursday Faber went further: "Relax. I don’t think that equities will collapse. I think we have major support going back to August 2010 when the S&P was at 1010," he said.

It would seem that the government’s or the nation state’s default option when countenanced with a decadent society emanating from failed policies has been to resort to war. That’s because war has the tendency to divert or distract the public’s attention which pushes the masses to rally around the flag in the name of patriotism.

As Nazi Germany’s Hermann Goering Commander-in-Chief of the Luftwaffe, President of the Reichstag, Prime Minister of Prussia and, as Hitler's designated successor once said in a conversation with Gustave Gilbert during the Nuremberg trial (an Allied appointed psychologist)

Why of course the people don't want war. Why should some poor slob on a farm want to risk his life in a war when the best he can get out of it is to come back to his farm in one piece? Naturally the common people don't want war neither in Russia, nor in England, nor for that matter in Germany. That is understood. But, after all, it is the leaders of the country who determine the policy and it is always a simple matter to drag the people along, whether it is a democracy, or a fascist dictatorship, or a parliament, or a communist dictatorship. Voice or no voice, the people can always be brought to the bidding of the leaders. That is easy. All you have to do is tell them they are being attacked, and denounce the peacemakers for lack of patriotism and exposing the country to danger. It works the same in any country.

Although war is a possibility (I earlier noted that the risk of military confrontation with Iran seem to be increasing here and here), in my opinion, World War III may not be inevitable.

I think that nation states will likely suffer more from internal strife (e.g. revolutions or secessions) which eventually leads to their collapse than from a global war in the scale of World War II. But the latter is an option that cannot be written off.

And if in case this should happen, it is unclear if equity markets will remain unscathed by a warfare dominated by cyberspace engagements. To quote Dr. Faber’s conflicting points: “This will be a war where you can stop airplanes from flying and bring the whole financial system of a country to a halt”. [italics added]

Perhaps Dr. Faber refers to other countries but not the US. But what if the US is the object of such cyber assaults such as the recent case of the FBI and the Department of Justice along with the websites of the entertainment industry (which perhaps could partly reflect on the protest to censor the web)?

The fate of financial assets will entirely depend on how World War III plays out. Thus, there is no straight cut answer to Dr. Faber’s scenario.

Monday, January 09, 2012

What To Expect in 2012

Everything we know “based on evidence” is actually based on evidence together with appropriate theory. Steven Landsburg

Prediction 2011: Largely on the Spot But Too Much Optimism

First, a recap on the analysis and the predictions I made during the end of December of 2010 in an article “What to Expect in 2011”[1]

I identified four predominant conditions that would function as drivers of global financial markets (including the Philippine Phisix) as follows:

1. Monetary authorities of developed economies will fight to sustain low interest rates.

2. More Inflationism: Bailouts and QEs To Continue

3. Effects of Divergent Monetary Policies

4. The Globalization Factor

How they fared.

1. Low Interest Rates Regime

I noted that the US Federal Reserve has the “penchant to artificially keep down interest rates until forced by hand by the markets”; this has apparently been validated last year even as most of the market’s focus has shifted to the Eurozone.

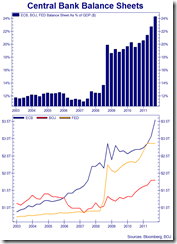

In fact, suppressing interest rates has not just been undertaken by the US Federal Reserve, whom has promised that current zero bound rates (ZIRP) would be extended to 2013[2] aside from manipulating the yield curve via ‘Operation Twist’, but by major developed and emerging central banks as shown above[3].

Apparently, the worsening debt crisis in Eurozone compounded by Japan’s triple whammy natural disaster and China’s slowing economy (or popping bubble?) has intuitively or mechanically prompted policymakers to respond concertedly, nearly in the same fashion as 2008. This has resulted to a decline of global interest rates levels to that of 2009[4].

2. Bailouts and QEs Did Escalate

Except the US Federal Reserve, major global central banks have already been actively adapting credit easing or money printing policies.

The balance sheets of top 3 central banks has now accounted for almost 25% of world’s GDP[5]. Yet this doesn’t include the Swiss National Bank[6] (SNB) and the Bank of England[7] (BoE) whom has likewise scaled up on their respective asset purchasing programs.

The world is experiencing an unprecedented order of monetary inflation under today’s fiat standard based modern central banking.

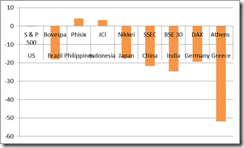

3. Divergent Impacts of Monetary Policies on Financial Markets

I previously stated that

Divergent monetary policies will impact emerging markets and developed markets distinctly, with the former benefiting from the transmission effects from the latter’s policies.

While global equity markets have been down mostly on partial and sporadic signs of liquidity contraction arising from the unfolding Euro crisis and from indications of a global economic slowdown, monetary policy activism or strong responses by central banks did result to distinctive impacts on the marketplace.

Emerging markets with the least inflationary pressures exhibited resiliency. ASEAN 4 bourses, going into the close of the New Year, were among the ten world’s best performers[8] and served as noteworthy examples of the above.

The relative performances of global bourses have likewise been reflected on the commodity markets[9].

4. Globalization Remained Strong which Partly Offset Weak Spots

While there had been signs of partial stagnation of global trade in terms of volume during the last semester of the 2011, trade volumes remained at near record highs and have hardly reflected on signs of severe downturn or a recession[10] despite the Euro crisis.

Since deepening trends of globalization (in finance and trade) has also been expanding the correlations of the financial markets[11], which has been largely characterized as ‘Risk On’ and ‘Risk Off’ environments, the aggressive actions by central banks and the non-recessionary global environment in the face of the Euro crisis and patchy signs of economic slowdown has partly neutralized such tight relationship which allowed for selective variances in asset performances.

Overall, almost every condition that I defined in December of 2010 had been validated.

5. Mostly Right Yet Too Optimistic

On how I expected the markets to perform, I wrote,

Unless inflation explodes to the upside and becomes totally unwieldy, overall, for ASEAN and for the Philippine Phisix we should see significant positive gains anywhere around 20-40% at the yearend of 2011 based on the close of 2010. Needless to say, the 5,000 level would seem like a highly achievable target. What the mainstream sees as an economic boom will signify a blossoming bubble cycle.

Of course my foremost barometer for the state of the global equity markets would be the price direction of gold, which I expect to continue to generate sustained gains and possibly clear out in a cinch the Roubini hurdle of $1,500.

To repeat, Gold hasn’t proven to be a deflation hedge as shown by its performance during the 2008 Lehman collapse. The performance of Gold during the Great Depression and today is different because gold served as a monetary anchor then. Today, gold prices act as a temperature that measures the conditions of the faith based paper money system.

2011 saw the Philippine Phisix and ASEAN bourses marginally up, which means that I have been too optimistic to suggest of a minimum 20% return that was way off the mark.

Nevertheless, it hasn’t been that bad since the long-time darling of mine, the Philippine mining index, overshot on my expectations.

And given that the mining sector’s extraordinary returns has alternated every year[12], it is unclear if mining index will remain to be the horse to beat. Yet, current global monetary dynamics may change all that.

Aside, another observation of mine has been validated.

Gold, allegedly a deflation hedge/refuge, has not turned out as many have said.

Except for the July-September frame, gold prices have largely moved along with the price direction of the S&P 500 (blue circles).

The July-September frame which marked a short-term deviation from the previously tight correlations seems to coincide with the end of the QE 3.0. This along with the unfolding Euro crisis put pressure on US equity markets first, which eventually culminated with FED chair Ben Bernanke’s jilting of the market’s expectations of QE 3.0.

The belated collapse of gold prices (red circle), in response to Mr. Bernanke’s frustrating of the market expectations for more asset purchasing measures, had been aggravated by other events such as the forced liquidations by MF Global[13] to resolve its bankruptcy and several trade ownership issues aside from other trade restrictions or market interventions[14] that has stymied on gold’s rally.

Nevertheless, the gold-S&P 500 linkage appears to have been revived, where both gold and the S&P has taken on an interim upside trend (green line).

The S&P 500 closed the year with microscopic losses while gold registered its 11th year of consecutive gains, up 10% in 2011.

Expect Volatile Markets in 2012

When asked to comment on the prospects of the stock market, JP Morgan’s once famous resounding reply was that “It [Markets] will fluctuate”.

1. Markets will Fluctuate—Wildly

2012 will essentially continue with whatever 2011 has left off.

Since 2011 has been dominated by the whack-a-mole policies on what has been an extension of the global crisis of 2008, which in reality represents the refusal of political authorities for markets to clear or to make the necessary adjustments on the accrued massive malinvestments or misdirection of resource allocation in order to protect the political welfare based system anchored on the triumvirate of the politically endowed banking sectors, the central banks and governments, then we should expect the same conditions in 2011 to apply particularly

1. Monetary authorities will continue to keep interest rates at record or near record low levels.

2. Money printing via QE and bailouts will continue and could accelerate.

3. There will be divergent impact from different monetary policies and

4. Globalization will remain a critical factor that could partly counterbalance the nasty effects of the collective inflationist policies (unless the ugly head of protectionism emerges).

I would add that since presidential election season in the US is fast approaching, most candidates or aspirants including the incumbent have been audibly beating the war drums on Iran[15], where an outbreak may exacerbate political interventions in the US and in the global economy and importantly justify more monetary inflationism.

One must realize that continued politicization of the marketplace via boom bust and bailout policies compounded by various market interventions and the risk of another war has immensely been distorting price signals which should lead markets to fluctuate wildly.

2. China and Japan’s Hedge—Steer Clear of the US Dollar

And where reports say that China and Japan have commenced on promoting direct transactions[16] by using their national currencies hardly represents acts to buttress the current system.

The Bank of Japan has also been underwriting their own Quantitative Easing (QE) which means the Japanese government are engaged in ‘competitive devaluation’ which is no more than a ‘beggar thy neighbour’ policy.

Instead, what this implies is that Japan and China, being the largest holders of US debt, seem to be veering away from their extensive dependence on the US economy as they reckon with, not only interest rate and credit risks, but also of currency, inflation, political and market risks. Even China and Japan appear to be taking measures to insure themselves from wild fluctuations.

On the other hand, China’s bilateral currency agreement with Japan plays into her strategy to use her currency as the region’s foreign exchange reserve[17].

3. Heightened Inflation Risks from Monetary Policies

QE 3.0 has not been an official policy yet by the US Federal Reserve but their balance sheet seem to be ballooning anew (chart from the Cleveland Federal Reserve[18]).

Yet this, along with surging money supply and recovering consumer and business credit growth, will have an impact on the US asset markets which should also be transmitted to global financial markets, as well as, to the commodity markets.

Yet given the large refinancing requirements for many governments (more than $7.6 trillion[19]) and for major financial institutions this year amidst the unresolved crisis, I expect major central banks to step up their role of lender of last resort.

Again the sustainability of the easy money environment from low interest rates and money printing by central banks will depend on the interest rates levels which will be influenced by any of the following factors: 1) inflation expectations 2) state of demand for credit relative to supply 3) perception of credit quality and or 4) of the scarcity/availability of capital.

Today’s bailout policies have been enabled and facilitated by an environment of suppressed consumer price inflation rates, partly because of globalization, partly because of the temporal effects from price manipulations or market interventions and partly because of the ongoing liquidations in some segments of the global marketplace such as from MF Global, the crisis affected banking and finance sectors of the Eurozone and also perhaps in sectors impacted by the economic slowdown or the real estate exposed industries in China, which may be suffering from a contraction.

However I don’t believe that the current low inflation landscape will be sustainable in the face of sustained credit easing operations by the central banks of major economies. Price inflation will eventually surface that could lead to restrictive policy actions (which subsequently could lead to a bust) or sustained inflationism (which risks hyperinflation). Signs from one of which may become evident probably by the second semester of this year.

Yet I think we could be seeing innate signs this: Given the current monetary stance and increasing geopolitical risks, oil (WTI) has the potential to spike above the 2011 high of $114 which may lead to a test of a 2008 high of $147.

4. Phisix: Interim Fulfilment of Expectations and Working Target

In the meantime, I expect the Philippine Phisix and ASEAN markets to continue to benefit from the current easy money landscape helped by seasonal strength, improvements in the market internals, and in the reversals of bearish chart patterns as forecasted last December[20]

The bearish indicators of head and shoulders (green curves) and the ‘death cross’ have now been replaced by bullish signals as anticipated[21]. The Phisix chart has now transitioned to the golden cross while ‘reverse head and shoulders’ (blue curves and trend line) has successfully broken out of the formation. It doesn’t require relying on charts to see this happen. Even the Dow Jones Industrials has affirmed on my prognosis[22].

The S&P 500, oil (WTI) and the Phisix seem to manifest a newfound correlation or has reflects on a synchronized move,whether this relationship will hold or not remains to be seen.

I believe that the Phisix at the 5,000 level should represent a practical working yearend target; where anything above should be a bonus.

Again all these are conditional to the very fluid external political-financial environment, which includes risks from not only from the Eurozone, but from China and the importantly US—whose debt level is just $25 million shy from the debt ceiling[23] (probably the debt ceiling political risk will become more evident during the last semester).

Moreover, I believe that gold prices will continue to recover from the recent low.

Gains will crescendo as global policymakers will most likely ramp up on the printing presses. Gold will likely reclaim the 1,900 level sometime this year and could even go higher and will end the year on a positive note.

But then again all these are extremely dependent or highly sensitive to the situational responses of global policymakers.

Predicting social events or the markets in the way of natural sciences is a mistake.

As the great Ludwig von Mises explained [24],

Nothing could be more mistaken than the now fashionable attempt to apply the methods and concepts of the natural sciences to the solution of social problems. In the realm of nature we cannot know anything about final causes, by reference to which events can be explained. But in the field of human actions there is the finality of acting men. Men make choices. They aim at certain ends and they apply means in order to attain the ends sought.

[1] See What To Expect In 2011, December 20, 2010

[2] See US Federal Reserve Goes For Subtle QE August 10, 2011

[3] Centralbanknews.info What Will 2012 Bring for Global Monetary Policy? December 27, 2011

[4] See Global Central Banks Ease the Most Since 2009, November 28, 2011

[5] Zero Hedge Top Three Central Banks Account For Up To 25% Of Developed World GDP, January 5, 2012

[6] See Hot: Swiss National Bank to Embrace Zimbabwe’s Gideon Gono model September 6, 2011

[7] See Bank of England Activates QE 2.0 October 6, 2011

[8] See Global Equity Market Performance Update: Philippine Phisix Ranks 6th among the Best, December 17, 2011

[9] See How Global Financial Markets Performed in 2011 December 31, 2011

[10] Key Trends in Globalization, New world trade data indicates slowdown but not recession in the global economy, November 25, 2011 ablog.typad.com

[11] Allstarcharts.com BCA Research: High Equity Correlations Are Here To Stay, January 4, 2011

[12] See Graphic of the PSE’s Sectoral Performance: Mining Sector and the Rotational Process, July 10, 2011

[13] See MF Global Fallout Haunts the Metal Markets, December 12, 2011

[14] See War On Gold: China Applies Selective Ban December 28, 2011

[15] See Could the US be using the Euro crisis to extract support for a possible war against Iran? January 8, 2012

[16] Bloomberg.com China, Japan to Back Direct Trade of Currencies, December 26, 2011

[17] See The Nonsense About Current Account Imbalances And Super-Sovereign Reserve Currency, April 20, 2011

[18] Cleveland Federal Reserve Credit Easing Policy Tools

[19] See World’s Biggest Economies Face $7.6 Trillion Bond Tab as Rally Seen Fading January 4, 2012

[20] See Phisix: Primed for an Upside Surprise December 11, 2011

[21] See How Reliable is the S&P’s ‘Death Cross’ Pattern?, August 14, 2011

[22] See US Equity Markets: From Death Cross to the Golden Cross, December 31, 2011

[23] Zerohedge.com Here We Go Again: US $25 Million Away From Debt Ceiling Breach, January 5, 2012

[24] von Mises Ludwig Misapprehended Darwinism, Refutation of Fallacies, Omnipotent Government p.120

Sunday, January 08, 2012

Could the US be using the Euro crisis to extract support for a possible war against Iran?

The US appears to be dead set on bringing war to Iran.

Reports suggests that bailouts of the Eurozone via the IMF in exchange for embargoes against Iran could be part of the rescue package dangled or concessions arranged by US authorities.

Writes the Wall Street Journal Blog,

Europe may have just traded a U.S.-pushed Iranian oil embargo in exchange for Washington’s support of International Monetary Fund bailout loans to Italy and Spain, if one economist’s speculation is right.

Jacob Kirkegaard, a fellow at the Peterson Institute for International Economics, speculates the timing Europe’s newly-proposed ban on Iranian oil imports is too fortuitous to be purely coincidental.

Greece, Spain and Italy–in that order–heavily depend on Iranian crude and have been the most resistant to an embargo. They are now no longer fighting a ban–Italy has stated it would support it in principle while the others have signaled they wouldn’t stand in the way. [The agreement in principle is subject to substantial negotiations on timing or exemptions for long-term deals.]

Each of those countries are also the current epicenters of Europe’s sovereign debt crisis. Athens is in the middle of negotiating an agreement with bondholders on a debt deal that will pave the way for a near doubling of emergency loans, including from the IMF. Italy has to roll over nearly $340 billion in debt this year, but the cost of borrowing has soared beyond levels economists say is sustainable. Rome late last year turned down an offer for an IMF loan, but many economists say Italy will need IMF credit to pull itself out of its financial mire. And Spain’s banks are facing a housing bubble that could very well mean Madrid must soon ask for IMF assistance.

Earlier the US has already began to apply political pressure by imposing sanctions against Iran’s central bank.

From Yahoo,

Iran's currency hit a new record low to the U.S. dollar on Monday, two days after President Barack Obama signed into law a bill targeting Iran's central bank as part of the West's efforts to pressure Tehran over its nuclear program.

The semiofficial Mehr news agency said the Iranian currency's exchange rate hovered late Monday around 17,800 riyals to the dollar, marking a roughly 12 percent slide compared to Sunday's rate of 15,900 riyals to the dollar. The riyal was trading at around 10,500 riyals to the U.S. dollar in late December 2010.

The report said Iran's central bank called on Iranian experts to meet Wednesday to discuss the turbulence in the currency market.

The bill Obama signed on Saturday includes an amendment barring foreign financial institutions that do business with Iran's central bank from opening or maintaining correspondent operations in the United States. The Obama administration, however, is looking to soften the impact of the measure, fearing they could lead to a spike in global crude oil prices or pressure key allies that import Iranian oil.

Economic sanctions are meant to isolate nations which may invite or have been designed to provoke reprisals.

I am reminded by World War II, where economic sanctions has served as major compelling factor that has prompted Japan to strike at the US.

Writes historian Eric Margolis,

When in late 1941, US President Franklin Roosevelt sought (my view) to push Japan into the war by imposing an embargo of oil and scrap metal on Japan, Tokyo had a two-year stockpile of oil.

Tokyo’s military-dominated government faced a stark choice: go immediately to war in hopes of a quick victory while there was still oil, or watch its oil stores dwindle way and thus face military impotence. War was the choice.

Japan’s leading military officer, Admiral Isoroku Yamamoto, warned Japan was going to war for oil, and would be defeated because of lack of oil.

Stirring up patriotic passion through war has been a facile way to generate votes, especially with the US presidential elections fast approaching.

With President Obama’s improving but still near record low approval ratings, chances of re-election remains murky.

And it is of no wonder why most of the GOP Republican candidates, except for Ron Paul, have also adapted a war stance.

Presidential aspirants from both camps have palpably been appealing to the public's emotions or to patriotism to solicit votes, as well as, tacitly appease the military industrial and banking interests groups.

In the words of former United States Senator from Indiana Albert J. Beveridge (1862-1927) also an American historian

Beware the leader who bangs the drums of war in order to whip the citizenry into a patriotic fervor, for patriotism is indeed a double-edged sword. It both emboldens the blood, just as it narrows the mind. And when the drums of war have reached a fever pitch and the blood boils with hate and the mind has closed, the leader will have no need in seizing the rights of the citizenry. Rather, the citizenry, infused with fear and blinded by patriotism, will offer up all of their rights unto the leader and gladly so.

People get what they deserve.