Japan's finance minister Taro Aso said Monday the elderly should be allowed to "hurry up and die" instead of costing the government money for end-of-life medical care.Aso, who also doubles as deputy prime minister, reportedly said during a meeting of the National Council on Social Security Reforms: "Heaven forbid if you are forced to live on when you want to die. You cannot sleep well when you think it's all paid by the government."This won't be solved unless you let them hurry up and die," he said.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, January 22, 2013

Japan’s Finance Minister to Aging Citizens: Hurry Up and Die

Wednesday, October 10, 2012

Ron Paul: Government Dependency Will End in Chaos

The media insists on characterizing statements about dependency on government handouts as controversial, but in truth such statements are absolutely correct. It's not that nearly half of Americans are dependent on government; it's actually more than half. If one includes not just people on food stamps and welfare, but also seniors on Medicare, Social Security and people employed by the government directly, the number is more like 165 million out of 308 million, which is 53%.Some argue that Social Security and Medicare benefits are a right because people pay into these programs their whole lives, or that we need a government safety net in place for people who fall on hard times. However, this all becomes a moot point when the funds people depend on become worthless due to government default or rampant inflation.This is less an issue of dignity or dependence on government, and more about the deceitfulness of government promises.The Fed recently announced that it plans to keep interest rates near zero and keep buying near worthless assets from banks indefinitely. This enables Congress to spend without having to take deficits or the debt seriously and there is every indication they intend to spend with impunity until the system collapses. There are no brakes on the runaway train. The federal debt ceiling law does nothing to limit spending. The ceiling will have to be raised yet again perhaps before the year is out. What is happening in Greece with austerity measures and riots in the street will happen here within a decade according to some realistic estimates if we do not find some way to fiscally restrain our government.There is little point in a debate about being entitled to healthcare or food or shelter from fellow taxpayers if the whole system has collapsed. And, with the way our politicians have taken over and mismanaged vast amounts of resources, collapse seems almost unavoidable. Yet the number of Americans who have significant dependency on government is dangerously high, and I honestly fear for them.Worse, corporate welfare is also at an all time high with no signs of diminishing. Though it is hard to quantify, Tad Dehaven at Cato has estimated that the government spends nearly twice as much on corporate welfare than on social welfare. Both parties are equally guilty. More and more, the business sector is learning to rely on taxpayer largesse in one form or another. They used to be solely concerned with providing a better product to the consumer at a better price. Now, success on Wall Street depends entirely too much on having the best lobbyists on K Street. If one includes the employees of "private" businesses who depend on government contracts, grants or bailouts, there are even more people dependent on government in some way.

Wednesday, October 03, 2012

Signs of Dancing on the Grave of Keynesianism

3) Last month, a school district in California sold $164 million worth of bonds at 12.6% interest; this is more than Pakistan, Botswana, and Ecuador pay in the international bond market.4) Based on the Treasury’s most recent statistics, US government interest payments to China will total at least $26.055 billion this year. The real figure may be much higher given that China has been purchased Treasuries for decades, back when interest rates were much higher. They’re still getting paid on those higher rates today.Even still, this year’s interest payment to China totals more than ALL the silver that was mined in the world last year.5) In August 2008, just before the Lehman Brothers collapse, the number of employed persons in the United States was 145.47 million persons. Over the subsequent years, the employment figure dipped to as low as 139.27 million. Today it stands at 142.1 million.Even if this is considered recovery, to ‘rescue’ those 2.8 million jobs, it took the federal government an additional $6.421 trillion worth of debt ($2.3 million per job), and a $1.9 trillion (203%) expansion of the Federal Reserve balance sheet.6) Meanwhile, despite trillions of euros in debt and bailouts, the unemployment rate in the eurozone just hit a record high of 11.4%… and a second Spanish bailout is now imminent.7) Inflation in Zimbabwe (3.63%) is lower than inflation in the UK (3.66%, August 2011-July 2012).8) Last week, the French government reached a ‘historic’ budget compromise, shooting for a budget deficit that’s ‘only’ 3% of GDP. This is based on an assumption that the economy will grow by 0.8%.In other words, France’s official public debt (which is already at 91% of GDP) will increase by 2.2% of GDP next year amid flat growth. And this is what these people consider progress.

It's because too many politicians believed that a free lunch was possible and a new economic paradigm had arrived. But we've heard that one before — like the philosopher's stone that could turn lead into gold. Prosperity without work is a dream of the ages.

Thursday, August 09, 2012

Wealthy French Mull Exodus in Response to Class Warfare Policies

“Soak the rich” socialist policies of French President François Hollande has been prompting many wealthy French citizens to consider the exit option

Reports the New York Times

The call to Vincent Grandil’s Paris law firm began like many others that have rolled in recently. On the line was the well-paid chief executive of one of France’s most profitable companies, and he was feeling nervous.

President François Hollande is vowing to impose a 75 percent tax on the portion of anyone’s income above a million euros ($1.24 million) a year. “Should I be preparing to leave the country?” the executive asked Mr. Grandil.

The lawyer’s counsel: Wait and see. For now, at least.

“We’re getting a lot of calls from high earners who are asking whether they should get out of France,” said Mr. Grandil, a partner at Altexis, which specializes in tax matters for corporations and the wealthy. “Even young, dynamic people pulling in 200,000 euros are wondering whether to remain in a country where making money is not considered a good thing.”

A chill is wafting over France’s business class as Mr. Hollande, the country’s first Socialist president since François Mitterrand in the 1980s, presses a manifesto of patriotism to “pay extra tax to get the country back on its feet again.” The 75 percent tax proposal, which Parliament plans to take up in September, is ostensibly aimed at bolstering French finances as Europe’s long-running debt crisis intensifies.

But because there are relatively few people in France whose income would incur such a tax — an estimated 7,000 to 30,000 in a country of 65 million — the gains might contribute but a small fraction of the 33 billion euros in new revenue the government wants to raise next year to help balance the budget.

The French finance ministry did not respond to requests for an estimate of the revenue the tax might raise. Though the amount would be low, some analysts note that a tax hit on the rich would provide political cover for painful cuts Mr. Hollande may need to make next year in social and welfare programs that are likely to be far less popular with the rank and file.

And class warfare politics has negatively affected business sentiment as well. Again from the same article,

Many companies are studying contingency plans to move high-paid executives outside of France, according to consultants, lawyers, accountants and real estate agents — who are highly protective of their clients and decline to identify them by name. They say some executives and wealthy people have already packed up for destinations like Britain, Belgium, Switzerland and the United States, taking their taxable income with them.

They also know of companies — start-ups and multinationals alike — that are delaying plans to invest in France or to move employees or new hires here.

Politicians and their apologists fail to realize that they are dealing with people who will respond adversely to their foolish repressive measures.

That's why there such a thing called the law of unintended consequences, or as per Wikipedia.org, used as an adage or idiomatic warning that an intervention in a complex system tends to create unanticipated and often undesirable outcomes

So far the concurrent panic in the peripheral crisis stricken Euro nations have been prompting for a stampede into French 10 year bonds. This despite the deteriorating fiscal conditions of the French government.

The French equity bellwether, the CAC, has also been in a rally mode since ECB President Draghi’s promise to do whatever it takes to save the Euro

Given the fluidity of events, current market actions may swiftly and drastically change.

And once the exodus of the wealthy French transforms into reality, then we should expect a selloff in both the bond and the equity markets.

Class warfare politics through taxing or soaking the rich serves only as camouflage to the real consequences—taxing everyone else including the poor, except for the political class—or myth of the Santa Claus Fund.

As the great Ludwig von Mises explained, (bold emphasis mine)

High surtax rates for the rich are very popular with interventionist dilettantes and demagogues, but they secure only modest additions to the revenue. From day to day it becomes more obvious that large-scale additions to the amount of public expenditure cannot be financed by "soaking the rich," but that the burden must be carried by the masses. The traditional tax policy of the age of interventionism, its glorified devices of progressive taxation and lavish spending have been carried to a point at which their absurdity can no longer be concealed. The notorious principle that, whereas private expenditures depend on the size of income available, public revenues must be regulated according to expenditures, refutes itself. Henceforth, governments will have to realize that one dollar cannot be spent twice, and that the various items of government expenditure are in conflict with one another. Every penny of additional government spending will have to be collected from precisely those people who hitherto have been intent upon shifting the main burden to other groups. Those anxious to get subsidies will themselves have to foot the bill. The deficits of publicly owned and operated enterprises will be charged to the bulk of the population. [p. 858]

The situation in the employer-employee nexus will be analogous. The popular doctrine contends that wage earners are reaping "social gains" at the expense of the unearned income of the exploiting classes. The strikers, it is said, do not strike against the consumers but against "management." There is no reason to raise the prices of products when labor costs are increased; the difference must be borne by employers. But when more and more of the share of the entrepreneurs and capitalists is absorbed by taxes, higher wage rates, and other "social gains" of employees, and by price ceilings, nothing remains for such a buffer function. Then it becomes evident that every wage raise, with its whole momentum, must affect the prices of the products and that the social gains of each group fully correspond to the social losses of the other groups. Every strike becomes, even in the short run and not only in the long run, a strike against the rest of the people.

An essential point in the social philosophy of interventionism is the existence of an inexhaustible fund which can be squeezed forever. The whole system of interventionism collapses when this fountain is drained off: The Santa Claus principle liquidates itself.

French class warfare politics essentially serves as the death warrant for the Euro.

Wednesday, August 08, 2012

Inflation Targeting Fails: Thailand’s Central Bank Chairman Admits

The Chairman of the central bank of Thailand says that inflation targeting has no longer been effective.

From Businessweek/Bloomberg,

Bank of Thailand Chairman Virabongsa Ramangkura comments on inflation targeting. He made the remarks during a speech late yesterday in Bangkok.

Thailand’s central bank has used inflation targets since 2000 and aims to keep core inflation, which excludes fresh food and fuel prices, between 0.5 percent and 3 percent.

“Central banks should change their ideas. Inflation targeting is no longer effective because inflation has been globalized. The world is more open and we are a member of the World Trade Organization. Commodity prices are driven by global supply and demand, not policy of a particular country.

‘‘So monetary policy shouldn’t be used to deal with inflation because we can’t do anything. Monetary policy should be used to support economic growth and reduce unemployment, which we call inclusive growth.”

“The source of instability for emerging countries is foreign exchange, not inflation. The stability of the foreign exchange rate depends on capital movements. If our interest rates are higher than dollar rates, that will open a loophole for attackers. This creates financial instability. So, monetary policy should take care of this, not inflation.”

Virabongsa says his views run counter to those of Governor Prasarn Trairatvorakul.

Ineffective, here, represents euphemism for failure

In truth, central bank inflation targeting has failed and will continue to fail, not because of asymmetric levels of “foreign exchange rates that depends on capital movements”—which accounts for a verbal sleight of hand in order to shift the blame to the capital markets—but rather from the following:

1. Central banks don’t know where and how their interventions—via money printing—will end up.

2. Central banks cannot ascertain where exactly is the so-called invisible “equilibrium price level”.

3. Because they don’t know both 1 and 2, central bank inflationism leads to excesses which produces boom-bust cycles and raises the risks of intractable (consumer price) inflation

4. Most importantly, inflationism has always been about promoting the political interests of the political authorities and their cronies.

And political goals principally conflicts with economic reality. Example: repeated bailouts of crony firms end up consuming the capital of the economy. Long term has been sacrificed for the short term. Productive capital wasted on unproductive politically supported undertakings.

Yet bailouts, has been, and will be justified through the camouflage of economic technical gobbledygook called “aggregate demand”.

To quote economic professor Antony P. Mueller,

Inasmuch as central banks dominate the discourse about monetary policy, there is almost no debate going on about the thesis that inflation targeting is not only defective in guaranteeing monetary stability but that it also provided the conditions for the current financial crisis to happen.

The episode that was praised as the great moderation was a great delusion, which has become the nightmare of a long stagnation.

There is a vital need to establish a sound monetary system. Its consequence would be moderate deflation and the avoidance of extreme booms and busts.

The main barrier against sound money is neither intellectual nor practical but political. The resistance comes from the public sector because the chief casualty of an institutional change to sound money would be the modern inflated government along with its warmongers, debt pushers, and all the rest of the spin doctors of deceitful promises who form part of this kingdom.

Yes inflationism or “something from nothing” policies via central banks has essentially been grounded on the politics of the Santa Claus principle.

So whether viewed from the knowledge problem of centralized institutions or from political dimensions or incentives guiding the political authorities, inflation targeting have been destined to fail.

Thursday, July 26, 2012

The Coming Global Debt Default Binge: Japan’s Pension Fund Sells Japanese Government Bonds (JGB)

The era of Japan’s low interest rates may be at an inflection point.

From San Francisco Chronicle/Bloomberg,

Japan’s public pension fund, the world’s largest, said it has been selling domestic government bonds as the number of people eligible for retirement payments increases.

“Payouts are getting bigger than insurance revenue, so we need to sell Japanese government bonds to raise cash,” said Takahiro Mitani, president of the Government Pension Investment Fund, which oversees 113.6 trillion yen ($1.45 trillion). “To boost returns, we may have to consider investing in new assets beyond conventional ones,” he said in an interview in Tokyo yesterday.

Japan’s population is aging, and baby boomers born in the wake of World War II are beginning to reach 65 and become eligible for pensions. That’s putting GPIF under pressure to sell JGBs to cover the increase in payouts. The fund needs to raise about 8.87 trillion yen this fiscal year, Mitani said in an interview in April. As part of its effort to diversify assets and generate higher returns, GPIF recently started investing in emerging market stocks.

GPIF is historically one of the biggest buyers of Japanese debt and held 71.9 trillion yen, or 63 percent of its assets, in domestic bonds as of March, according to the fund’s financial statement for the 2011 fiscal year. That compares with 13 percent in domestic stocks, 8.7 percent in foreign bonds and 11 percent in overseas equities.

Again the above represents the unintended consequences of the unsustainable welfare state. These could be incipient signs of the liquidation of Japan’s Santa Claus political institutions.

The lack of internal financing (from resident savings) means that Japan’s enormous debts will need to be financed by external (foreign) savings. This also means that Japan will be in tight competition with the Eurozone and the US to attract financing from the world. The nuclear option is that the Bank of Japan (BoJ) will become the financier of last resort.

Neo-Keynesians and Fisherians who claim that the world will undergo prolonged episodes of low interest rates based on historical experiences and from the prospects of deflation, fail to see that this has NOT just been about banking financial crisis, but about the crises of governments manifested through unsustainable debts.

Most of their analysis has been moored to historical banking-financial crisis, e.g Great Depression and Japan’s lost decade, rather than government debt crises.

It is dangerous to read the recent past as roadmap of the future. The above chart from the Economist shows that interest rates of major economies (US Germany Spain and Italy) had their volatile chapters.

When there will be inadequate or scant access to private sector savings, then the chances for a full blown debt crisis becomes a clear and present danger.

Once interest rates rises—out of the lack of financing and or from BoJ’s inflation financing—higher rates would mean higher interest rate payments which is likely to swell the existing debts.

Yet given the Japan's insufficient economic growth from growing political interventionism, surging interest rates will negatively impact both Japan’s banking and financial system as the largest holders of JGBs and Japan’s government—a self-reinforcing spiral.

So the debt crisis, which has already been ravaging the Eurozone, may likely be transmitted to Japan. Unfolding events have been so fluid which means conditions may deteriorate swiftly beyond the public's expectations.

Be careful out there.

Thursday, May 31, 2012

Quote of the Day: On Banking Union

But a banking union just makes the problem worse. Not today, maybe. But certainly tomorrow. What makes government action attractive is the opportunity for the body politic to pool its money to achieve things that individuals cannot achieve on their own. This idea ignores the possibility of voluntary collective action. But more importantly, the romance of this idea ignores the reality that inevitably, politicians are spending other people’s money. One of the simplest and deepest ideas of Milton Friedman is that people don’t spend other people’s money very carefully, especially when they are spending it on other people.

That’s from Professor Russ Roberts at the Café Hayek on proposals for a banking union to solve the EU debt crisis.

Whether it is banking union or fiscal union they are all the same, they ALL depend on the free lunch (Santa Claus) principle or of spending other people’s money.

And this is what makes the touted political solutions unfeasible and unsustainable. The easiest thing to do in this world is to spend other people's money.

Monday, May 28, 2012

Is Greece Falling into a Failed State?

According to the mainstream media and establishment experts, Greeks supposedly loathed austerity. They wanted “growth”, which is a euphemism for continued unsustainable government spending. If true, then this means that Greeks wanted free lunch.

But many Greeks may have come to realize that there is NO such thing as a free lunch. They needed to pay taxes in return for political entitlements.

Yet Greeks have been balking at doing so.

From Reuters.com/GreeceReporter.com

With anxiety mounting that Greece might vote for anti-austerity parties in the June 17 elections and be forced to leave the Eurozone of 17 countries using the euro as a currency, more Greeks – already legendary tax evaders – have stopped paying taxes. A senior Finance Ministry official on May 23 said that tax revenues have fallen 10 percent while two tax officials who declined to be named told Reuters that May revenues fell by 15-30 percent in tax offices away from the major cities and relative wealth centers of Athens and Thessaloniki.

So Greeks have been refusing to pay taxes. The left hand does not know what the right hand is doing. That’s if the establishment’s assertion is true. Greeks cannot have it both ways.

Yet Greeks realize that if they cannot pay, then they would have to default on their debts.

But the establishment says that the only way to salvation is through devaluation that can only be actualized from an exit. So their prescription: Default by devaluation.

So this ‘exit’ prospect gives further jitters not just to the average Greeks, but to foreign businesses based on Greece, as well. Foreign businesses have been apprehensive about having inadequate laws to cover or protect them once Greece decides to exit.

From the New York Times,

What can companies do when the legally impossible becomes reasonably probable?

Under European Union law, Greece cannot leave the euro. That is the theory. But in practice, any protection the law offers investors could be difficult to enforce, according to lawyers trying to protect their corporate clients against the upheaval sure to follow if Greece were to default on its debts and adopt a new currency.

So their advice is blunt: Remove cash and other liquid assets from Greece and prepare to take a short-term hit on any other investments…

But, apart from trying to ensure that debts are paid promptly and therefore in euros, legal options for companies are limited. Contracts covered by Greek law, particularly for services delivered in Greece, provide little protection against the currency’s being redenominated and devalued — a development regarded as unlikely until recently.

“Greece would, through its laws, be able to amend contracts governed by Greek law or to be performed within the territory of Greece,” Mr. Clark said. “It is the governing law and the place of performance of the contract that is most important.”

International contracts, which might be covered by British, German or Swiss law, would be more likely to be honored in the designated currency, though in some cases the wording of the legal document may be vague.

And even if the law is on their side, companies would find that to extract payment from a Greek company, they would need a judge in Greece to enforce a ruling from a foreign court.

When the average Greeks doesn’t want to pay taxes, and when foreign businesses are either closing shop or transferring elsewhere, then this means that there will be insufficient tax revenues for the current government to finance her survival.

This also means that parasites have severely impaired the hosts, which may mean the prospective extinction of the parasitical relationship.

From FT/IBNLive.in

Greece's public finances could collapse as early as next month, leaving salaries and pensions unpaid unless a stable government emerges from the June 17 election, according to Lucas Papademos, the technocrat prime minister who left office after this month's inconclusive vote.

Mr Papademos warned that conditions were deteriorating faster than expected with cash flow likely to turn negative in early June amid a sharp fall in tax revenues and a loosening of spending controls during two back-to-back election campaigns.

Mounting anxiety that Greece is headed for further political instability and a possible exit from the euro has prompted many Greeks to postpone making tax payments, and has also accelerated outflows of deposits from local banks.

Athens bankers estimate that more than €3bn of cash withdrawn since the May 6 election has been stashed in safe-deposit boxes and under mattresses in case the country is forced to readopt the drachma.

Austerity becomes a NATURAL process as economic reality has been reasserting itself. This exposes the promises of a "state based elixir" as monumental delusion.

The prescription of devaluation has been provoking a bank runs and has been blowing up right ON the faces of establishment experts calling for devaluation.

This brings us to where the Greece might be headed for.

The new Deutsche bank boss calls Greece as a "failed state".

From Irish Times,

The incoming co-chief executive officer of Deutsche Bank today described Greece as a "corrupt" and "failed" state.

"Greece is the only country, I feel, where we can say 'it's a failed state,' it is a corrupt state, corrupt as far as its political leadership is concerned, and obviously other people had to be willing to support this," Juergen Fitschen, who takes up his post next week, said in a speech at a conference in Berlin.

Failed states, are characterized according to Wikipedia.org by

Often a failed state is characterized by social, political, and/or economic failure.

In reality “failed states” are mainly products of unsustainable parasitical relationships, whether in Somalia, Chad or Sudan as rated by US think tank Fund for Peace and Foreign Policy.

But this does not necessarily mean social, political and economic failure as commercial operations exists. Otherwise logic says that these nations will have been uninhabited or deserted either through diaspora or death. But this has clearly not been the case.

Ironically, the US Central Intelligence Agency even admits that the number one “failed state” Somalia as having a “healthy informal economy”.

Thus the “inability to provide public services” does not represent reality. The difference is that mainstream cannot swallow or fathom such ideas. And the global political establishment has been repeatedly attempting for “failed states” to go mainstream through foreign interventions.

Instead, what a “failed state” means is that there is no standing government or that imposed government will mostly likely be ignored by society or what could be called “stateless society”.

I am not sure if Greece will technically become a failed state.

What is certain is that we are witnessing the accelerating collapse of a parasitical relationship anchored upon the spendthrift welfare and bureaucratic state.

This validates anew the great Ludwig von Mises who presciently warned more than half a century ago that

An essential point in the social philosophy of interventionism is the existence of an inexhaustible fund which can be squeezed forever. The whole system of interventionism collapses when this fountain is drained off: The Santa Claus principle liquidates itself.

And like Dr. Marc Faber, the collapse of the current Greece form of government should be bullish for Greeks over the long term (whether through exit or as part of the EU), as Greeks will be compelled to live within the laws of economics through greater economic freedom, and eschew feeding on political parasites.

Wednesday, May 16, 2012

Greeks Mount Civil Disobedience, Scorn Taxes

Raising taxes has been one of the major proposed elixir of “growth” by mainstream analysts for resolving the crisis in the Eurozone. More inflationism and more deficit spending as the other nostrums.

Unfortunately, economic reality and intentions by politicians and their institutional backers don’t seem to square. Greeks have mounted a civil disobedience campaign against paying taxes.

Here is the Financial Times (Alphaville) Blog,

The

desperatecunning scheme to get Greeks to pay property taxes by bundling them with electricity bills didn’t last long. You guessed it, people stopped paying their electricity bills and now it looks like the power company – which had to be bailed out last month – has stopped even trying to collect the levy.From Ekathimerini, the Greek daily (emphasis ours):

“Public Power Corporation (PPC) has already disengaged itself from involvement in the payment of the special property tax that had been incorporated into electricity bills.

“Well-informed sources suggest that the new bills the company is issuing do not include the property levy despite the law providing for the first installment concerning 2012.

The decision, the same sources say, appears to have the acquiescence of the Finance Ministry.

“Judging by the fact that unpaid bills in the first quarter of the year totaled some 1 billion euros, PPC believes it has become clear that households cannot afford to pay electricity bills that are burdened further by the extraordinary property tax in the current recession conditions.

The government had hoped to raise €1.7bn-€2bn from the levy in the fourth quarter of last year. But a massive unions-led civil disobedience movement against this “injustice” scuppered that and a ruling that it was illegal to disconnect people’s electricity supply for non-payment sent the collection rate even lower.

However, the memorandum of understanding with the IMF-EU signed in March demands that Athens collects a range of back taxes, such as the property tax from 2009 which was essentially never collected. So it will be interesting to see how the Troika reacts to these most recent developments.

Again, more signs of the ongoing self-liquidation process of Europe’s embrace of the Santa Claus principle.

Greece banks reported a surge in deposit withdrawals last Monday, and capital flight or "buy orders received by Greek banks for German bunds" to the tune of € EUR800 million.

Also, tax revolts have also become apparent in Italy.

A recent report from the Telegraph.co.uk (hat tip: Cato's Dan Mitchell)

In the last six months there has been a wave of countrywide attacks on offices of Equitalia, the agency which handles tax collection, with the most recent on

Saturday night when a branch was hit with two petrol bombs.

Staff have also expressed fears over their personal safety with increasing numbers calling in sick and with one unidentified employee telling Italian TV: “I have told my son not to say where I work or tell anyone what I do for a living.”

In another incident last week Roberto Adinolfi a director with arms firm Finmeccanica was wounded by anarchists in Genoa. The group later said in a letter claiming responsibility that they would carry out further attacks.

Annamaria Cancellieri, the interior minister, said she was considering calling in the army in a bid to quell the rising social tensions.

“There have been several attacks on the offices of Equitalia in recent weeks. I want to remind people that attacking Equitalia is the equivalent of attacking the State,” she said in an interview with La Repubblica newspaper.

Tuesday, May 15, 2012

The Liquidation of Europe’s Santa Claus Principle

Dr. Ed Yardeni has a nice follow up on Europe’s imploding wonderland which poignantly captures the unfolding developments at Eurozone.

Dr. Yardeni at his blog writes,

Welcome to Neverland! Last Wednesday, I wrote that Europe is a socialist’s wonderland. Actually, it’s more like where Peter Pan resides. Peter, as we all know, never ages and has no interest in ever growing up. He prefers the company of a tiny fairy named Tinker Bell and hangs out with the Lost Boys. There’s no adult supervision in Neverland. It’s all about eternal childhood and escapism. That sure sounds like the Europe that socialists have created and are trying to preserve. Let's join the fun:

(1) A good article on this subject, titled “What the Greek Left Wants,” appeared in last Wednesday’s WSJ. The author is a columnist for protagon.gr. His main conclusion about the Greek elections held a week ago is that “[w]hile austerity measures did play a part in voter discontent, the most important factor in the outcome of the elections was opposition to any talk of structural reform of the Greek economy.”

He observes that Syriza, the radical left party, ended up in second place largely because it promised to maintain the status quo: “The Greek left today does not represent an industrial proletariat that wants a bigger share of the economic pie. Syriza represents all the groups that have been able to grow and flourish under Greece's political system and who now feel threatened by reforms. It derives its support from various professional interest groups--lawyers, teachers, journalists and civil servants--who feel that their jobs and special privileges are at risk if Greece is forced to open up its economy to competition.”

(2) The only adult supervision in Europe’s Neverland seems to be coming out of Germany, particularly Chancellor Angela Merkel. Last Thursday, she rejected calls from her center-left opponents in Germany and Europe for economic stimulus policies that rely on new debt. In a speech before the Bundestag, she admonished, “Growth through structural reforms is sensible, important and necessary. Growth on credit would just push us right back to the beginning of the crisis, and that is why we should not and will not do it.” Yesterday, Merkel suffered a major blow after voters in Germany's biggest region, North Rhine-Westphalia, rejected her austerity policies, raising doubts that her government can stay in power after next year's general election.

(3) In her speech, the German Chancellor seemed to be responding to Italian Prime Minister Mario Monti’s call on Wednesday for a “new compromise.” In other words, he wants to add more deficit-financed spending to the fiscal austerity pact that 25 of the 27 leaders of the EU had agreed to at the end of last year. He wants to see more public spending on large infrastructure projects. He added that his proposal was aimed at "winning over German minds and, what's more difficult, German hearts."

Monti’s comments might also have been aimed at winning over Italian hearts and minds. In local elections in Italy on Sunday and Monday of last week, the vote saw heavy losses for the center-right PDL, a key party in his majority, and big gains for opposition parties, including The 5 Star Movement, which campaigns for Italy to leave the euro and default on its debt.

(4) Last Tuesday, Monti called for changes in EU budget rules to allow governments to pay outstanding bills to the private sector without pushing up their budget deficits and for greater distinction between public investments and other types of spending. Reuters reported: “The issue of late payments by the public sector is under the spotlight in Italy, where firms are being squeezed by a lack of liquidity and the state is notoriously slow in settling bills with the private sector, estimated at least 60 billion euros. Monti said budget deficit calculations should distinguish between ‘virtuous’ public investments and less productive state spending, something so far resisted by Germany and some other northern European countries.”

(5) This morning’s Washington Post reports: “Greece appears headed to new parliamentary elections next month, further delaying its efforts to meet international demands to overhaul its economy, after leaders of the country’s major political parties declared little hope Sunday for a last-ditch effort to form a coalition government. The failure of the leaders to pull together a coalition brings Greece one step closer to leaving the 17-country bloc that uses the euro currency, although much will depend on the new elections.”

Dr. Yardeni’s zinger…

(6) In other words, the Europeans want to grow, but they don’t want to grow up. They want to play accounting and other games. The unruly crowd is ignoring the sensible, but stern admonishments of Frau Merkel. She might have to cut off their allowance. As the WSJ notes today: “By next month, Athens must identify €11.5 billion, or $15 billion, in fresh spending cuts or face suspension of the international loans it needs to pay pensions and run schools. If it doesn't get the money, it would eventually have to print its own.”

Europe’s wonderland is really a psychological alter ego problem.

Such delusions of grandeur have been premised on what the great Ludwig von Mises called as the Santa Claus principle—the misconception of the existence of the inexhaustible fund which political authorities can draw upon.

Unfortunately economic reality will prove to be a bitter medicine to swallow and would pose as rude awakening for the incorrigible utopians for three reasons.

As Professor Mises explained (bold highlights mine)

First: Restrictive measures always restrict output and the amount of goods available for consumption. Whatever arguments may be advanced in favor of definite restrictions and prohibitions, such measures in themselves can never constitute a system of social production.

Second: All varieties of interference with the market phenomena not only fail to achieve the ends aimed at by their authors and supporters but bring about a state of affairs which — from the point of view of their authors' and advocates' valuations — is less desirable than the previous state of affairs which they were designed to alter. If one wants to correct their manifest unsuitableness and preposterousness by supplementing the first acts of intervention with more and more of such acts, one must go further and further until the market economy has been entirely destroyed and socialism has been substituted for it.

Third: Interventionism aims at confiscating the "surplus" of one part of the population and at giving it to the other part. Once this surplus is exhausted by total confiscation, a further continuation of this policy is impossible.

The pressures seen in the financial markets have mainly been symptomatic of the ventilation of economic reality against utopian fantasies. And fighting against reality will mean more sufferings.

Europe’s Santa Claus fund is in the process of self-liquidation.

Sunday, April 22, 2012

Will France’s Elections Signify as Death Warrant of the Euro?

France holds its elections today with 10 candidates in contention. Currently all the leading candidates appear to be rabid interventionists and inflationists who appeals to class warfare, protectionism, anti-immigration and nationalist platforms,

Writes the Wall Street Journal, (bold emphasis mine)

Nicolas Sarkozy, the center-right incumbent, is proposing to shrink the budget deficit by raising taxes in the name of "solidarity." On top of his already-passed hikes in corporate and personal income taxes, and his 4% surcharge on high incomes, Mr. Sarkozy also promises an "exit tax" on French citizens who move abroad, presumably to make up for the revenue that goes missing when all those new levies impel high earners to leave the country.

As for the reforms on the lips of every other policy maker in Europe, Mr. Sarkozy makes some of the right noises but won't even go as far as the (mostly broken) promises he made in 2007. In a 32-point plan issued this month, he offers some labor reform but more proposals that are vague (creating a "youth bank" for enterprising young people) or off-point (promoting French language and the values of the Republic).

Mr. Sarkozy proposes reducing payroll charges paid by employers but would make up for it by increasing VAT and taxes on investment income. This assumes there will be investment income left in France once Mr. Sarkozy's financial-transactions tax goes into effect in August.

Mr. Sarkozy's campaign is particularly disappointing compared to the one five years ago. Promising a "rupture" with France's old ways, he told voters in 2007 that they could no longer afford a sprawling state that coddled its workers and drove away entrepreneurs. Yet this year he seems content to reinforce a French model that's even more broken than before. If Mr. Sarkozy retakes the Elysée next month, he will have done so by turning his back on the center-right resurgence that he once led to victory.

The President's Socialist rival is a throwback of a different sort. François Hollande's campaign has adopted a fiery old-left style that most had taken for dead after the Socialists' 2007 defeat. All of Mr. Hollande's major economic policy plans have roots in a punitive populism that would make U.S. Congressional class warriors blush. According to the latest polls, he leads Mr. Sarkozy 29%-24% in the first-round vote and by an even wider margin in the likely runoff.

Mr. Hollande says he's "not dangerous" to the wealthy—he merely wants to confiscate 75% of their income over €1 million, and 45% over €150,000. He is, however, a self-avowed "enemy" of the financial industry, and he plans to impose extra penalties on oil companies and financial firms. He'd also raise the dividends tax and impose a new, higher rate of VAT on luxury goods. All of this is necessary, Mr. Hollande says, to chop the massive debt that President Sarkozy has heaped upon France.

But swiping at Mr. Sarkozy's debt record hardly makes sense when Mr. Hollande's own spending plans would pile on still more borrowing. The Socialist candidate is playing Santa Claus, promising lavish new goodies to French voters while other euro-zone governments are pulling back.

Inside Mr. Hollande's gift bag: 60,000 new teaching jobs, new housing subsidies and rent controls, and increased public funding for small and medium enterprises. He would raise the minimum wage to €1,700 a month and enact a new law to prevent and fight layoffs. He also promises to reverse Mr. Sarkozy's most important domestic-policy victory: raising the retirement age to 62 from 60.

So national elections in France has the usual dynamics of prompting politicians to pander to the gullible masses especially to “free market hostile” voters.

Chart from the Economist

Among major economies, the French population has been most averse towards to the free market.

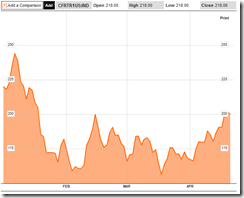

Nevertheless France’s major benchmark the CAC 40, as of Friday’s close, has largely given up its gains and has now been unchanged on a year to date basis, perhaps partly due to the lingering Euro crisis as well as uncertainties from the outcome of elections.

Such concern has likewise been manifested on Credit Default Swaps (CDS) or the cost to insure debt, where there has been recent amplified concerns over the credit quality of French debt papers.

In case the winning French politician actualizes rhetoric into interventionist policies, then we can expect lesser resources to be available for productive ends as more of these will be diverted towards political projects. This also means the likelihood of migration of capital out of the French economy (capital flight), as well as, a transition to a larger informal economy.

With a prospective French political spending binge amidst a debt crisis plagued Europe, this means policies of interventionism will need to be backed by inflationism. Yet if such actions becomes deeply entrenched, then today’s election may have sealed the fate of the Euro.

As the great Ludwig von Mises warned

An essential point in the social philosophy of interventionism is the existence of an inexhaustible fund which can be squeezed forever. The whole system of interventionism collapses when this fountain is drained off: The Santa Claus principle liquidates itself.

Or as former British Prime Minister Margaret Thatcher once said,

The problem with socialism is that eventually you run out of other people's money [to spend].

Thursday, October 06, 2011

US Debt up $162 Billion in Three Days; now 98.9% Debt/GDP

The US government is on a spending spree.

Quoting the anonymous writer who comes by the name of Tyler Durden of the Zero Hedge (bold highlights original)

total debt is now at, obviously, a new record high of $14,856,859,498,405.73, which is a $20 billion increase overnight, $67 billion in the past two days, and $162 billion in the last three days. We will repeat the last part: total US debt has increased by $162 billion in three days. Said otherwise, total US Debt/GDP is now 98.9%.

Politicians and their allies believe they can spend their way to prosperity. They believe in the Santa Claus principle.

They have to be reminded that, to quote Ludwig von Mises,

An essential point in the social philosophy of interventionism is the existence of an inexhaustible fund which can be squeezed forever. The whole system of interventionism collapses when this fountain is drained off: The Santa Claus principle liquidates itself.

In a world of scarcity, there is simply no such thing as a free lunch. Eventually markets will expose such tomfoolery.

Saturday, August 20, 2011

The Zombie Political Economy

The welfare state breeds and fosters violence.

Daily Reckoning’s Bill Bonner explains, (bold emphasis mine)

In economic terms, a zombie is a parasite. He contributes less to the economy than he takes from it. He lives at the expense of others.

Almost any profession or career can be a nest for a zombie; an auto mechanic who rips off his customers, for example, is a zombie…at least in a sense. But most often, zombies are created, enabled, and supported by government. Government transfer payments create whole armies of zombies. Government bailouts turn whole industries into zombies. Government programs and government employment turn millions of otherwise reasonably honest and reasonably productive people into leeches. A guy who might have been a decent gardener, for example, becomes an SEC lawyer or a Homeland Security guard.

Politicians like zombies. Zombies are cheap. If you buy a vote from a man who is independently wealthy, it’s gonna cost you. And the bourgeoisie – which earns its money from honest toil and enterprise – is hard to buy. But zombie votes? They’re a dime a dozen. Just increase Social Security or Medicare; the zombies will line up to vote for you.

It’s relatively easy to turn people into zombies. And it’s fairly easy to support them when an economy is healthy and expanding. But when an economy goes into a contraction, you can no longer afford to give the zombies their meat. Then what?

Then, watch out. The zombies rise up.

Let me add that political economic parasitism has inherent limits, not only from the state of the economy, but most importantly, from the availability of supply of hosts.

Once parasites have grown extensively out of the proportion to the supply of hosts, the system collapses.

Political dependency, then, mutates into violence.

Thursday, August 11, 2011

Britain’s Riots: Symptoms of the Disease called Welfare State

The psychology of entitlement or dependency derived from the welfare state brings with it the propensity for violence once this privilege is seen as being taken away. The political beneficiaries think that there is an inexhaustible Santa Claus fund always there to serve them.

Add to the baneful effect of this dependency psychology is the lack of respect for the sanctity of private property rights.

And Britain’s riots appear to have been manifesting these symptoms.

Writes Allister Heath cityam.com (hat tip Dan Mitchell)

The cause of the riots is the looters; opportunistic, greedy, arrogant and amoral young criminals who believe that they have the right to steal, burn and destroy other people’s property. There were no extenuating circumstances, no excuses. The context was two-fold: first, decades of failed social, educational, family and microeconomic policies, which means that a large chunk of the UK has become alienated from mainstream society, culturally impoverished, bereft of role models, permanently workless and trapped and dependent on welfare or the shadow economy. For this the establishment and the dominant politically correct ideology are to blame: they deemed it acceptable to permanently chuck welfare money at sink estates, claiming victory over material poverty, regardless of the wider consequences, in return for acquiring a clean conscience. The second was a failure of policing and criminal justice, exacerbated by an ultra-soft reaction to riots over the past year involving attacks on banks, shops, the Tory party HQ and so on, as well as an official policy to shut prisons and reduce sentences. Criminals need to fear the possibility and consequence of arrest; if they do not, they suddenly realise that the emperor has no clothes. At some point, something was bound to happen to trigger both these forces and for consumerist thugs to let themselves loose on innocent bystanders.

But while all three main parties are responsible for flawed policies that have fuelled this growing underclass at a time of national prosperity – 5.5m-6m adults now on out of work benefits, a number that has been roughly constant for over two decades – the argument made by some that the riots were “caused” or “provoked” by cuts, university fees or unemployment is wrong-headed. Just because someone is in personal trouble doesn’t give them the right to rob, attacks or riot.

In any case, the state will spend 50.1 per cent of GDP this year; state spending has still been rising by 2 per cent year on year in cash terms. It has never been as high as it is today – in fact, it is squeezing out private sector growth and hence reducing opportunities and jobs. Many of the vandals were school children not yet in the labour market; unemployment is a tragedy that must be fought but 9, 10 or 14 year olds can’t be pillaging because of it. Equally tragically, most of the older rioters would never have any hope of going to university, regardless of cost, such is their educational poverty.

What they wanted is free money and free goods and so they helped themselves. They were driven by greed, a culture of entitlement, of rights without responsibility, combined with a complete detachment from traditional morality, generalised teenage anger and a sense that anything goes in the current climate. This wasn’t a political protest, it was thievery.

read the rest here

Monday, August 08, 2011

Imploding Welfare States: France Faces Downgrade After U.S. Cut

One by one the Bismarckian welfare states appear to be collapsing from their own weight.

From Bloomberg,

The decision by Standard & Poor’s to downgrade the U.S. credit rating leaves France as the AAA country most likely to lose its top grade, some investors and economists say.

France is more expensive to insure against default than lower-rated governments including Malaysia, Thailand, Japan, Mexico, Czech Republic, the state of Texas and the U.S.

“France is not, in my view, a AAA country,” said Paul Donovan, London-based deputy head of global economics at UBS AG. “France can’t print its own money, a critical distinction from the U.S. It is not treated as AAA by the markets.”

While all three major credit-rating companies have confirmed France’s top level in recent months, market measures indicate increasing investor skittishness over the country’s vulnerability to the European debt crisis. Euro-region central bank governors signalled after emergency talks yesterday that they would buy bonds from Spain and Italy to counter investor concerns and limit fallout from the U.S. cut…

While France’s debt of 84.7 percent of gross domestic product is less than Italy’s 120.3 percent, as a percentage of economic output it has risen twice as fast as Italy’s since 2007. French government debt totaled 1.59 trillion euros ($2.3 trillion) at the end of 2010, according to the European Union; Italy’s was about 1.8 trillion euros. France has had a larger budget deficit than Italy every year since 2006. S&P rates Italy A+, four levels below France.

Chart from the Economist

It has been turning out to be a great vindication and equally a monumental triumph for the Classical Liberals whom have warned all these years about the artificiality of this system.

As the great Ludwig von Mises once wrote,

An essential point in the social philosophy of interventionism is the existence of an inexhaustible fund which can be squeezed forever. The whole system of interventionism collapses when this fountain is drained off: The Santa Claus principle liquidates itself.

This process of liquidating the Santa Claus principle has been happening as Risk Free are being exposed as Risk Loaded.

Although governments should be expected to keep up the struggle and resort to even more desperate measures in order to preserve this unsustainable system (via inflationism).

At the end of the day, economic reality will overwhelm them.