This serves as a classic example of the establishment’s “kiss of death”

About two weeks ago, two major Bulgarian banks suffered a classic bank run where the European Commission bailed out the banking system with a €1.7bn emergency credit line.

The fun part has been that the IMF gave Bulgaria’s banking system a clean bill of health two weeks prior the crisis.

From the Macedonian International News Agency

Earlier this summer, IMF bureaucrats went to Sofia, Bulgaria to study the country’s economic progress.And roughly a month ago, they released an official report which stated, among other things, that Bulgarian banks are “stable and liquid.”Talk about epic timing. Because less than two weeks later, Bulgaria’s banking system was in the throes of a full-blown crisis.There was a run on two of the nation’s largest banks—several hundred million dollars had been withdrawn in a matter of hours.And the Bulgarian central bank had to step in and take over both of them or risk a collapse in the entire system.

From 'Stable and liquid' into a banking crisis.

The same mainstream article seems to have been aware of perils of the fractional reserve banking system

This is the modern miracle of fractional reserve banking. When you make a deposit, your bank only holds a tiny percentage of that cash.The rest of it gets loaned out or invested in securities that pay a much higher rate of return than the pitiful amount you receive in interest.Needless to say, the less money banks hold in reserve, the more money they’re able to invest… and the more profit they make.This puts their incentives and our incentives at odds. Because as depositors, it’s better for us if the bank holds most (if not all) of our funds.In typical form, though, governments stepped in to settle this dispute. And a century ago, they sided with the banks.Because of this, it’s perfectly legal for banks to hold a tiny percentage of customer deposits. So now, anytime there’s the slightest spook (as happened in Bulgaria), it creates a panic.

‘Slightest spook” which “creates panic” has been implicitly attributed to either depositor’s irrationality or sabotage.

But such hasn’t really been the case with Bulgaria’s bank runs.

For instance, the license to operate of Bulgaria’s fourth largest bank, the Corporate Commercial Bank, has just been revoked by the Bulgaria’s central bank, Bulgaria’s National bank. This has reportedly been due to the deficits or “‘hole’ in the bank” amounting to 3.5 billion leva as the majority stockholder Tsvetan Vassilev has allegedly been “draining his own bank”, according to a report from The Sofia Globe

In short, what “spooked” depositors had fundamental basis. The report also says that the Corporate Commercial Bank will be allowed to collapse. This means that the affected bank had more than just liquidity issues, it has a solvency problem. Depositors sensed this and the bank run ensued.

Yet the same fundamental basis has apparently been ignored or overlooked by the IMF.

As you can see, mechanical quant or math model based analysis will hardly ever capture human activities operating behind scenes.

And without understanding the socio dynamics operating behind the numbers, pure number crunching will lead statisticians astray. This is because financial ratios or economic statistics can just be fabricated to look robust. Also since statistical models have been designed to incorporate certain variables, this tends to leave out other relevant factors, when everything in this world is interconnected.

Importantly, since numbers represent history, it would be patently misguided to simplistically extrapolate the past into the future. This should be emphasized considering that the world operates in a complex dimension.

And it is not just the IMF, Sovereign Man’s Simon Black writes,

In the case of Bulgaria, the EU Commission soothingly announced that “the Bulgarian banking system is well-capitalized and has high levels of liquidity compared to its peers in other member states.”Whoa whoa wait a minute.Are these geniuses really saying that the country experiencing a bank run due to its LACK of liquidity is MORE liquid than the rest of Europe??Yes, that is exactly what they’re saying.So it begs the question– if Bulgarian banks with their “high levels of liquidity” can suffer such shocks, what can happen to other European banks which are worse off?I think the lesson here is clear: The people in charge of regulating the system and making these proclamations about bank safety are totally CLUELESS.

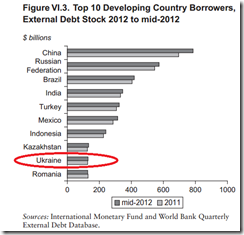

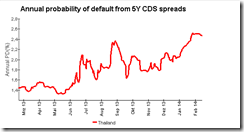

And the lesson from the miscalculation of Bulgaria’s case can likewise be seen in the risk asset markets around the world, including the Philippines.

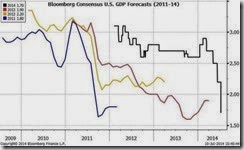

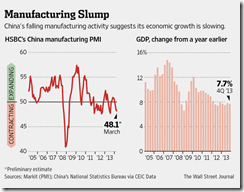

In the US, record stocks have been construed by the mainstream as headed for "infinity and beyond" even when the consensus projections of the economic performance have repeatedly been downscaled over the past 4 years. The 2014 projections has shown to be the deepest (see chart above).

In short, while the consensus continues to predict the economic performance with consistent brazen inaccuracy, the record breaking stock markets streak means that the gullible public continues to believe in the "growth" story peddled by Wall Street.

As Contra Corner’s David Stockman wryly observed

There is nothing more predictable than the bevy of Wall Street economists who come charging out of the blocks early each year proclaiming that money printing by the Fed will finally work its magic, and that real GDP growth will hit “escape velocity”. But this year the markdowns have come fast and furious. After the disaster of Q1 and the limp data reported for Q2 to-date, the revised consensus outlook for 2014 at 1.7% is already below the tepid actual results of the last three years. So much for the year when “screaming” growth was certain to happen.

Such kind of outlook has been common in a manic phase.

In a post mortem analysis of pre Lehman crisis bubble deniers, Doug Noland of the Credit Bubble Bulletin at the PrudentBear.com refers to this piece by popular mainstream economist Ben Stein at the New York Times in August 12, 2007 (bold mine, italics original)

The job of an economist, among many other duties, is to put things into perspective. So, because I am an economist, among other duties, here is a little perspective on the recent turmoil in the stock and bond markets. First, when the story of this turbulence is reported, the usual explanation mainly has to do with some new loss in the subprime mortgage world… Here is the first instance in which proportion tells us that something is out of whack: The total mortgage market in the United States is roughly $10.4 trillion. Of that, a little over 13%, or about $1.35 trillion, is subprime — certainly a large sum. Of this, nearly 14% is delinquent, meaning late in payment or in foreclosure. Of this amount, about 5% is actually in foreclosure, or about $67 billion. Of this amount, according to my friends in real estate, at least about half will be recovered in foreclosure. So now we are down to losses of about $33 billion to $34 billion… The total wealth of the United States is about $70 trillion. The value of the stocks listed in the United States is very roughly $15 trillion to $20 trillion. The bond market is even larger… This economy is extremely strong. Profits are superb. The world economy is exploding with growth. To be sure, terrible problems lurk in the future: a slow-motion dollar crisis, huge Medicare deficits and energy shortages. But for now, the sell-off seems extreme, not to say nutty. Some smart, brave people will make a fortune buying in these days, and then we’ll all wonder what the scare was about.”

The above is a splendid example of statistical analysis clothed in economic wardrobe that hardly covers substantial investigation of the entwined dynamics of credit, money, prices and capital. In short, economic reasoning has been muddled with statistical reading predicated on data mining.

Secondly, fixation on the past numbers has led to the gross underestimation of risks. This has primarily been due to the misappraisal of the proportionality of risks that basically omitted the potentials of a contagion. Again numbers (or models) hardly ever captures the dimension of human response in the face of a meltdown.

This means that like the IMF, the EU Commission and conventional analysis, shouting and obsessing over statistics or historical numbers produces incorrigible myopia or hopeless cluelessness.

Ironically instead of the sell-off being “extreme” and “nutty”, from an ex-post perspective, the above article turns out to be a comic riffraff, a paragon of contorted perception of reality, mania ‘this time is different’ blindness, and importantly, a principal reason why one should not trust mainstream economists or experts.

As post Keynesian monetarist Joan Robinson rightly pointed out “The purpose of studying economics is not to acquire a set of ready-made answers to economic questions, but to learn how to avoid being deceived by economists.”