The so-called “tapering” has all been a poker bluff. And that bluff has been called as global central banks take on an increasingly dovish stance.

From Bloomberg:

The era of easy money is shaping up to keep going into 2014.The Bank of Canada’s decision yesterday to drop language about the need for future interest-rate increases unites it with other central banks reinforcing rather than retracting loose monetary policy. The Federal Reserve delayed a pullback in its monthly asset purchases, while emerging markets from Hungary to Chile cut borrowing costs in the past two months“We are at the cusp of another round of global monetary easing,” said Joachim Fels, co-chief global economist at Morgan Stanley in London.Policy makers are reacting to another cooling of global growth, led this time by weakening in developing nations while inflation and job growth remain stagnant in much of the industrial world. The risk is that continued stimulus will inflate asset bubbles central bankers will have to deal with later. Already, talk of unsustainable home-price increases is spreading from Germany to New Zealand, while the MSCI World Index of developed-world stock markets is near its highest level since 2007.

Easy money has hardly produced the desired effects, yet the stubborn insistence by central bankers to do the same thing over and over yet expecting different results.

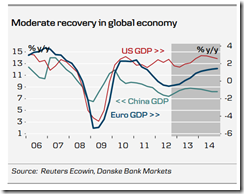

The economic payoff has been limited. The International Monetary Fund this month lopped its forecast for global economic growth to 2.9 percent in 2013 and 3.6 percent in 2014, from July’s projected rates of 3.1 percent this year and 3.8 percent next year. It also sees inflation across rich countries already short of the 2 percent rate favored by most central banks.Central bankers are on guard to keep low inflation from turning into deflation, a broad-based decline in prices that leads households to hold off purchases and companies to postpone investment and hiring.

Promoting debt has gone global.

Some central banks in emerging markets are already acting. Chile unexpectedly lowered its benchmark rate by a quarter point to 4.75 percent on Oct. 17, pointing to weaker growth, inflation and the global outlook. Israel on Sept. 23 surprised analysts when it cut its key rate a quarter point to 1 percent, the lowest in almost four years.“With the dollar much weaker in recent days and weeks, you’ll see central banks that were reluctant to ease start to do that now,” said Thierry Wizman, global interest rates and currencies strategist at Macquarie Group Ltd. in New York. “They can be less worried about capital flight if the Fed isn’t tightening policy, and the strength in their currencies is probably imparting some disinflation into their economies, giving them a window to cut rates.”Hungary, Latvia, Romania, Serbia, Sri Lanka, Egypt and Mexico have also eased since the start of September although Indonesia, Pakistan, Uganda and India tightened with the latter softening the blow by relaxing liquidity curbs in the banking system at the same time.

Yet cheap credit equals asset bubbles

The cheap cash may come at a price that policy makers will have to pay later if it inflates asset bubbles. Germany’s Bundesbank said this week that apartments in the country’s largest cities may be overvalued by as much as 20 percent. In the U.K., BOE officials are rebutting commentary about a housing bubble as prices in London jumped 10.2 percent in October from the prior month.Swedish and Norwegian property markets are also proving a concern to their central bankers, and policy makers in New Zealand and Singapore have already sought to cool demand. Meantime, U.S. stocks are heading toward the best year in a decade with about $4 trillion added to U.S. share values this year.

As I have repeatedly been pointing out here, easy money regime represents a transfer of resources from the real economy to the cronies of the banking-finance and to the political class and cronies of the welfare-warfare state and the bureaucracy. Such has been enabled, intermediated and facilitated by the global central banks via asset bubbles.

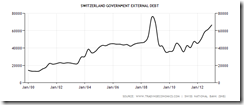

Also such asset bubbles have been financed by a massive build up of debt.

Global debt has been estimated at $223 trillion last May 2013—313% (!!!) global gdp…and growing fast.

According to the Wall Street real time economics blog

In a comprehensive report on global indebtedness, economists at ING found that debt in developed economies amounted to $157 trillion, or 376% of GDP. Emerging-market debt totaled $66.3 trillion at the end of last year, or 224% of GDP.The $223.3 trillion in total global debt includes public-sector debt of $55.7 trillion, financial-sector debt of $75.3 trillion and household or corporate debt of $92.3 trillion. (The figures exclude China’s shadow finance and off-balance-sheet financing.)

Again easy money promotes interests of political agents. Credit easing policies has produced an explosion of central bank assets as government debts skyrockets.

This comes as global GDP shrinks.

![[clip_image009%255B3%255D.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh5zLN_BZQ9W5f4txrRC6PqnBuhu4NkgrO6V5LYpnkhdpTbo-3qjcsdirIlUJV716ZCq6txnIk1Gq8TssDR13cqoa_7HDwjsvJK07caIhRIt8zsqev33CQAEmk7BQuKmFiYBHsP/s1600/clip_image009%25255B3%25255D.png)

I pointed out last week of the growing imbalance between the growth of debt and GDP in the US. I wrote “since 2008, the US acquired $7 of debt for every $1 of statistical economic growth”

The other way to look at this is to ask; how will $1 of growth pay for $7 of debt?

Dr. Marc Faber at the Daily Reckoning writes

Moreover, the Fed wants to stimulate credit growth with its artificially low interest rates. But again, credit growth has largely lost its impact on the real economy. The multiplier on GDP of an additional dollar of debt is now negligible.

So Central Banks are caught in a ‘loop the loop’ or ‘cul de sac’ trap. To maintain the illusion of sustainability credit easing policies must exist in perpetuity. However, the easy money environment further inflates systemic debt thus intensifying systemic fragility or vulnerability to a crisis. And so the feedback loop.

Yet at the end of the day economist Herbert Stein’s law “If something cannot go on forever, it will stop” will prevail.

And the great Austrian economist Ludwig von Mises warned (bold mine)

The boom can last only as long as the credit expansion progresses at an ever-accelerated pace. The boom comes to an end as soon as additional quantities of fiduciary media are no longer thrown upon the loan market. But it could not last forever even if inflation and credit expansion were to go on endlessly. It would then encounter the barriers which prevent the boundless expansion of circulation credit. It would lead to the crack-up boom and the breakdown of the whole monetary system.