There are no possible rewards of a just distribution in a system where the distribution is not deliberately the result of people bringing it about. Justice is an attribute of individual action. I can be just or unjust toward my fellow man. But the conception of a social justice to expect from an impersonal process with nobody can control to bring about a just result, is not only a meaningless conception, it’s completely impossible. You see everybody talks about social justice, but if you press people to explain to you what they mean by social justice…what to accept as social justice, nobody knows.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, December 25, 2012

Video: Hayek: Social Justice is a Meaningless Concepcion

Wednesday, December 05, 2012

Quote of the Day: When We Reify the Model, We Misunderstand the World

We reify the model, and misunderstand the world.People need to understand that this is exactly the *same* insight that dawned upon Ludwig Wittgenstein — mental constructs made of “given givens” which are given to one mind fail to capture the imperfect networks of imperfectly coordinated common patterns of orienting our self in the world via language — and these ‘given given’ entities mislead us about the source of significance or meaning — we go looking for significance in ‘given given’ entities, eg Plato’s essences, Russell’s logical atoms, Frege’s senses, Kripke’s direct references, Lewis’s possible world entities.When we reify the mental construct we’ve built of ‘language’ using logic and meaning entities, we misunderstand the real world of the social phenomena of language.In the economic case, we lose sight of networks of price relations in the world as found social tools already existing in the world for orienting our doings in coordination with other people. Social tools which aren’t always perfect and don’t always guarantee perfect coordination.In the language case, we lose sight of networks of shared practices of going on in the world involving speech and written words as found social tools already existing in the world for orienting our doings in coordination with other people. Social tools with aren’t always perfect and don’t always guarantee perfect coordination.Prices and language are external social network realities with an existence and reality far beyond the closed system of any single individual’s formal mental model of the price system or the language system made of of ‘given givens’ or stipulated ‘meanings’ and their formal relations.The lesson of Mises’ socialist calculation argument and Wittgenstein’s private language argument is that we can’t recreate this social thing that lies outside us in a fully surveyed formal system of “givens”, we can’t recreate it and we can’t replace it, what we do is make use of it coordination our social doings within this larger *socially* given network of relations, which we don’t receive as ‘given given’ entities like a hat in a box, but as networks of significance we are constantly orienting ourselves within and internalizing, in the first instance without any real explicit articulated fixed rules of going on together in a coordinated way. We acquire usefully and commonly coordinated practices via imitation, trial and error, training, absorbing the culture, practice, getting advice from others, etc.

Thursday, October 25, 2012

Quote of the Day: The Limits of Experience

what we know about our action under given conditions is derived not from experience, but from reason. What we know about the fundamental categories of action—action, economizing, preferring, the relationship of means and ends, and everything else that, together with these, constitutes the system of human action—is not derived from experience. We conceive all this from within, just as we conceive logical and mathematical truths, a priori, without reference to any experience. Nor could experience ever lead anyone to the knowledge of these things if he did not comprehend them from within himself.

Tuesday, October 09, 2012

Quote of the Day: An Empirical Law Lacks the Guarantee of Absolute Validity a Priori

Among economists the opinion often prevails that the empirical laws, ‘because they are based on experience,’ offer better guarantees of truth than those results of exact research which are obtained, as is assumed, only deductively from a priori axioms …Testing the exact theory of economy by the full empirical method is simply a methodological absurdity, a failure to recognize the bases and presuppositions of exact research. At the same time it is a failure to recognize the particular aims which the exact sciences serve. To want to test the pure theory of economy by experience in its full reality is a process analogous to that of the mathematician who wants to correct the principles of geometry by measuring real objects. . . .An empirical law lacks the guarantee of absolute validity a priori, i.e., simply according to its methodological presuppositions …To want to transfer [the empirical method] to the results of exact research is, however, an absurdity, a failure to recognize the important difference between exact and realistic research. To combat this is the chief task of the preceding investigations.”

Monday, October 08, 2012

Possible Complications from Turkey-Syria Clash

Turkey's neighborly love-fest ended soon after Syria erupted in civil war. For reasons that still remain murky, Erdogan dropped his "love-thy-neighbor"policy and began actively supporting Syria's insurgents.Until the Syrian uprising, Turkey had enjoyed good trade and political relations with Damascus. Syria had more or less dropped its claims to Turkish-ruled Hatay province, and told its Kurdish minority not to make trouble for the Turks. Hatay, and its strategic port of Iskenderun, were part of historic Syria (as was Lebanon and Palestine), but passed with French help to Turkish rule in the last century. If relations between Ankara and Damascus continue to worsen, this thorny issue may again heat up.Turkey blundered into Syria's civil war soon after it erupted in March, 2011. Ankara allowed Syrian insurgent groups, funded and armed by Saudi Arabia, France, Britain, the US and Qatar, to operate from its soil. CIA established an important logistics and communications base for the insurgents at the US air base at Incirlik, Turkey. US, British and French special forces based in Turkey discreetly joined in the war to overthrow the Assad regime in Damascus – all part of Washington's undeclared but very real and intensifying multi-dimensional war against Iran, Syria's closest ally.Each passing day of Syria's brutal civil war raises the risk that Turkey will send its armed forces into Syria, either to create so-called "civilian corridors"or no-fly zones to ground the Assad regime's air force. All-out NATO intervention led by the US could occur after American presidential elections.Meanwhile, the besieged Assad regime in Damascus has lost control of a northern border region inhabited by 2 million ethnic Kurds who have become autonomous. Ankara, which faces a virtual independent Kurdish state in northern Iraq and its own long-simmering uprising by its Kurdish minority, is deeply alarmed by the specter of Kurdish nationalism.The war in Syria has accentuated Turkey's serious Kurdish problem. This writer covered the Turkish – Kurdish conflict in eastern Anatolia a decade ago, in which over 40,000 had died by 1992 alone. Turkey thought it had put an end to the Kurdish PKK insurgency by capturing its leader, Abdullah Ocalan, in 1999. The PKK's main base was in Syria.Ocalan remains in prison. But the Kurdish independence movement has sprung again to life. Syria will very likely resume aiding Kurdish PKK fighters to exact revenge on Turkey for abetting anti-regime guerillas. This is a huge problem for Turkey as Kurds make up 15-20% of its population.By fueling Syria's civil war, Erdogan has kicked the Kurdish hornet's nest.The conflict in Syria is pitting its minority Alawites (an offshoot of Shia Islam), who dominate the Assad regime, against the long-repressed Sunni majority. As Syria's Alawites fight for what some believe is their lives, their struggle is reverberating in Lebanon, where Shiites make up the largest religious community. Turkey's long-marginalized Alevis, who are another distant offshoot of Shia Islam and close to Syria's Alawis, and who are looked down on by the Sunni majority as heretics, are also feeling the reverberations of the Syrian conflict. Alevis may make up as much as 15% of Turkey's population of some 74 million.Recent revelations of a massacre of Alevis in 1938 at the end of the era of Turkish strongman Ataturk has inflamed Alevi emotions in Turkey and deepened their sense of persecution and historic injustice.So the Syrian conflict is reopening some of the deep fissures in Turkey's body politics just at a time when its zesty economy was enjoying a 7% growth rate – not far from China's – and Turkey had become the Mideast's cock of the walk.Now, Syria bodes ill for all involved.

As a human endeavor like any other, war making is the product of reason, purpose and choice.

Thursday, September 27, 2012

Quote of the Day: The Mercantilist’s Pareto Strawman

The market economy has never been without its critics and enemies. Those who feel threatened by the market; those who, however unwisely, feel they could do better without it; economists with little imagination; those, like the devotees of Pareto optima, with only too much of it; those who find most entrepreneurs disgusting characters; those attracted by the romantic charm of a feudal order in which they never had to live; social thinkers offended by the raucous tone of modern advertising; and social thinkers who know only too well how to exploit envy and greed in the service of anticapitalistic movements – all these make a formidable array of opponents.

Saturday, August 11, 2012

The Major Risk from Currency Union Breakups: Hyperinflation

At the Peterson Institute for International Economics, Mr. Anders Aslund has an interesting paper on the historical aftermaths of the dissolution of currency unions.

Mr. Aslund opens with a refutation of the Nirvana fallacy of the Keynesian prescription on the currency devaluation elixir. Here Mr. Aslund rebuts Nouriel Roubini. (all bold highlights mine)

While beneficial in some cases, devaluation is by no means necessary for crisis resolution. About half the countries in the world have pegged or fixed exchange rates. During the East Asian crisis in 1998, Hong Kong held its own with a fixed exchange rate, thanks to a highly flexible labor market. The cure for the South European dilemma is available in the European Union. In the last three decades, several EU members have addressed severe financial crises by undertaking serious fiscal austerity and reforms of labor markets, thus enhancing their competitiveness, notably Denmark in 1982, Holland in the late 1980s, Sweden and Finland in the early 1990s, all the ten post communist members in the early 1990s, and Germany in the early 2000s. Remember that as late as 1999, the Economist referred to Germany as “the sick man of the euro.”

More recently, the three Baltic countries, Estonia, Latvia, and Lithuania, as well as Bulgaria have all repeated this feat (Åslund 2010, Åslund and Dombrovskis 2011). Among these many crisis countries, only Sweden and Finland devalued, showing that devaluation was not a necessary part of the solution. The peripheral European countries suffer in various proportions from poor fiscal discipline, overly regulated markets, especially labor markets, a busted bank and real estate bubble, and poor education, which have led to declining competitiveness and low growth. All these ailments can be cured by means other than devaluation.

Mr. Aslund on the currency union dissolution during the gold standard eon.

It was rather easy to dissolve a currency zone under the gold standard when countries maintained separate central banks and payments systems. Two prominent examples are the Latin Monetary Union and the Scandinavian Monetary Union. The Latin Monetary Union was formed first with France, Belgium, Italy, and Switzerland and later included Spain, Greece, Romania, Bulgaria, Serbia, and Venezuela. It lasted from 1865 to 1927. It failed because of misaligned exchange rates, the abandonment of the gold standard, and the debasement by some central banks of the currency. The similar Scandinavian Monetary Union among Sweden, Denmark, and Norway existed from 1873 until 1914. It was easily dissolved when Sweden abandoned the gold standard. These two currency zones were hardly real, because they did not involve a common central bank or a centralized payments system. They amounted to little but pegs to the gold standard. Therefore, they are not very relevant to the EMU.

“Abandonment of gold standard” simply suggests that some members of these defunct unions wantonly engaged in inflationism which were most likely made in breach of the union’s pact that had led to their dissolution.

Mr Aslund tersely describes on one account of “successful” post gold standard breakup…

Europe offers one recent example of a successful breakup of a currency zone. The split of Czechoslovakia into two countries was peacefully agreed upon in 1992 to occur on January 1, 1993. The original intention was to divide the currency on June 1, 1993. However, an immediate run on the currency led to a separation of the Czech and Slovak korunas in mid-February, and the Slovak koruna was devalued moderately in relation to the Czech koruna. Thanks to this early division of the currencies, monetary stability was maintained in both countries, although inflation rose somewhat and minor trade disruption occurred (Nuti 1996; Åslund 2002, 203). This currency union was real, but thanks to the limited financial depth just after the end of communism, dissolution was far easier than will be the case in the future. In particular, no financial instruments were available with which investors could speculate against the Slovak koruna

It seems unclear why the Czech and Slovak experience had been the least worse or had the least disruption compared to the others.

Yet considering that inflation is a monetary phenomenon with political objectives, “limited financial depth” seems unlikely a significant factor the “success”. Instead it may have been that political authorities of the Czech and Slovak experience, aside from the “early division of currencies” which may have given a transitional time window, may have likely implemented some form of monetary discipline which lessened the impact.

Mr Aslund finds that the the incumbent European Union seems more relevant with three recent accounts of currency disintegration which had cataclysmic results.

The situation of the EMU is very different from these three cases. It has no external norm, such as the gold standard, and it is a real currency union with a common payments mechanism and central bank. The payments mechanism is centralized to the ECB and would fall asunder if the EMU broke up because of the large uncleared balances that have been accumulated. The more countries that are involved in a monetary union, the messier a disruption is likely to be.

The EMU, with its 17 members, is a very complex currency union. When things fall apart, clearly defined policymaking institutions are vital, but the absence of any legislation about an EMU breakup lies at the heart of the problem in the euro area. It is bound to make the mess all the greater. Finally, the proven incompetence and slowness of the European policymakers in crisis resolution will complicate matters further.

The three other European examples of breakups in the last century are of the Habsburg Empire, the Soviet Union, and Yugoslavia. They are ominous indeed. All three ended in major disasters, each with hyperinflation in several countries. In the Habsburg Empire, Austria and Hungary faced hyperinflation.

Yugoslavia experienced hyperinflation twice. In the former Soviet Union, 10 out of 15 republics had hyperinflation. The combined output falls were horrendous, though poorly documented because of the chaos. Officially, the average output fall in the former Soviet Union was 52 percent, and in the Baltics it amounted to 42 percent (Åslund 2007, 60).

According to the World Bank, in 2010, 5 out of 12 post-Soviet countries—Ukraine, Moldova, Georgia, Kyrgyzstan, and Tajikistan—had still not reached their 1990 GDP per capita levels in purchasing power parities. Similarly, out of seven Yugoslav successor states, at least Serbia and Montenegro, and probably Kosovo and Bosnia-Herzegovina, had not exceeded their 1990 GDP per capita levels in purchasing power parities two decades later (World Bank 2011).

Arguably, Austria and Hungary did not recover from their hyperinflations in the early 1920s until the mid-1950s. Thus the historical record is that half the countries in a currency zone that breaks up experience hyperinflation and do not reach their prior GDP per capita as measured in purchasing power parities until about a quarter of a century later, which is far more than the lost decade in Latin America in the 1980s.

The causes of these large output falls were multiple: systemic change, competitive monetary emission leading to hyperinflation, collapse of the payments system, defaults, exclusion from international finance, trade disruption, and wars. Such a combination of disasters is characteristic of the collapse of monetary unions.

Why hyperinflation poses as the greatest risk for the disintegration of the fiat money based currency unions?

A common reflex to these cases is to say that it was a long time ago, that things are very diferent now, and that other factors matter. First of all, it was not all that long ago. Two of these economic disasters occurred only two decades ago. Second, hyperinflation was probably the most harmful economic factor, and it is part and parcel of the collapse of a currency zone, regardless of the time period. About half of the hyperinflations in world history occurred in connection with the breakup of these three currency zones. The cause was competitive credit emission by competing central banks before the breakup. Third, monetary indiscipline and war are closely connected. The best illustration is Slovenia versus Yugoslavia. In the first half of 1991, the National Bank of Yugoslavia started excessive monetary emission to the benefit of Serbia. On June 25, 1991, Slovenia declared full sovereignty not least to defend its finances. Two days later, the Yugoslav armed forces attacked Slovenia (Pleskovic and Sachs 1994, 198). Fortunately, that war did not last long and Slovenia could exit Yugoslavia and proved successful both politically and economically

Again since inflationism essentially represents monetary means to attain political ends, previous accounts of hyperinflation in post currency union dissolution may have been a result of policy miscalculations from political leaders trying to attain the illusory positive effects from devaluation.

Or most importantly or which I think is the more relevant is that in absence of access to local and foreign savings through banking or financial markets, political authorities in pursuit of their survival have resorted to massive money printing operations.

Also since hyperinflation means the destruction of division of labor or free trade, one major consequences have been to seek political survival through plunder, thus the attendant war. Inflationism, according to great Ludwig von Mises has been “the most important economic element in this war ideology”.

Looking at history has always been deterministic. We look at the past in the account of how narrators describes the connections of the facts in them. But we must not forget of the importance of theory in examining these facts.

As Austrian economist Hans Hermann Hoppe explains,

There must also be a realm of theory — theory that is empirically meaningful — which is categorically different from the only idea of theory empiricism admits to having existence. There must also be a priori theories, and the relationship between theory and history then must be different and more complicated than empiricism would have us believe.

I concur that hyperinflation could likely be the outcome for many European countries once a breakup of the Eurozone becomes a reality. This will not happen because history will merely repeat itself, but because the preferred recourse by politicians has been to resort to inflationism. Theory and history have only meshed to exhibit the likelihood of such path dependent political actions.

Friday, August 10, 2012

Quote of the Day: A Fair Exchange is an Unequal Exchange from which All Parties Expect To Gain

Value is the significance a good has for the well-being of a human being or beings. The value of a good is determined by the importance attached to the utility of the marginal unit in satisfying some human want.

All life is change. For men, life is a series of choices by which we seek to exchange something we have for something we prefer. We know what we prefer. No other man or bureaucrat is capable of telling us what we prefer. Our preferences are our values. They provide us with the compass by which we steer all our purposeful actions. And last but not least, a fair exchange is not an equal exchange. A fair exchange is an unequal exchange from which all parties expect to gain.

Barring force, fraud, or human error, every free market transaction provides all parties with a psychic profit or higher value, according to their own scale of values. Anything that raises cost or hinders the free and voluntary transactions of the market place must keep human satisfactions from reaching their highest potential. Today the greatest obstructions to the attainment of higher human satisfactions are the well-meaning but futile political interferences with the mutually beneficial transactions of a free market economy.

This is the summary from must read speech made by the late economist Percy L. Greaves, Jr. (1906–1984)

Sunday, August 05, 2012

Prediction Record of the US Federal Reserve: The Sun Will Come Out Tomorrow

The US Federal Reserve’s supposed transparency has only been exposing their string of serial forecasting blemishes.

Evan Solitas has been tracking the Fed’s performance and observed, (bold emphasis mine)

The Bernanke Fed has made a significant effort since June 2009, when the NBER judges the recession to have ended, to increase transparency by providing guidance about future policy and macroeconomic forecasts. What is striking, however, is how this transparency has not prevented in the slightest the intellectual dishonesty in ignoring its failure to meet its own goals.

A disparaging but not unfair comparison would be to little orphan Annie. "The sun'll come out tomorrow," Annie sang. "Bet your bottom dollar that tomorrow there'll be sun." The 3-to-4 percent recovery growth we've been long promising will come out tomorrow, the FOMC basically says every quarterly meeting. Bet your bottom dollar that tomorrow there'll be lower unemployment.

The Fed must love tomorrow. Because, as they say, it's always a day away.

What I mean by this is the Fed makes projections, misses them by miles and consistently in the wrong direction, and then doesn't own up to it. They just push back their forecast. The forecasts are not inappropriately optimistic, either -- it's just that the Fed's actions have fallen short, and that there is zero accountability to target the forecast.

Their transparency, however, allows us to demonstrate thoroughly the extent of this failure.

Their fundamental error: the haughty assumptions that human action can be aggregated into mathematical expressions similar to natural sciences or positivism.

Reason and experience show us that there are two separate realms: the external world of physical, chemical, and physiological phenomena, and the internal world, in our minds, of our thoughts, feelings, valuations, and purposes in life. There is no bridge connecting these two spheres. They are not connected automatically. We always have the right to choose our actions. Identical external events often produce different human reactions, and different external events sometimes produce identical human actions. We do not know why.

So, the science of human action is different from the physical sciences. We cannot experiment with human beings except in a physiological, medical, or biological sense. In the realm of ideas, we cannot experiment as we can in the physical sciences. We cannot duplicate situations in which all things are maintained the same as before. We cannot change one condition and always get the same consequences. We cannot experiment with human actions, because the world, its population, its knowledge, its resources are all constantly changing and cannot be held still.

In economics we must use our minds to deduce our conclusions. We have to say, Other things being equal, other things being the same, this change will produce such and such an effect. We have to trace in our minds the inevitable results of contemplated changes. We are dealing with changeable human beings. We cannot perform actual experiments, because the human conditions cannot be duplicated, controlled, or completely manipulated in real life like chemical experiments in a laboratory. Therefore, there are great differences between economics and the physical sciences. We cannot experiment and we cannot measure. There are no constants with which to measure the actions and the forces which determine the actions and the choices of men. In order to measure you must have a constant standard, and there is no constant standard for measuring the minds, the values, or the ideas of men.

More, Federal Reserve (central bank) 'experts' are unlikely to produce unorthodox or radical or ‘out of the box’ thinking as they are supposed to uphold the institutions that employ them, thus the “zero accountability”. It's not about being right or wrong but what needs to broached by such institutions.

Bluntly put, their studies are basically designed to rationalize or justify the existence of their institutions. You may call this biased analysis. Also the conflict of interests between politicized money and the citizenry highlights the agency problem or the principal agent dilemma.

And such outlook applies to almost all political and politically affiliated institutions.

Why is this important? Because the Fed or central bank policies or centrally planned monetary actions have essentially been derived from their analysis or outlook.

And analysis with consistently large deviance from economic reality would only translate to high probability that their accompanying actions would have negative implications or consequences than the intended or expected goals or objectives.

Policy errors, thus, are likely to be the rule than the exception.

In short, we shouldn’t trust central bankers. We don’t even need them.

Thus, prudent investors need to anticipate of such centrally planned monetary misdiagnosis-malpractice, and take appropriate action to protect or insure themselves from their adverse effects.

Don’t forget half of every transactions we make has been coursed through political (fiat legal tender based) money. And distortions of the economics of money through interventions only extrapolates to parallel disruptions in the production or economic structure. This is why boom bust cycles and hyperinflation exists.

Friday, August 03, 2012

Quote of the Day: Freedom is Indivisible

First, let me say that freedom is indivisible. You cannot lose a part of your freedom, the freedom of speech, the freedom to buy, the freedom to print, without eventually losing all of your freedom. Of course, all freedom is based on economic freedom. Freedom is indivisible. No one man invented the airplane. It took many, many men to invent today's jet. It took a lot of history, a lot of just minor improvements.

My great teacher, Mises, asks, "What is the automobile of 1969?" He answers his own question: "It is just the automobile of 1909 with thousands upon thousands of minor improvements." Everyone who suggested an improvement did it with the hope that he would make a profit. Many made suggestions that fell by the wayside. But it was the freedom of those men to work on improving the automobile that has given us the automobile that we have today. No one man invented it, neither did one man produce it.

This is from the late economist Percy L. Greaves, Jr’s must read article (it's really a transcript from a talk) about the essence of Economics.

Tuesday, June 26, 2012

Quote of the Day: The Spurious Idea of Measuring Value

The basis of modern economics is the cognition that it is precisely the disparity in the value attached to the objects exchanged that results in their being exchanged. People buy and sell only because they appraise the things given up less than those received. Thus the notion of a measurement of value is vain. An act of exchange is neither preceded nor accompanied by any process which could be called a measuring of value. An individual may attach the same value to two things; but then no exchange can result.

This is from the great Ludwig von Mises from his magnum opus Human Action Chapter XI Section 2 p.204. (hat tip Mises Blog)

This is in accord to yesterday’s quote of the day where Professor Deirdre McCloskey bashed the notion of using mathematical formalism to measure “happiness”.

Monday, June 25, 2012

Quote of the Day: The Folly of Measuring Happiness

What the economists could measure pretty easily, though, was the money you have for buying sandwiches or paying the rent. Income is not your happiness and doubling it will not make you twice as happy—but it does measure your capability for action.

That’s from a lengthy critique, by Professor and author Deirdre McCloskey, on experts who fallaciously attempt to “engineer a happy society”

Tuesday, June 12, 2012

Quote of the Day: Economics is a Display of Abstract Reasoning

Economics, like logic and mathematics, is a display of abstract reasoning. Economics can never be experimental and empirical. The economist does not need an expensive apparatus for the conduct of his studies. What he needs is the power to think clearly and to discern in the wilderness of events what is essential from what is merely accidental.

That’s from the great Ludwig von Mises from his magnum opus Human Action. (hat tip Mises Blog).

Friday, May 25, 2012

Is ASEAN Resilient from Euro Debt Woes?

A World Bank economist declares ASEAN as "resilient" to the shocks from the Eurozone

Reports the Bloomberg,

Economies in the Association of Southeast Asian Nations are “resilient” to Europe’s sovereign debt woes, with governments having room for monetary and fiscal policy changes, World Bank Managing Director Sri Mulyani Indrawati said.

“For countries, especially Asean countries who are very resilient to the crisis, they still have the ability to maneuver from their own policy space, whether this is on a fiscal side or a monetary side,” Sri Mulyani said in an interview in Tokyo yesterday. “That’s very important.”

Asian policy makers are under renewed pressure to support growth as the world grapples with the threat of a Greek exit from the euro. Greece’s political impasse has deepened the European crisis and sent Asian currencies and stocks tumbling, adding to the uncertain outlook for exports and growth.

Really?

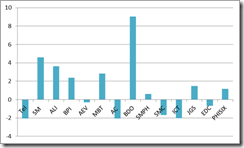

The panic in the Eurozone have partly incited the slump in global equity markets. Europe’s Stox50 has led the recent market rout which spread to ASEAN (ASEA) and other global benchmarks, such as the S&P and Emerging Markets (EEM).

I say “partly” because it would seem misguided to fixate solely at the Eurozone as the key contributing factor in driving the conditions of the global financial markets, as well as, the global economy.

The overall doldrums of global equity markets, possibly includes the China factor and perhaps uncertainty over US monetary policies and or US politics among many others

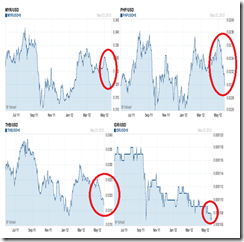

Yet the transmission from current shocks has likewise become evident in the region’s currencies. The the ringgit, the peso, the baht and the rupiah (left to right) have been conjointly whacked.

Add to this picture, the weakening of global commodity prices.

In short, seen from the actions of financial markets, there hardly has been evidence to support claims of “resiliency” or innuendos of “decoupling”.

Of course, actions in the financial markets may not exhibit the performance of the real economy as had been the case of 2007-2008.

But my point is that it would seem as an appeal to the heuristic and oversimplification of analysis to project on so-called 'resiliency' when the extent of uncertainty have yet to be identified and ascertained in today’s complex and vastly interconnected world.

As the great Professor Ludwig von Mises explained,

Economics does not allow of any breaking up into special branches. It invariably deals with the interconnectedness of all the phenomena of action.

Tuesday, May 15, 2012

Quote of the Day: Blinded by Science

Even some from the mainstream gets it.

Finance is often said to suffer from Physics Envy. This is generally held to mean that we in finance would love to write out complex equations and models as do those working in the field of Physics. There are certainly a large number of market participants who would love this outcome.

I believe, though, that there is much we could learn from Physics. For instance, you don’t find physicists betting that a feather and a brick will hit the ground at the same time in the real world. In other words, they are acutely aware of the limitations imposed by their assumptions. In contrast, all too often people seem ready to bet the ranch on the flimsiest of financial models.

Someone intelligent (if only I could remember who!) once opined that rather than breaking the sciences into the usual categories of “Hard” and “Soft,” they should be split into “Easy” and “Difficult.” The “Hard” sciences are generally “Easy” thanks to the ability to perform repeated controlled experiments. In contrast, the “Soft” sciences are “Difficult” because they involve trying to understand human behaviour.

Put another way, the atoms of the feather and brick don’t try to outsmart and exploit the laws of physics. Yet financial models often fail for exactly this reason. All financial model underpinnings and assumptions should be rigorously reviewed to find their weakest links or the elements they deliberately ignore, as these are the most likely source of a model’s failure.

That’s from GMO’s James Montier (source Zero Hedge).

Mr. Montier also discusses the psychological aspects of people’s predisposition for mathematical or science based models: particularly “complexity to impress” (The penchant to signal “intelligence” to acquire social acceptance—my opinion) and “defer to authority”.

And here is the warning against being blinded by science from the dean of the Austrian school of economics the great Professor Murray N. Rothbard,

Not only measurement but the use of mathematics in general in the social sciences and philosophy today, is an illegitimate transfer from physics. In the first place, a mathematical equation implies the existence of quantities that can be equated, which in turn implies a unit of measurement for these quantities. Second, mathematical relations are functional; that is, variables are interdependent, and identifying the causal variable depends on which is held as given and which is changed. This methodology is appropriate in physics, where entities do not themselves provide the causes for their actions, but instead are determined by discoverable quantitative laws of their nature and the nature of the interacting entities. But in human action, the free-will choice of the human consciousness is the cause, and this cause generates certain effects. The mathematical concept of an interdetermining "function" is therefore inappropriate.

Friday, May 04, 2012

Quote of the Day: Mathematics Diminishes Economics

Mathematics, seemingly so precise, inevitably ends in reducing economics from the complete knowledge of general principles to arbitrary formulas which alter and distort the principles and hence corrupt the conclusions.

That’s from the great Murray N. Rothbard, who discussed the origins of the methodology of praxeology or human action from J.B. Say.

Outside the promotion of self-esteem, mathematics via econometrics and or statistics serves as intellectual cover to what is truly heuristics based biases.

Sunday, April 22, 2012

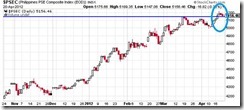

Bullish Signal Confirmed as Phisix Sets New Record High

As I said last week, rising stock prices on a slew of internal and external bad news usually signifies as bullish indicators.

Here is what I wrote,

Foreign trades have also been sluggish with paltry changes over the last two weeks. Yet, despite the marginal actions by foreign investors, the Philippine Peso posted modest advances.

So essentially, last week’s action suggest of a rotation away from second and third tier issues back into the blue chips.

Yet I expect to see normalization of trading activities in terms of Peso volume which should undergird either the current consolidation phase or a fresh attempt to break away into new highs.

When the markets to defy the spate of bad news that signifies as a bullish signal.

Speaking of luck that’s exactly how it turned out the week!

First of all, the Phisix broke into fresh nominal record high even as the Scarborough issue has not been resolved.

As an aside, I would reiterate that for whatever innuendos about resources alluded by media, the Spratlys-Scarborough issue has not been about oil or commodities but more about unspecified political agenda which could be related to promoting arm exports or ploys to divert the public from festering real political issues or as justifications for inflationism.

I might add that the heated kerfuffle over territorial claims has expanded to cover the disputed Senkaku Islands, where Japanese authorities has jumped into the fray to announce of their acquisition of the island from the “owners”. This has resulted to a political backlash from Chinese authorities.

Given that politics in Japan seems to have been entangled with monetary policies, Japan’s recent provocative foreign policy posture could be portentous of Bank of Japan’s (BoJ) moves to expand its stimulus (via asset purchases), perhaps under the pretext of increasing military spending.

Going back to the Philippine stock market, given the record performance, we can’t discount the prospects of interim ‘profit taking’. But again I think momentum still favors the bulls.

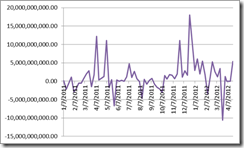

Second, net foreign trade has turned significantly positive mostly bolstered by the GT Capital’s listing last Friday

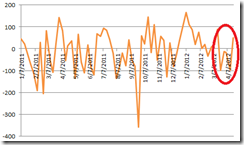

Third market breadth also turned positive…

…as advancing issues took the driver’s seat anew.

If the positive momentum, which is likely to be reflected on the actions of the benchmark Phisix should persist, then we would see a broadening of gains over the broader market.

Most of the gains had been concentrated on the sectoral leaders since the start of the year, particularly, property, finance and holding companies or mother units of the former two.

I think that rotation will occur among the heavyweights as the current leaders may take a short reprieve.

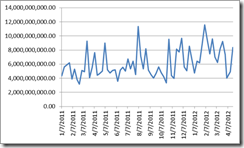

Importantly the Peso volume DID normalize…

Daily traded Peso volume (averaged weekly) surged amidst as last week’s record breakout.

I see a continuity of the bullish or upside momentum of the financial markets which may last until the first semester of the year, where central bank steroids are due for expiration. While this may lead to an interim volatile phase perhaps backed by deteriorating economic or financial conditions in Europe or in China, we should expect downside volatility to be met by aggressive responses from central bankers. This feedback mechanism between markets and central bank interventions has not only been made to condition the markets, but has become the central bankers’ guiding policy of crisis management.

BSP’s Euthanasia of the Rentier

This dogmatic approach has been assimilated even by the local central bank, the Bangko Sentral ng Pilipinas (BSP).

Just last week, domestic interest rate policies have been kept at “historics” lows whose levels were justified as “sufficient to help boost economic activity and avoid potential spike in inflation amid volatile global oil prices”.

The BSP blames external factors as secondary variables of domestic inflation through a “likely rise in foreign portfolio investments and higher prices of electricity amid petitions for further power-rate increases.”

In reality, interest rates policies that has driven been to superficially “historic” lows that are financed by “money from thin” are the real cause of inflation

Austrian economist Dr. Frank Shostak explains,

The exchange of nothing for something that the expansion of money out of "thin air" sets in motion cannot be undone by an increase in the production of goods. The increase in money supply — i.e., the increase in inflation — is going to set in motion all the negative side effects that money printing does, including the menace of the boom-bust cycle, regardless of the increase in the production of goods.

And symptoms from BSP’s actions have been manifesting on the domestic credit markets. Notes the Inquirer.net

True enough, credit growth so far this year has been robust. As of February, data from the central bank showed that outstanding loans by universal and commercial banks grew by 18 percent year on year to P2.74 trillion. The BSP said the increase in bank lending benefited both individual and corporate borrowers.

A boost in bank lending is not “a one-size-fits-all” thing.

A boost in bank lending that has NOT been prompted by consumer preferences but from the skewing price signals due to political “money printing” policies designed to achieve quasi permanent booms leads to bubble cycles.

And what is deemed as “robust growth” by media are, in reality, signs of malinvestments and speculative diversion of productive capital. Some of these borrowed money will find their way to the local stock exchange, real estate properties, bond markets and much of which will be diverted into consumption spending or misallocated capital that leads to capital consumption.

And adding to the policies of the promotion of “aggregate demand” or “the euthanasia of the rentier” through “historic” low interest rates has been the announcement by the local version of the welfare state, the Social Security System (SSS), to lower interest rates and to increase loanable amount to members for housing loans.

Apparently, little has been learned by local political authorities of the lessons from the latest US centric political homeownership crisis that has diffused across the world and whose phantom continues to haunt the political economies of the developed world.

Noble intentions eventually get burned by politically instituted economically unfeasible projects.

Sell In May?

Fund manager David Kotok of Cumberland Advisors rightly points out the differences in the current environment from yesteryears, such that seasonal statistical patterns like Sell in May and Go Away may not be relevant to current conditions.

History shows that ‘Sell in May and go away’ has applied when the Federal Reserve was in a tightening mode during the six-month span from May to November. If the Fed was actively raising interest rates, withdrawing or constricting credit, imposing additional reserve requirements, or taking an action that was of a tightening mode, stock markets were usually punished in that six-month period.

When we did the study we examined what the Fed did, not what it said. We used actual changes in the Federal Funds rate to determine whether the Fed was tightening, easing, or neutral. Once the Fed took the interest rate to zero at the end of 2008, the historical data series lost its power for forecast purposes, since the Fed cannot take the rate below zero. However, we believe the concept is valid even if the present measurement problem exists.

It is human action and NOT charts (for example the failed death cross pattern of the S&P 500 of 2011) or seasonal patterns, based on either statistics or historical outcomes, that determines future outcomes.

The substantial impact of central bank policies on the markets has been through the manipulation of money. Since money is a medium of exchange which represents half of every transactions people make, tinkering with money has greater tendency to alter or reshape the incentives of people.

Manipulation of money through inflationism tend to narrow people’s time orientation or increases time preferences which has been and will be ventilated through several attendant actions, as higher inclination to take debt, misdirection of investments via distorted price signals, consumption based lifestyles or pejoratively known as “consumerism”, greater risk appetite or higher inclinations towards speculation.

So when major central banks combine to tamper with money, which among themselves account for about 85% of the capital markets of the world, we can expect participants of the marketplace to adjust accordingly to these newly implemented policies. Current policies have been engendering asset inflation, which in reality has been designed to keep the flagging banking system and the unsustainable welfare states afloat.

Even emerging market central banks, as the Philippines have employed the same policies which are often justified from “growth risk”. Yet despite the standardization of monetary policies, the differences in market outcomes have been resultant to variances of people’s actions relative to the idiosyncratic structural compositions of each political economy.

In addition, while monetary policies have significant effects on people’s incentives other policies also matters such as fiscal policies and tax regimes, rule of law and protection of property rights, trade and economic freedom, and regulatory policies.

The bottom line is all these policies would have a greater impact to people’s action than simply reading numbers and history as basis for predictions.

As the great Ludwig von Mises wrote in Theory and History

Historicism was right in stressing the fact that in order to know something in the field of human affairs one has to familiarize oneself with the way in which it developed. The historicists' fateful error consisted in the belief that this analysis of the past in itself conveys information about the course future action has to take. What the historical account provides is the description of the situation; the reaction depends on the meaning the actor gives it, on the ends he wants to attain, and on the means he chooses for their attainment...

The historical analysis gives a diagnosis. The reaction is determined, so far as the choice of ends is concerned, by judgments of value and, so far as the choice of means is concerned, by the whole body of teachings placed at man's disposal by praxeology and technology.

Along the lines of the Professor von Mises, my former idol the exemplary stock market guru but who now has been converted to a crony, Warren Buffett, once lashed out at the tendency of people to anchor or rely heavily on past performance. The ailing 81 year old billionaire Mr. Buffett said

If past history was all there was to the game, the richest people would be librarians.

Tuesday, April 17, 2012

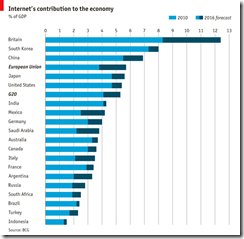

Understating the Internet’s Contribution to the Global Economy

The Economist writes,

MUCH of the world may still (or again) be in recession, but the internet keeps growing—and so does its economic weight. In the G20 countries, the internet economy will grow at more than 10% annually for the next five years and by 2016 reach $4.2 trillion, or 5.3% of GDP—up from $2.3 trillion and 4.1% in 2010, according to a recent report by the Boston Consulting Group (BCG). But there are big differences between countries. Britain leads the pack. Its internet economy is now bigger than its construction and education sectors, mainly thanks to the popularity of e-commerce. To paraphrase Adam Smith, the country has become a nation of digital shopkeepers. China and, to some extent, India stand out thanks to internet-related exports in goods and services, respectively. South Korea and Japan are also strong in both e-commerce and exports. Europe punches below its weight, mainly because its internet economy is held back by a lack of a single digital market. If the European Commission succeeds in creating one, the old continent may be able to pull ahead of the new one by 2016.

My research is done principally through the internet and this has been facilitating much of my transactions executed on a traditional non-internet based platform. The newsletters I send to my clients have also been internet based.

Aside from my newsletters, the web perhaps also plays a role in the information acquisition of my clients for them to decide on their financial markets transactions—but the degree of application may likely to be different.

Have these been captured by statistics? Apparently not.

Attempts to quantify the internet’s contribution to the economy has been grossly misleading for the simple reason that much of what the internet contributes—access to information, knowledge, connectivity, communications and the ensuing productivity it brings—cannot be measured.

Testament to these has been the impact of the internet to the Arab Spring or popular Middle revolts of last year.

Professor of business and technology Soumitra Dutta in an interview with Knowledge@wharton says that the internet has enabled changes in people’s social relationships and norms that has contributed to last year’s Arab Spring upheavals.

Technology has empowered individual citizens, and of course this pushes against various constraints, whether it is political constraints, or gender constraints. The same thing is happening in the rest of the world, by the way, the Middle East is not unique in this. So what this calls for is not a retreat from technology, but a more enlightened approach to understanding how technology interweaves with social values and norms. Eventually, social norms are going to be influenced and changed by widespread use of technology, but that's the way society largely develops.

And to repeat a quote which I earlier posted from Jeffrey Tucker,

That the Internet has vastly increased productivity is the understatement of the century. The Internet has given birth to products and services that have never before existed — search, online advertising, video games, web-based music services, online garage sales, global video communications. Moreover, the main beneficiaries have been old-line industries that seem to have nothing to do with the Internet.

The most difficult-to-quantity aspect of digital media has been its contribution to the sharing of ideas and communication throughout the world. This has permitted sharing and learning as never before, and these might be the single most productive activity in which the human person can ever participate. The acquisition of information is the precondition for all investing, entrepreneurship, rational consumption, the division of labor and trade…

No amount of empirical work can possibly encapsulate the contribution of the Internet to our lives today. No supercomputer could add it all up, account for every benefit, every increase in efficiency, every new thing learned that has been turned to a force for good. Still, people will try. You will know about their claims only thanks to the glorious technology that has finally achieved that hope for which humankind has struggled mightily since the dawn of time.

The appeal to quantify the internet into statistical accounts falls into the same fallacious trap as in the treatment of human action as natural sciences.

As Mark Twain scornfully said,

Lies, damned lies and statistics.

Thursday, April 12, 2012

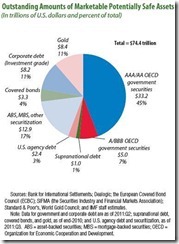

The Myth of ‘Safe Assets’

The IMF is concerned about the potential shortage of supply of “safe assets”

Writes the Wall Street Journal Blog

Worries about nations’ fiscal health could cut the world’s supply of “safe” government debt by 16% in the next four years, the International Monetary Fund said Wednesday.

The diminishing supply comes even as demand rises for safe assets such as high-quality corporate bonds and sovereign debt, which many banks and investors need amid market uncertainty and regulatory changes.

The shrinking pool of safe assets could create more worries about financial stability, the IMF said.

“Safe asset scarcity will increase the price of safety and compel investors to move down the safety scale as they scramble to obtain scarce assets,” the fund said in its Global Financial Stability Report. “It could also lead to more short-term spikes in volatility, and shortages of liquid, stable collateral that acts as the ‘lubricant’ or substitute of trust in financial transactions.”

The notion of ‘safe assets’, which rest on the assumption of ‘intrinsic value’, is really an illusion. It has been a myth repeatedly peddled, inculcated and propagandized for the public to accept the falsehood of the necessity of the welfare-warfare state. The power to tax does not guarantee economic and financial feasibility and consequently ‘security’.

Safety does not emerge out of government decree, as the recent crisis or as history shown whether applied to government bonds or to money.

Instead, valuations are subjectively determined by acting man or by individuals.

The great Professor Ludwig von Mises explained

Value is the importance that acting man attaches to ultimate ends. Only to ultimate ends is primary and original value assigned. Means are valued derivatively according to their serviceableness in contributing to the attainment of ultimate ends. Their valuation is derived from the valuation of the respective ends. They are important for man only as far as they make it possible for him to attain some ends.

Value is not intrinsic, it is not in things. It is within us; it is the way in which man reacts to the conditions of his environment.

Neither is value in words and doctrines. It is reflected in human conduct. It is not what a man or groups of men say about value that counts, but how they act. The oratory of moralists and the pompousness of party programs are significant as such. But they influence the course of human events only as far as they really determine the actions of men.

Put differently, to paraphrase a popular axiom, safe assets are in the eyes of the beholder.

Take for instance gold.

Gold was essentially an ignored asset at the start of the new millennium, however following 11 consecutive years of price increases, the public’s perception has substantially changed. Now gold has been incorporated as part of the safe asset list of the IMF.

Through history, gold’s perceived safety arises from the money attributes it possesses compared with, or relative to, fiat currencies.

As I previously wrote,

paper currencies are basically IOUs issued and stamped by governments as “legal tender” and backed by nothing but FAITH in the issuer. Because paper money is an IOU, it bears counterparty risks.

Where money as a medium of exchange requires these characteristics: durability, divisibility, scarcity, portability, uniformity and acceptability, unlimited issuance of paper money essentially diminishes the moneyness quality of paper currencies. As we cited earlier given the massive and full scale deployment of the printing press globally, such the raises the risk of a potential of disintegration of the present financial architecture.

However gold may not permanently be a refuge asset either. A serendipitous discovery of a process that enables gold to be produced abundantly would lead to a loss of the current attributes and thereby the subsequent loss of gold’s moneyness. And in the world of rapid advances in technology this is something we cannot discount.

To quote Dr. Frank Shostak

If the increase in the supply of gold were to persist, people would likely abandon gold as the medium of exchange and adopt another commodity.

Bottom line: Safety is matter of subjective individual valuations and definitely not decreed by politicians and or the bureaucracy.

Chart from Dr. Ed Yardeni

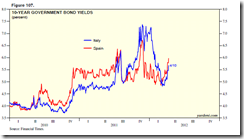

To the contrary, what government declares as “safe” are likely to be the riskiest assets. A good example is the ongoing crisis in the Eurozone where toxicity has surfaced out of supposed “safe” debt instruments.

It has been the nature of the state to abuse on their powers, by plundering their citizenry through arbitrary laws, or policies of financial repression (includes inflationism), that ultimately undermines the quality of government issued papers.

In short, self-destructive actions cannot be reckoned as ‘risk free’ which serves as a paradoxical, or must I add absurd, proposition.