If you suspected that mainstream economists are useless at the job of seeing a crisis in advance, you would be right. Dozens of studies show that economists are completely incapable of forecasting recessions. But forget forecasting. What's worse is that they fail miserably even at understanding where the economy is today. In one of the broadest studies of whether economists could predict recessions and financial crises, Prakash Loungani of the International Monetary Fund wrote very starkly, "The record of failure to predict recessions is virtually unblemished." This was true not only for official organizations like the IMF, the World Bank, or government agencies but for private forecasters as well. They're all terrible. Loungani concluded that the "inability to predict recessions is a ubiquitous feature of growth forecasts." Most economists were not even able to recognize recessions once they had already started.In plain English, economists don't have a clue about the future.If you think the Fed or government agencies know what is going on with the economy, you're mistaken. Government economists are about as useful as a fork in a sugar bowl. Their mistakes and failures are so spectacular you couldn't make them up if you tried…Why do people listen to economists anymore? Scott Armstrong, an expert on forecasting at the Wharton School of the University of Pennsylvania, has developed a "seer-sucker" theory: "No matter how much evidence exists that seers do not exist, suckers will pay for the existence of seers." Even if experts fail repeatedly in their predictions, most people prefer to have seers, prophets, and gurus with titles after their names tell them something—anything at all—about the future.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, November 21, 2013

Quote of the Day: Economists are about as useful as a fork in a sugar bowl

Sunday, October 14, 2012

Signs of the Accession of Austrian Economics in China

Three years ago, Keynesianism was official policy. The 2008 financial crisis had Beijing gloating over the failure of the free-market "Washington Consensus" and touting the "China Model" of government intervention. Keynesianism fit the statist zeitgeist and Beijing then suffered an export slump, so the government allocated $3.5 trillion—or about 50% of gross domestic product—in bank loans and direct spending.Mr. Zhang's academic colleagues were all praise for the "China Model," but in 2009 he was giving speeches entitled "Bury Keynesianism." Then a top administrator at Peking University, where he now teaches economics, he argued that since the financial crisis was caused by easy money, it couldn't be solved by the same. "The current economy is like a drug addict, and the prescription from the doctor is morphine, so the final result will be much worse," he said.

He invoked the ideas of the late Nobel laureate Friedrich Hayek and the Austrian School of Economics to argue that if the economy weren't allowed to adjust on its own, China's minor bust would be followed by a bigger one. He also advocated doing away with existing distortions such as the monopolies enjoyed in many industries by state-owned enterprises.Those were the days when China was fast becoming the world's second-largest economy (growth in one 2010 quarter crossed 11% on an annual basis), so the establishment was in no mood to listen. "When I criticized the central government's stimulus policy, many senior officials were not happy," Mr. Zhang says. It might not have helped that at last year's World Economic Forum in China he called the government's powerful National Development and Reform Commission "a bunch of smart people doing something really stupid."Ultimately, Beijing's stimulus fed a false investment boom that stoked asset bubbles—then the morphine wore off while the government tightened. Officials claim the economy grew at 7.6% year-on-year between April and June this year. Skeptics think the real number is closer to 4%. (One London research house says 1%.) Meanwhile, industries dominated or favored by the state, such as steel or solar power, are idling from overcapacity. Countless sheets of copper are reportedly stacked in warehouses, blocking doorways and exemplifying Hayek's notion of "malinvestment."In other words, the stimulus was a poster child for Mr. Zhang's Austrian theories. And the sheer size of the failure suddenly has people paying attention. "The Keynesian policy didn't deliver what it promised," he says, so "more and more people realize that . . . when the government makes investment [in] something that's useless, recession will come."

"We human beings always seek happiness," says Mr. Zhang. "Now there are two ways. You make yourself happy by making other people unhappy—I call that the logic of robbery. The other way, you make yourself happy by making other people happy—that's the logic of the market. Which way do you prefer?"

Wednesday, June 06, 2012

The Essence of Keynesian Economics

The following is an excerpt from a speech/keynote address by Dr. Richard Ebeling (hat tip Bob Wenzel) [bold emphasis mine, italics original]

The General Theory of Employment, Interest and Money was published on February 4, 1936. The essence of Keynes’s theory was to show that a market economy, when left to its own devices, possessed no inherent self-correcting mechanism to return to “full employment” once the economic system has fallen into a depression.

At the heart of his approach was the belief that he had demonstrated an error in Say’s Law. Named after the nineteenth-century French economist Jean-Baptiste Say, the fundamental idea is that individuals produce so they can consume. An individual produces either to consume what he has manufactured himself or to sell it on the market to acquire the means to purchase what others have for sale.

Or as the classical economist David Ricardo expressed it, “By producing, then, he necessarily becomes either the consumer of his own goods, or the purchaser and consumer of the goods of some other person . . . Productions are always bought by productions, or by services; money is only the medium by which the exchange is effected.”

Keynes argued that there was no certainty that those who had sold goods or their labor services on the market will necessarily turn around and spend the full amount that they had earned on the goods and services offered by others. Hence, total expenditures on goods could be less than total income previously earned in the manufacture of those goods. This, in turn, meant that the total receipts received by firms selling goods in the market could be less than the expenses incurred in bringing those goods to market. With total sales receipts being less than total business expenses, businessmen would have no recourse other than to cut back on both output and the number of workers employed to minimize losses during this period of “bad business.”

But, Keynes argued, this would merely intensify the problem of unemployment and falling output. As workers were laid off, their incomes would necessarily go down. With less income to spend, the unemployed would cut back on their consumption expenditures. This would result in an additional falling off of demand for goods and services offered on the market, widening the circle of businesses that find their sales receipts declining relative to their costs of production. And this would set off a new round of cuts in output and employment, setting in motion a cumulative contraction in production and jobs.

Why wouldn’t workers accept lower money wages to make themselves more attractive to rehire when market demand falls? Because, Keynes said, workers suffer from “money illusion.” If prices for goods and services decrease because consumer demand is falling off, then workers could accept a lower money wage and be no worse off in real buying terms (that is, if the cut in wages was on average no greater than the decrease in the average level of prices). But workers, Keynes argued, generally think only in terms of money wages, not real wages (that is, what their money income represents in real purchasing power on the market). Thus, workers often would rather accept unemployment than a cut in their money wage.

If consumers demand fewer final goods and services on the market, this necessarily means that they are saving more. Why wouldn’t this unconsumed income merely be spent hiring labor and purchasing resources in a different way, in the form of great¬er investment, as savers have more to lend to potential borrowers at a lower rate of interest? Keynes’s response was to insist that the motives of savers and investors were not the same. Income-earners might very well desire to consume a smaller fraction of their income, save more, and offer it out to borrowers at interest. But there was no certainty, he insisted, that businessmen would be willing to borrow that greater savings and use it to hire labor to make goods for sale in the future.

Since the future is uncertain and tomorrow can be radically different from today, Keynes stated, businessmen easily fall under the spell of unpredictable waves of optimism and pessimism that raise and lower their interest and willingness to borrow and invest. A decrease in the demand to consume today by income-earners may be motivated by a desire to increase their consumption in the future out of their savings. But businessmen cannot know when in the future those income-earners will want to increase their consumption, nor what particular goods will be in greater demand when that day comes. As a result, the decrease in consumer demand for present production merely serves to decrease the business¬man’s current incentives for investment activity today as well.

If for some reason there were to be a wave of business pessimism resulting in a decrease in the demand for investment borrowing, this should result in a decrease in the rate of interest. Such a decrease because of a fall in investment demand should make savings less attractive, since less interest income is now to be earned by lending a part of one’s income. As a result, consumer spending should rise as savings goes down. Thus, while investment spending may be slackening off, greater consumer spending should make up the difference to assure a “full employment” demand for society’s labor and resources.

But Keynes doesn’t allow this to happen because of what he calls the “fundamental psychological law” of the “propensity to consume.” As income rises, he says, consumption spending out of income also tends to rise, but less than the increase in income. Over time, therefore, as incomes rise a larger and larger percentage is saved.

In The General Theory, Keynes listed a variety of what he called the “objective” and “subjective” factors that he thought influenced people’s decisions to consume out of income. On the “objective” side: a windfall profit; a change in the rate of interest; a change in expectations about future income. On the “subjective” side, he listed “Enjoyment, Shortsightedness, Generosity, Miscalculation, Ostentation and Extravagance.” He merely asserts that the “objective” factors have little influence on how much to consume out of a given amount of income—including a change in the rate of interest. And the “subjective” factors are basically invariant, being “habits formed by race, education, convention, religion and current morals . . . and the established standards of life.”

Indeed, Keynes reaches the peculiar conclusion that because men’s wants are basically determined and fixed by their social and cultural environment and only change very slowly, “The greater . . . the consumption for which we have provided in advance, the more difficult it is to find something further to provide for in advance.” That is, men run out of wants for which they would wish investment to be undertaken; the resources in the society—including labor—are threatening to become greater than the demand for their employment.

Keynes, in other words, turns the most fundamental concept in economics on its head. Instead of our wants and desires always tending to exceed the means at our disposal to satisfy them, man is confronting a “post-scarcity” world in which the means at our disposal are becoming greater than the ends for which they could be applied. The crisis of society is a crisis of abundance! The richer we become, the less work we have for people to do because, in Keynes’s vision, man’s capacity and desire for imagining new and different ways to improve his life is finite. The economic problem is that we are too well-off.

As a consequence, unspent income can pile up as unused and uninvested savings; and what investment is undertaken can erratically fluctuate due to what Keynes called the “animal spirits” of businessmen’s irrational psychology concerning an uncertain future. The free market economy, therefore, is plagued with the constant danger of waves of booms and busts, with prolonged periods of high unemployment and idle factories. The society’s problem stems from the fact that people consume too little and save too much to assure jobs for all who desire to work at the money wages that have come to prevail in the market, and which workers refuse to adjust downward in the face of any decline in the demand for their services.

Only one institution can step in and serve as the stabilizing mechanism to maintain full employment and steady production: the government, through various activist monetary and fiscal policies.

In Keynes’s mind the only remedy was for government to step in and put those unused savings to work through deficit spending to stimulate investment activity. How the government spent those borrowed funds did not matter. Even “public works of doubtful utility,” Keynes said, were useful: “Pyramid-building, earthquakes, even wars may serve to increase wealth,” as long as they create employment. “It would, indeed, be more sensible to build houses and the like,” said Keynes, “but if there are political or practical difficulties in the way of this, the above would be better than nothing.”

Nor could the private sector be trusted to maintain any reasonable level of investment activity to provide employment. The uncertainties of the future, as we saw, created “animal spirits” among businessmen that produced unpredictable waves of optimism and pessimism that generated fluctuations in the level of production and employment. Luckily, government could fill the gap. Furthermore, while businessmen were emotional and shortsighted, the State had the ability to calmly calculate the long run, true value and worth of investment opportunities “on the basis of the general social advantage.”

Indeed, Keynes expected the government would “take on ever greater responsibility for directly organizing investment.” In the future, said Keynes, “I conceive, therefore, that a somewhat comprehensive socialization of investment will prove the only means of securing an approximation to full employment.” As the profitability of private investment dried up over time, society would see “the euthanasia of the rentier” and “the euthanasia of the cumulative oppressive power of the capitalist” to exploit for his own benefit the scarcity of capital. This “assisted suicide” of the interest-earning and capitalist groups would not require any revolutionary upheaval. No, “the necessary measures of socialization can be introduced gradually and without a break in the general traditions of the society.”

This is the essence of Keynes’ economics.

Read more about the policy influences from Keynesian economics by Dr. Ebeling here

I would add that the Keynesian economics has been fraught with many logical fallacies but had been gained wide acceptance due to its math models or aggregate driven analysis.

Nonetheless one standout among the many logical fallacies would be Begging the Question where (Nizkor Project)

Begging the Question is a fallacy in which the premises include the claim that the conclusion is true or (directly or indirectly) assume that the conclusion is true

The embedded conclusion is that government is the elixir while the market is the problem, thus, all premises have been adjusted to conform to these even if the logical sequence of their argument becomes self-contradictory (yes thus the crisis of abundance!)

In short, the cart before the horse reasoning.

Keynesianism is essentially heuristics but garbed with mathematical formalism.

So when practitioners of the faith are caught with their internal logical inconsistencies, they deliberately resort to verbal prestidigitation (usually by using moral high ground of social justice based on short term solutions) as an escape mechanism.

Tuesday, May 29, 2012

Rumored Stimulus for China Boosts Asian Markets

Rumors about another massive ‘stimulus’ from China has reportedly bolstered the Asian markets.

Reports the Marketwatch.com,

China is set to ramp up stimulus spending to help stabilize the economy, with a program of interest-rate cuts and infrastructure-related spending being planned, according to analysts, who caution the program won’t be big enough to bring about a rapid turnaround in the slowing mainland economy.

In a research note Monday, Credit Suisse said the new policy emerged from a meeting by the State Council, or China’s cabinet, last week when Premier Wen Jiabao urged “greater emphasis on growth.”

“We believe that government has started a new round of fiscal stimulus,” Credit Suisse analyst Dong Tao wrote in a note to investors.

Last week, the central government unveiled a 2 trillion yuan ($316 billion) credit line to the Ministry of Railways, 170 billion yuan in subsidies to environmental projects and about 78 billion yuan in support to social-housing projects, according to Credit Suisse.

Local governments were also encouraged to submit infrastructure project proposals for approval before the end of June, with the government promising to speed up funding support, according to Credit Suisse.

“All of these moves seem to suggest that the Chinese government has become more active in dealing with growth downturn,” Tao said.

Rumors are one thing. Real actions are more important.

Considering that the euro and China’s markets have been oversold, rumors may indeed provide rationalization to an oversold bounce.

Let me repeat what I wrote last Sunday on China,

Again, developments in China will MAINLY be hinged on the response by political authorities on the unfolding economic events.

I’d prefer to see the Chinese government make good on such a rumor before making my move.

The risk is that official actions may be less than the expected stimulus which may incite another intense downdraft.

A report suggested that political consensus over more stimulus remains uncertain. According to an Op Ed at the Sydney Morning Herald

Commentary in China, though, is far from unanimous that Beijing's leadership is ready - and able - to kick the economy up a gear.

A senior Chinese economic official, indeed, has said that the country is unlikely to start another round of massive stimulus package to spur growth.

And like Pavlov’s Dogs, this should be added proof of the intense addiction to steroids by global financial markets which means sharply volatile days ahead, again in both directions.

And this also represents further evidence that China's economy, mainly dependent on Keynesian policies, has been a ballooning bubble.

Be careful out there.

Tuesday, February 07, 2012

Japan’s Bubble Legacy: Airports Bleeding Taxpayers Dry

Japan’s financially floundering airports represent as classic examples of Keynesian policy of “socialization of investments” gone awry intertwined with the dynamics of a busted bubble.

From the Japan Times

Japan has 98 airports, and most of them are operating in the red as a result of exaggerated demand forecasts and rampant, costly and arguably pork-barrel construction projects.

The transport ministry hopes to mitigate the problem by selling off the management rights to 27 state-owned airports as soon as 2014. The ministry also plans to issue an airport reform blueprint by summer

And guess which among Japan’s airport business remains profitable?

Again from the same Japan Times article, [bold emphasis mine]

In most cases, the central and local governments manage the runways, aircraft aprons and other regulated facilities while private companies or joint public-private ventures run the terminal buildings and parking lots. Of the 98 airports, 28 are run by the central government and 67 by local governments…

Not all but most facilities specifically linked to flight operations are running at a loss, even though most terminal buildings and parking lots are turning profits.

Most of the income to cover the operations of runways, aprons and other aircraft-related facilities, however, comes from landing fees, which have suffered for years at airports nationwide amid the sluggish economy and lack of passengers.

And how the losses came about? [bold emphasis mine]

One key reason is overcapacity. The government built too many airports based on overrated demand projections, experts say.

Because airports are considered public infrastructure, profit is not the only consideration taken into account when building them.

The nation has many remote islands whose only transportation link to the outside world is by air, even when demand for travel is minimal and steers aviation operations into the red.

But the situation was compounded in large part by politics, with decisions made to build airports in rural, virtually no-traffic areas where turning a profit was never a realistic proposition but just a way to get voters government-backed jobs from more pork-barrel projects.

Another drawback has been the "pool system" of state budgetary allocation, a one-size-fits-all policy for financing airport operations that did little to clarify which airports were at risk of habitually losing money, experts say.

The more or less blanket operations of all state-run airports provided little incentive for individual hubs to seek more efficient operations, Sayuri Hirai, a senior consultant at Daiwa Institute of Research, told The Japan Times.

The easiest way to spend money is to spend other people’s money. Since politicians and their bureaucracy are not held accountable and are not disciplined by profits and losses and lack stakeholdings for their decisions, miscalculations, inefficient allocations and wastages are the common or typical outcome. This is exactly what has transpired with Japan’s airports which have been bleeding Japanese taxpayers dry. Hence the recent thrust to privatize parts of these.

Besides, political actions have mostly been about short term vote enhancing considerations, hence the proclivity to undertake on grand projects regardless of their feasibility such as “build airports in rural, virtually no-traffic areas”.

Not included in the report are the influences by vested interest groups on the decisions of policymakers, which again makes government spending sensitive to the allures of venality.

Moreover, politicians have not been incented to acquire or don't possess the knowledge to take upon viable projects for the same reasons—they are not subject to market forces. There hardly has been any efforts on these, as evidenced by “one-size-fits-all” financing.

Another reason for such massive scale of miscalculation and malinvestments had been that the real estate boom days may have influenced the decision of policymakers. Japan's bubble had been fueled by a credit boom that had been designed to offset the US dictated Japan's policy to appreciate the yen that gave the artificial impression of lasting prosperity which eventually was unmasked.

Also I would surmise that many of these projects had been from the pump priming or fiscal stimulus undertaken by the government to offset the economic decline. This again tells us how government dictated efforts results to resources mostly going down the drain.

As the great Ludwig von Mises wrote,

The fashionable panacea suggested, lavish public spending, is no less futile. If the government provides the funds required by taxing the citizens or by borrowing from the public, it abolishes on the one hand as many jobs as it creates on the other. If government spending is financed by borrowing from commercial banks, it means credit expansion and inflation. Then the prices of all commodities and services must rise, whatever the government does to prevent this outcome.

Apparently Japan fell for the enticements of interventionism and still endures the consequences for their sins.

Sunday, February 05, 2012

Quote of the Day: Pedestrian Economics

Keynesianism is itself adorned in magnificent scientific costume and make-up, and its practitioners have built for themselves elaborate games to play that cause them to think that they’re engaged in something more than pedestrian economics. They can shift IS-LM curves, as well as aggregate-demand curves; they can calculate multipliers (“balanced budget” and otherwise); they can impress hoi polli with mysterious terms such as “liquidity trap,” “marginal efficiency of capital,” and “marginal propensity to consume.” But through it all, they – at least when doing Keynesian economics – ignore the very heart of the economy, namely, the goo-gob-gillions of daily adjustments that individuals make to changes in their knowledge, and the smaller – yet still large – number of creative acts that people do daily in hopes of improving their economic prospects. Paying far too little attention to these micro-level matters (or – what is the same thing – assuming these micro-level matters to be fixed and given in ways that, by assumption, leave demand as the only available variable to affect the economy), Keynesians of course can build impressive models that show how exogenous changes in demand will do this or that to the economy.

But these models miss 99 percent of the relevant action – and they miss all of the action that pedestrian economists never become aware of. No pattern of sustainable specialization and trade was ever created by aggregate demand. And no such pattern can be explained or understood by using a method of analysis that focuses only on what, in the final analysis, are largely the consequences of people’s success or failure at establishing patterns of sustainable specialization and trade.

Professor Donald J. Boudreaux expounds on the structural flaws of the Keynesian methodology.

I’d further add that pedestrian economics is in reality, heuristics (mental short cuts) paraded as economic reasoning that has been clothed with math models (mostly used or intended to justify an underlying uneconomic political belief.)

Friday, January 20, 2012

Philippine Government Applies Keynesian Remedies, Boom Bust Cycle Ahead

The Philippine government will be applying Keynesian measures of “euthanasia of the rentier” and the “socialization of investments” to prop up economic “growth” (permanent quasi-booms)

The euthanasia of the rentier as reported by the Bloomberg

The Philippines cut interest rates for the first time since July 2009, joining emerging markets from Thailand to Indonesia in easing monetary policy as a deteriorating global economy threatens growth.

Bangko Sentral ng Pilipinas lowered the rate it pays lenders for overnight deposits by a quarter of a percentage point to 4.25 percent, according to a statement in Manila today. The decision was predicted by 13 of 17 economists in a Bloomberg News survey, with the rest expecting no change. The central bank maintained the reserve requirement ratio at 21 percent.

“The Philippine economy is likely to face external headwinds in 2012,” Governor Amando Tetangco said in the statement. “The benign inflation outlook allowed some scope for a reduction in policy rates to help boost economic activity and support market confidence.”

Asian policy makers are under mounting pressure to protect growth after the World Bank cut its global economic forecast this week, saying a recession in the euro region could exacerbate a slowdown in countries such as India and China. Lower borrowing costs and slowing price gains may aid Philippine President Benigno Aquino’s efforts to boost expansion as he increases spending and seeks investment for roads and airports.

Socialization of Investments, again from the Bloomberg

President Aquino is increasing spending this year to a record 1.83 trillion pesos ($42 billion) to help bolster growth to as much as 8 percent annually. The government also plans to offer as many as 16 projects to investors this year, compared with one contract awarded in 2011.

Ayala Corp., leading a consortium that won a contract last month to build a four-kilometer, four-lane paved toll road leading to provinces south of the capital, may bid for two road projects and a contract to run an airport, Managing Director Eric Francia said Dec. 15.

Aquino has won sovereign-rating upgrades from Fitch Ratings and Moody’s Investors Service after intensifying efforts to narrow the budget gap from a record 314 billion pesos in 2010.Standard & Poor’s raised its outlook on the country’s debt rating last month.

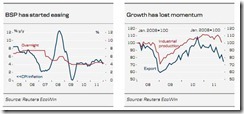

Chart from Danske Bank

So the Philippine government via the BSP will push real interest rates deeper into negative territory (left window) that will punish the saving public and the average fixed income investors. This represents a policy which redistributes resources from creditors (again savers) to borrowers (I would guess would be mostly cronies), that benefits the politically privileged banking system (as intermediaries), aside from encouraging the public to take on speculative activities (stock market boom as previously predicted) and a misdirection of capital towards long range investments. Such policies also will promote consumption activities which will likely lead to trade deficits.

These are composite ingredients to the business cycle or boom bust cycle.

The BSP’s adapted measure rhetorically represents an appeal to the popular that has been ensconced by the herding or bandwagon effect, as central banks of major economies has embarked on a similar easing cycle. As earlier pointed out, global interest rates are now in 2009 levels. The other way to see the current global easing cycle is that central banks could be in coordination with one another, and or that this represents as the central bankers dogmatic approach in dealing with any perceived threats to statistical growth.

In addition, consumption of capital will only be amplified by the massive fiscal spending of the Aquino administration ($42 billion) which would mostly end up in inefficient use, wastage and in the pockets of politicians and bureaucrats and their cronies.

I would further that the BSP’s easing process could have been synchronized with the prospective fiscal policies, aimed at providing funds to cronies, who will undertake most of the private-public partnerships, and to the government whom will be requiring these funds that will probably be obtained from the local markets, as earmarked for boosting growth.

And I would propound a political spectrum in these actions—these could be meant to shore up the public’s support for the administration who currently has pushed for an impeachment trial of the Supreme Court Chief Justice.

Public support for the administration means pressure for the Senate, whom has been adjudicating the impeachment trial, to deliver a verdict that is favorable to the administration.

Nevertheless, while this would have temporal benefits for the stock market, and for the economy as measured by spending based statistics, the evil effects of high inflation and malinvestments point to an eventual bust sometime ahead (I can’t determine the exact frame, but we can observe this via interest rates).

For now profit from political folly.

Wednesday, December 21, 2011

Quote of the Day: Keynesian Nostrum

Keynesianism is not a panacea because Keynesianism has dominated public policy making for half a century and has left us in such a state of public debt. Keynesianism broke the old time fiscal religion of balanced budgets and fiscal responsibility, and changed not only attitudes of economists and policy makers, but also eroded whatever institutional constraints existed on public spending that had existed. Keynesianism cannot work to solve our current problems because Keynesianism is responsible for our current problems. Keynesianism provided an illusion of short term prosperity, but the reality of long term stagnation. Of course, the revealing of the illusion can be put off, as I have pointed out before, if there is the discovery of new opportunities for gains from trade, and/or gains from innovation.

But the governmental habit of spending is still there and the bill has to be paid as some point. Keynesianism is a disease on the body politic because it caters to the natural propensity of politicians to focus on short run, and to concentrate benefits and disperse costs.

That’s from Professor Pete Boettke.

Keynesianism has functioned as the intellectual pillar of the 20th century welfare-warfare based political economy. Yet in applying Keynesian prescriptions to Keynesian generated predicaments would tantamount to “doing things over and over again and expecting different results”. Albert Einstein, who was attributed with the quote, call this insanity. However, modern politicians and their allies seem to know only one option thereby insisting on the same route which brought us to our present conditions.

Friday, December 16, 2011

Video: Predictive Value of Austrian Economics versus Keynesian Economics

Notice the intense pressures Austrians face when confronted by usually hostile mainstream crowd. I know how this feels.

And this is where Mahatma Ganhi's rule applies

First they ignore you, then they laugh at you, then they fight you, then you win

Friday, November 04, 2011

Wealthy Chinese Consider Emigration

Many say that the 21st Century belongs to China.

While I certainly hope that China will, I am not entirely convinced, especially not if the Chinese themselves seem distrustful of their nation’s future.

This bleak news from the Wall Street Journal, (bold highlights mine)

More than half of China's millionaires are either considering emigrating or have already taken steps to do so, according to a survey that builds on similar findings earlier this year, highlighting worries among the business elite about their quality of life and financial prospects, despite the country's fast-paced growth.

The U.S. is the most popular emigration destination, according to the survey of 980 Chinese people with assets of more than 10 million yuan ($1.6 million) published on Saturday by Bank of China and wealth researcher Hurun Report.

While growth has slowed, China's economic performance is still the envy of the Western world: It registered annual gross domestic product growth of 9.1% in the third quarter, and the International Monetary Fund has forecast growth of 9.5% for all of 2011.

Concerns are mounting, however, that China's growth could be derailed by a raft of problems, including high inflation, a bubbly real-estate sector and a sharp slowdown in external demand.

Many Chinese who have profited most from the country's growth also express increasing concerns in private about social issues such as China's one-child policy, food safety, pollution, corruption, poor schooling, and a weak legal system.

Rupert Hoogewerf, the founder and publisher of Hurun Report, said the most common reason cited by respondents who were emigrating was their children's education, followed by a desire for better medical treatment, and the fear of pollution in China.

"There's also an element of insurance being taken out here," he said, citing concerns about the economic and political environment.

He cautioned, though, that it was unclear if the survey results signaled capital flight as many high-net-worth individuals who were emigrating also said they were keeping much of their money invested in China.

China maintains capital controls that make it hard for rich Chinese to move their money out of the country, but there are substantial loopholes in the system.

Some economists say they have detected signs of large capital outflows in recent months, likely driven by a decline in global risk appetite and expectations of slower yuan appreciation.

A research report from Bank of America Merrill Lynch's strategy team in Hong Kong last month cited "hot-money outflows" as one of four systemic risks that could lead to a hard landing for China's economy. It said that a sign of such outflows were record gambling revenue in the gambling enclave of Macau, a former Portuguese colony near Hong Kong, where many mainland Chinese go to gamble.

In another indication of the jittery mood among China's rich, several Western embassies have also noted a marked increase this year in the number of applications for investment visas, a category that allows people to immigrate if they invest a certain amount of money, according to diplomats.

There is evidence, too, of an uptick in the number of Chinese people buying high-end properties in major Western cities, especially London, Sydney and New York, according to property analysts.

The recent economic success experienced by China has mainly been due to her embrace of globalization.

However, deepening tensions brought upon by rapidly expanding bottom-up economic forces has apparently come into conflict with the rigid political priorities of the China’s government aimed at the preservation of the incumbent structure.

And because of the attendant fear of social disorder arising from an economic bust, which may upset the current political balance, China’s political authorities have careened towards adapting short sighted Keynesian policies that has resulted to an inflating bubble economy that risks a massive bust, possibly in the near future.

Perhaps many of these Chinese millionaires may be sensing trouble ahead (see bold highlights above), not only from a bubble bust, but also from the growing fragile state of China’s unsustainable capitalist-communist political economy.

Yet, a substantial exodus from many of China’s productive sectors will likely put further strain on such tenuous relationship.

This is not to say that a China Century may not be ahead, instead this is to say that China must ultimately depend on market forces to determine the economic direction than rely on temporary nostrums from political diktat that only hastens erosion of the current political economic framework.

Eventually China’s political leadership will have to decide either to cope up with the swift and material changes in her economy or to revert to the old China model of a closed society. The success or failure of the goal of a China Century, thus, depends on the political choices taken.

Thursday, July 07, 2011

Graphs of the Day on Keynesian Stimulus: All that Jazz but still Nothing to Show For

From Cato’s David Boaz (chart above and the following except)

this was the recovery that was aided by the largest Keynesian-style big government “stimulus” since World War II. Since 2008, total federal “stimulus” has been $4.6 trillion, as shown in the chart. As a share of GDP, recent deficit spending has been far greater than during all other recessions since the war.

Biggest Keynesian Stimulus + Slowest Recovery = Time to Rethink Keynesian Theory.

Following the Keynesian doctrine, the US government threw the proverbial “everything but the kitchen sink” on demand side management.

Not only has the econometric model elixir failed to accomplish the purported goals, but importantly, such measures has exposed the US fiscal balance to even more undue risks. (chart from Heritage Foundation).

Yet for them, it's never enough. And given that policymaking trends have been mostly influenced by this ideology, one can be assured that what is unsustainable won't last; accrued imbalances fostered by such measures will be unraveled in the fullness of time.

Sunday, July 03, 2011

Greece Crisis: Does Fiscal Austerity Mean a Deflationary Policy?

The same principle leads to the conclusion, that the encouragement of mere consumption is no benefit to commerce; for the difficulty lies in supplying the means, not in stimulating the desire of consumption; and we have seen that production alone, furnishes those means. Thus, it is the aim of good government to stimulate production, of bad government to encourage consumption.-Say, Jean-Baptiste

For some it is held the current actions by Eurozone government represent as “deflationary policies”.

Such notion has been premised from the economic ideology which sees the economy as driven by aggregate demand.

Demand side economics see spending as the ultimate driver of any economy. Where private spending has been reckoned as insufficient or inadequate, government has been prescribed to takeover the spending process or through “socialization of investment”; otherwise the lack of spending, which supposedly impairs the aggregate demand, would result to people hoarding money, an outcome which this camp morbidly dread most: deflation.

This is why this camp argues for the “euthanasia of the rentier” which is to keep interest rates at perpetually low levels (if only they can abolish interest rates!).

Also, because spending is seen as the only driver of the economy, it doesn’t matter if spending is financed by unsustainable debt loads or by money printing “parting with liquidity”[1]. For them, spending is spending period.

This is an example of what I would call as analysis blinded by the Nirvana fallacy or “the logical error of comparing actual things with unrealistic, idealized alternatives. It can also refer to the tendency to assume that there is a perfect solution to a particular problem[2]” where mathematical models based on aggregate assumptions have substituted for real life activities. Statistical aggregates assume that people think and act homogeneously.

This also serves as another example where this mainstream economic pedagogy leads to a lack of common sense and self-discipline[3] because this camp basically advocates that people should borrow and spend to prosperity even when reality says that this would be impossible (see Jean Baptiste Say quote above).

How true has deflation been the problem of the PIIGS or the crisis affected nations of peripheral Europe?

At present, NONE of the PIIGS has shown DEFLATION as an economic condition as exhibited by the charts from tradingeconomics.com.

Instead, PIIGS have shown symptoms of mild stagflation (high unemployment and high inflation).

Of the five, only Ireland encountered consumer price deflation for over a year in 2009-2010.

Others like Spain and Portugal experienced very limited bouts of deflation in 2009.

Thus, little of what the demand side economics have feared has ever been true since the 2008 Lehman crisis began to unravel.

Theoretically, fiscal austerity means transferring of non-productive resources to productive resources.

Yet because of the dependency/entitlement culture which had been inbred from too much of “socialized investment”, as in the case of Greece, Greeks have taken to the streets[4]

As Takis Michas, staff writer for the Greek national daily, Eleftherotypia in a Cato Forum accounting for the seeds of the crisis[5]

The largest part of public expenditure was directed, not to public works or infrastructure, but to the wages of public service workers and civil servants.

The grounds for the rent-seeking struggles of the future were thus firmly laid.

As resources are freed for productive use, deflation then should be seen as positive because the productive private sector should be able to use these freed resources to produce goods and services, which would fuel a genuine recovery. With more output than than the growth of supply of money this is known “growth deflation” similar to the dynamics of falling prices of mobile phones, appliances and computers.

And that’s why a major part of Greece’s crisis ‘austerity plan’ resolution has been to undertake mass privatization[6].

However theoretical isn’t actual.

The unfolding Greece crisis isn’t being resolved entirely to free resources for productive means, instead the bailouts have been intended to use these resources to protect the banking system from a collapse[7]. Resources are merely being transferred from government welfare programs to the politically privileged banking sector.

Thus, the Greece bailout has been and will continue to be financed by European Central Bank’s inflationism.

Since the end of 2009, just as the Greece Debt Crisis surfaced[8], ECB’s M3 annual growth rate continues to climb, as shown by the chart from Bloomberg[9] (upper window). Such rate of increase in the money supply has shadowed the growth rate of the Euro’s inflation (chart from trading economics.com[10]).

For as long as the ECB and EU governments will continue to finance these serial bailouts by inflationism, then we should see more inflation and not deflation.

At the end of day, false economics leads to misdiagnosis and wrong predictions/conclusions.

[1] what-when-how.com SOCIALIZATION OF INVESTMENT

[2] Wikipedia.org Nirvana Fallacy

[3] See Financial Success is a Function of Common Sense and Self Discipline June 23, 2011

[4] See The Anatomy of False Economics as Revealed by the Greece Crisis, June 28,2011

[5] Michas Takis , Policy Forum: A Greek Tragedy, Cato Policy Report Cato.org, July/August 2011

[6] ca.reuters.com Greek sovereignty to be massively limited: Juncker, July 3, 2011

[7] See Greece Crisis: The Lehman Moment Hobgoblin, June 19, 2011

[8] News.bbc.co.uk Greece timeline June 16, 2011

[9] Bloomberg.com ECB M3 Annual Growth Rate SA (ECMAM3YY:IND)

[10] Tradingeconomics.com Euro Area Inflation Rate

Tuesday, June 28, 2011

The Anatomy of False Economics as Revealed by the Greece Crisis

We have been told by economic ideologues that spending translates to prosperity especially if this is done by government via ‘free lunch’ socio-welfare programs.

The Greece debt and entitlement crisis should be one good example of how quant economics gets it so badly.

From the Daily Mail, (all bold highlights mine) [ht: Prof William Anderson]

There is another bonus for users of this state-of-the-art rapid transport system: it is, in effect, free for the five million people of the Greek capital.

With no barriers to prevent free entry or exit to this impressive tube network, the good citizens of Athens are instead asked to 'validate' their tickets at honesty machines before boarding. Few bother.

This is not surprising: fiddling on a Herculean scale — from the owner of the smallest shop to the most powerful figures in business and politics — has become as much a part of Greek life as ouzo and olives.

Indeed, as well as not paying for their metro tickets, the people of Greece barely paid a penny of the underground’s £1.5 billion cost — a ‘sweetener’ from Brussels (and, therefore, the UK taxpayer) to help the country put on an impressive 2004 Olympics free of the city’s notorious traffic jams.

The transport perks are not confined to the customers. Incredibly, the average salary on Greece’s railways is £60,000, which includes cleaners and track workers - treble the earnings of the average private sector employee here.

The overground rail network is as big a racket as the EU-funded underground. While its annual income is only £80 million from ticket sales, the wage bill is more than £500m a year — prompting one Greek politician to famously remark that it would be cheaper to put all the commuters into private taxis.

‘We have a railroad company which is bankrupt beyond comprehension,’ says Stefans Manos, a former Greek finance minister. ‘And yet, there isn’t a single private company in Greece with that kind of average pay.’

Significantly, since entering Europe as part of an ill-fated dream by politicians of creating a European super-state, the wage bill of the Greek public sector has doubled in a decade. At the same time, perks and fiddles reminiscent of Britain in the union-controlled 1970s have flourished.

Ridiculously, Greek pastry chefs, radio announcers, hairdressers and masseurs in steam baths are among more than 600 professions allowed to retire at 50 (with a state pension of 95 per cent of their last working year’s earnings) — on account of the ‘arduous and perilous’ nature of their work.

We are further told that by devaluation Greece would solve its problems.

From Wall Street Journal’s Holman Jenkins Jr., (bold highlights mine) [ht: Dan Mitchell]

Whether Greece gets debt relief now or later, the Greeks will not escape sweeping structural reform of their economy—one of the most corrupt, crony-ridden, patronage-ridden, inefficient, silly economies in Christendom. Its tax system operates on voluntarism and fine judgments about whether the bribe or the tax would be more burdensome to pay. The state railroad maintains a payroll four times larger than its ticket sales. When a military officer dies, his pension continues for his unwed daughter as long as she remains unwed. Various workers are allowed to retire with a full state pension at age 45.

Those who say if only Greece still had its own currency, so much pain would have been avoidable, exaggerate. Under no possible currency regime would Greece have been able to go on forever borrowing money from foreigners to live beyond its means or its willingness to work. The same is true to lesser degree of other troubled European economies, including Portugal and Spain.

All along, the challenge of the euro was the challenge that undid the gold standard—to make "the law of one price" prevail across multiple countries in the age of interest group democracy. "One price" in one country works—Americans will pick up and move 3,000 miles for a job, but even in America, not without pain.

Yet the nostalgia for a Europe of independent currencies is mostly nostalgia for an illusory shortcut—even more so as services, rather than tradable goods, become the overwhelming source of employment in modern economies. Greece, with its sun and history, has every potential to make a happy, privileged existence inside the euro zone. Today's growth gap between Europe's north and south, which some say proves the unwisdom of a common monetary policy, is hardly organic—it's the product of their common mistake in loading too much debt on unreformed southern economies in giddy expectation of euro-based prosperity.

Putting into perspective the scale of Greece’s predicament from the accrued free lunch policies, from the Foxnews.com (bold emphasis mine)

Greece's Finance Ministry estimates that, on its current track, government debt will reach €501 billion by 2015. That comes to a debt of over $66,000 per person, and Greece’s personal income is only about two-thirds our own. Greater deficits and 17 percent interest rates can cause difficult problems to grow into impossible ones very quickly.

Greece can and should do much more. Both the European Central Bank and the IMF estimate that Greece can pay off €300 of the €347 billion debt by selling off shares the government owns in publicly traded companies and much of its real estate holdings. The government owns stock in casinos, hotels, resorts, railways, docks, as well as utilities providing electricity and water. But Greek unions fiercely oppose even partial privatizations. Rolling blackouts are promised this week to dissuade the government from selling of even 17 percent of its stake in the Public Power Corporation.

It takes common sense and self-discipline to realize that:

-Spending more than what one earns cannot happen indefinitely

-Redistribution has its limits. Picking on someone’s pocket is a zero sum game.

-Welfare programs engender a culture of entitlement and dependency.

-Printing money won’t solve the problems of insufficient production. Greece’s problem has been about the chronic or deep-seated culture of over-dependency from political-welfare programs than from the lack of ‘aggregate demand’.

-Where politics determines economics, or where zero sum (free lunch) political economics is applied, poverty is the outcome.

Economic reality eventually exposes false economics.

Saturday, April 30, 2011

Keynesians On A Losing Streak

Keynesians have been on a losing streak. They have got it so wrong in predicting the direction of markets and inflation. And importantly, their policy prescriptions have likewise failed to achieve the purported economic recovery.

In a comparison between Reagan and Obama policies, the Wall Street Journal concludes, (bold emphasis mine)

The contrast in results between the current recovery and the Reagan years is instructive because the policy mix was so different. In the 1980s, the policy goals were to cut tax rates, reduce regulatory costs and uncertainty, let the private economy allocate capital free of political direction, and focus monetary policy on price stability rather than on reducing unemployment. This is the policy mix we need to rediscover if we are going to escape our current malaise and stop suffering from the Keynesian discount.

In reaction to this article, economist Tim Kane of the Kauffman Foundation writes, (bold emphasis original)

The great advantage of Keynesianism is also its great weakness. It is exceedingly simple. It's fair to think of monetary policy in simple terms: tighten money supply or loosen it? While there are surely nuances of financial oversight and regulation, the point is that fiscal policy is simply never going to be so simple. It wasn't simple in 1500, and it sure isn't simple now. Fiscal policy under modern Keynesianism is, in public policy discussion, reduced to precisely that crude metric: more deficit-based government expenditures/taxes or less. To say it misses the forest for the trees is also too simple. What it misses is the genotype for the phenotype. Or how about: it misses the recipe for the ingredients?...

The one dilemma I have is not whether modern Keynesianism is bankrupt (it is), but what that implies about the growth rate. When I heard Scott Sumner speak in January, I really had to wonder if I, let alone he, believed there was a bubble in 2008 or not. If it was a bubble, then we shouldn't expect GDP to "recover," nor can anyone blame politicians for the relatively weak recovery. Right? No, wrong, dead wrong. If it was a real recession and not a bubble, then clearly the policy response has failed. If instead it was a bubble, then the policy response has been an obscene waste of money. There is no way out for Keynesians now.

It’s no use to for liberals to make the excuse that “crisis has setback the pace of economic activity by a greater degree compared with other post-war recessions” for the failure of their policies to generate traction. That would signify as red herring.

That’s because the financial crisis had been the outcome of the same set of Keynesian policies employed to inflate the last bubble.

As Paul Krugman wrote in 2002 (New York Times) (bold emphasis mine)

The basic point is that the recession of 2001 wasn't a typical postwar slump, brought on when an inflation-fighting Fed raises interest rates and easily ended by a snapback in housing and consumer spending when the Fed brings rates back down again. This was a prewar-style recession, a morning after brought on by irrational exuberance. To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.

Apparently Mr. Greenspan complied.

And the great Ludwig von Mises had been validated anew when he presciently wrote, (bold highlights mine)

There are still teachers who tell their students that “an economy can lift itself by its own bootstraps” and that “we can spend our way into prosperity.” But the Keynesian miracle fails to materialize; the stones do not turn into bread. The panegyrics of the learned authors who cooperated in the production of the present volume merely confirm the editor’s introductory statement that “Keynes could awaken in his disciples an almost religious fervor for his economics, which could be affectively harnessed for the dissemination of the new economics.”…

There is no use in arguing with people who are driven by “an almost religious fervor” and believe that their master “had the Revelation.” It is one of the tasks of economics to analyze carefully each of the inflationist plans, those of Keynes and Gesell no less than those of their innumerable predecessors from John Law down to Major Douglas. Yet, no one should expect that any logical argument or any experience could ever shake the almost religious fervor of those who believe in salvation through spending and credit expansion.

The false religion has been exposed anew.

Monday, April 11, 2011

China' Potemkin Cities and Malls

This obsession towards achieving statistical GDP from central planning reminds me of two John Maynard Keynes quotes,

The right remedy for the trade cycle is not to be found in abolishing booms and thus keeping us permanently in a semi-slump; but in abolishing slumps and thus keeping us permanently in a quasi boom.

If the Treasury were to fill old bottles with bank-notes, bury them at suitable depths in disused coal-mines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again (the right to do so being obtained, of course, by tendering for leases of the note-bearing territory), there need be no more unemployment and, with the help of repercussions, the real income of the community, and its capital wealth, would probably become a good deal greater than it actually is.The obvious result has been an ongoing quasi-boom (as Keynes has predicted) but which ultimately will be faced with the restrains from natural the law of economics which equates to a prospective bust (from the Austrian perspective).

The desire to uphold the Keynesian unemployment goals will backfire and result to China's version of today's MENA political crisis.

First video is from Dateline

Second video from AlJazeerah

There are still teachers who tell their students that “an economy can lift itself by its own bootstraps” and that “we can spend our way into prosperity.” But the Keynesian miracle fails to materialize; the stones do not turn into bread. The panegyrics of the learned authors who cooperated in the production of the present volume merely confirm the editor’s introductory statement that “Keynes could awaken in his disciples an almost religious fervor for his economics, which could be affectively harnessed for the dissemination of the new economics.” And Professor Harris goes on to say, “Keynes indeed had the Revelation.”

There is no use in arguing with people who are driven by “an almost religious fervor” and believe that their master “had the Revelation.” It is one of the tasks of economics to analyze carefully each of the inflationist plans, those of Keynes and Gesell no less than those of their innumerable predecessors from John Law down to Major Douglas. Yet, no one should expect that any logical argument or any experience could ever shake the almost religious fervor of those who believe in salvation through spending and credit expansion.

![clip_image002[4] clip_image002[4]](http://lh3.ggpht.com/-DbMXhB0MxII/ThUEVz2K1CI/AAAAAAAAG2c/SaCRKzGSGwE/clip_image002%25255B4%25255D_thumb.jpg?imgmax=800)

![clip_image002[6] clip_image002[6]](http://lh5.ggpht.com/-4royrtj4bLU/ThUEWj49JPI/AAAAAAAAG2k/zyj9eKAe7_Y/clip_image002%25255B6%25255D_thumb.jpg?imgmax=800)