And right here let me say one thing: After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying and selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine - that is, they made no real money out of it. Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance. Jesse Livermore

Mechanical chartists will consider the present environment a sell.

That’s because the Phisix has joined her ASEAN neighbors (MYDOW- Malaysia, IDDOW- Indonesia and Thailand-SETI) into a transition towards the bearish “death cross”—where long term moving averages have gone above the short term moving averages.

As an aside, it’s a heresy for fanatic chart practitioners to know the fact that trading based on mechanical charting usually leads to needless churning, which benefits brokers, commissioners (like me) and governments (taxes) more than investors, due to the accumulated transaction costs that only hampers or diminishes on investor’s returns. Who cares about truth, anyway? For most people, belief is about social acceptance than of reality.

Never mind if trying to catch tops and bottoms of highly dynamic price actions of each securities driven by variable human choices under unique circumstances would seem like fictional heroine Alice—of the famed Charles Lutwidge Dodgson known under the pseudonym Lewis Carroll’s fable—who tries to ascertain if Wonderland was a reality.

To quote the legendary Jesse Livermore via Edwin Lefevre through the classic Reminiscences of a Stock Operator[1]

The reason is that a man may see straight and clearly and yet become impatient or doubtful when the market takes its time about doing as he figured it must do. That is why so many men in Wall Street, who are not at all in the sucker class, not even in the third grade, nevertheless lose money. The market does not beat them. They beat themselves, because though they have brains they cannot sit tight.

Feeding on emotional impulses and cognitive biases only deprives market participants of the needed regimen of self-discipline and importantly narrows a participant’s time preference in conducting risk reward analysis in the silly pursuit of short term “frequent” gains but at the risks of the magnitude of greater risk.

Again the legendary Jesse Livermore

Disregarding the big swing and trying to jump in and out was fatal to me. Nobody can catch all the fluctuations. In a bull market your game is to buy and hold until you believe that the bull market is near its end. To do this you must study general conditions and not tips or special factors affecting individual stocks.

It is important for market practitioners to realize that what counts is the magnitude of the effects of one’s action than of its frequency[2].

Frequency will mostly be about luck while magnitude will account for the impact of patience, discipline and mental rigor.

Going back to the big picture, given that the developed economies has once again embarked on undertaking policies to substantially ease financial conditions, which this time includes developed markets periphery and some emerging markets, e.g. Australia recently joined Turkey, Brazil and Indonesia to cut policy rates[3], we may be looking at the next leg of the boom phase of the present bubble cycle.

Outside another round of exogenous based political spooks, market internals in the Phisix appear to be showing meaningful signs of improvements.

While volume still lacks the vigor of a strong recovery, possibly due to the sluggishness brought about by the extended holiday from an abbreviated trading week, signs like average number of trades (computed on a weekly basis) seem to be holding ground and showing incremental improvements.

To consider this week’s losses in the Phisix seem to reflect on the weakness of the global markets.

My interpretation of last week’s action was one of natural profit taking following a strong push from the previous weeks. The correction of which only used the Greece political circus as an excuse to take profits.

For instance, the US Dow Jones Industrials saw a winning streak of 5 consecutive weeks which accrued gains of 12.92%, but gave back 2.03% this week for a retracement of 15% from the previous gains.

The Phisix seem to reflect on the same motions, the local benchmark racked up 11% over the same 5 week period where US markets went up, but lost 1.43% this week equivalent to a 13% retracement.

Yet over the broad market, except for the financial sector which was largely unchanged, the mining sector led the losses which weighed mostly on the local composite bellwether.

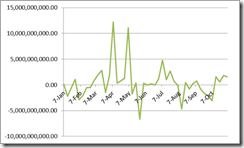

And this week’s losses have hardly dinted on foreign sentiments, which as stated last week, the present recovery appears to be accelerating.

Again one of the major surprises has been that foreign investors has hardly been affected even by the September shakeout.

Finally, the Peso’s performance again appear to reflect on the actions of the Phisix.

The gap generated the other week seeems as being filled, using the current profit taking mode as pretext.

Nevertheless, since the outperformance and the momentum by ASEAN bourses seem to have been spoiled by the recent exogenous contagion, an easing financial environment will likely spur the next leg up, barring unforeseen circumstances.

My bet is that the Phisix’s ‘death cross’ along with the ASEAN counterparts are likely false signals that will become whipsaws soon, another failed chart pattern.

[1] Gold-eagle.com Wisdom of Jesse Livermore 6

[2] See Dealing With Financial Market Information, February 27, 2011

[3] FT.com Growth fears prompt Australian rate cut, November 1, 2011