The Barclay’s LIBOR scandal seems to be rippling across the world.

From the Bloomberg,

Regulators from Stockholm to Seoul are re-examining how benchmark borrowing costs are set amid concern they are just as vulnerable to manipulation as the London interbank offered rate.

Stibor, Sweden’s main interbank rate, and Tibor in Japan are among rates facing fresh scrutiny because, like Libor, they are based on banks’ estimated borrowing costs rather than real trades. In some cases they may be easier to rig than Libor as fewer banks contribute to their calculation, according to academics and analysts.

“Many of the ingredients which made it pretty easy to manipulate Libor and collude are common in other benchmarks,” said Rosa Abrantes-Metz, an economist with consulting firm Global Economics Group and an associate professor at New York University’s Stern School of Business. “Regulatory agencies are starting to take a look at those and there is a growing sense they need to change.”

Barclays Plc (BARC), the U.K.’s second-largest bank, was fined a record 290 million pounds ($450 million) last month for attempting to rig Libor and Euribor, its equivalent in euros, to appear more healthy during the financial crisis and boost earnings before it. At least 12 banks including Royal Bank of Scotland Group Plc (RBS) and Deutsche Bank AG are being investigated for manipulating Libor.

Regulators and industry groups are now turning their attention to whether other benchmark rates were manipulated in the same way. Sweden’s central bank, the Japanese Bankers Association, the Monetary Authority of Singapore and South Korea’s Fair Trade Commission have all announced probes into how their domestic rates are set.

Derivatives Traders

Libor is determined by a daily poll carried out on behalf of the British Bankers’ Association that asks banks to estimate how much it would cost to borrow from each other for different periods and in different currencies.

The issue is here is that interest rates have been manipulated thereby prompting speculations that there might have been large discrepancies in the pricing of interest rates that affects much of the world financial markets.

The so-called manipulations occurred at the peak of the crisis in 2008 and has reportedly even been warned by NY Fed’s then President Timothy Geithner and so as with the BIS.

Apparently NO one took LEGAL action or that authorities simply looked the other way.

Now this has become a big issue.

But the much of the agog (impact of price manipulations) out of the LIBOR scandal has barely been a fact.

In spite of the alleged Libor shenanigans, Professor Gary North shows here in numerous charts that interest rates had been determined by the markets.

Writes Professor North, (bold original)

There is no sign that these two gigantic and interlinked credit markets were different in any significant sense over the entire decade. In other words, Barclays bank had no influence over rates. The banks that were involved rigged the system from 2005 to 2009.

Then what is the scandal all about? Ignorance of basic economics. What about the banks that manipulated the LIBOR rate? They made money on the margin, but they did not have any significant effect on these rates. You can see this in the LIBOR charts.

The scandal is a tempest in a teapot. No one lost much money. The banks did not keep rates lower than the market for more than a few hours -- maybe days, but I want to see proof.

The rates were governed by market forces.

The idea that Barclays kept rates down for years is ludicrous. No commercial bank can keep rates down if investors are willing to pay for a different allocation of capital than what the banks want. The bankers can make money at the margin, paying a little less for loans. But after 2008, none of this mattered. Bankers did not want to borrow from each other.

The appalling ignorance of basic economic theory is why we see the headlines about Barclays and the manipulation of rates. Bankers probably made many millions of pounds extra, but this had no measurable effect on the direction of interest rates. We are not talking about hundreds of billions. We are not talking about the Bank of England.

Columnists like to get attention. There is nothing like a scandal to get attention. But to say that the commercial banks manipulated inter-bank rates is saying that (1) central banks and reserve requirements don't count for much; (2) market rates can be held down by a few commercial banks, thereby overcoming the market for capital: lenders and borrowers.

The people who cry "scandal" do not think through the implications of what they are saying. Making a lot of money is one thing. It is possible. Re-structuring the derivatives market totaling about a quadrillion dollars in assets/promises is something else.

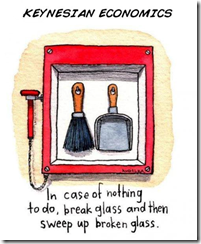

The problem has little to do with rate-tinkering by Barclays and the others. The problem, then as now, is the misguided Keynesianism that undergirds the policy decisions of the West's central bankers.

In reality, the major manipulators of the markets has been the central bankers led by the US Federal Reserve, who seem to be looking to divert the public’s attention from the real causes of the present imbalances: central banking inflationism.

With allegations that banks has been culpable for the manipulations of the interest rates the reactions will likely be a tsunami of lawsuits, of course calls for tighter regulations (which may be the real intent of the scandal-mongerers)

From another Bloomberg article,

Wall Street, grappling with mounting regulatory probes and investor claims over alleged interest-rate manipulation, may face yet another formidable foe: Itself.

Goldman Sachs Group Inc. (GS) and Morgan Stanley are among financial firms that may bring lawsuits against their biggest rivals as regulators on three continents examine whether other banks manipulated the London interbank offered rate, known as Libor, said Bradley Hintz, an analyst with Sanford C. Bernstein & Co. Even if Goldman Sachs and Morgan Stanley forgo claims on their own behalf, they oversee money-market funds that may be required to pursue restitution for injured clients, he said.

Because Libor is based on submissions from only some of the world’s largest banks, the probes threaten to pit firms uninvolved in setting the rate against any implicated in its manipulation, Hintz said. Libor serves as a benchmark for at least $360 trillion in securities.

“This will be a feeding frenzy of sharks,” said Hintz, who has served as treasurer of Morgan Stanley (MS) and chief financial officer of Lehman Brothers Holdings Inc. “We’re going to have Wall Street suing Wall Street.”

It’s definitely going to be a feeding frenzy especially for politicians whom are likely to use the current sentiment against Wall Street (Occupy Wall Street) and the global financial industry as fodder for electoral mudslinging or as an opportunity to acquire votes with the US national elections fast approaching.

Wall Street rending each other apart will likely exacerbate the prevailing uncertainty.