To paraphrase a recent comment I received from a mercantilist: Because of the US dollar standard, mercantilism have been more prevalent today.

It is easy to dismiss such an argument as post hoc fallacy since two distinctive variables have been made to function as causally related. Nevertheless let us see from a few charts and graphs whether this claim has validity, even if we exclude the role of the US dollar.

To rephrase the issue: Has the world economic trend been more about mercantilism or globalization?

According to Google’s Public Data World merchandise trade as % of GDP has ballooned from a little less than 20% in 1960s to about nearly half of the world's economy today.

Even trade balance of services, again from Google Public Data, based on OECD economies volume has leapt sixfold since 1996.

Above is the breakdown of global trade per sector in 2010 (World Trade Organization)

Add to the current dynamic the dominance of intra-region trade

One major reason for the surge in global trading activities has been due to major moves to LIBERALIZE trade via substantial reductions tariffs which came from Regional Trade Agreement (RTA), Multilateral Trade Negotiations (MTN) and or even unilateralism (WTO)

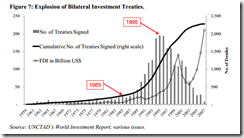

Bilateral investment treaties peaked in 1995 but the effects of these are still being felt today through massive growth in cross border investments

While there have been some protectionist pressures as consequence to the financial crisis of 2008, generally speaking trade liberalization has been minimally affected.

From IMF Finance

The number of new protectionist actions peaked in the first quarter of 2009 and bottomed in the third quarter of 2010. However, recent GTA data suggest that protectionist measures are increasing again; protectionist actions in the third quarter of 2011 alone were as high as in the worst periods of 2009 (Evenett, 2011).The Group of 20 (G20) advanced and emerging economies account for most of the trade measures, most of which did not involve tariffs, imposed since 2008. There has been no significant increase in the overall use of tariffs or temporary trade barriers, such as antidumping measures, aimed at assisting local firms injured by import competition (Bown, 2011). Such measures affected only about 2 percent of world trade (Kee, Neagu, and Nicita, 2010; WTO, 2011). The trend of gradual tariff liberalization observed since the mid-1990s has not been affected

The World Trade Organization (WTO) notes of the recent increases in Non-Tariff Measures (NTM). But these have been based on technical barriers to trade (TBT) regarding standards for manufactured goods and sanitary and phytosanitary (SPS) or measures concerning food safety and animal/plant health, and partly domestic regulation in services which have hardly been about restricting competition.

From the WTO,

“I think it is a good time for the WTO to have a closer look at non-tariff measures (NTMs)”, said WTO Director-General Pascal Lamy, at the launch of the Report. “A clear trend has emerged in which NTMs are less about shielding producers from import competition and more about the attainment of a broad range of public policy objectives. The new NTMs, typically SPS and TBT measures but also domestic regulation in services, address concerns over health, safety, environmental quality and other social imperatives. The challenge is to manage a wider set of policy preferences without undermining those preferences or allowing them to become competitiveness concerns that unnecessarily frustrate trade.”

The above trends seems quite clear. Globalization has been the dominant theme of the world economy over the past decades, regardless or in spite of the role of the US dollar.

Now of course, events of the past may not extrapolate to the future.

Bottom line: The religion of politics makes many people see fantasies as self constructed reality.