An official of Moody’s claims that there has been “no property bubble” in the Philippines.Moving along nothing to see here.

The Businessworld writes,

Real estate has again become a hot-button topic after banks saw their exposure to the industry breach regulatory limits in 2012. At P821.7 billion and comprising 20.9% of their total loan portfolio, the amount exceeded the BSP-mandated 20% cap.The breach, though, was due to a new definition of "exposure." Banks were required to report not just real estate loans but also investments in debt and equity securities that finance real estate activities. These activities range from the acquisition, construction and development of properties, as well as buying and selling, rental and management.Banks also had include loans for socialized and low-cost housing developments, which were previously exempted from the reportorial requirements.Mr. Tremblay said the figure was no cause for alarm, noting: "The new definition of ‘exposure’ includes loans to low-cost and socialized housing and these segments tend to be less susceptible to speculation."The BSP is mulling raising the 20% cap to accommodate the new definition as well as property market growth since 1997, when the limit was first introduced."Prospectively, we are not too fixated on any specific numerical cap. There is no magic number that can determine the point beyond which real estate exposure becomes a credit concern," Mr. Tremblay said.The focus, instead, should be on factors such as demand and supply, underwriting standards, loan-to-value ratios and the leverage of households and firms. These can more accurately show whether the appreciation of prices and borrowers’ behavior is driven by fundamentals or speculation, he pointed out."So far, trends in these areas have remained within reasonable limits," Mr. Tremblay claimed. -

The Moody’s expert says the market should focus on demand and supply. Totally agreed.

But if domestic demand has been growing at anywhere at 6-9%, part of which has been financed by debt, and that the supply side has been growing at the rate of about 25% or more bolstered mainly by credit, then are these not signs of burgeoning imbalances? Particularly the ballooning variance between demand, on one side, and on the other, the growth of credit, as well as, the supply side, are not signs of bubbles?

And when such exemplary growth in credit and the supply side is being clustered into popular sectors (real estate, shopping malls, casino, BPO vertical offices), these do not account for as signs of asset bubbles?

Where then is economics in the above article which the Moody’s expert supposedly preaches?

One does not establish the presence or absence of a bubble by reading only statistics and by proclaiming immense faith on authorities for managing them.

Statistics are historical data. They don’t tell much about the future.

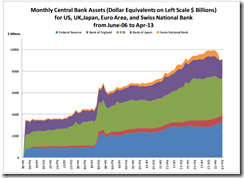

While governments have been pursuing activist policies, this does not ensure the sustainability of current trends for the simple reason that their actions merely signifies as "extend and pretend" or "kick the can down the road". All such actions will have serious ramifications. Japan's much ballyhooed Abenomics has as of this writing triggered riots in the Japanese bond markets. If the riots escalate then we might soon see a debt crisis in Japan that will have a domino effect around the world. Does the Moody's see this?

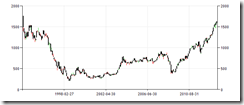

It’s the same reason why mainstream economists failed to see the bubble which culminated with the Lehman bankruptcy in 2008 from which UK’s Queen Elizabeth censured them. In reality most of them were cheerleading the bubble until the bubble boomeranged on their faces.

Moody’s has also not failed to see the US bubble, but even played an important part in the lowering of credit standard by becoming stamp pads for issuers of structured securities.

Yet what Moody’s ignore, is the most critical factor: the trajectory of credit growth both from the supply and demand side, not limited to real estate but to other sectors associated with them.

When the Philippine government promotes zero bound rates to induce “domestic demand” and at the same time reduce SDA rates purportedly for “banks to withdraw some of their funds parked in the BSP, thereby increasing money circulating in the economy” , these policies don’t incentivize or promote debt a build-up?

And what’s the purpose of credit rating upgrades?

Investopedia on Credit ratings:

Credit is important since individuals and corporations with poor credit will have difficulty finding financing, and will most likely have to pay more due to the risk of default.

So upgrades extrapolates to an ease of finding credit finance. In short, it is a reward for borrowers or an inducement to borrow. So current upgrades doesn’t provide incentives to further fuel a bubble through more debt?

This is basic economic logic which seem to operate in a vacuum.

Apparently in the eyes and mind of the mainstream, "economics" is a convenient word used to disguise pseudo expertise from the truth and to pander to a politically brainwashed crowd who has been mesmerized by the four most dangerous words of investing, “this time is different”.

Yet unfortunately such mentality is in itself a sign of the manic phase of a bubble cycle in motion.

Caveat emptor.