If you would be a real seeker after truth, it is necessary that at least once in your life you doubt, as far as possible, all things.—Rene Descartes (1596-1650) French philosopher

In this issue:

Phisix: BSP Panics, Raises BOTH Official and SDA Rates!!!!

-BSP Panics! Implements Sixth and Seventh Tightening Moves in Six Months!

-Understanding Markets via the Business Cycle

-Credit and Stock Market Cycles Converge

-The Obverse Side Of Every Mania Has Been A Crash

-Will The Firming US Dollar Index Usher In The Tetangco Moment?

-The Difference between Money Illusion and Statistical REAL GDP

-Petron Corp’s Money Illusion

Phisix: BSP Panics, Raises BOTH Official and SDA Rates!!!!

BSP Panics! Implements Sixth and Seventh Tightening Moves in Six Months!

Shocking! The BSP raised simultaneously official rates and the SDA rates last week by 25 bps apiece[1]. These marks the second rate increases for both. Incidentally, this represents the SIXTH and SEVENTH policy actions in just SIX months!!!

The BSP’s path to tightening commenced at the end of March with an increase in reserve requirements[2] as baptism. The second adjustment in reserve requirements was in May[3]. Then the BSP called for a banking stress test and upped the SDA rates in June[4]. Prior to this week’s activities, the initial official rate hike was announced at the end of July[5].

Ever wonder WHY these BSP’s drastic measures and the seeming acts of desperation??? Or why has the BSP been PANICKING???

So while domestic stock market has been in a panic buying spree[6], the BSP has been in a panic to tighten! Both of these forces are antipodal as seen from discounted cash flow analysis[7]. So who will eventually be right, the stock market bulls or the BSP?

Yet who among the mainstream domestic and international analysts covering the Philippines has seen this???

Prior to the first policy action (reserve requirement) last March, I transcribed my expectations on BSP’s possible moves[8] (bold original):

The BSP has been BOXED into a corner.

Option 1. If the BSP tightens then the whole phony credit fueled statistical economic boom collapses. So will be the destiny of free lunch for the Philippine government.

Option 2. If the BSP maintains current negative real rates or invisible subsidies via financial repression to the government through a banking financed boom, then stagflation will deepen and spur higher interest rates despite the BSP’s King Canute rhetoric.

So we are most likely to end up with Option 1 where economic reality via the markets will force the BSP to eventually tighten, or else God forbid, the Philippines suffer even a far worst fat tailed disaster: hyperinflation.

So as predicted, the BSP appears to have taken the route of Option 1, they have been “forced” to tighten—in a rather…distressed manner

And it does seem like BSP Governor Amando M Tetangco Jr. meant “real business” when he recently warned of “complacency” and on “chasing the market” as I previously noted[9] (bold original)

And if the Governor Tetangco truly means what he has warned about, or if he is true to his word, then the public should expect that this caveat will get to be transmitted into monetary policies via HIGHER policy rates. If not, then all these have merely been about political and moral posturing.

Either way, market risks have now gone mainstream!!!

So why should a supposedly “sound” boom be accompanied by symptoms of overvaluations and consumer price pressures? Why the need to tighten if the predicament has been one of supply side pressures where liberalization of imports would be the simple and commonsensical answer to address price pressures? What is the relationship of tightening (money) with supply side (real economy) constraints? What is the relationship of tightening (money) with massive asset overvaluations (financial assets)?

Since the BSP’s message has become repeatedly been opaque, evasive, contradictory and non-transparent, I provide the answer: Credit.

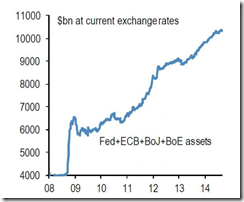

The outcome of monkeying around with interest rates has been to fuel a credit boom. Since current banking based credit expansion represents spending unbacked by savings, the deluge of new money which has entered the economic stream, as evidenced by 9 consecutive months of 30%++ money supply growth rate, has prompted for systematic price distortions that has resulted to imbalances in both the real economy and in financial assets. So we see the symptoms of excessive mispricings or financial asset overvaluations compounded by consumer price pressures.

The BSP’s panic has basically accounted for as attempts to curb and to control the unintended vices (credit based speculative orgies or the inflation Godzilla) that has been spawned and unleashed from the previous thrust to boost ‘aggregate demand’ to spike the statistical economy via the manipulation of interest rates.

The so-called transformational boom has signified as the sweet spot from such policies. Since every policy carries with it a political dimension, the credit boom implicitly has been intended to support ambitious government spending programs as well as to generate popular approval for the populist incumbent administration.

Now that the economic backlash from unsustainable policies has surfaced, the BSP has been ‘forced’ to impose a partial reversal of such policies. Interestingly, some in the media portrays BSP’s actions as the ‘most aggressive’. They never ask, if everything has been hunky dory, then why the need for “aggressiveness”? So it’s more about desperation from a topsy-turvy condition.

Yet again since the current economic growth model has mutated to a “debt drives growth”, then what happens to G-R-O-W-T-H when the BSP succeeds at easing on credit expansion?

And since the current credit boom translates to intensive leveraging of the balance sheets of entities with access to the formal banking system and to the capital markets, the current BSP actions eventually shifts the risk equation from inflation to levered balance sheets.

Remember, only 20+ out of 100 households have bank access[10], whereas the cargo of debt have mostly been in the balance sheets of the companies owned by plutocrats or the politically connected economic elites who not only controls over 80+% of the stock market capitalization, has almost exclusive access to the bond markets—as of 1Q 2014 only 4 of the 30 largest local currency bonds[11] are from unlisted entities. Yet some of these has connections with listed firms—and most importantly whose firms constitutes about three fourths of the economy’s output[12]. In short, there is concentration of credit risk from mostly heavily levered firms.

These dynamics are ingredients to a crisis.

With their current actions, the BSP now wishes that the domestic economic and financial entities will be sturdy enough to such absorb rate increases. Yet the BSP fails to understand that her previous policies have been pivotal to the structural deformation of the nation’s economic model. Profits, earnings, income and demand have mostly become dependent on the supply side growth financed by debt. Thus, the archetype of “debt drives growth”, borrowed from policies of the US Federal Reserve, has been heavily dependent on zero bound rates. Take these foundations away will only lead to disorderly adjustments given the legacies of debt.

So hope now has become a part of BSP’s policies.

Yet even from the perspective of BSP actions alone, the chicken has come home to roost.

As one would note, things don’t just “occur” as most people think it is. Actions have consequences. Today’s events and the BSP responses have been due to previous actions.

Today’s BSP’s seemingly desperate recourse to tighten has been a scenario that I have warned about in November 2012[13]

Next year when price inflation (stagflation) becomes a real economic and market risks, will the Philippine government own up to their mess or will they simply pass the blame on the markets for these?

Oh, by the way, who in the mainstream has seen the current problems being addressed by the BSP coming?

Of course the BSP actions come way too late as the mania has taken off. Current rate increases are still benign as they remain in a negative real rate environment—consumer price inflation remains higher than the nominal official interest rates.

I expect the same reaction here.

Understanding Markets via the Business Cycle

As a money manager, it is important for me to know of the risk environment. Knowledge of the risk environment enables one to assess the risk-reward tradeoff and the probability payoff from one’s portfolio allocation.

And in the understanding that people’s actions are purposeful, where actions have been responses to incentives, the same actions underpin voluntary exchanges or the markets. Markets thus are a process of human interaction of voluntary exchanges guided by incentives.

As the great Austrian economist Ludwig von Mises once wrote[14], The market process is a daily repeated voting in which every penny gives a right to vote.

Financial markets are no different. And cycles are prominent features in the financial markets. Cycles essentially represent patterns of reactions by people to certain similar conditions.

For instance, government tampering with interest rates leads to boom bust cycles according to the Austrian Business Cycle Theory (ABCT). So if we follow the ABCT, all one needs to know is the whereabouts of the bubble cycle.

For instance in September 2010 I enumerated on why and how Philippine property markets will reach a euphoric stage[15]: (bold added)

The current “boom” phase will not be limited to the stock market but will likely spread across domestic assets.

This means that over the coming years, the domestic property sector will likewise experience euphoria.

For all of the reasons mentioned above, external and internal liquidity, policy divergences between domestic and global economies, policy traction amplified by savings, suppressed real interest rate, the dearth of systemic leverage, the unimpaired banking system and underdeveloped markets—could underpin such dynamics.

Thus the environment of low leverage and prolonged stagnation in property values is likely to get a structural facelift from policy inducements, such as suppressed interest rates which are likely to trigger an inflation fuelled boom by generating massive misdirection of resources-or malinvestments.

Of course many would argue on a myriad of tangential or superficial reasons: economic growth, rising middle class, urbanization and etc... But these would mainly signify as mainstream drivels, as media and the experts will seek to rationalize market action on anything that would seem fashionable.

Using the end of September 2010 as basis, as of Friday’s close the Phisix returned +75.65%. This has been led by holdings sector +103.17%, banking and financials +80.95% the property sector +74.33%, industrials +72.08%, mining 45.18% and services 37.03%.

In the real sector, property euphoria has already been reached with the Philippines topping the global list of housing price gains in Q4 2013 based on IMF-Global Property Guide-OECD-Haver benchmark. The world’s hottest housing market! How can these not be euphoria??

These price gains have indeed been pillared by “a structural facelift from policy inducements” as bank credit to the property sector ballooned from 2007-2013 and outpaced other sectors. Other bubble industries such as trade, financial intermediation and construction likewise posted hefty growth in bank credit over the same period.

And indeed a “myriad of tangential or superficial reasons” have been used to justify current conditions: economic transformation, strong external position (forex reserves! forex reserves! forex reserves!), low public debt, good governance and etc…

Practically all that I have enunciated here—from market response to credit growth to media rationalization—has occurred exactly as defined.

The boom bust cycle can be analogized as the following:

Person X earns 100,000 currency units (CU) a year. Let us say Person X borrows 900,000 (CU) at zero interest rates amortized 10 years. Let us further assume that Person X will spend all the amount on consumption and leisure. At Year ZERO, Person X obtains fresh spending power from newly issued credit by a bank. Over the same period, in spending all the new money Person X will experience a consumption spending boom. As legendary investor Jim Rogers in an interview last year said, Give Me A Trillion Dollars And I'll Show You A Really Good Time!

Unfortunately after the spending boom, debt needs to be repaid. So unless Person X’s income grows, only 10,000 of annual income will be left for Person X’s personal sustenance. Thus the frontloading of debt based spending creates a temporary boom which eventually morphs into a depression.

The reason I use general currency unit is to emphasize that the law of economics are universally applicable, which means they applicable everywhere.

So even at zero bound there are limits to debt acquisition.

What if banks/ developer via in house financing offer another 100,000 currency unit loan for Person X to acquire a property at zero rates with 10 year amortization? Will Person X take it? The answer is a likely no because Person X will be left with no sustenance for survival.

In the US according to a study by the New York Federal Reserve, renters haven’t been buying homes because of too much debt, low savings/income and or deficient credit rating[16]. Has the problem been about a lack of liquidity? The answer is no, the problem has been about the renter’s balance sheet constrains.

So Person X will not have the capacity to borrow because he/she has been overleveraged.

Several lessons from here:

Today’s (short term) gains from consumption financed by debt can be tomorrow’s (long term) depression.

Having too much unproductive debt leads to LOWER growth. The Philippine economy has been heavily gorging on debt since 2009 on mostly speculative activities. This will eventually weigh on, if not collapse, real and even statistical growth.

Having high levels of unproductive debt INCREASES credit risks. The BSP’s raising of interest rates will eventually expose or bring into the spotlight unfeasible speculative or capital consuming projects made viable only BECAUSE of zero bound rates. Non Performing Loans (NPLs) which are coincident if not lagging indicators will eventually reflect on this. Philippine consumer loans on real estate and auto loans have already revealed emergent signs of rising NPLs in 1Q 2014[17].

You can lead a horse to a water fountain but you CANNOT make him drink. Once balance sheet problems have been exposed, no amount of stimulus would make balance sheet impaired entities take on credit until their respective balance sheets have been repaired.

Once credit problems surfaces in the Philippine setting, those expecting a revival from bailouts will be disappointed. The Philippines is quite sensitive to inflation pressures given that food has a significant weighting on the household budget. So government stimulus would only raise inflation risks that could lead to social instability.

Lastly, contra mainstream, things don’t happen “just because”. Rather things happen out of human responses to incentives. Former relatively clean balance sheets or as I said in 2010 “an environment of low leverage” enabled Philippines firms to wolf down on debt from zero bound rates, thus having to amplify the so-called transformational boom.

This means that the BSP’s present dramatic response may not only imply the addressing of the risks from price inflation or from asset overvaluation but from risks that system-wide private sector debt may have reached PRECARIOUS levels!

Credit and Stock Market Cycles Converge

What cyclical stage are we at from the other perspective?

First the credit cycle. The credit cycle, according to Investopedia.com, involves access to credit by borrowers. Credit cycles first go through periods in which funds are easy to borrow; these periods are characterized by lower interest rates, lowered lending requirements and an increase in the amount of available credit. These periods are followed by a contraction in the availability of funds. During the contraction period, interest rates climb and lending rules become more strict, meaning that less people can borrow. The contraction period continues until risks are reduced for the lending institutions, at which point the cycle starts again[18].

The credit boom has been accompanied by the patent lowering of lending standards. There have already been signs of financial institutions offering “no money down loans”[19]. This means the race to issue loans comes with deteriorating quality therefore increasing credit risks.

As noted last week, the domestic shadow banking industry has been bulging along with the formal banking credit growth. The shadow banking sector’s growth has mostly been through in-house financing from the property sector and also from intra-corporate loans. Part of the shadow banking activities has been in response to government regulations where shadow banks circumvent or go around them. If the formal banking system has been emitting indications of tolerating greater credit risks in order to scrimp for yields, how much more for the in-house financing of property developers in order to artificially goose up sales? So shadow banks pose as another source of loose lending practice risk.

Even the formal banking sector appears to be dabbling with financial engineering via securitization. This means domestic financial institutions may be experimenting to package into investment instruments, pools of mortgages with various risk quality aimed at the transfer of credit risk to yield starved investors. The transfer of credit risk will likely induce more hazardous risk taking by financial institutions.

Companies like SMC practice what looks like a Hyman Minsky’s Ponzi financing scheme[20] which the banking system continues to facilitate. SMC’s rolling debt in and debt out of mostly short term debt in 2013 has reached nearly 10% of the Philippine banking system’s total resources. Rising rates will magnify SMC’s debt burden and raise SMC’s portfolio’s risk with banks.

The stock market valuations perspective.

As noted last week, based on Warren Buffett’s favorite metric the market cap to gdp, the ratio has already eclipsed the pre-Asian crisis levels signaling massive overvaluation. This is unsustainable for the simple reason that markets cannot continually outgrow the economy.

When the legendary investor the late Sir John Templeton, noted of the market cycle as “Bull-markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria”, he was referring to the dominant sentiment of the marketplace in each phase of the cycle.

For the current landscape, it has been obvious that the maturity phase of optimism has passed. The wild and frenetic churning of domestic stocks by domestic retail investors underscores euphoria, even if peso volume has been lower than that of during the 7,400 highs of May 2013.

The fear of being left out appears to govern the mindset of the current set of players whom have been incited to bouts of panic buying episodes regardless of valuations or risks. Again media’s shouting of g-r-o-w-t-h has been the conditioning signal trigger to such actions.

The “everybody is a genius” dynamic has undergirded the ONE way trade mentality. And any opposition to “stocks and economy has nowhere to go but up” religion has been treated with contempt if not with irreverence.

From the character of the dominant players, smart money dominates every stealth phase of a bubble. The entry of institutional investors reinforces the upside trend of a bubble. The next phase is the bandwagon effect from the public which turns stocks into a casino that culminates with a blow off phase.

Yet each time the bulls are hurt by the appearance of the bears, the former fights back with ferocity as we are seeing today.

The Obverse Side Of Every Mania Has Been A Crash

History gives us valuable clues, especially of our mistakes or even the flaws of our ancestors.

I am not a fan of patterns, although patterns exist. To anticipate a prospective repetition of a pattern, this requires important parallels in the fundamental sphere.

At 11 years old, the current bullmarket phase in the Philippine stock exchange (2003-2014; right) is as old as its predecessor (1986-1997; left). This implies that the current bullmarket may most likely be aging.

Interestingly, today’s underlying conditions (debt, valuations) appear to be even worse than that of the pre-Asian Crisis forebears. I don’t have data to compare with in the context of sentiment.

Over the past 28 years every single chapter of manias, expressed by parabolic price movements, has been followed by crashes.

In other words, the obverse side of every mania has been a crash

The two cyclical bear markets amidst the 1986-1997 bullmarkets exhibit the phenomenon: what goes up fast, goes down fast.

The 1994 top transitioned into an incredible saga of stock market volatility which had been characterized by 3 bear market strikes until the end of 1995. The Phisix lost 33% from top to the trough of 1995 where the bulls got second wind.

The final 1996-97 manic run ended the animated bull-bear battle since 1993 with a crash. The crash preceded the Asian Crisis by about 5 months.

The 2007 top played out a little bit different.

The September-October rebound from the bear market strike of July-August, was resolved by a drip, drip, drip then a flood or a slomo downhill before a collapse.

Remember, the Philippines hardly had economic fundamental weakness except through the contagion (which was vented on asset markets and on exports).

Yet record (forex reserves!, forex reserves!, forex reserves!) didn’t stop the stock market or the peso from cratering.

This brings us to the 2013 mania, which if everyone recalls also suffered from a bear market strike.

Yet the 2014 manic drama remains unresolved.

So if price patterns, fundamentals and sentiment (now even policy actions) have been converging, and if the obverse side of every mania has been a crash, then a crash cannot be discounted to happen anytime.

Because I am neither a seer nor a tarot card reader, I don’t know what will be the trigger (external or internal). I don’t know when it may happen. What I know is that history’s insights plus current events reveal that this has been the destiny, regardless of popular sentiment.

Remember confidence is fickle and can change in an instant.

Will The Firming US Dollar Index Usher In The Tetangco Moment?

As a final note on markets, the US dollar index has been firming of late. Since July 1, the US dollar index has been up by 5%!

Their individual charts reveal that the US dollar has been rising broadly and sharply against every single currency in the basket during the past 3 months.

Yet a rising US dollar has usually been associated with de-risking or a risk OFF environment. Last June 2013’s taper tantrum incident should serve an example.

There have been cracks in the EM space. Commodities have been guttered this week. Equities and currencies of Brazil and Turkey got slammed.

So far, the adverse impact from the rising US Dollar index on Asian-ASEAN markets has been marginal. But I wouldn’t rule out a spreading of a risk OFF environment, if the US dollar index continues to soar.

And as I have been saying here, the BSP chief has consistently been warning about the risks of market volatility from capital flight as consequence of exogenous events. Yet I have countered that foreigners are being conditioned publicly as scapegoats to what truly has been an internal imbalance problem only camouflaged by inflated statistics.

Nonetheless, will the firming US dollar index usher in the Tetangco Moment???

The Difference between Money Illusion and Statistical REAL GDP

I have been excoriated for supposedly not using “real” GDP during my discourse last week on the “money illusion”. That’s because “real” GDP, it has been held, represents the more accurate indicator of ‘g-r-o-w-t-h’.

I guess my message didn’t sink in, so let me clarify.

The intent of the money illusion treatise has been mainly to illustrate on the distortive effects of inflationism on prices and output and therefore the economy. This specifically can be seen from this excerpt (bold original) “And even if output declines, for as long as the decline will not be equal or be more than the inflation rates, the numbers will reveal “growth”. You can apply this to a firm, an industry, or a nation”.

The mention of “a firm, an industry, or a nation” signifies of the general effects from the money illusion principle.

I applied the money illusion principle exercise to my analysis of the 2Q GDP (bold original): “All told, outside manufacturing, there has been little support to the 2Q statistical economy except through the bubble sectors, particularly trade and real estate. Thus the kernel of 2Q 2014 6.4% growth must have been through the money illusion.”[21]

Perhaps the failure to connect the dots between the money illusion and the statistical GDP has incited the reaction to readily dismiss the relationship and instead offer “real” GDP as supposedly a superior metric for economic analysis.

This represents a typical reaction from bubble worshippers where the mechanical impulse has been to resort to the citation of statistics in defense against information opposed to their beliefs.

But for me, such intuitive response represent what I call the “Talisman effect” of screaming incantations (applied here—statistics) in order to do away “evil spirits” (applied here—any contradictory information against popularly held beliefs).

Also such objection can be deemed as the attribution substitute heuristic—where such mental abbreviations represent the sidestepping of complex issues by shifting to what is seen as ‘easily calculable’, or in this case the short cut is to ‘shout’: real GDP!

But sole dependence on official statistics (whether Philippines or from multilateral institutions) extrapolates to its incontrovertibility. In other words, such assumptions are predicated on “faith” on the data provider.

But that’s where I differ. I do NOT trust or have faith on these figures!

Because of blind faith, the consensus hardly raises any questions on the methodology or the accuracy of the numbers behind official statistics or even its implications. They swallow hook line and sinker the numbers as “facts”

Let us use BSP’s current actions as example. As a matter of proportionality, official inflation figures are not only below economic growth figures but have allegedly been within the target range although at the upper limits. So logic leads us to question why should 4.9% statistical inflation rate metastasize into a nationwide based political issue? Why has CPI of 4.9% compelled the BSP to panic with 6+1 policy actions in 6 months??? Why have the BSP chief warned on “chasing the markets”??? All these seemingly desperate moves because official numbers reflects on real social conditions????

Yet the official figures are merely estimates mostly from surveys constructed by political agencies. Since people act in accordance to the individual’s underlying incentives, which applies to political agents as well, what has largely been underappreciated or has been unseen by the public is that of the incentives guiding the political institution’s calculation as previously explained at length.

As in the case of Soviet Union, present day Argentina and Venezuela, such ‘growth’ numbers neither represents reality nor substitutes for truth. In the case of USSR, even the late celebrity economist Paul Samuelson had been fooled by growth statistics as to endorse the Soviet political economic framework only to see the communist nation state disbanded 3 years after!!! What happened to ‘g-r-o-w-t-h’? Recently, due to accounting magic, Nigeria’s statistical growth DOUBLED overnight[22]! So one can have statistical ‘growth’, even while many people have been starving!

Yet more signs of massaging of statistical g-r-o-w-t-h data. In July 2013, the Chinese government admitted to selective statistical reporting or hiding of data sets at the industry level[23]. In October of the same year, since the padding of growth data has mostly been at the local level, the national government of China vowed a crackdown on ‘falsified data’[24]. In Italy, sagging economic growth has impelled the government to include the illegal drug sales, smuggling and prostitution in the gross domestic product calculation in order to buoy the statistical economy[25] in May 2014. How does one get to compute “illegal” into GDP? Beats me. The United Kingdom also followed to include the sex and drug industry[26] also in their GDP late May 2014.

As the late British economist Ronald Coase once wrote[27], “If you torture the data enough, nature will always confess”.

So to correlate “money illusion” with real GDP is either to blur/confuse or to severely miscomprehend on the issue.

Applied to the Philippines, as I recently posited, “the possible understatement of the deflator, the PCE (denominator), may have boosted “growth” story”[28]. The point is, one can easily boost GDP figures by simply underreporting estimated inflation figures or by tweaking numbers that have been based mostly on surveys.

I also previously pointed out[29] that even BSP Deputy Governor Diwa C Guinigundo in a paper to the Bank of International Settlements admitted to the limitations of domestic official statistical ‘inflation’ data (bold mine): “Excluding asset price components from headline inflation also has little effect. Currently, the CPI includes only rent and minor repairs. The rent component of the CPI is, however, not reflective of the market price because of rent control legislation. The absence of a real estate price index (REPI) reflects valuation problems, owing largely to the institutional gaps in property valuation and taxation. While the price deflator derived from the gross value added from ownership of dwellings and real estate could represent real property price, it is also subject to frequent revisions, making it difficult to forecast inflation.”

Even from the government’s lens, their own actions have functioned as an impediment to the ‘accurate’ representation of (market priced based) statistical data.

So why should I trust the government’s data when the government themselves even concede of its structural deficiencies? So why should I rely on ‘real’ GDP when inherent problems in the official ‘inflation’ data makes the price deflator ‘difficult to forecast inflation’?

Can bubble worshippers do a better job than the good BSP Deputy Governor and his team of econometricians to prove on the objective accuracy of these estimated numbers established by the government (say the PCE deflator)?

Yet my view is different from the establishment. Since there is no constancy in human action (or where the only constant is change) and where human action is subjective, accuracy of statistical economic data represents no more than a statist’s fantasy.

As the great dean of the Austrian school of economics, Murray N Rothbard wrote (bold mine)[30],

Econometrics not only attempts to ape the natural sciences by using complex heterogeneous historical facts as if they were repeatable homogeneous laboratory facts; it also squeezes the qualitative complexity of each event into a quantitative number and then compounds the fallacy by acting as if these quantitative relations remain constant in human history. In striking contrast to the physical sciences, which rest on the empirical discovery of quantitative constants, econometrics, as Mises repeatedly emphasized, has failed to discover a single constant in human history. And given the ever-changing conditions of human will, knowledge, and values and the differences among men, it is inconceivable that econometrics can ever do so.

And from this, I am on the side of the engineer of Hong Kong’s economic boom via economic freedom, the late British Finance Minister of Hong Kong, Sir John Cowperthwaite, who reportedly was averse to statistics because for him these represent tools for political interventions.

As per the Le Quebecois Libre[31] (bold mine): Asked what is the key thing poor countries should do, Cowperthwaite once remarked: "They should abolish the Office of National Statistics." In Hong Kong, he refused to collect all but the most superficial statistics, believing that statistics were dangerous: they would led the state to to fiddle about remedying perceived ills, simultaneously hindering the ability of the market economy to work”

It’s not just statistical massaging but likewise public indoctrination of inflated statistics.

Yet here is an example of how media warps a statistical economic g-r-o-w-t-h story.

In short, the same number can provide different stories as seen from different angles, yet media’s presentation has been to slant information towards the popular appeal while at the same time ignoring all other dimensions. So every positive media slant from statistically inflated numbers reinforces the bias of every uncritical bubble lemming. Media says follow my lips and say G-R-O-W-T-H! Audience in a Zombie/robot like manner respond: G-R-O-W-T-H! Nice.

And this is the kind of “Talisman effect” which the consensus employs when dealing with knowledge opposite to their entrenched one way trade beliefs—they quibble from the basis of numbers that favors them (selective perception). It’s like arguing over head or tails but essentially such disagreement stems from looking at the same coin, without asking whether the coin is a counterfeit or not! Or simply said, the consensus tactic has been to debate the numbers (superficiality) rather than scrutinize over reasoning or logic behind those numbers and or the theories that has backed the origins of the statistical methodologies.

Does slavish devotion to numbers or faith based dependence on official statistics manifest an exercise of prudence or of sloppy analysis?

Petron Corp’s Money Illusion

Meanwhile, here is a real time application of the money illusion principle at the company level. Let me cite Petron Corp’s [PSE: PCOR] 1H 2014 financial standings as an example.

In a presentation from parent San Miguel to investors[32], PCOR’s net sales (total revenue less cost of sales, returns, allowances, and discounts) jumped by 18% even as volume underpinning the sales grew by only 8%. This represents a whopping 10% disparity! [To be clear, companies use current prices to calculate for financial statements hence no deflators involved] This implies that most of PCOR’s top line gains (55%) have likely been from price differentials easily attributable to the money pumped into the system from the banking system via the successive 9 months of 30% money supply growth.

Given that the bulk of Petron’s revenues come from crude, fuel and lubricants sold to distributors or resellers, the BSP’s wholesale price index over the same period appears to reflect on these dynamics. And much of those top line gains from price differentials dynamics have apparently spilled over to become ‘profits’.

In short, PCOR’s 1H 2014 financial standings exhibit how inflationism artificially boosts revenues, earnings and profits. That’s aside from the subsidies provided by zero bound interest rates that has depressed the cost of servicing existing liabilities (PCOR, like the parent, has a heavily leveraged balance sheet with 6.41 debt/Ebitda in 2014 based on 4-traders.com estimates), and from the continuing use of credit to finance operation and expansion.

Yet in order for PCOR’s financials to continue to expand at this rate, the oil firm would need the BSP to sustain her accommodative policies. But again inflationism is no free lunch, since there are wide ranging natural—social, economic and political—costs on these.

And don’t forget the BSP has launched its second official rates increase PLUS second SDA rate increase, thereby partially withdrawing subsidies to these subsidy dependent firms

Regardless of the merits of historical official data, here is the more important question: What happens, or what will statistics or financial data eventually reveal, once the effects of money illusion fade away? This applies to official statistics both nominal and real GDP, as well as to profits earned by Petron and by other levered firms and most especially the government whom has been the primary beneficiary of financial repression policies, as seen through relatively ‘low’ debt levels and from inflated taxes brought about by the subsidies from the same zero bound policies.

Does the consensus know??? To give a hint: Since inflationism has not been on their radar screens, once a reversal of this phenomenon emerges, not only will they be jolted, but they may likely experience financial angst. In short, the consensus won’t like it.

I’ll end this note with a germane quote from Samuel Langhorne Clemens popularly known by his pen name Mark Twain

It is easier to fool people than to convince them that they have been fooled.