The simmering debate over the proposed loan to the IMF by the Bangko Sentral ng Pilipinas (BSP) can be summarized as:

For the anti-camp, the issue is largely one of purse control or where to spend the government (or in particular the BSP’s money) seen from the moral dimensions.

For the pro-camp or the apologists for the BSP and the government, the argument has been made mostly over the opportunity cost of capital or (Wikipedia.org) or the expected rate of return forgone by bypassing of other potential investment activities, e.g. best “riskless” way to earn money, appeal to tradition, e.g. Philippines has been lending money to the IMF for decades, and with some quirk “foreign exchange assets …are not like money held by the treasury” which is meant to dissociate the argument of purse control with central bank policies.

I will be dealing with latter

This assertion “foreign exchange assets …are not like money held by the treasury” is technically true or valid in terms of FORM, but false in terms of SUBSTANCE.

Foreign exchange assets are in reality products of Central Banking monetary or foreign exchange policies of buying and selling of official international reserves (Wikipedia.org)

This means that foreign exchange assets and reserves are acquired and sold by the BSP with local currency units, or the Philippine Peso, prices of which are set by the marketplace

It is important to address the fact that the local currency the Peso has been mandated as legal tender by The New Central Bank Act or REPUBLIC ACT No. 7653 which says

Section 52. Legal Tender Power. -

All notes and coins issued by the Bangko Sentral shall be fully guaranteed by the Government of the Republic of the Philippines and shall be legal tender in the Philippines for all debts, both public and private

This means that ALL transactions made by the BSP based on the Peso are guaranteed by the Philippine government. This also further implies that foreign exchange assets held by the BSP, which were bought with the Peso, are underwritten by the local taxpayers. Therefore claims that taxpayer money as not being exposed to the proposed BSP $1 billion loan to the IMF are unfounded, if not downright silly. We don’t need to drill down on the content of the balance sheet and the definition of International Reserves for the BSP to further prove this point.

The more important point here: whether foreign exchange or treasury or private sector assets, we are dealing with money.

And money, as the great Austrian professor Ludwig von Mises pointed out, must necessarily be an economic good, the notion of a money that would not be scarce is absurd.

As a scarce good, money held by the National government or by the BSP is NOT money held by the private sector.

Therefore the government or the BSP’s “earnings” translates to lost “earnings” for the private sector.

Costs are not benefits. To paraphrase Professor Don Boudreaux, that the benefit the BSP gets from investing in the asset markets might make sacrificing some unseen private sector industries worthwhile does not mean such sacrifices are a benefit in and of itself.

The public sees what has only been made to be seen by politics. Yet the public does not see the opportunities lost from such actions. Therefore, the cost-benefit tradeoff cannot be fully established.

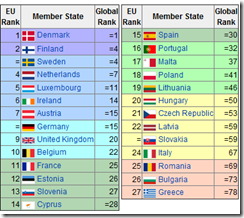

Besides, any idea that loans to the IMF is risk free is a myth. There is no such thing as risk free. The laws of economics cannot be made to disappear, or cannot become subservient, to mere government edicts as today’s crisis has shown. Remember the IMF depends on contributions from taxpayers of member nations. And for many reasons where taxpayers of these nations might resist to contribute further, and or where the loan exposures by the IMF does not get paid, then the IMF will be in a deep hole.

As I pointed previous out the risk to IMF’s loan to crisis nation are real. There hardly has been anything to enforce loan covenants or deals made with EU's crisis restricted nations.

Also, it is naïve to believe that just because the Philippines has had a track record of lending to the IMF, that such actions makes it automatically financially viable or moral. This heuristics (mental short cut) wishes away the nitty gritty realities of the distinctive risks-return tradeoffs, as well as the moral issues, attendant to every transaction. Here the Wall Street saw applies: Past performance does not guarantee future outcomes.

It is further misguided to believe that the government (in particular the BSP) behaves like any other private enterprises.

As a side note, I find it funny how apologists use logical verbal sleight of hand in attempting to distinguish central bank operations from treasury operations but ironically and spuriously attempts to synthesize the functionality of government and private enterprises.

Two reasons:

1. Central banks are political institutions with political goals.

As the great dean of Austrian School of economics, Murray N. Rothbard pointed out,

The Central Bank has always had two major roles: (1) to help finance the government's deficit; and (2) to cartelize the private commercial banks in the country, so as to help remove the two great market limits on their expansion of credit, on their propensity to counterfeit: a possible loss of confidence leading to bank runs; and the loss of reserves should any one bank expand its own credit. For cartels on the market, even if they are to each firm's advantage, are very difficult to sustain unless government enforces the cartel. In the area of fractional-reserve banking, the Central Bank can assist cartelization by removing or alleviating these two basic free-market limits on banks' inflationary expansion credit.

2. The guiding incentives and structure of operations for government agencies (not limited to the BSP) is totally different from profit-loss driven private enterprises.

Again Professor Rothbard,

Proponents of government enterprise may retort that the government could simply tell its bureau to act as if it were a profit-making enterprise and to establish itself in the same way as a private business. There are two flaws in this theory. First, it is impossible to play enterprise. Enterprise means risking one's own money in investment. Bureaucratic managers and politicians have no real incentive to develop entrepreneurial skill, to really adjust to consumer demands. They do not risk loss of their money in the enterprise. Secondly, aside from the question of incentives, even the most eager managers could not function as a business. Regardless of the treatment accorded the operation after it is established, the initial launching of the firm is made with government money, and therefore by coercive levy. An arbitrary element has been "built into" the very vitals of the enterprise. Further, any future expenditures may be made out of tax funds, and therefore the decisions of the managers will be subject to the same flaw. The ease of obtaining money will inherently distort the operations of the government enterprise. Moreover, suppose the government "invests" in an enterprise, E. Either the free market, left alone, would also have invested the same amount in the selfsame enterprise, or it would not. If it would have, then the economy suffers at least from the "take" going to the intermediary bureaucracy. If not, and this is almost certain, then it follows immediately that the expenditure on E is a distortion of private utility on the market — that some other expenditure would have greater monetary returns. It follows once again that a government enterprise cannot duplicate the conditions of private business.

In addition, the establishment of government enterprise creates an inherent competitive advantage over private firms, for at least part of its capital was gained by coercion rather than service. It is clear that government, with its subsidization, if it wishes can drive private business out of the field. Private investment in the same industry will be greatly restricted, since future investors will anticipate losses at the hands of the privileged governmental competitors. Moreover, since all services compete for the consumer's dollar, all private firms and all private investment will to some degree be affected and hampered. And when a government enterprise opens, it generates fears in other industries that they will be next, and that they will be either confiscated or forced to compete with government-subsidized enterprises. This fear tends to repress productive investment further and thus lower the general standard of living still more.

From here we derive the third view that distinguishes from the two mainstream camps:

Government is NOT supposed to “earn” money. Government should leave the private sector to earn from productive undertakings. Whatever “surpluses” or “earnings” should be given back to the taxpayers. How? By reducing taxes, by cutting down government spending and or by paying down public debt.

The “returns” from these actions will surely outweigh gains made from political speculations. Unfortunately this has been unseen.

As the great Frederic Bastiat once remarked

Between a good and a bad economist this constitutes the whole difference - the one takes account of the visible effect; the other takes account both of the effects which are seen, and also of those which it is necessary to foresee. Now this difference is enormous, for it almost always happens that when the immediate consequence is favourable, the ultimate consequences are fatal, and the converse. Hence it follows that the bad economist pursues a small present good, which will be followed by a great evil to come, while the true economist pursues a great good to come, - at the risk of a small present evil.