The financial crisis served to differentiate two types of investments–the ones that get bailed out and the ones that don’t. Investors naturally have a preference for the former. That means big banks can get cheap credit. And what does Basel tell them they can do with their cheap credit? Buy government bonds.So what we have had over the past ten years is a massive exercise in credit allocation by the world’s bank regulators. They offer explicit and implicit guarantees to banks that invest in assets officially designated as low risk, and now they are shocked, shocked to find capital pouring into exactly those assets.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, April 06, 2013

Quote of the Day: Credit Allocation Determined by World’s Bank Regulators

Wednesday, November 28, 2012

New Currency Reserves: Australian Dollar, Canadian Dollar and Gold

From about 2% of total reserves in 2009, the allocation to “other currencies” has risen to over 5%. The Canadian and Australian dollars probably account for the vast majority of this increase.To be sure, the IMF’s announcement is only a recognition of what central banks have been doing. It does not make the Canadian and Australian dollars any more attractive. Nevertheless, the shift into alternative currencies is a trend that is likely to persist. Global FX reserves total over $11 trillion, so a 1% change in currency allocation during the span of a year amounts to more than $100 billion.A large sum for relatively small economies like Canada and Australia to absorb.

Zero bound short term interest rates, ballooning central bank balance sheets, large fiscal deficits and worrisome government debt levels are forcing investors, in both the public and private sectors, to seek out relatively sound alternatives to the major currencies.

Wednesday, November 07, 2012

Why Short Selling has been at the Losing End

THE long-short ratio of global equities, a gauge of market sentiment, is at a five-year high. The ratio, which measures the value of stocks available for short-selling to what is actually on loan, shows longs outnumber shorts by a factor of more than 12, suggesting investors are increasingly bullish. Higher stockmarkets are driving the ratio upwards, as the amount on loan has not changed significantly in the last few years. The appetite for short-selling has been affected by uncertainty over regulation, and by a change of strategy from hedge funds (big short-sellers), which have been less leveraged since the financial crisis. But while the long-short ratio of American and European equities has increased, bears are far from extinct: between 7% and 8% of lendable value is still on loan to short-sellers.

Friday, August 31, 2012

Indian Banks Reduce Exposure on US Banks

More signs of anxiety in the global financial markets: Indian banks reportedly reduced deposits with US Banks

From Financial Chronicle (mydigitalfc.com)

India banks’ deposits with US banks dipped in June, reflecting heightened risk aversion. This showed up in a fall in custodial liabilities of American banks to counterparties in India, which shrank by over $2 billion in June.

According to the US treasury data released, custodial liabilities of American banks payable in US dollars in June was $13.059 billion. A year ago, the holdings were $15.288 billion.

The custodial liabilities included foreign currency deposits by Indian banks in American banks. Indian banks hold dollar deposits with US counterparts for settlement of international liabilities.

Andhra Bank currency trader Vikas Babu said, “There is some risk aversion on US banks. So, banks have shifted to short-term US treasuries for less than one year for liquidity purposes.”

The shift to US treasuries, however, was not necessarily driven by interest earnings. Short-term holdings in US treasuries earned barely 0.5 per cent. Correspondent account balances, that are technically current accounts, earned zero interest. But the shift was partly on account of the fact that foreign institution balances in US banks are not covered by the US federal deposit insurance company (FDIC). FDIC provides insurance cover for bank deposits only to US entities and residents.

The shift to US treasuries was also apparent from a steep $9.5 billion rise in holdings to $50.8 billion by Indian institutions, including the RBI. The increase in holdings was despite compression in India’s external reserves by $26.5 billion in June from the corresponding period of the previous year.

Aside from possible concerns over the health of the US banking sector, the shift to short term securities could also mean that Indian banks may be expecting a spike in US interest rates, perhaps in anticipation of another round of asset purchases by the US Federal Reserve.

Also Indian banks may be under pressure from the recent economic slowdown. Indian banks have been required to raise 1.75 trillion capital by 2018 in order to comply with Basel III capital adequacy standards (yahoo)

Wednesday, May 30, 2012

Will Gold be a Part of Basel Capital Standard Regulations?

At the Mineweb.com, Ross Norman CEO of Sharps Pixley thinks that chances are getting better for gold to take a role in the banking system’s capital standard regulations.

Mr. Norman writes,

Banking capital adequacy ratios, once the domain of banking specialists are set to become centre stage for the gold market as well as the wider economy. In response to the global banking crisis the rules are to be tightened in terms of the assets that banks must hold and this is potentially going to very much favour gold. The Basel Committee for Bank Supervision (or BCBS) as part of the BIS are arguably the highest authority in banking supervision and it is their role to define capital requirements through the forthcoming Basel III rules.

In short, they are meeting to consider making gold a Tier 1 asset for commercial banks with 100% weighting rather than a Tier 3 asset with just a 50% risk weighting as it does today. At the same time they are set to increase the amount of capital banks must set aside as well. A double win potentially.

Hitherto banks have been much dis-incentivised to hold gold while being encouraged to hold arguably riskier assets such as equity capital, currencies and debt instruments, none of which have fared too well in the crisis. With this potential change in capital adequacy requirements. bank purchases of gold would drive up its value relative to other high quality qualifying assets, increasing its desirability for regulatory purposes further. This should result in gold being re-priced to bring it on a par with all other high quality assets.

While this should be good news, gold isn’t structurally compatible with the current form of political institutions (welfare-warfare state-central banking and privileged bankers) highly dependent on inflationism.

Since the Basel standards have in itself been fundamentally flawed, like in the past, governments and their adherents will only use gold as scapegoat for any future crisis. But who knows.

Nevertheless, the above serves as added indications where gold will likely play a greater role in the global economy, perhaps as money.

Monday, March 12, 2012

Bank Regulations as Instruments of Repression

From IFC Review, (hat tip Dan Mitchell)

Banks and other financial services firms had to deal with 60 regulatory changes each working day during 2011, according to a report from Thomson Reuters Governance, Risk & Compliance, reports City AM.

Regulators around the world announced 14,215 changes in 2011, a 16 per cent increase from the 12,179 announcements in 2010.

The report shows that the majority of regulatory activity, 57 per cent, came from the US, while the UK and rest of Europe made up 22 per cent and Asia accounted for 15 per cent.

The volume of announcements, which can include anything from a speech which may signal the direction of a new regulation to a final binding rule, has grown continuously since 2008 when regulators issued 8,704 changes.

The firm warn that the level of announcements will increase even more during 2012 as governments tighten regulation and new directives, including those related to the US Dodd-Frank act, are implemented.’

The incredible pace of regulatory changes (60 regulatory changes a day!!!) will prompt for many innocent people to be charged as criminals as in my experience.

The deluge of banking regulations represents the repressive nature of arbitrary regulations which will and has been used to subjugate the citizenry or the public largely unaware of the existence of these regulations.

Yet these are intensifying signs of desperation by the politicians whom has conscripted, and or colluded, with the banking system to extort resources from the public to sustain their privileges.

In reality, the torrent of new regulations also account for as disguised capital controls or a form of financial repression. Harvard’s Carmen Reinhart in today’s Bloomberg OpEd writes,

some of these requirements may be motivated by a government’s desire to curb money laundering and tax evasion, the measures also amount, in some cases, to administrative capital controls.

So the public is being wangled financially and oppressed politically through a variety of new arbitrary regulations under the cover of money laundering and or tax evasion. Laws are being used to violate and restrain our freedom in the name of political expediency.

Anti Money Laundering Laws (AMLA) is an example of the numerous bank regulations that has been covered by the alterations in the banking regulatory regime. Cato’s Dan Mitchell discusses the law’s ineffectiveness.

Saturday, February 11, 2012

Understanding America’s Debt Culture

Writes The End of the American Dream

When most people think about America's debt problem, they think of the debt of the federal government. But that is only part of the story. The sad truth is that debt slavery has become a way of life for tens of millions of American families. Over the past several decades, most Americans have willingly allowed themselves to become enslaved to debt. These days, most of us are busy either going into even more debt or paying off the debt that we have accumulated in the past. When your finances are dominated by debt, it makes it really hard to ever get ahead. Incredibly, 43 percent of all American families spend more than they earn each year. Even while median household income continues to decline (now less than $50,000 a year), median household debt continues to go up. According to the Federal Reserve, median household debt in America has risen to $75,600. Many Americans spend decades caught in the trap of debt slavery. Large numbers of them never even escape at all and die in debt. It can be a lot of fun to spend lots of money and go into lots of debt, but it can be absolutely soul crushing to toil and labor for years paying off those debts while making others wealthy in the process. Hopefully this article will inspire many people to try to escape the chains of debt slavery once and for all.

Because the truth is that the American people need a wake up call. Consumer borrowing rose by another $19.3 billion in December. Right now it is sitting at a grand total of $2.5 trillion according to the Federal Reserve.

Overall, consumer debt in America has increased by a whopping 1700% since 1971.

We always criticize the federal government for going into so much debt, but we rarely criticize ourselves for our own addiction to debt.

Debt slavery is destroying millions of lives all across this country, and it is imperative that we educate the American people about the dangers of all this debt.

The following are 30 facts about debt in America that will absolutely blow your mind....

Credit Card Debt

#1 Today, 46% of all Americans carry a credit card balance from month to month.

#2 Overall, Americans are carrying a grand total of $798 billion in credit card debt.

#3 If you were alive when Jesus was born and you spent a million dollars every single day since then, you still would not have spent $798 billion by now.

#4 Right now, there are more than 600 million active credit cards in the United States.

#5 For households that have credit card debt, the average amount of credit card debt is an astounding $15,799.

#6 If you can believe it, one out of every seven Americans has at least 10 credit cards.

#7 The average interest rate on a credit card that is carrying a balance is now up to 13.10 percent.

#8 According to the credit card calculator on the Federal Reserve website, if you have a $10,000 credit card balance and you are being charged a rate of 13.10 percent and you only make the minimum payment each time, it will take you 27 years to pay it off and you will end up paying back a total of $21,271.

#9 There is one credit card company out there, First Premier, that charges interest rates of up to 49.9 percent. Amazingly, First Premier has 2.6 million customers.

Auto Loan Debt

#10 The length of auto loans in America just keeps getting longer and longer. If you can believe it, 45 percent of all new car loans being made today are for more than 6 years.

#11 Approximately 70 percent of all car purchases in the United States involve an auto loan.

#12 A subprime auto loan bubble is steadily building. Today, 45 percent of all auto loans are made to subprime borrowers. At some point that is going to be a massive problem.

Mortgage Debt

#13 Total home mortgage debt in the United States is now about 5 times larger than it was just 20 years ago.

#14 Mortgage debt as a percentage of GDP has more than tripled since 1955.

#15 According to the Mortgage Bankers Association, approximately 8 million Americans are at least one month behind on their mortgage payments.

#16 Historically, the percentage of residential mortgages in foreclosure in the United States has tended to hover between 1 and 1.5 percent. Today, it is up around 4.5 percent.

#17 According to Dylan Ratigan, 46 percent of all mortgaged properties in Florida are underwater, 50 percent of all mortgaged properties in Arizona are underwater and 63 percent of all mortgaged properties in Nevada are underwater.

#18 Overall, nearly 29 percent of all homes with a mortgage in the United States are underwater.

#19 If you can believe it, the mortgage lenders now have more equity in U.S. homes than the American people do.

Medical Debt

#20 Medical debt is a major problem for a growing number of Americans. One study discovered that approximately 41 percent of all working age Americans either have medical bill problems or are currently paying off medical debt.

#21 Sadly, the number of Americans that are protected by health insurance continues to decline. An all-time record 49.9 million Americans do not have any health insurance at all right now, and the percentage of Americans covered by employer-based health plans has fallen for 11 years in a row.

#22 But even if you do have health insurance, there is still a good chance that you could end up with huge medical debt problems. According to a report published in The American Journal of Medicine, medical bills are a major factor in more than 60 percent of the personal bankruptcies in the United States. Of those bankruptcies that were caused by medical bills, approximately 75 percent of them involved individuals that actually did have health insurance.

Student Loan Debt

#23 Total student loan debt in the United States is rapidly approaching 1 trillion dollars.

#24 If you went out right now and starting spending one dollar every single second, it would take you more than 31,000 years to spend one trillion dollars.

#25 In America today, approximately two-thirds of all college students graduate with student loan debt.

#26 The average student loan debt load is now approximately $25,000.

#27 After adjusting for inflation, U.S. college students are borrowing about twice as much money as they did a decade ago.

#28 One survey found that 23 percent of all college students actually use credit cards to pay for tuition or fees.

#29 The student loan default rate has nearly doubled since 2005.

#30 Student loans made to directly to parents have increased by 75 percentsince the 2005-2006 academic year.

At this point, most Americans are up to their eyeballs in debt. According to a recent study conducted by the BlackRock Investment Institute, the ratio of household debt to personal income in the United States is now 154 percent.

Our entire economy has become based on credit.

Read the rest here

You’d hear or read of many adverse or negative imputations as “consumerism”, “not producing enough”, “spendthrift behavior”, “squanderville” and etc… from the mainstream, as if it has been the nature of Americans to be prodigal.

Lost on the real causation for the present circumstances, the politically popular theme has been to shift the blame on China for “currency manipulation” and or for financing US “profligacy”. In short, China bashing has served as a convenient political scapegoat for politicians and their allies.

Yet there have hardly been significant mainstream inquiries on what forces or variables may have influenced or motivated Americans to adapt on such consumption debt-financed based lifestyles.

In terms of government policies, a black hole emerges from mainstream thinking.

While the mainstream fixates on the moral aspects of the debt-consumption dynamics, they gloss over the effects of government policies that have vastly skewed people’s behavior to take on debts at the expense of savings and equity.

For instance, the credit fueled 2008 housing bubble has largely been policy driven. The speculative environment was entwined with debt based consumption activities.

Tax deductions on interest for corporations, and similarly for individuals—tax deductibility on mortgage interest and government subsidies on mortgages—encouraged debt take up and over-leveraging.

Another, capital regulations discouraged traditional mortgage lending and incentivized securitization, which has been abetted by the conflict of interest role played by credit rating agencies, whom ironically have been tightly regulated by the US government.

Also, public policy to promote housing or homeownership provided the moral hazard aspects via commitment by government to various housing subsidies. Thus, American’s penchant for McMansions. (My source Professor Arnold Kling: THE FINANCIAL CRISIS: MORAL FAILURE OR COGNITIVE FAILURE?)

Importantly, the zero bound interest rate policies, or formerly known as the Greenspan Put, favored debtors at the expense of savers. The Greenspan Put had also functioned as a conventional tool used against past crisis which has successfully kicked the proverbial can down the road.

Policies implemented by team Bernanke today have been NO different from the past, ergo the eponymous Bernanke Put.

Artificially suppressed interest rates thereby increases people’s time preference to consume at the expense production.

As the illustrious Ludwig von Mises explained,

The very act of gratifying a desire implies that gratification at the present instant is preferred to that at a later instant. He who consumes a nonperishable good instead of postponing consumption for an indefinite later moment thereby reveals a higher valuation of present satisfaction as compared with later satisfaction. If he were not to prefer satisfaction in a nearer period of the future to that in a remoter period, he would never consume and so satisfy wants. He would always accumulate, he would never consume and enjoy. He would not consume today, but he would not consume tomorrow either, as the morrow would confront him with the same alternative.

Thus, alternative to consumption activities from boom bust policies would be to entice short term speculation; ergo today’s speculative inflationary boom.

The ‘innovative’ and unparalleled Quantitative Easing (QE) approach also shields the banking system from having to face the harsh reality of the required market adjustments, from the massive malinvestments accumulated, brought upon by past policies.

QEs labeled as credit easing by central banks, have likewise been designed to promote debt by alleviating the conditions of the accounting books of the banking and financial industry.

In addition, America’s debt culture signifies a product of mainstream ideology

I previously wrote,

The culture of debt signifies symptoms of accrued policies shaped by the dominant economic ideology which sees spending as the key force for promoting prosperity or keeping society “permanently in a quasi-boom”.

The war against savings, which is being channeled through policy-based low interest rates (“The remedy for the boom is not a higher rate of interest but a lower rate of interest! For that may enable the boom to last”-General Theory) punishes savers and rewards speculative activities which benefits the wards of central banks—added profits for the banking industry cartel and expanded government spending for politicians.

Never mind the law of diminishing returns on debt to an economy

Past ephemeral successes [plus sustaining a debt based political economy] will lead global authorities towards path dependent policy choices (which is why I think that global QEs will continue)

Besides, politicians and the bureaucracy sees such policies as even more beneficial to them even if the markets suffer from the convulsions of debt overdose: people will be more captive to them which expands their control over the society.

Put differently, the cartelized political institutions made up of the triumvirate of the central bank, the welfare state and the politically privileged “too big to fail” banks represents as the major beneficiaries of a debt driven society, and thus, the incumbent political agents will continue to focus on maintaining the status quo founded on policies, laws and regulations that rewarded debts.

Sad to say, the laws of economics has been catching up with the artificiality of such political arrangement.

Monday, December 05, 2011

How Capital Regulations Contributed to the Current Crisis

At the Wall Street Journal, American Enterprise Institute’s Peter J. Wallison explains how capital regulations are partly responsible for the current mess (bold emphasis mine)

Basel is the Swiss city where the world's bank supervisors regularly meet to consider and establish these rules. Among other things, the rules define how capital should be calculated and how much capital internationally active banks are required to hold.

First decreed in 1988 and refined several times since then, the Basel rules require commercial banks to hold a specified amount of capital against certain kinds of assets. Under a voluntary agreement with the Securities and Exchange Commission, the largest U.S investment banks were also subject to the form of Basel capital rules that existed in 2008. Under these rules, banks and investment banks were required to hold 8% capital against corporate loans, 4% against mortgages and 1.6% against mortgage-backed securities. Capital is primarily equity, like common shares.

Although these rules are intended to match capital requirements with the risk associated with each of these asset types, the match is very rough. Thus, financial institutions subject to the rules had substantially lower capital requirements for holding mortgage-backed securities than for holding corporate debt, even though we now know that the risks of MBS were greater, in some cases, than loans to companies. In other words, the U.S. financial crisis was made substantially worse because banks and other financial institutions were encouraged by the Basel rules to hold the very assets—mortgage-backed securities—that collapsed in value when the U.S. housing bubble deflated in 2007.

Today's European crisis illustrates the problem even more dramatically. Under the Basel rules, sovereign debt—even the debt of countries with weak economies such as Greece and Italy—is accorded a zero risk-weight. Holding sovereign debt provides banks with interest-earning investments that do not require them to raise any additional capital.

Accordingly, when banks in Europe and elsewhere were pressured by supervisors to raise their capital positions, many chose to sell other assets and increase their commitments to sovereign debt, especially the debt of weak governments offering high yields. If one of those countries should now default, a common shock like what happened in the U.S. in 2008 could well follow. But this time the European banks will be the ones most affected.

In the U.S. and Europe, governments and bank supervisors are reluctant to acknowledge that their political decisions—such as mandating a zero risk-weight for all sovereign debt, or favoring mortgages and mortgage-backed securities over corporate debt—have created the conditions for common shocks.

I have explained here and here how Basel capital standard regulations does not address the root of the crisis—fiat money and central banking—and will continue to churn out rules premised on political goals, knee jerk responses to current predicaments (time inconsistent rules) and incomplete knowledge.

A manifestation of the institutional distortions as consequence to regulations which advances political goals can be noted at the last paragraph where US and European governments and bank supervisors are “reluctant to acknowledge that their political decisions”, which have not only “created conditions for common shocks”, but has existed to fund the welfare state and the priorities of political leaders in boosting homeownership ownership which benefited or rewarded the politically privileged banks immensely.

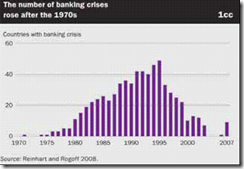

Capital regulation rules will continue to deal with the superficial problems of the banking system which implies that banking crises will continue to haunt us or won’t be going away anytime soon despite all model based capital ratio adjustments. It's been this way since the closing of the gold window or the Nixon shock (see above chart from the World Bank)

Saturday, October 29, 2011

The Myth of the Poor as Borrowers, Rich as Lenders

“The Poor are Borrowers and the Rich are lenders” has been one of the enduring myths which the left uses to champion the Keynesian policies of the “euthanasia of the rentier” and central banking.

David Gordon quotes the great Murray Rothbard,

Often, this turns out to be the reverse of the truth. "Debtors benefit from inflation and creditors lose; realizing this fact, older historians assumed that debtors were largely poor agrarians and creditors were wealthy merchants and that therefore the former were the main sponsors of inflationary nostrums. But of course, there are no rigid 'classes' of creditors and debtors; indeed, wealthy merchants and land speculators are often the heaviest debtors" (p. 58).

Even the conditions of nations today do not support this argument.

Based on the 2010 NIIP or Net International Investment Position statistics by the IMF, which has been defined as a country’s domestically owned assets minus foreign assets, the table above reveals that the US stands as the world’s largest borrower or debtor. (source: Financial Sense)

Yet there has been NO rigidity in classes—some rich countries are creditors while some rich countries are debtors.

Class based borrowing and lending is simply based on fantasy.

As individuals, we act (save, consume or invest) based on our unique value scales and time preferences and not because of the abstraction of being “rich or poor”.

Also it would be equally naïve to say that rescuing Wall Street was about “the poor”, that’s because Wall Street thrived upon unsustainable debt acquired from rampant speculation.

It is the reason why the largest US investment banks vanished from planet earth in 2008, and is the reason for the Troubled Asset Relief Program (TARP) and the explosion of the US Federal Reserve’s balance sheet in 2008, who absorbed toxic assets from the banking and finance industry by transferring the risk to US taxpayers.

From the US Federal Reserve of Cleveland

These debts were held NOT by the poor but the real estate, financial and banking class elites who profited from Keynesian policies of the euthanasia of the rentier aimed at attaining “permanent quasi booms”, which eventually backfired.

Besides, current political institutions have NOT been designed to protect the poor.

Apart from taxes, the banking system funnels savings of ordinary citizens to finance the government through sovereign securities (treasuries) as mandated by bank capital regulations. Central banks puts a backstop on this.

And politicians spend the savings of the average citizenry partly on vote generating welfare programs and substantially on special interest groups (e.g. green jobs, military industrial complex, banking and finance, foreign dictators) which have not mainly been about the protection of the poor. The poor have perennially been used as an unfortunate tool to justify the political mulcting of society.

Going back to rescuing Wall Street, coincidentally, Wall Street houses the largest number of people who are considered as super rich.

From the Wall Street Journal Blog

Bottom line: to argue that the “euthanasia of the rentier” is required to redistribute wealth from the rich to the poor has exactly been the reverse—the politically endowed rich benefits from “privatize profits and socialize losses” policies at the expense of society.

As a reminder not all of the rich are cronies. Those who depend on political privileges should be distinguished from those who generate wealth by serving the consumers.

Importantly, those who argue from the above faulty premises are either engaged in self-deception, or if, not hopelessly bereft of reasoning arising from the obsession to politics.

Monday, October 10, 2011

Global Banking Regulators to Force Banks to Hold More Liquid Assets

From the Reuters,

Global banking regulators will press ahead with the first worldwide effort to force banks to hold more liquid assets, the chairman of the Basel Committee on Banking Supervision said in an interview with the Financial Times on Monday.

Stefan Ingves, who also heads the Swedish central bank, said the Basel group plans to put uniform implementation of the Basel III reforms at the top of its agenda.

The measures, which will also force banks to cut back on short-term funding, have come under scrutiny from some of the 27 member countries who say the rule changes could damage the broader economy.

The reforms, which were agreed to by the member states, will force banks to hold more top-quality capital against unexpected losses, but there are rising concerns that some countries will not stick to the agreement.

Bank capital standards will continue to put pressure on the markets as I explain here and here. More liquid assets will not stop the consequent crisis from central banking induced bubble cycles. In fact, this could worsen it.

By forcing banks to hold more liquid assets, which will likely come in the form of government debt, this compels banks to finance financially strained governments. So productive capital will be channeled to preserve the privileges of the political and the banking class at the expense of the economy, which signifies a form of financial repression.

Central bank based bank capital regulations are essentially aimed at the preservation of the unsustainable banking system-central banking-welfare-warfare state political economy.

Monday, September 05, 2011

Why Capital Standard Regulations Will Fail (Part 2)

In my earlier post, I presented one of the three major arguments on why capital regulation standards won’t live up on its expected role to curb systemic failures.

regulators think that the action of bankers can be restrained by virtue of fiat. They are delusional. They forget that as humans, regulator-banker relationship will be subject to various conflict of interests relationships such as the agency problems, time consistency dilemma, regulatory arbitrage and regulatory capture aspects.

In reality, more politicization of the banking-central banking amplifies systemic fragility.

In a recent paper Cato’s Kevin Dowd, Martin Hutchinson, Simon Ashby, and Jimi M. Hinchliffe writes, (bold emphasis mine)

In this paper, we provide a reassessment of the Basel regime and focus on its most ambitious feature: the principle of “risk-based regulation.” The Basel system suffers from three fundamental weaknesses: first, financial risk modeling provides the flimsiest basis for any system of regulatory capital requirements. The second weakness consists of the incentives it creates for regulatory arbitrage. The third weakness is regulatory capture.

The Basel regime is powerless against the endemic incentives to excessive risk taking that permeate the modern financial system, particularly those associated with government-subsidized risk taking. The financial system can be fixed, but it requires radical reform, including the abolition of central banking and deposit insurance, the repudiation of “too big to fail,” and reforms to extend the personal liability of key decision makers—in effect, reverting back to

a system similar to that which existed a century ago.The Basel system provides a textbook example of the dangers of regulatory empire building and regulatory capture, and the underlying problem it addresses—how to strengthen the banking system—can only be solved by restoring appropriate incentives for those involved.

So the Cato study essentially echoes my insights.

For me, ‘regulatory empire building’ signifies as the conventional political process that has been designed to promote and sustain a welfare-warfare state. The welfare-warfare state depends on the de facto fiat paper money platform that basically operates on a central banking-banking industry cartel, which funnels much of the funds from the private sector to the political class (financial repression).

The Basel system essentially institutionalizes such operating framework. Capital standard regulations applied to the global banking system which assigns government bonds as ‘risk free’, which requires banks to finance government spending by holding sovereign liabilities into their balance sheets, has been backfiring on the back of unsustainable economics of the welfare-warfare state. Economics cannot be dictated by fiat or by legislation.

The financial system can indeed be fixed, but I think, it will take a a major systemic collapse for the political incentives to change.

In the meantime, politicians around the world will invariably resort to various band-aid, kool aid and ‘extend and pretend’ measures in response to any emergent problems. This will continue to accrue strains into the fragile incumbent operating system.

Let me repeat, politicization of the banking and financial industry will amplify, and not reduce, systemic fragility.

Genuine reforms must be directed towards empowering the markets over politics.

Monday, August 22, 2011

Why Capital Standard Regulations Will Fail

Global regulators have been arguing over the kind of regulations required for crisis prevention.

From Bloomberg,

Capital standards designed to fortify the global financial system are eroding as European officials, beset by a debt crisis, rewrite the regulations and U.S. rulemaking stalls.

The 27 member-states of the Basel Committee on Banking Supervision fought over the new regime, known as Basel III, for more than a year before agreeing in December to require banks to bolster capital and reduce reliance on borrowing. Now, as they put the standards into effect in their own countries, European Union lawmakers are revising definitions of capital, while the U.S. is struggling to reconcile the Basel mandates with financial reforms imposed by the Dodd-Frank Act.

“The game on the ground has changed in Europe and the U.S.,” said V. Gerard Comizio, a former Treasury Department lawyer who is now a senior partner at Paul Hastings Janofsky & Walker LLP in Washington. “The realists in Europe realized that their banks cannot raise the capital they’d need to comply. U.S. banks have reversed course and are more assertively fighting against it. The future of Basel III looks less certain now than it did when it was agreed to.”

The Basel committee revised its capital standards and outlined new rules on liquidity and leverage after the 2008 crisis exposed the vulnerability of the banking system. Credit markets froze following the collapse of Lehman Brothers Holdings Inc., sending the world economy into its first recession since World War II. Basel III was meant to create “a much stronger banking and financial system that is much more resilient to financial crises,” said Mario Draghi, who will take over as president of the European Central Bank in November.

Not Binding

Basel standards aren’t binding, so each country needs to write its own rules putting the agreed-upon principles into effect. The European Commission proposed regulations to parliament last month that would translate Basel III into law. A majority of EU governments also must endorse them. U.S. regulators led by the Federal Reserve have to come up with their own version, though they don’t need legislative approval.

The proposed EU rules, submitted by financial services commissioner Michel Barnier, omitted a ratio designed to improve banks’ cash positions, deferred decision on a rule to limit borrowing, revised capital definitions and extended some compliance dates. In the U.S., regulators are stymied because the 2010 Dodd-Frank Act bars the use in banking rules of credit ratings, which Basel III relies on to determine risk.

First, regulators have been squabbling over proposed elixirs, when in reality they are arguing about treatments to the symptom rather than the disease itself.

All these web of proposed regulations, on top of existing maze, won’t stop the banking financed boom bust cycle. This is because the current central banking based monetary system has been engineered for bubbles.

As the great Murray N. Rothbard wrote

for it is the establishment of central banking that makes long-term bank credit expansion possible, since the expansion of Central Bank notes provides added cash reserves for the entire banking system and permits all the commercial banks to expand their credit together. Central banking works like a cozy compulsory bank cartel to expand the banks' liabilities; and the banks are now able to expand on a larger base of cash in the form of central bank notes as well as gold.

Two, regulators think that the action of bankers can be restrained by virtue of fiat. They are delusional. They forget that as humans, regulator-banker relationship will be subject to various conflict of interests relationships such as the agency problems, time consistency dilemma, regulatory arbitrage and regulatory capture aspects.

In reality, more politicization of the banking-central banking amplifies systemic fragility.

Yet amidst the publicized noble intentions, we can’t discount that the implicit desire by regulators for these laws have been to expand control over the marketplace and to protect the interests of certain groups (regulatory favored groups).

Three, as shown above opposing interests leads to conflicting design of regulations.

In a world of complexity, centralization is bound for failure.

Let me add that while many see capital adequacy laws as one way of restraining bubbles, such perspective do not account for the unseen or unintended consequences.

Expanding capital adequacy regulations or laws can have lethal effects on the economy: they destroy money.

As Professor Steve Hanke explains, (bold emphasis mine)

The oracles have erupted in cheers at the increased capital-asset ratios. They assert that more capital has made the banks stronger and safer. While at first glance that might strike one as a reasonable conclusion, it is not the end of the story.

For a bank, its assets (cash, loans and securities) must equal its liabilities (capital, bonds and liabilities which the bank owes to its shareholders and customers). In most countries, the bulk of a bank’s liabilities (roughly 90%) are deposits. Since deposits can be used to make payments, they are “money.” Accordingly, most bank liabilities are money.

To increase their capital-asset ratios, banks can either boost capital or shrink assets. If banks shrink their assets, their deposit liabilities will decline. In consequence, money balances will be destroyed. So, paradoxically, the drive to deleverage banks and to shrink their balance sheets, in the name of making banks safer, destroys money balances. This, in turn, dents company liquidity and asset prices. It also reduces spending relative to where it would have been without higher capital-asset ratios.

The other way to increase a bank’s capital-asset ratio is by raising new capital. This, too, destroys money. When an investor purchases newly-issued bank equity, the investor exchanges funds from a bank deposit for new shares. This reduces deposit liabilities in the banking system and wipes out money.

By pushing banks to increase their capital-asset ratios to allegedly make banks stronger, the oracles have made their economies (and perhaps their banks) weaker.

Prof. Tim Congdon convincingly demonstrates in Central Banking in a Free Society that the ratcheting up of banks’ capital-asset ratios ratchets down the growth in broad measures of the money supply. And, since money dominates, it follows that economic growth will take a hit, if banks are forced to increase their capital-asset ratios.

Professor Hanke goes to show how these regulations have impacted the Eurozone which has resulted to declining money supplies that has led to the recent market turbulence. Read the rest here

To add, adherence to math or algorithm based models has been one of the principal weakness of such regulations, writes Philip Maymin, (bold emphasis mine)

One might think that the ideal regulations would be those that find the right numbers for these portfolios, not too small and not too large—the Goldilocks of risk.

Surprisingly enough, it is not possible. It turns out that no algorithm for calculating the required risk capital for given portfolios results in lower systemic risk.

In Maymin and Maymin (2010), we prove why this is so, both mathematically and empirically. First, the math. Imagine that there are 1,000 securities whose returns are each independently distributed according to the standard bell curve of a normal distribution. Simulate five years of monthly returns for each security, and then calculate the volatility that each one actually realized. Because there are only sixty data points for each security, some securities will appear to have a little higher volatility than they truly do, and some will appear to have a little less. Out of the one thousand securities, how many would you guess exhibit less than 80 percent of their true volatility?

The answer is ten, and we show this with a formula in the paper. If we make the situation more realistic by relaxing the assumption about normality, the problem is exacerbated, and the ten securities with the lowest realized volatilities would deviate even further from their true volatility.

We also show empirically that the securities with historically low volatility tended to have almost twice as much subsequent risk, while those with historically high volatility tended to have almost half as much subsequent risk. For both the riskiest and least risky securities, therefore, historical risk is a statistical illusion.

Here's where the problem of objective regulations comes in. To see it, consider the perspective of a bank deciding what to invest in. It can invest in any of the 1,000 securities, but if it invests in the special ten that exhibit less than 80 percent of their true volatility, it will have to put up one-fifth less capital than otherwise. At least to some extent, those ten securities will be more favored than the others. What's worse, every bank will favor the same ten securities because the objective regulations are the same for everyone.

If those securities continue to rise, then no problem will be apparent. But if they should fall, then, suddenly, all banks will need to liquidate the exact same positions at a time when those positions are falling anyway. This sets the stage for systemic failure. Consider sub-prime mortgages as an illustration. These assets appeared to be historically low-risk and were, therefore, regulatorily favored. Banks invested more in them than they perhaps should have. For a while, as real estate prices continued their ascent, no problems surfaced. But once the market turned, banks began experiencing more losses on their sub-prime mortgage holdings than their regulatorily-mandated risk calculations had planned for. Banks needed to raise capital quickly and began doing two things: selling the sub-prime mortgages, dropping the prices even lower; and selling other assets. Because the banks all acted nearly simultaneously, and all in the same direction, the impact on the markets was both broad and deep, and systemic collapse became a real threat.

Bottom line: whack-a-mole stop-gap regulations meant to preserve the current fragile, broken and unsustainable paper money system founded on the cartelized system of welfare government-central banking-politically privileged "Too big to fail" banks will ultimately fail.

Paper money will return to its intrinsic value-ZERO.