Note: I am in a hurry so this week's outlook will be abbreviated.

This year’s top-notch performers among global stock markets[1] (based on year-to-date) accounted for biggest losers in the region this week: I am referring to ASEAN equities.

Correction and NOT a Reversal

ASEAN markets had recently been defying ‘gravity’ but as I noted last week[2] there seems to be signs of tightening correlations.

Over the short term or during past two months, the correlation of Phisix and ASEAN indices with that of distressed global equity markets have evinced formative signs of tightening or reconvergence.

As I have been saying, divergences in market performance may persist for as long as a global recession is not in the horizon.

One must remember that decoupling signifies as an unproven thesis that can only be validated during a full-blown crisis. It’s a theory that I have been sceptical of, considering the concurrent interconnectedness and interdependence of global economies.

So the previous downside volatility of the global financial markets appears to have been carried over during this week, which had adversely affected ASEAN markets.

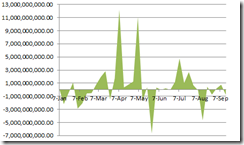

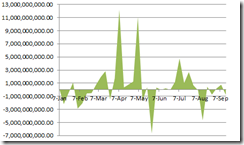

Yet reports of China-led BRIC (Brazil, Russia and India) proposed rescue[3] of the Eurozone by buying of Euro bonds, and most importantly, the joint or coordinated liquidity infusions by major central banks[4] as the U.S. Federal Reserve, the Bank of England, Bank of Japan, and the Swiss National Bank through foreign currency swap lines or exchanging of an agreed amount of currencies (see the basics here[5]), underpinned a fierce rally in major global equity markets.

We seem to be witnessing another variety of quantitative easing (QE) or money printing measures at work.

Perhaps one unstated objective for the synchronized liquidity injections has been to finance $800 billion derivatives[6], where 40% of which has been accounted for by “equity” options, whose expiration on during last week would have reportedly triggered tremendous pressure on the marketplace. Also such interventions could have been meant to forcibly cover equity ‘shorts’ via the derivatives market which signifies another war against the markets and alternatively represents as policies aimed to bolster equity markets.

As I have repeatedly been pointing out, what I call as the Bernanke’s doctrine[7] has been about inducing a stock market boom that would serve as a wealth effect transmission to the economy.

Furthermore, the violent pendulum gyrations seen in the market breadth[8] of US markets resonates how today’s financial markets have behaving—boom bust cycles.

Essentially, emanating from the embers of the 2008 meltdown, global equity markets have increasingly been steroid dependent which means MORE boom bust cycles ahead.

Again as I projected last week

Friday saw big declines in Asian currencies as the US dollar fiercely rebounded over a broad number of major currencies. This US dollar rally may see an extension this Monday (unless there will be declarations for major actions by US and European policymakers over the weekend).

The unfolding crisis in the Eurozone has been prompting for short term funding predicaments that has led to liquidations across financial markets worldwide, including Asia.

This has been reflected on Asian currencies as well as the Peso.

This terse quote from a Bloomberg article summarizes the week’s action in Asia’s currency markets[9]

Losses for the won, rupee, ringgit and Taiwan dollar were the worst since mid-2010.

As with most of Asia, the Philippine Peso lost a hefty 1.91% over the week.

This Is NOT 2008, Redux

I would disagree to imputations that current environment is about rising risk aversion. Such description would likely apply to financial markets of crisis afflicted economies but not to Asia markets.

Proof?

The Euro debt crisis and fears of another recession has indeed been increasing overall market anxieties around, but for Asia such concern has been muted, relative to 2008.

The above graph of Credit Default Swap prices representing debt default risks of Asian sovereigns from ADB[10] shows that credit concerns in the region subdued.

In addition, net foreign trade in the Philippine Stock Exchange has been inconsequential despite emergent signs of selling pressures so far.

It could be that local investors may seem to have been more ‘traumatized’ (Post Stress Traumatic Disorder) by the last crisis to stampede into US dollars, relative to foreigners.

Moreover, while emerging markets in general have endured equity outflows from the recent volatility, this has partly been offset by inflows to the bond markets[11].

And there is even more evidence that risk environment has been conspicuously nuanced compared to 2008—the continuing lofty levels of prices of gold and other precious metals and even of oil.

Notice that the recent downside actions of the S&P 500 (SPX) has been accompanied by downswings of gold, precious metals (DJGSP) and oil (WTIC), yet the former two has basically risen above the levels from where the declines were triggered.

Furthermore, oil at $87 hardly accounts for a ‘recessionary’ environment.

And there have been some insinuations that bullion banks have been significantly hurt by the recent upsurge in gold prices, such that manipulation of the gold-precious metal markets downwards has been undertaken to ease on the losses of these banks under the camouflage of central bank actions.

As Goldmoney.com Alasdair Macleod writes[12],

In common with dealers and market makers in all markets, bullion traders run short positions in bull markets. The turnover on the bullion markets is massive, and a dealer active on behalf of its customers and its own trading book can make substantial dealing profits. So long as those profits exceed the losses on their short positions, all is well. This is why the greatest threat to the bullion market is not the bull market itself, but prices rising too rapidly.

In the last two months, the market for gold has been particularly strong, erasing trading profits for many bullion dealers. Central bankers see this as the result of financial flows building due to the difficulties in the euro area. The targets for these flows out of the euro are the Swiss franc and gold, so the SNB’s move is designed to take the heat out of both of them.

The whopping $2 billion trading losses racked up by Swiss bank UBS[13] from supposedly unauthorized trade by a ‘rogue’ trader, Kweku Adoboli, has allegedly been due to voluminous exposure in “shorting” silver[14].

All machinations to manipulate the metals market will prove to be a temporary event. We should see metals rally significantly in the light of intensifying interventions (via assorted money printing measures) in the marketplace.

With the team Ben Bernanke meeting this week (September 21st) for an extended 2 days[15], we should expect Operation Twist, a pioneering measure telegraphed by Mr. Bernanke in his last speech[16], which aims to lower interest rates on the longer duration securities, to be formally in operation.

This could be backed by another formal QE 3.0 or by a significant interest rate cut on excess reserves (IOER) meant to disincentivize banks from parking their excess reserves at the Fed.

And considering that much of the developed world has been already been immersed into various forms of QE, we should expect improvements in global equity markets that should filter over to ASEAN markets.

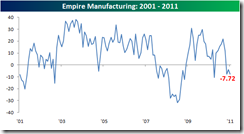

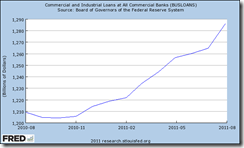

Again, to repeat, this has NOT been 2008. There are hardly signs of deflationary risks that warrant an increase of cash holdings. In the US, money supply has been rampaging along with improving signs of credit conditions[17]. Elsewhere, we should expect policy directions towards an accommodative stance by keeping current levels of interest rates or perhaps even by lowering policy rates.

Central bank activism essentially differentiates today’s environment from that of 2008.

PSE Still in Consolidation Mode

The local market has indeed been under pressure, but again there have hardly been signs of major deterioration.

True, every sector has been marked by declines this week with the ALL sector suffering the largest loss due to Manulife (-6.02%).

Mining, being overextended, suffered most from last week’s profit taking. Again I view this as a fleeting event.

The Phisix has been rangebound. However, trading indicators seem to suggest of partially oversold conditions (MACD). This implies that a rebound could be in the offing.

And peso volume has been dropping as the Phsix consolidates. This serves as indication of the diminishing strength of sellers.

Market internals, despite last week’s significant profit taking, has not materially deteriorated.

If US markets will continue to rebound, then we should see the current consolidation trend in the Phisix to segue into an ascending trend.

I would certainly watch the US Federal Reserve’s announcement and the ensuing market response.

If team Bernake will commence on a third series of QE (dependent on the size) or a cut in the interest rate on excess reserves (IOER), I would be aggressively bullish with the equity markets, not because of conventional fundamentals, but because massive doses of money injections will have to flow somewhere. Equity markets—particulary in Asia and the commodity markets will likely be major beneficiaries.

As a caveat, with markets being sustained by policy steroids, expect sharp volatilities in both directions.

[1] See Global Equity Market Performance Update: ASEAN Equity Markets as co-Leaders, September 13, 2011

[2] See Phisix-ASEAN Equities: Staying Afloat Amidst Global Financial Market Hurricane, September 11, 2011

[3] See BRICs Mulls Bailout of the Eurozone September 14, 2011

[4] See Hot: Major Central Banks to Jointly Offer US Dollar Liquidity, September 15, 2011

[5] See How Does Swap Lines Work? Possible Implications to Asia and Emerging Markets, October 30, 2008

[6] Naked trader.com Almost 40% of S&P 500 Options Expire Sept. 16, JPMorgan Says

[7] See US Stock Markets and Animal Spirits Targeted Policies, July 21 2010

[8] See US Equity Markets: Signs of Intensifying Boom Bust Cycles, September 17, 2011

[9] Bloomberg.com Asian Currencies Fell in Week on Concern Europe’s Debt Crisis Will Worsen, September 17, 2011

[10] Asianbondsonline.org Emerging East Asia CDS - Senior 5-year

[11] Wall Street Journal Emerging Market Local Currency Bonds Funds Continue To Draw Money, September 16, 2011

[12] Macleod Alasdair Central banks and the gold price goldmoney.com September 11, 2011

[13] Washington Post, UBS says rogue trader caused $2 billion loss, September 15, 2011

[14] Keiser Max BREAKING: UBS rogue trader was trying to exit a naked silver short…. [UPDATED], maxkeiser.com September 15, 2011

[15] IBTimesFX The Week Ahead September 16, 2011

[16] See US Mulls ‘official’ QE 3.0, Operation Twist AND Fiscal Stimulus, September 9, 2011

[17] See US in a Deflationary Environment, NOT! (In Charts) September 16, 2011