I believe that the Phisix has entered a temporary corrective phase, or a pause from the bullmarket.

I wrote last week[1]

given the recent dramatic record run up, we should expect natural profit taking process to follow. And perhaps such profit taking will take cue from weakening commodity prices (CRB) and stock markets abroad led by the S&P 500 (SPX). This is likely to be a temporary event, or another episode where steroid propped financial market clamors to be fed with more steroids of inflationism.

Perhaps the weekend elections in the Eurozone could also spice things up.

I have been pointing out from the start of the year that the bullrun of the local stock market may last until the first semester of this year[2] from which we may encounter renewed volatility.

In March I said[3]

the raft of credit easing measures announced last month will likely push equity market higher perhaps until the first semester or somewhere at near the end of these programs. Of course there will be sporadic shallow short term corrections amidst the current surge.

However, the next downside volatility will only serve as pretext for more injections until the market will upend such policies most likely through intensified price inflation.

The reason for pointing this out is to dispel the misimpression that I only see the market as moving in one direction—UP.

It just so happened that last week’s correction came sooner and deeper than expected.

For Every (Mini) Boom, a (Mini) Bust

And the recent re-emergence of the downside volatilities which again has likely been prompted by overbought conditions seems to have taken cue from the external environment.

Emerging markets around the world or not limited to Asia have mostly been slammed. Major Asian bourses have been battered as well.

In a relative sense, in general, Asia has endured substantially more losses than the US or Europe.

And it is ironic that crisis afflicted Portugal, Italy and Spain posted marginal gains this week. Meanwhile Greece equities collapsed, the ASE general crumbled by 11.3% this week and down 10% for the year.

Meanwhile the losses of the Phisix seem understated.

Instead of the usual rotation, or the process of alternating winners and losers, this week, the broader market breadth sharply deteriorated.

In just one week, overall positive market sentiment seemed to have been reversed. Declining issues reasserted dominance with manifest forcefulness.

The scale of last week’s dramatic recoil has almost mirrored the fierce downside move of September-October of 2011, where the Phisix lost 18% from the August peak.

Of course current conditions are different from the 2011. But the point of the above is to show the perspective from the big picture and not just to absorb the frames presented.

Technically speaking the Phisix has yet to breach the 50-day moving averages. This could be seen yet as a positive sign.

In addition, the seeming resiliency of the Phisix means that while most of the broad market losses have been concentrated on the implosion of many “miniature” bubbles seen in second and third tier issues, the heavyweights has been less affected.

Of the 13 issues with 3% and above free market capitalization float that constitutes 70.38% of the Phisix basket as of Friday’s close, 3 defied the last week’s carnage, while 5 issues fell more than the decline of the Phisix. The Phisix dropped 2.63% which reduced year to date gains to 17.93%

It is just apt to remind everyone that Newton's third law of motion[4] “To every action there is always an equal and opposite reaction" has some validity in the stock markets.

The lesson being that during occurrences of market euphoria, where powerful speculative activities or price chasing dynamics results to many high flying issues, a reversal of which would result to prices falling more swiftly and more intensely almost as they have ascended.

Prices fall faster than they rise because of the behavioral principle of loss aversion[5], where fear is a stronger motivator than the pleasure of gain.

That’s why I don’t recommend chasing prices.

Asset price inflation is followed by asset price deflation: minor boom bust cycles within major boom bust cycles.

Except for the mining issues, the previously biggest winners (Property and finance) have basically been last week’s largest losers. Because the losses of the holder sector have been limited the mother units of top performers have taken the top spot in terms of returns on a year to date basis.

The swift and dramatic reversal of the market’s sentiment haunted the high flying mining peripheries first, which then rippled across to the heavyweights, the contagion effect has visibly been seen in the breakdown of the mining index.

Commodity Prices as Stethoscope

Importantly, adverse developments at the world commodity markets may have influenced the recent crash of the local mining sector.

Yet such decline have not been limited to gold or oil but dispersed throughout the entire commodity spectrum.

And instead of earlier divergences[6] where global financial assets has seen price inflation amidst a backdrop of declining commodity prices, recently, divergences seem to have transformed into a convergence—where both commodity prices and financial securities have been evincing signs of lethargy.

This serves as further proof that assets have been highly correlated and that markets have been severely distorted or “broken”[7] where the pricing mechanism have been manipulated to reflect on the preferred pricing levels by politicians.

Thus today’s investing environment has been transformed into a grand casino operating on the principle of a “Risk On or Risk Off” environment.

From the technical viewpoint, commodity markets seem to highlight the ongoing corrosion of price trends. Both the broad commodity index the Reuters/Jefferies (CRB) and the main US oil benchmark the West Texas Intermediate Crude (WTIC) seem to be signaling a bearish head and shoulder pattern. The WTIC has already broken down while the CRB has yet to breakdown.

Though I am not a believer in patterns, the numerous momentum players can make such patterns as self-fulfilling over the short term.

That’s why this week will be crucial for the CRB, where a successful breakdown of which may be portentous to global stock markets, the Phisix as well.

We should remember that oil markets hardly exhibits “real economics” or free market based demand and supply. Oil markets, as I have repeatedly pointing out, have been highly politicized[8].

The welfare states of many of the major producers, particularly OPEC economies or even non-OPEC such as Russia[9] greatly depends lofty oil prices, perhaps about $85 and above. Even President Obama’s green energy projects have been anchored on high oil prices.

This means that if oil prices breaks below their welfare threshold for a prolonged period, then this would incite popular uprising and the eventual collapse of the current political order.

And this is why oil producing governments have been limiting private sector’s access to oil reserves[10]. Yet the capacity by these governments to bring oil to the surface has been constrained by government budget, which has been mostly spent on welfare (yes to buy off their political privileges from their constituents), and the lack of technology.

The implication of the above is that these governments will probably try to restrict production, seek the war option[11] (e.g. urge the US to militarily take on Iran), inflate their economies to pay for their welfare system or influence major central banks and politicians of major economies to resort to more inflationism.

I might add that given the current political arrangement, it may not be farfetched to deduce that many, if not most US politicians from both parties, have been bankrolled by these oil producing client states.

Add to these, falling oil prices jeopardizes President’s Obama’s green projects.

Thus contemporary political institutions significantly dependent on revenues from resources (resource curse) rather than from trade would represent a vested interest group that would lobby to seek for bailouts in the form of inflation or through bank rescues.

Don’t forget one of the beneficiaries of US Federal Reserve bailout in 2009, was ironically, the Libyan government headed by then ally turned enemy Muamar Gaddafi[12]

So from this supply side perspective we understand that the policy direction of current governments will be through more inflationism. [On the demand side, money printing has enabled the welfare state to grow]

China’s Weakening Consumption Demand?

The listless state of commodity prices may be driven by two important forces;

One is consumption demand.

If the sluggishness in commodity prices has been representative of consumption demand, then the likely source for such weakness could emanate from China.

Soft economic data on export and import data for April (right window[13]) and a seeming rolling over of China’s equity markets (left window) seem to support this angle.

While many analysts read this to be an anomaly, such as ‘calendar effect’, I don’t. I would prefer to wait and watch.

I have been saying that China could be the global markets next black swan[14] whose economic slowdown has been highlighted by growing signs of the political fissures.

And that’s why I believe that the Scarborough Shoal territorial claim dispute has either been a squid tactic meant to divert the public’s attention from real economic conditions or a yeoman’s undercover sales job for the US and China’s military industrial complex[15] or both.

And given China’s Keynesian policies of permanent quasi booms, then it should be expected that a commensurably huge bust will be in the offing. Evidences of malinvestments have already been present; 64 million empty apartments, ghost cities and vacant shopping malls[16] which have been considerably financed by China’s version of the $1.7 trillion shadow financing system[17].

The question for the coming bust is a WHEN rather than an IF. And this depends on the China’s state of real savings

At present, the $64 trillion question is to what degree will China’s government’s conduct the bailout? If China still has substantial real savings then her government may be able to kick the proverbial can down the road.

As Austrian economist Dr. Frank Shostak explains[18],

For a while, the government's package can appear to be working; this is because there is still enough real savings to support both profitable and unprofitable activities. If, however, savings and capital are shrinking, nothing is going to help, and the real economy will follow up with further declines.

That’s why I am largely neutral on China’s financial markets.

In the commodity sphere, China has become the proverbial gorilla in the room as the largest, if not a significant, consumer of many commodities (see upper window)

As IMF’s Shaun K. Roache writes[19],

China is a large consumer of a broad range of primary commodities. As a percent of global production, China’s consumption during 2010 accounted for about 20 percent of nonrenewable energy resources, 23 percent of major agricultural crops, and 40 percent of base metals. These market shares have increased sharply since 2000, mainly reflecting China’s rapid economic growth. History has shown that as countries become richer, their commodity consumption rises at an increasing rate before eventually stabilizing at much higher levels.

Further, commodity prices seem to be correlated with the actions of China’s equity bellwether the Shanghai index (lower window[20]).

Yet the correlation can go both ways, either China’s or the commodity markets could lead. The Shanghai index [SSEC] may recover (perhaps boosted by a major move from Chinese authorities) and this may provide a lift to commodity prices, otherwise a continuing and deepening slowdown of China’s economy could pose as a drag to the commodity markets which will diffuse into the SSEC.

On the other hand, a major boost from a major central bank could power commodities higher, and this may help buoy China’s markets higher.

Or Indecisive Central Bankers?

Weak commodity prices may have also been symptomatic of asset liquidations, perhaps evidenced by JP Morgan’s $2 billion trading losses in credit derivatives[21].

This may be indicative that commodity prices along with financial asset prices could be factoring in less than aggressive interventions from major central banks.

And this may have been underscored by the ECB’s reluctance to intervene[22], perhaps until political impasse at several EU nations will have been resolved.

Sunday’s elections in Greece has failed to “put together a government[23]” from which contending parties, divided between pro- or anti- bailout camps, have reportedly been haggling to form a coalition to avert national elections. Such national elections have been seen as increasing the risks of a Greece exit from the EU.

Ironically, the EU officials appear to be openly talking about a Greek exit[24], perhaps to condition the public of its eventuality.

The same is true for France where the parliamentary elections in June will either solidify the dominance of the socialists[25] or may open the nexus for the extreme (fascist) right to acquire and expand power[26].

Thus until the political leadership of these nations have been established, the ECB will likely to adapt a wait and see stance.

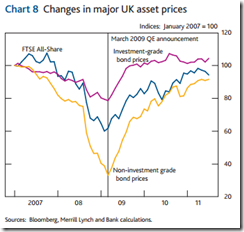

And except for the Bank of Japan (BoJ) whom has continued to expand her balance sheet[27], the Bank of England (BoE) as well, has officially declared a halt[28] on their asset purchasing program, which I say is temporary.

Meanwhile, US Federal Reserve through their chairman Mr. Ben Bernanke continues to dither or give mixed signals on the prospects of more quantitative easing measures[29]. True monetary conditions in the US remains easy, as seen by the renewed pickup of growth in M2, but this could be offset by perceptions about inadequate support.

The current Operation Twist has also been slated to expire next month or on June[30].

And if history will rhyme, then the past two incidences where the Fed technically concluded market intervention programs led to sharp downside volatilities, as shown in the republished chart[31].

My hunch is that the current market pressures could most likely be exhibiting parallel symptoms of market’s apprehension over the lack of further steroids.

[As a reminder, I am vehemently against inflationism, but as an investor, we have to be realists and play by the cards we are dealt with]

Conclusion and Recommendations

The current weakness in commodity prices, which has partly been transmitted to the global stock markets, could represent a deepening China’s economic slowdown (bust has not yet been established) or the factoring in by financial markets of the withholding of the provision of more support to the financial markets, by central bankers, via direct interventions of asset purchases or even both.

And any further weakness in commodity prices will likely filter into the asset markets.

As an aside, I know much of the mainstream will say that weak commodity markets should be a positive aspect because these lowers input costs and improves profits. In reality, what they mean is that “low consumer price inflation” will justify more interventions from major central bankers.

And this has been exactly the message I have been saying, see my March note

“the next downside volatility will only serve as pretext for more injections”

The general idea is that markets have been prone to boom bust cycles or the inflation cycle[32] or volatility as a result of government and central bank policies that keeps markets dependent on “on and off” steroid boosters.

My guess is that China’s markets will be addressed politically in the same way too.

And it would seem that periods of greater market volatility and the ensuing fear will leave market participants begging for more interventions and inflationism.

For the Phisix, the current resiliency by the heavy caps has been a noteworthy auspicious development. Yet we should not discount the likelihood of a contagion from any adverse exogenous events.

My inclination is that based on the above evidences and in the understanding that NO TREND GOES IN A STRAIGHT LINE, the Phisix will likely undergo a correction or profit taking phase.

This retrenchment, perhaps 5-10% from the peak or a low of 4,800, should be seen as healthy and normal. Should this be realized then the local benchmark will likely drift rangebound.

Of course external developments will play a big role in either confirming or falsifying this.

Yet I am LESS inclined to believe that a new high for the Phisix will be reached soon. Such should be until major central bankers will have announced their renewed support for the markets or if there have been conspicuous signs that they have been operating behind the curtains.

Should I be wrong and the local (and global) markets continue to tread higher without support from major central bankers, unless this would be backed by a strong surge of lending from the banking system particularly in the US, Europe or China, then we should even be more cautious, as any rally would likely lose steam from the current environment, again, without steroids.

The outlier risk from this would even be a crash, as Dr. Marc Faber suggests[33] during the second half of the year.

So far, the fact is, that the damage seen in the market internals will have to be remedied first.

The good part is that the much of the selloff has been locally driven which unfortunately has affected many momentum participants. Yet foreign buying remains net positive in spite of the carnage and may have provided cushion to the heavyweights.

Well this chapter should serve as part of our continued learning process.

Finally in the expectation of the possibility of the non-participation of central banks until June or after, this means greater volatility ahead in both directions.

Investors may raise their cash balance during rallies and buy on every episodes of panic. And in the event that any one of the major central banks declares the next steroid (the size should matter), then our strategy shifts to buy high, sell higher.

[1] See Bubble Signs at the PSE: Raising Capital Through Pre-selling Model, May 7, 2012

[2] See An Inflationary Boom Powered Phisix Bullmarket January 22, 2012

[3] See Global Stock Markets: Will the Recent Rise in Interest Rates Pop the Bubble? March 18, 2012

[4] Wikipedia.org Newton's third law

[5] Wikipedia.org Loss aversion

[6] See Are Falling Gold Mining Stocks Signaling Deflation? April 25, 2012

[7] See “Pump and Dump” Policies Pumps Up Miniature and Grand Bubbles Aprl 30,

[8] See Are Surging Oil Prices Symptoms of a Crack-up Boom?, February 24, 2012

[9] See The Geopolitics of Oil and Russia’s Knowledge Economy March 13, 2012

[10] See Peak Oil Represents Government Failure, February 10, 2011

[11] See Saber Rattling over Iran is only Part of the Big Oil Price Story January 25, 2012

[12] See US Federal Reserve Lent To (or Bailed Out?) Libya’s Qaddafi in 2009, April 5, 2011

[13] Danske Research China: Slowing imports & exports due to calendar effects? , May 10, 2012

[14] See Signs of China’s Snowballing Political Crisis: Six Arrested over Coup Rumors, April 1, 2011

[15] See The Scarborough Shoal Standoff Has Not Been About Oil, April 16, 2012

[16] See China’s Tiger by the Tail, April 13, 2012

[17] See China’s Bubble Cycle: Shadow Financing at $1.7 Trillion, June 28, 2011

[18] Shostak, Frank The Rescue Package Will Delay Recovery, September 29, 2008 Mises.org

[19] Roache Shaun K. China's Impact on World Commodity Markets, IMF Working Paper, May 2012

[20] Holmes Frank Looking to China to Fire Up its Economy, May 11, 2011

[21] Tavakoli Janet Jamie Dimon's SNAFU: JPMorgan's Other Derivatives' Losses Huffington Post, May 12, 2012

[22] Reuters India, ECB fends off pressure to take crisis action May 8, 2012

[23] Reuters.com Greek president makes last push to avert elections, May 12, 2012

[24] Thestar.com Greek euro-exit talk seeps into public as officials air doubts, May 9, 2012

[25] Bloomberg.com French Favor Socialists, Allies in June Parliamentary Elections, May 11, 2012

[26] See Will French Politics Swing from Socialism to Fascism? May 12, 2012

[27] See Bank of Japan Adds More Stimulus, April 27, 2012

[28] See Bank of England Halts QE for Now, May 10, 2012

[29] Wall Street Journal Bernanke Expresses Fiscal Concerns To Senate Democrats, May 10, 2012

[30] Federal Open Market Committee Federal Reserve issues FOMC statement, US Federal Reserve September 21, 2011

[31] See Central Bankers Whets Wall Street’s Fetish For Inflationism, March 12, 2012

[32] See Chart of the Day: The Inflation Cycle, April 5, 2012

[33] See Dr. Marc Faber Warns of 1987 Crash if No QE 3.0 May 11, 2011