The recent rally by US stock markets seems quite impressive but not convincing enough to suggest that treacherous days have been mitigated.

The S&P 500 has nearly broken out of the current resistance levels

Earnings, which the rally has mostly been attributed to, have fundamentally trumped economic data.

From the Bloomberg,

U.S. stocks rose, sending the Standard & Poor’s 500 Index to a two-month high, amid better- than-estimated earnings and bets that disappointing economic data will lead the Federal Reserve to add stimulus.

International Business Machines Corp. (IBM), the biggest computer-services provider, and EBay Inc. (EBAY), the largest Internet marketplace, gained at least 3.7 percent as profits beat forecasts. Walgreen Co. (WAG) soared 12 percent after renewing a contract with Express Scripts Inc. (ESRX) Morgan Stanley (MS) slid 5.3 percent after missing estimates as trading revenue plunged. Google Inc. (GOOG), owner of the most popular search engine, rose 3.1 percent at 5:34 p.m. New York time as revenue surged 35 percent.

The S&P 500 (SPX) advanced 0.3 percent to 1,376.51 at 4 p.m. New York time, the highest since May 3. The Dow Jones Industrial Average added 34.66 points, or 0.3 percent, to 12,943.36. The Nasdaq Composite Index gained 0.8 percent to 2,965.90. Volume for exchange-listed stocks in the U.S. was 7 billion shares today, up 4.8 percent from the three-month average…

Today’s advance extended a three-day rally in the S&P 500 to 1.7 percent. Earnings have exceeded analyst estimates at about 71 percent of the 108 S&P 500 companies that have reported quarterly results so far, according to data compiled by Bloomberg. Analysts project a 2.1 percent decline in second- quarter profits, the data showed.

As one would note: aside from earnings, equity markets again, are being serenaded by the prospects of more steroids from the FED. The article devotes two more paragraphs on these.

Bad news is good news again.

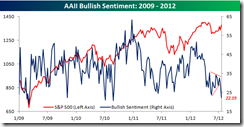

Extreme bearish sentiments or the ‘crowded trade’, chart from Bespoke Invest, may have provided the fulcrum for the current bullish momentum.

But current economic figures does not seem to support the continuation of this rally.

From the same article,

Sales of existing U.S. homes unexpectedly dropped and manufacturing in the Philadelphia region contracted for a third month. Other reports today showed consumer confidence weakened, claims for unemployment benefits rose and an index of leading economic indicators declined more than forecast.

Moreover, leading economic indicators fell more than expected.

From another Bloomberg article.

The index of U.S. leading economic indicators fell more than forecast in June, a sign the U.S. economic expansion is slowing.

The Conferences Board’s gauge of the outlook for the next three to six months decreased 0.3 percent after a revised 0.4 percent increase in May, the New York-based group said today. Economists projected the gauge would drop by 0.1 percent, according to the median estimate in a Bloomberg News survey.

Retail sales unexpectedly declined in June for a third straight month, indicating that slow progress in job creation is holding back consumer spending, which accounts for about 70 percent of the economy. Federal Reserve Chairman Ben S. Bernanke said July 17 that progress in reducing unemployment is likely to be “frustratingly slow.”…

Six of the 10 indicators in the index contributed to the decrease, led by a drop in a gauge of manufacturing orders and consumers’ expectations for business conditions. Four indicators increased.

And worst, % annual change of M2 have been dropping steeply which should impact both the economy and the markets in the coming months.

Again, outside real actions from the FED, eventually US stock markets, which provides the leadership to world markets, will have to price in real events to sustain such momentum.

But don’t forget political deadlocks, as manifested by Bernanke’s recent warning on the fiscal cliff and taxmaggedon, and on other issues, such as the debt ceiling and or even the Barclay’s LIBOR scandal, can simply swell out of proportions that may trigger mayhem in an environment clouded by immense UNCERTAINTY.

Even external shocks as the worsening of the Euro debt crisis or of a China economic recession could also tilt the balance of risks in US stocks.

Eventually promises are not going to be enough.