Threats over an alleged US government shutdown, which has become the centerpiece focus of the debt ceiling debate, has sent cost of insuring debt higher this week

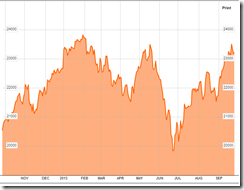

chart from Deutsche Bank

Notes the Wall Street Journal:

The cost of insuring against a U.S. default for a year has risen sixfold in the past week, reaching its highest level since 2011, reflecting investor bets that the government could fall behind on its debt payments in the coming weeks.The Treasury Department said on Wednesday that by Oct. 17 it would have only $30 billion left to pay bills, and that money is only expected to last one or two more weeks unless Congress raises the so-called debt ceiling, which limits U.S. borrowing. Many Republicans have said they would approve such a move only in exchange for a long list of demands, such as changes to the White House's health-care law and lower tax rates. The White House has said it won't negotiate with Republicans at all and wants the debt ceiling raised immediately.The stark political divisions have led many lawmakers, analysts and investors to wonder whether policy makers will be able to reach an agreement in time.This has driven the annual cost to insure $10 million of U.S. government debt for one year using derivatives called credit-default swaps, or CDS, to €31,000 ($41,930), according to Markit data. That is up from about €5,000 as recently as last Friday and is the highest it has been since August 2011, the month in which U.S. debt was downgraded from the highest level by Standard & Poor's Ratings Services.Default protection on U.S. Treasurys is quoted in euros, just as European sovereign CDS contracts are quoted in dollars, sparing investors the risk the hedge will fall in value at the same time as the currency itself.

Actions of the CDS markets have hardly been consistent with the bond markets.

As shown above, the 1 year (UST1Y) 3 year (UST3Y) and 6 months (UST6M) has recently been rallying (falling yields) mostly from the FED’s UNtaper—a deliberate tactic conducted by the FED similar to the Pearl Harbor surprise bombing equivalent of the bond vigilantes.

This means that while cost of insuring of US debt has meaningfully risen, the treasury markets (particularly the short maturities) have been saying otherwise.

Yet rising CDS (default risks) will be used as political leverage to justify the call for raising the debt ceiling. (Have the CDS markets been stage managed?)

Americans have been deeply hooked on entitlements. More than 70% of Federal Spending has been due to dependency programs and growing.

This means that despite the hullabaloo in the US Congress, which really is just a vaudeville, as congress people will fear the wrath of losing political power and privileges from entitlement dependent-parasitical voters, eventually the debt ceiling will be raised. (charts from the Heritage Foundation).

Like actions of central banks led by the US Federal Reserve, America’s welfare state will be pushed to the brink of a crisis or will fall into a crisis first, before real reforms will be made.

In the world of politics, cost-benefit tradeoffs has been reduced to short term expediencies.

Updated to add:

Including "housing, other loan guarantees, deposit insurance, actions taken by the Federal Reserve, and government trust funds”, economist James Hamilton estimates at over $70 trillion or 6 times official debt (RT.com)

Meanwhile Boston University Laurence Kotlikoff has even far staggering figure. He pins the fiscal gap which includes unfunded liabilities at $222 trillion or 20 times bigger than official figures.

Mr. Kotlikoff as quoted by Real Clear Policy:

Updated to add:

Including "housing, other loan guarantees, deposit insurance, actions taken by the Federal Reserve, and government trust funds”, economist James Hamilton estimates at over $70 trillion or 6 times official debt (RT.com)

Meanwhile Boston University Laurence Kotlikoff has even far staggering figure. He pins the fiscal gap which includes unfunded liabilities at $222 trillion or 20 times bigger than official figures.

Mr. Kotlikoff as quoted by Real Clear Policy:

The official debt is something that has to be repaid, and the government is committed to principal and interest payments. But the government has other commitments, like Social Security payments, health care and Medicare payments, Medicaid payments, and defense expenditures. And it also has negative commitments, namely taxes. So you want to put everything on even footing. Most of the liabilities the government has incurred in the postwar period have been kept off the books because of the way we’ve labeled our receipts and payments. The government has gone out of its way to run up a Ponzi scheme and keep evidence of that off the books by using language to make it appear that we have a small debt.