Remember I spoke about the ASEAN standout here?

Well, mainstream finally sees this or this now is in the news.

From Bloomberg,

Southeast Asia (MXSO), the heart of the 1997 currency crisis, produced the best risk-adjusted returns for Asian stocks since global markets started to rebound three years ago, as investors sought a haven from Europe’s debt turmoil.

Benchmark indexes in the Philippines, Malaysia, Thailand, Indonesia and Singapore returned the most among Asia-Pacific markets worth more than $100 billion in the three years ended July 17, according to the BLOOMBERG RISKLESS RETURN RANKING. All five beat an index of developed markets by risk-adjusted returns, and four came out on top over five years.

“Investors have been focused on and rewarded in the smaller Asean markets because they have been more defensive and domestic-oriented,” said Timothy Moe, a Hong Kong-based strategist at Goldman Sachs Group Inc., referring to the Association of Southeast Asian Nations. “That’s been a better source of growth than what we see in the other more cyclical markets in North Asia. It probably will continue,” he said in a Bloomberg television interview in Hong Kong on June 26.

Southeast Asian governments have bolstered spending on infrastructure and stepped up efforts to spur domestic consumption in a bid to reduce their economies’ reliance on exports. That’s helping to shield the nations from Europe’s debt crisis and a global economic slowdown, which has fueled volatility in the northern Asian markets.

Asean countries shipped 32.9 percent of their exports to the U.S. and European Union in 2010, down from 72.4 percent in 2000, according to data from the organization’s website. China’s exports to the EU and U.S. accounted for a combined 38 percent of total overseas shipments in 2010, according to Bloomberg calculations based on data from the customs bureau.

Small and domestic seems now the flavor.

I don’t have any qualms of being small, but I do mind when media implies that financial markets today rewards cronyism and protectionism via “domestic-orientation”…scarcely a positive aspect to extol.

Of course, it is even ridiculous to say that ASEAN’s advantage has been about “bolstered spending on infrastructure and stepped up efforts to spur domestic consumption”.

Which economies have not been ‘spending’ to bolster consumption? Has not today’s crisis emerged from too much debt financed spending in order to uphold ‘consumption’?

It is also worth pointing out that despite the huge reduction in exports to the US and EU by ASEAN, they still make up a third of exports.

And it misleads to focus only on exports because there are other important external linkages as remittances, capital or investment flows and the banking system.

Yet a reduction in exports down to such level does not imply or guarantee of immunity from a global recession (that’s if a recession occurs)

More ASEAN hallelujahs…

Five Asean economies -- Indonesia, Thailand, Philippines, Malaysia and Vietnam -- along with China and India will outpace the rest of the world over the next two years, the International Monetary Fund said in an April report. In 2013, the Asean-5 will grow 6.2 percent, compared with 2.4 percent in the U.S., 0.9 percent in the euro area and 1.7 percent in Japan, it said.

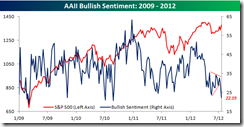

Faster economic growth has fueled stock-market gains and valuations. The MSCI South East Asia Index has rallied 13 percent this year, including dividends, and more than doubled since 2008. The MSCI Asia Pacific Index has gained 3.8 percent in 2012 and returned 43 percent since the end of 2008.

The supposed ASEAN brilliance has really not about ‘faster economic growth’ but about three major unseen factors.

First is low debt as consequence of restructuring from the Asian crisis

As rightly pointed out by the article,

Southeast Asia “does not have debt problems like Europe,” Alan Richardson, a Singapore-based fund manager for Samsung Asset Management Co., who helps oversee $82 billion, said by phone on July 2. The region “hasn’t been through a strong investment up-cycle compared to the BRIC economies, so increasingly investors are seeing Asean has an alternative equity class.”

The second and most important which has been tightly correlated to the first is domestic negative interest rates.

Negative interest rates have been conducive or encourages debt take up in low debt economies.

So what has been deemed as relatively ‘faster’ economic growth is in reality an ongoing credit boom as discussed here. I mentioned that even Fitch rating has recently warned the Philippines on this.

The third interrelated factor has been the monetary easing policies by developed economies.

Many international investors have taken ASEAN as quasi-refuge justified as ‘investment’ based on growth when in reality (particularly the Japanese), they represent as yield searching dynamic or rampant speculation meant to preserve the purchasing power of their savings (euphemism for capital flight) against reckless monetary policies at home.

Be reminded that one major characteristic of a bubble is to broadcast a "new paradigm". This seems what we are seeing today in ASEAN

The BRICs has initially been thought to have been the 'new paradigm'; now this has been shattered.

Booms brought about by bubble policies will eventually be exposed for what they are, as they have always been.

Be careful out there.