In my own time, governments have taken the place of people. They have also taken the place of God. Governments speak for people, dream for them, and determine, absurdly, their lives and deaths. Ben Hecht in Perfidy (via David Harsanyi)

Any moment now the ‘divisive’ issue over the US debt ceiling will likely reach settlement.

And by this I mean that the debt ceiling will be raised and that a landmark deal will be made over fiscal dynamics of the US in the coming years.

The supposed GOP Boehner Bill HR 2693 which recently passed the House[1] but was rejected by the Senate[2] already exposed such eventuality. That’s because the House bill proposed a new debt ceiling from US $14.294 trillion[3] to possibly $16.994 trillion—a figure cited by Zero Hedge[4]!

If this is true then such an increase would largely depend on the willingness of foreigners to finance the US government. Otherwise, we should expect the US Federal Reserve to step up the plate[5] with serial asset purchasing programs or interest rates in the US will rise that could heighten risks of the highly leveraged banking system, and equally, menace the deep in the hock US government.

What is being deliberated in real time is the mechanics governing the debt ceiling bill. On what increasingly seems like ‘staged dispute’ supposedly based on ‘ideology’—cut along party lines of tax increases versus government spending, the emerging compromise will account for a farcical display of attaining fiscal discipline.

As of this writing, the Bloomberg reports a working framework being threshed out[6],

The tentative framework includes immediate spending cuts of $1 trillion and creation of a special committee to recommend additional savings of up to $1.8 trillion later this year. The new panel would have to act before the Thanksgiving congressional recess in late November and Congress would have to approve its recommendations by late December or government departments and programs, including defense and Medicare, would face automatic, across-the-board cuts, the person said.

No more than 4 percent of Medicare would be subject to cuts, and beneficiaries would be unaffected as reductions would apply to providers, the person said. Social Security would be untouched.

These proposed spending cuts will likely signify as reduction in the growth rate of future spending, rather than actual spending cuts. In addition “additional savings” are likely to come in the form of tax increases.

What gradually is being revealed is that the “extend and pretend” or “kick the can down the road” policies would only widen the door for more inflationism that would set up a major crisis down the road that would make 2008 pale in comparison.

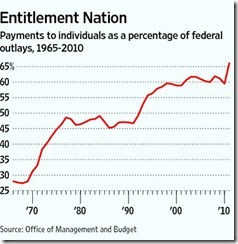

The kernel of the US debt ceiling crisis has been encapsulated by the chart below from the Wall Street Journal.

As the Wall Street Journal editorial accurately writes[7],

This is the road to fiscal perdition. The looming debt downgrade only confirms what everyone knows: Congress has made so many promises to so many Americans that there is no conceivable way those promises can be kept. Tax rates might have to rise to 60%, 70%, even 80% to raise the revenues to finance these promises, but that would be economically ruinous.

As writing on the Wall, there have been three credit rating agencies, outside the largest, that has downgraded the credit standing of the US, namely Weiss Ratings, Egan-Jones Ratings Co. and Beijing based Dagong Global Credit Rating[8]

The left believes that an inexhaustible Santa Claus fund exists to finance political programs which would hardly affect the distribution of resources or how the economy operates. They see the world in a prism of social stasis, where people’s actions are homogenous and can be easily manipulated.

The left believes that forcing others to pay for supposed “rights”, or in actuality, for veiled privileges that benefits vested interest groups in the name of social welfare—they would advance the cause of the economy. They ignore the reality that resources are scarce and forced redistribution represents a zero sum game-where one benefits at the expense of the other. Yet, the politically blinded left never seem to realize that restricting choices available to people leads to violence.

And worst, markets are increasingly being held hostage by political brinkmanship as political leaders try to extract negotiation leverage by spooking the marketplace with veiled threats of Armageddon[9]

The great libertarian H. L. Mencken was eloquently precise when he wrote[10]

Civilization, in fact, grows more and more maudlin and hysterical; especially under democracy it tends to degenerate into a mere combat of crazes; the whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by an endless series of hobgoblins, most of them imaginary.

Part of such endless series of hobgoblins to promote expansive government power and unsustainable welfare programs grounded on the antics of ‘default’ has resulted to the dramatic flattening of the US yield curve (stockcharts.com).

The spike in the 3 month T-Bills runs in contrast to the actions on the longer maturity term structure, which registered declines in the yields and thus the flattening of the curve.

Add to these has been the recent languor seen in major global equity markets and another record run in gold prices.

US equities represented by the S&P 500 fell sharply this week (3.92%) while the volatility index (VIX) spiked along with it. In addition, the debt issue has weighed on the US dollar (USD).

So essentially, gold prices seem to tell us that there would be more inflation ahead.

Hence political bickering and jawboning have placed considerable stress in the marketplace.

Again, this shows that in today’s milieu neither economics nor corporate fundamentals determine the direction of markets but political developments, which runs in defiance of conventional wisdom.

The fact is that the US has been in a covert default mode, through consecutive Quantitative Easing or credit easing, the purchasing power of the US has been on a decline. The current purchasing power of the US dollar has been lower than when these debts had been contracted. Thus the stealth default.

As Murray N. Rothbard wrote[11],

Inflation, then, is an underhanded and terribly destructive way of indirectly repudiating the "public debt"; destructive because it ruins the currency unit, which individuals and businesses depend upon for calculating all their economic decisions.

Unless politicians face up to these realities, the US will default sooner or later. And much of these near term moves to default will be through inflationism.

And again policy choices or political direction is likely to be path dependent in accordance to how political institutions have been designed; fundamentally to sustain or preserve the status quo of the cartelized system of central banks-‘too big to fail’ banking system-welfare based government.

At the end of the day, the debt ceiling will be raised and inflationism will prevail, as day of reckoning will be postponed.

All these will be reflected on the marketplace.

Again profit from political folly.

[1] Yahoo.com House passes Boehner’s debt ceiling plan–and Senate puts it on ice, July 29,2011

[2] USA Today House rejects Senate debt bill; Obama wants compromise, July 30, 2011

[3] Wikipedia.org 2011 U.S. debt ceiling crisis

[4] Zero Hedge, Here Is Boehner's Amended Amended Bill, July 29, 2011

[5] See Falling Markets, QE 3.0 and Propaganda June 12, 2011

[6] Bloomberg.com Deal Framework Reached on Raising U.S. Debt Ceiling, July 31, 2011

[7] Wall Street Editorial The Road to a Downgrade A short history of the entitlement state. July 28, 2011

[8] US News Money Meet 3 Ratings Agencies That Have Already Downgraded the U.S., July 22, 2011

[9] Guardian.co.uk US debt battle: Showdown on Capitol Hill, July 18, 2011

[10] Wikiquote.org H. L. Mencken

[11] Murray N. Rothbard Repudiate the National Debt, lewrockwell.com

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiikZ2L0LUMpqb1sN-eSRDAgMH2y93OX5Khcc3Bfffj8yZ0TKubwzlcD9q33pCMUtt2hldKCWm9S_LY5uuFC-4PZowoKeWwRAg5ZQpwHTG35JMFNGsZm-j35KFOQzjGiPJpqncJ/?imgmax=800)

![clip_image004[4] clip_image004[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgYis7IwvUqn8BRaspJb0jweftWOVvMzixmvR3-9tQMaYsr-LEtfGZGVQTGvuyBAgQAbZdmUd9gBTRTljJt8qjNdduvFowFI6oY19eVI_09tfsOBo1_AxQhpRn8NqfJRQTG5Hq1/?imgmax=800)

![clip_image006[4] clip_image006[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjkaPXqTPKz1TNvb9xi-VGtt7pbzlWgnyjYcbp4VZZHMKceBwy_ZxMB0E9iShg3tpqzbx9YmbDlrbmqgYUwAawo3V5_x_XuCt33NSCB-Dc7CdH9kwnv7hQvXK-ZTSVAGtjwQWH1/?imgmax=800)

![clip_image008[4] clip_image008[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgxdDPGRuNwO32-8Zby7ruuT3xWdn4xIELI3hVJZ3U6_agccRo7DFueT5nSe8dhHWBdVWprbr_9ikOK1uTNNd39dAqc8F2tvZTnMAqM1IzonSv7KUKdMzU6mOsCD7kw0uojbIoN/?imgmax=800)

![clip_image010[4] clip_image010[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgnzvFycVwVxQ8UWTb3lJSTolde77wKx2x9Gviw7Sf19egrB4Vrmfx_J8gXBJ3WRDI-4N8s2AoidH9dkpnwGw0496_8RVn_eRnfglVIOmqE5rnDuQB-FGdz5w9x97LLWYtqGEjd/?imgmax=800)