The much awaited breathing space for the Phisix has finally arrived, but the crucial question is how long and how deep will this last?

This week’s marginal .71% decline has been only the second weekly decline for the year, or 2 out of the 10 weeks into the 1st quarter of 2012.

Market Internals Exhibits Healthy Rotational Process

But the actions of the local benchmark have not been representative of the overall dynamics.

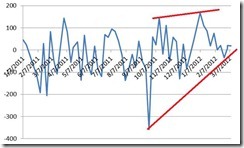

Despite this week’s profit taking, market internals continue to exhibit positive developments. The weekly advance-decline spread seems to be improving, highlighted by a positive market breadth where there had been marginally more advancing issues than declining issues.

This implies that the current retrenchment has been more about the big market caps.

Of the 10 largest free floated market cap components of the Phisix, only Bank of the Philippine Island [PSE:BPI] and San Miguel Corporation [PSE:SMC] posted gains thereby partly offsetting the losses seen in the major benchmark, while the rest were in the red, led by SM Prime Holdings [PSE:BPI] and Philippine Long Distance Company [PSE:TEL]. Combined these issues account for 62.2% of the Phisix market capitalization as of Friday’s close.

So market internals have only been affirming our rotational process at work.

As I previously wrote[1],

the rotational process extrapolates to the shifting market’s attention from heavyweights to second or third tier issues and vice versa which can also be a dynamic found within specific sectors.

And amidst the Phisix correction, sectoral performance had also been mixed. The industrials and the mining sector, whom have been this year’s laggards has apparently outperformed their peers.

Meanwhile the gains in the industrial sector has been led by water utility Manila Water Corporation [PSE:MWC] the laggard independent power producer Energy Development Corporation [PSE:EDC] and electricity distribution monopoly Meralco [PSE: MER]

Year-to-date EDC and SMC has deviated from the bullish path of their contemporaries. My hunch is that the anomalies in the correlations should end soon.

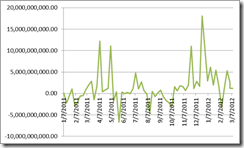

Average Daily peso volume (weekly basis) remains robust despite the profit taking sessions.

Peso Firming Against Inflating Currencies

Yet despite sporadic selling pressures in some of the big cap issues, net foreign trade exhibited sustained inflows. In short, locals took profits while foreign funds have been net buyers of local equities.

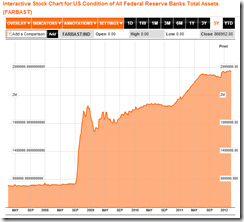

And on the account of a policy induced “search-for-yield” dynamics here and abroad which will likely be stimulated even more by cumulative efforts to keep interest rates at zero bound in major economies, I expect an acceleration of foreign fund flows into local assets (stocks, bonds and properties) to be priced into the local currency, the Philippine Peso.

Foreign portfolio flows in 2011 moderated[2], partly manifesting on global apprehensions on the Euro crisis. Yet if the currently instituted liquidity based rescue programs temporarily does alleviates the crisis in the Eurozone, the risk ON environment will whet the appetite of foreign arbitrageurs.

Again as I recently wrote[3],

should portfolio flows into the Philippines intensify, through the PSE and local bond markets, then the lagging Philippine Peso will likely see more room for appreciation.

And the local currency will not only appreciate against the US dollar but likewise against all countries undertaking massive credit easing measures.

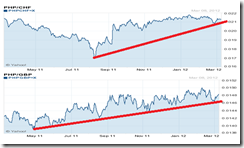

We are already seeing this in the context of the Peso vis-à-vis the Euro (upper) and the Japanese Yen (lower), where we seem to be witnessing major trend reversals.

The Peso has also been appreciating against the Swiss Franc (upper) and the British Pound (lower)

The currency markets have only been validating what the great Ludwig von Mises taught us about valuing currencies[4].

These observers do not understand that the valuation of a monetary unit depends not on the wealth of a country, but rather on the relationship between the quantity of, and demand for, money. Thus, even the richest country can have a bad currency and the poorest country a good one.

What this means is that the Philippines (and our ASEAN contemporaries) is likely to lure spread arbitrages or carry trades from US, Japanese, Swiss and European investors or punters that is likely to kick start a foreign stimulated boom in the local assets including those listed on the Philippine Stock Exchange.

The Journey Of A Thousand Miles Begins With A Single Step

The bottom line is that given the current conditions where major economies have just initiated on recalibrating their policies to ease credit further, then it is unlikely to expect a material profit-taking mode. Since the effects of these policies usually come with a time lag, we can expect a strong momentum perhaps until the 2nd quarter of the year where some of the credit easing programs are due to end.

In addition, aside from a positive market breadth, the markets hardly showed of any signs of distribution. Last week only reinforced my long held view of a broad based rotational process where there had been a rotation away from big caps to the broader market (second and third tier issues), rotation among sectors (from leaders to laggards) and rotation of issues within specific sectors.

All of which have been manifestations of an inflationary boom.

Moreover, if a correction does occur, any profit taking of around 5-10% should be reckoned as healthy and a buying window. Remember, predicting the market over the short term can be very tricky.

Nonetheless it is important to realize that the long term is an accretion of short term actions. To analogize, I would not see tomorrow if I die today, thus tomorrow is a function of my living of every moment until tomorrow, or as represented in a popular axiom, the journey of a thousand miles begins with a single step.

This extrapolates that for any long term projections to be fulfilled, the accumulated dominant direction of short term actions, in spite of sharp fluctuations, has to be in the path of the long term.

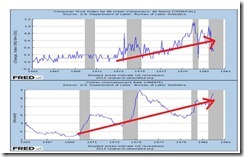

For instance, I’ve long asserted my audacious prediction that the Phisix is bound for and will breach the 10,000 levels.

This I believe my target isn’t an issue of an IF but a WHEN. This will possibly be fuelled by an amalgam of factors such as a domestic boom bust cycle[5], global wealth convergence trends and or globalization.

While there may be medium term obstacles such as the recent contagion from an external bubble bust 2007-2008, the general trend of the Phisix has been one of the upside and has been confirming the secular bull market trend.

This seems reminiscent of the past 17-year cycle where the previous bullmarket had two interregnums (green ellipses) prior to the Phisix climax in 1994-1997.

I am not certain whether we will see a repeat of the discontinuities similar to the 1986-1997 bull market cycle or will suffer more than the past cycle before reaching my goal or if the Phisix will proceed to double. What needs to be monitored are drivers of the current trends and the whereabouts[6] of the present boom cycle based on internal and external dynamics.

So far even as the Phisix has reached half of my target, domestic systemic leverage has yet to reach bubble proportions. Thus while another external contagion bust may hamper the current phase anew, for as long as any intermissions have NOT originated from domestic imbalances, the secular bullish trend of the Phisix should be expected to continue.

In finale, anyone who argues about the long term without the series of short term actions confirming their views is engaged in a practise of wishful thinking.

[1] See New Record Highs for the Philippine Phisix; How to Deal with Tips February 20,2012

[2] IMF.org THE PHILIPPINES 2011 ARTICLE IV CONSULTATION, IMF Country Report March 2012

[3] See Phisix: Expect A Breakout from the 5,000 level Soon, February 26, 2012

[4] Mises, Ludwig von 3. Trend Of Depreciation II. THE EMANCIPATION OF MONETARY VALUE FROM THE INFLUENCE OF GOVERNMENT On The Manipulation Of Money And Credit p.25 Mises.org

[5] See The Phisix And The Boom Bust Cycle, January 10, 2011

[6] See After 5,000: What’s Next for the Phisix? March 5, 2012