True heroism is remarkably sober, very undramatic. It is not the urge to surpass all others at whatever cost, but the urge to serve others, at whatever cost. –Arthur Ashe (1943-1993)

In this issue

Phisix at Record 7,400: Be Fearful When Others Are Greedy

-Phisix at Record 7,400 Defies the BSP Chief’s Warnings

-Despite the $ 2 billion Bond Offering, Strains in Bond Markets Remain

-Deflationary Forces Have Landed: Crashing M3, Negative CPI, Spike in CDS, Falling Peso

-Record Phisix 7,400 on Record Index Pump!

-Record Phisix as Domestic Casino Stocks Crash!

-Phisix 7,400: Déjà vu 1997?

-2015: Real Time Crashes Will Spread and Intensify

Phisix at Record 7,400: Be Fearful When Others Are Greedy

The Philippine Stock Exchange celebrates the New Year with a run to a record high.

Phisix at Record 7,400 Defies the BSP Chief’s Warnings

In August of 2014, the Philippine central bank, Bangko Sentral ng Pilipinas Governor Amando Tetangco Jr. issued an Alan Greenspan like “irrational exuberance” warning in a speech. Then, I quoted him[1]:

What can you control? Certainly your risk appetite. Controlling this when greed gets the better of you is very difficult. So in a period of low volatility such as what we have been experiencing, practice the discipline of setting limits. This discipline will not only help you to avoid the pitfalls of “chasing the market”.

In a follow up speech in October, the BSP chief elaborated on this[2]:

While we have not seen broad-based asset mis-valuations, the BSP remains cognizant that keeping rates low for too long could result in mis-appreciation of risks in certain segments of the market, including the real estate sector and the stock market as markets search for yield.

“Mis-appreciation of risks” from the “pitfalls of chasing the market” simply entails overvaluation from excessive speculation. And the primary target for flagrant speculation has been specified as the “real estate sector and the stock market”

Mr. Tetangco’s commented on how this euphoria can unravel

Right now because of excess liquidity in the system, the industry doesn’t seem to mind much that real interest rates are negative. But ladies and gentlemen, when the tide turns, those projects that you may have “approved” based on a specific expected value may not provide you the “return” you anticipated. With this in mind, our policy actions have been aimed at helping you manage your own risk appetites.

Let me first point to the paradox, contradictions or the cognitive dissonance in the statements.

Of course, since real interest rates represents an invisible subsidy (transfer) to borrowers, specifically to the real estate and ancillary sectors, these sectors love the free lunches served to them on a silver platter as they gorge on debt, rationalized on statistical G-R-O-W-T-H which has actually been shouldered or paid for by the currency holders.

And by stating that “keeping rates low for too long could result in mis-appreciation of risks” which has prompted for “the pitfalls of chasing the market” in “the real estate sector and the stock market” the BSP unintentionally had been caught in a contradiction.

Why has there been a low interest rate regime low in the first place? Hasn’t this been because of the BSP’s actions?

In 2009, the BSP embraced the US Federal Reserve zero bound policy. The BSP chief then promulgated that “Maintaining an expansionary monetary policy stance to the extent that the inflation outlook allows, could support market confidence and assure households and businesses that risks to macro-stability are being addressed decisively”[3].

In short, the yield chasing mania from incumbent easy money regime signified by “a period of low volatility” has been a product of “keeping rates low for too long” policies.

But the BSP pins the blame on market participants even as the former recognizes that the latter has only been responding to the central bank’s policies.

Yet even with an implicit attribution that their policies have been the cause to chasing the markets, the BSP offers their position as market saviors “our policy actions have been aimed at helping you manage your own risk appetites.”

Well, Phisix at 7,400 apparently has not been a sign that the BSP has been helping the public manage their risk appetitive. To the contrary Phisix 7,400 have been representative of the intensifying “mis-appreciation of risks”

And considering that bank credit expansion continues to swell at a blazing rate of 18.6% in November, perhaps much of the newly issued money has been funneled towards “chasing the markets”.

But interestingly, the BSP chief’s pointed of how things can go haywire from his October spiel: “when the tide turns, those projects that you may have “approved” based on a specific expected value may not provide you the “return” you anticipated.”

What’s the difference between the essence of the BSP chief’s comments and the following quote?

The whole entrepreneurial class is, as it were, in the position of a master builder whose task it is to erect a building out of a limited supply of building materials. If this man overestimates the quantity of the available supply, he drafts a plan for the execution of which the means at his disposal are not sufficient. He oversizes the groundwork and the foundations and only discovers later in the progress of the construction that he lacks the material needed for the completion of the structure. It is obvious that our master builder's fault was not overinvestment, but an inappropriate employment of the means at his disposal.

The BSP chief’s warnings simply reverberate on what the great Austrian economist Ludwig von Mises calls as malinvestments[4].

Unfeasible projects that had been made feasible via interest rate subsidies eventually discover that there is no such thing as a free lunch: the mismatch between the structure of investments and production activities with that of the supply of capital goods will lead to what the BSP chief says as “projects that you may have “approved” based on a specific expected value may not provide you the “return” you anticipated”—or with reference to the gem of a Warren Buffett axiom from the 2001 Berkshire annual report, “After all, you only find out who is swimming naked when the tide goes out”.

Despite the $ 2 billion Bond Offering, Strains in Bond Markets Remain

The Philippine bond markets have already been expressing signs of these.

Even as Philippine stock markets levitated from last December’s shakeout which incensed bulls that inspired this ‘managed’ run-up, Philippine bonds massively sold off going into the close of the year to materially flatten the yield curve.

And instead of being a seasonal variable, the December selloff in the domestic bond markets accounted for an ongoing trend since 2011. This can be seen via the 2011-13 December yield spreads of the 10 year and 20 year minus 1 and 2 year and 3 months and 6 months

I noted that a rally was to be expected considering that the Philippine government would be offering dollar based bonds at the year’s start. The tightly controlled bond markets had to express “confidence” to attract financiers. So it was. This week, the Philippine government raised $2 billion bonds in the international debt market at 3.95% from the initial offering coupon rate of 4.25% which means privileged access to credit from “real interest rates are negative” around the world.

See what a stock market boom (plus yield fixing by banking-government cabal and Moody’s upgrade) can give to the government?

I expected a major rally. The rally did come, but for now, such has hardly has been ‘major’.

Short term yields (1 year and below) slid but remains above or at June 2013 taper tantrum highs. Yields of 4 and 5 year treasuries have inverted again! (although a minor inversion)

Yield spreads widened only for 20 year minus 6 months and 1 year but remained steady for the rest. 10 year minus 2 year has even flattened amidst the rally.

As I recently noted[5]:

Instead of an anomaly, the flattening of the yield curve is an indication of the business cycle in progress.It has been a sign of monetary produced imbalances that has prompted credit markets to arbitrage on the asset liability mismatches via the spread differentials—whose windows have now been closing. It has been a sign of how credit expansion has engendered massive pricing distortions in the economy that has been demonstrated by inflationary pressures which have now been reflected on the bond markets. And it has also been a sign that such credit expansion fueled boom has been backed by a lack of savings.

From an academic viewpoint, Austrian economists Philipp Bagus and David Howden notes of the significance of flattening yield curve as an expression of the business cycle[6].

Lacking adequate savings for the terms of the projects, these malinvestments must be liquidated. But when exactly will the recession set in? Two cases may be distinguished. In the first, the disturbance directly affects productive ventures. In the second case, financial intermediates first enter distress and only later affect productive enterprises.In the first case, companies finance additional long-term investments with short-term loans. This is the case of Crusoe getting a short-term loan from Friday. Once savers fail to roll over the short-term loans and commence consuming, the company is illiquid (assuming other savers also curtail their lending activities). It cannot continue its operations to complete the project. More projects were undertaken than could be completed with the finally available savings. Projects are liquidated and the term structure of investments readapts itself to the term structure of savings.In the second case, companies finance their long-term projects with long-term loans via a financial intermediary. This financial intermediary borrows short and grants long-term loans. The upper-turning point of the cycle comes as a credit crunch when it is revealed that the amount of savings at that point in time is insufficient to cover all of the in-progress investments. There will be no immediate financial problems for the production companies when the rollover stops, as they are financed by long-term loans. The financial intermediaries will absorb the brunt of the pain as they will no longer be able to repay their short-term debts, as their savings are locked-up in long-term loans. The bust in this case will reverberate backward from the financial sector to the productive sector. As financial intermediaries go bankrupt, interest rates will increase, especially at the long end of the yield curve, lacking the previous high-degree of maturity mismatching driving them lower. Short-term rates will also increase due to a scramble for funds by entrepreneurs who try to complete their projects. This will place a strain on those production companies that did not secure longer-term funding, or rule out new investment projects that were previously viable under the lower interest rates. Committed investments will not be renewed at the higher rates

Importantly, if stock markets are about credit and liquidity, and its corollary, ‘confidence’, then the flattening of the yield curve means indications of diminishing liquidity conditions. So record stocks come in the face of declining liquidity extrapolates to heightened risks!

Deflationary Forces Have Landed: Crashing M3, Negative CPI, Spike in CDS, Falling Peso

I noted above the BSP reported November bank credit expansion at a blistering rate 18.6%. This comes in the light of collapsing money supply growth rate last pegged at 9% in November.

Let me quote the BSP on this[7]: Preliminary data show that domestic liquidity (M3) grew by 9.0 percent year-on-year in November to reach P7.3 trillion. M3 growth decelerated from the 15.4-percent expansion recorded in October. On a month-on-month seasonally-adjusted basis, M3 contracted by 1.2 percent. Money supply continued to increase due largely to the sustained demand for credit. (bold mine)

Claims on the private sector and secondarily claims on other financial institutions account for about 73% of November M3.

Did you notice? Money supply on a month-on-month basis has CONTRACTED. So the Philippines now have been experiencing seminal episodes of DEFLATION in monetary terms!

The yield curve and the money supply growth rates seem as in a chorus to suggest of ongoing liquidity strains!

And notice further of the collapse in statistical consumer price inflation from the above data as of November (data from NSCB)

The BSP reported December CPI at 2.7% (bold mine)[8]: Year-on-year headline inflation for the whole year of 2014 averaged 4.1 percent, within the Government’s inflation target range of 4.0 percent ± 1.0 percentage point for the year. This was the sixth consecutive year that the average inflation rate has been within the government target. Inflation in December eased further to 2.7 percent from 3.7 percent in November, and was likewise within the BSP’s forecast range of 2.4-3.2 percent for the month. Similarly, core inflation—which excludes certain food and energy items to better capture underlying price pressures—slowed down to 2.3 percent in December from 2.7 percent in the previous month. On a month-on-month seasonally-adjusted basis, inflation was unchanged at -0.1 percent in December.

Although there seems to be a discrepancy between the reported -.01% (BSP) and tradingeconomics data (perhaps owing to seasonality adjustments; see left window), the statistical fact is that Philippine consumer price inflation has SHRANK for two successive months!

Monetary deflation has ushered in CPI deflation that appears to have been ventilated at the bond markets through higher short term yields and a significant flattening of the yield curve!

Folks, forces of deflation appear to have landed on Philippine shores!

While CPI deflation may have partly been influenced by crashing oil and commodity prices abroad, the strains on household spending activities has already been evident as shown by the declining growth rates since the 3Q of 2013 through 3Q of 2014 based on the 3Q statistical GDP as I previously pointed out.

The supply side can’t be said to be overproducing, industrial production while up in November over the previous months has been below 2013 levels both in growth rates and in nominal terms based on data from National Statistics Office. Nor has this been the case for imports. While imports has supposedly grown 7.5% in October, based on nominal terms October imports have been down compared to each of the three months of the 3Q 2014.

As a side note, exports reportedly leapt 19.2% in November following a paltry 2.5% growth in October based on NSO data. But a glimpse of nominal levels indicates that there have been only marginal changes on a monthly basis based on October and November, from tradingeconomics data. Said differently, based on US dollar quotes, both October and November export performance has been materially lower than the monthly performance during the past 5 months.

In short, the decline in statistical CPI has largely been a function of eroding consumer demand.

Whatever happened to the vaunted Philippine consumer boom story whose capacity to consume has been perceived by the consensus as interminable?

The New York Times recently featured a slideshow of the “death spiral” of US shopping malls. The growth imbalances between the supply side relative to demand that had led to the sorry fate of US “dead malls” serve as a blueprint for the Philippine equivalent.

Together with casinos and other property related projects, this serves as a wonderful example of the blatant mismatch between the structure of investments and production activities with that of the supply of capital goods

And once demand continues to fall, these imbalances will be exposed as excess capacity, financial losses and magnified credit risks.

Yet the irony has been that the huge leap in bank credit growth rates hasn’t translated to money circulation in the economic stream suggests that current loan growth has been about debt rollover (Debt IN Debt OUT) than of capital expenditures.

And notice too that despite the $2 billion international issuance at lower coupon rates, the price to insure Philippine debt via Credit Default Swaps (based on Deutsche Bank data) has hardly improved from the recent spike (see right window).

What this implies is that underneath all those rose colored glasses statistics and record stock markets, credit risks have been on the rise!

The falling peso should add to the current pressures. The peso closed down .5% to Php 44.95 this week. The falling peso simply means more peso for every dollar imports which should affect CPI through prices of imported goods and services. Importantly, this also means more pesos for every US dollar based debt.

Unless hedged, domestic companies exposed to the “short dollar” loan portfolio would need more peso based growth to offset bigger dollar requirements for debt service. The Wall Street Journal estimates that Philippine firms have borrowed $12.16 billion since 2008. While this signifies a drop in the bucket for the $ 4 trillion emerging market US dollar loan portfolio to non-banks out of the overall $9 trillion exposure, a major seizure in one of the major borrowers (say Brazil or China) can ripple across the world as falling dominoes via an emerging market “margin call”.

The central bank of central banks or the Bank for International Settlements via Hyun Song Shin have warned on this as previously noted[9].

Yet the current statistical monetary and CPI data and actions in the bond markets pose as a significant challenge to 4Q 2014 statistical GDP. The current developments are likely to serve as more negative surprises for the consensus sporting a one way G-R-O-W-T-H mindset where RISK have been priced out of existence. Of course the caveat is that since government makes the data they can show anything.

Bottom line: There has been a widening divergence developing in the Philippine financial system and the economy.

Forces of deflation (bubble bust) have emerged. Such has been revealed by cratering money supply growth rate, crashing CPI, pressures on the bond via elevated short term yields and tightening yield spreads and a surge in Credit Default Swaps (CDS) in the face of ballooning credit growth rates. The falling peso adds to the pressure in the real economy via CPI inflation and credit risks from external liabilities.

All these adverse forces have been occurring in the face of record highs stock markets.

Also Phisix 7,400 essentially defies the warnings made by the BSP chief. Given that the BSP has stopped tightening, perhaps out of political pressures from the natural beneficiaries of the boom has been the government, the banking system and their clients (bubble sectors and the stock market), Phisix 7,400 signifies how the BSP has lost control over the mania.

So the BSP has been trapped from their own policies.

Record Phisix 7,400 on Record Index Pump!

The next question is how has the Phisix reached the record highs?

My answer is simple. It has been massaged to the current levels.

Managing the index has been coursed through three ways.

One, index managers go into a maniacal bidding spree of select grotesquely overpriced securities as global stock markets suffered from a meltdown.

The likely intent has been to reduce the possibility of bearish sentiment from developing. The other possible objective is to depict to the world how Philippine stocks have developed invincibility to become immune from any contagion. Corrections have become impermissible. Philippine stocks can only go up. Valuations hardly matters.

The operations begin after a few minutes from the opening bell. Big declines at the open are either totally erased or reversed to show gains by the closing bell. This has been the case in 3 instances October 16 2014 and December 15 2014 and last Tuesday January 6 2015 since the rally that began in early 2014.

Last Monday, when US-European markets convulsed, panic buying operations went into action even as most of Asia had suffered significant losses. The Phisix ended up unchanged at the close.

Such all-day operations have used only during global market pressures.

The second way has been what I call the ‘afternoon delight pump’. Morning sessions are usually left for the markets to determine their levels. After the lunch recess, index managers go to work, they frantically push up prices of 3-4 issues with a combined market cap of 20% until the session’s close.

The third way has been “marking the close” or the manic pumping of key index issues at the last minute prior to the pre-run off period. By the way, marking the close is considered a violation of the Philippine Security Exchange Commission’s Security Regulations Code. But for as long as violations benefit the establishment, who cares?

The “afternoon delight” pump and the “marking the close” has usually been used as combination and has become a regular feature since the start of 2014, although its frequency has increased during the last quarter of 2014. This reveals of the desperation to attain 7,400. Why?

During the first attempt at 7,400 in 2013, these index massaging has been rare.

But today, index managers have become increasingly frantic. They have most likely been infuriated by the recent reemergence of downside volatility particularly when domestic casino stocks came under the limelight of global contagion.

In one occasion particularly 18th of December, the Phisix encountered a startling wild rollercoaster ride session marked by two round trips—an early sharp 1.6% upside at the open that had been more than erased. By the lunch recess, the Phisix was stunningly down 1.2%. After lunch, the fantastic afternoon pumping scheme basically eviscerated the 1.2% intraday loss. The closing was even grander, a whopping 92.5% of the day’s .91% gains attained by marking the close!

Overall, the Phisix gyrated by an astounding 6.5% intraday—from gains to losses and back to gains mostly based on index massaging! This could mark a record of sorts.

From then, the index managers never looked back. Last week’s global stock market meltdown, as mentioned above, the Phisix was cushioned by the January 6th index massaging operations. When global stock markets strongly recoiled from losses due to the Fed Evans who said that tightening soon would be catastrophic and the ECB’s jawboning, such rally provided tailwinds to the domestic mania. Thus, the Phisix at 7,400.

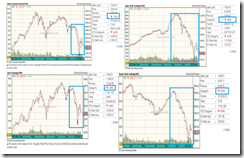

Peso volume speaks loudly of the quality of the record high.

In May 15th 2013, when the Phisix first reached 7,403, Peso volume was at a marvelous Php 21.4 billion. In the September 2014 chapter, peso volume was at a measly Php 9.5 billion as I showed here.

Friday January 9th edition posted a better than September feat at Php 11.2 billion, but still almost a half way shy of the 2013 failed attempt.

The weekly averaged daily peso volume (left) reveals of the relatively low volume ramp to record highs. What has distinguished 2014 from 2013 has been the delirious rate of turnovers (right) which has been about 35% higher today.

Stock market pumping means to acquire specific equity securities at higher than the market rates. Marking the close is a wonderful example.

Yet the increasing frequency of the stock market pump means that these index managers have been heavily accumulating equity positions at record high levels.

Looking at the charts of the 30 Phisix composite members, 15 or half have closed above 2013 highs. 2 are at 2013 highs while the rest or 13 are below their respective 2013 watermark levels. So the record high hasn’t reflected a broad based run.

Curiously of the half that has been above the 2013 levels, some have soared in a parabolic or near vertical fashion. Wow. Total Mania.

And of course with PE ratios at 30, 40, 50 and PBV at 4,5,6,7 this has NOT been about G-R-O-W-T-H, but the incantations of G-R-O-W-T-H to justify mindless bidding up of mispriced securities.

When stock market returns outpace earnings or book value growth, the result is price multiple expansions. This is why current levels of PE ratios are at 30, 40, 50 and PBVs are at 4,5,6,7. This is NOT about G-R-O-W-T-H but about high roller gambling which relies on the greater fool theory or of fools buying overpriced securities in the hope to pass on to an even greater fool at even higher prices—all in the name of G-R-O-W-T-H!

Going back to the index massaging, this only implies that in order to generate a bandwagon effect, index managers have mostly been piling on the most popular issues.

So in order to finance the next series of managing or to reload, they would need to sell at least at breakeven levels. So has the furious rate of turnovers been symptoms of the manipulation of index rather than of retail speculation gone berserk?

Otherwise, index managers have been stashing boatloads of overvalued securities such that a market crash would expose on their balance sheet problems (whether they are private or public firms). This explains the intolerance for any correction. So the continuous pump to keep façade of their balance sheets.

Yet what more if such heavy accumulation of key popular index stocks at record prices has been financed through credit? Perhaps another reason why stocks can’t be allowed to go down.

Record Phisix as Domestic Casino Stocks Crash!

This week’s record run has mostly been bannered by the holdings and property sector. The financial sector even posted losses for the week. Why the loss in the financial sector? Have these been about the emergent recognition of the effect of tightening spreads on bank balance sheets?

Interestingly, domestic casino stocks have been in serious trouble—crashing in the face of record Phisix 7,400!

Large integrated resorts have mainly been about shopping malls and hotels with casinos as come-ons or attractions. Yet the heavily leverage casino stocks translates to magnified credit risks to lenders. As I have previously explained, there are about Php 45-50 billion of debt that are at risks if Chinese gamblers don’t appear soon enough and or if the domestic economy fumbles and or if domestic political and financial elites will hardly patronize them to profitability.

Considering that about 3 of 10 residents are “banked”, then this means that leverage circulates among a small segment of banked people and institutions. Let me add that the reason the Philippines has low gearing ratio per capita is because of the mostly unbanked population. But if we should measure gearing in terms of the population of only banked entities, the leverage levels should soar.

In short, casino stocks are just part of the concentration risks from systemic overleverage which obviously the record Phisix 7,400 chooses to ignore.

Phisix 7,400: Déjà vu 1997?

I am not a fan of pattern seeking in charts, if patterns serve as a standalone metric. But I consider patterns, if they account for the whereabouts of the business cycle especially when backed by fundamentals.

Today’s record Phisix (top) which has been part of the 2013-2014 volatility seems like a miniature replica of the 1994-1997 topping process.

The remarkable rally of 1993 which delivered an astonishing 154% returns peaked in early 1994. What followed was an exceptional periods of volatility. From 1994-1995 there had been three accounts where the Phisix fell by about 20% but rallied back. This I call as bear market strikes.

By the end of 1995, the bulls eventually regained the upper hand and pushed the Phisix back to marginally top the 1994 highs by February of 2007 before the Asian crisis collapse.

The current episode had the Phisix climax in May of 2013. The bull run had been disrupted by the Bernanke taper talk and by the volatility from BoJ’s QE 1.0. What followed next was three occasions where the Phisix had attempted a touchdown on bear market levels.

Nonetheless the bulls recovered momentum from the start of 2014 mainly due to the index managers through today’s record high. The Phisix returned 22.76% in 2014. This week’s record run has generated 2.38%.

Aside from chart patterns of 1997 and today, there are many other similarities.

-Current stock market valuations have already topped the 1995-96 levels.

-Credit to GDP has mostly like substantially eclipsed the 1997 highs of 62.2%.

As I wrote last July[10]

In a speech last year, the BSP chief cited the credit to GDP at 50.4% as of Q4 2012. Allow me a back of the envelop calculation using current data to establish 2013 debt levels.The average BSP’s measure of the banking system loan growth in 2013 has been at 13.5%. The average annualized growth per quarter in 2012 has been at 7.225%. So this implies a credit-to-gdp ratio now at around 56.7%Such level outstrips the 1984 high at 51.59%. This is the same period or in particular in 1983, where the Philippines faced a balance of payment crisis and an eventual inflationary recession in 1984 which I previously discussed here, chart from Wikipedia.org. Notice high inflation, high interest rates (T-bills). Rings a bell? (I know the bulls will assert we can’t have a balance of payment crisis because of foreign reserves! But shouting foreign reserves! foreign reserves! foreign reserves! are not free passes to bubbles)Current credit-to-gdp levels have also surpassed the 1996 high at 54.85% and have been just shy away from the 1996 high of 62.22% in 1997. If the pace of current credit growth is sustained through the year at current economic growth levels, the 1997 acme will be easily reached or exceeded by the yearend.At any rate, the Philippines economy has now reached critical levels—where if the past will rhyme—points to severe economic turbulence ahead.

The average banking system loans to the productive economy rates growth rates for the past 11 months has been at 18.53%. Let me wear the hat of the mainstream to assume that statistical GDP for 2014 will be optimistically at 6%. This extrapolates to a net credit growth of 12.53%. If my 2013 estimates at 54.85% has been anywhere accurate, then 2014’s credit to gdp ratio would total 67.38%! Yet if the statistical GDP falls below 6%, the larger the gains of net credit growth, the higher credit to gdp ratio!

-In 1997, Japan raised sales taxes and suffered a recession. Japan raised sales taxes in April 2014 and has been in a recession. If Japan’s recession deepens then there will likely be a feedback transmission to her trading partners and vice versa.

-ASEAN nations have been acquiring more debt than the pre-1997 days.

As example, syndicated loans from M&A are at record levels. From Nikkei Asia[11] (bold mine): The volume of syndicated loans in Southeast Asia was at its largest ever in 2014 with Singapore leading the pack, according to a report by a financial research firm Dealogic. As merger-and-acquisition activity rises in Southeast Asia, more companies are using syndicated loans for funding. Loans hit a record high of $119.5 billion in the region, up from $86.6 billion the previous year. The number of syndicated loan deals totaled 247, compared to 294 in 2013. Singapore is the largest generator of syndicated loans in the region. The city-state's volume expanded 71% to $60.5 billion in 2014, recording the largest year-on-year increase in Southeast Asia. Indonesia and Malaysia followed, with $21.4 billion and $18.3 billion of syndicated loans in 2014, respectively

I have noted in September of the S&P warning of top ASEAN firms whose growth has increasingly relied on debt.

As a refresher, from theNationMultiMedia.com[12]: "Asean companies are increasingly using debt to finance growth and are likely to continue doing that over the next two years," said Standard & Poor’s credit analyst Xavier Jean. Standard & Poor’s estimates that internal cash flows and cash balances could fund only about half of almost US$300 billion Asean’s largest companies spent on expansion and acquisitions between 2008 and the first quarter of 2014. At the same time, these companies issued about $150 billion of additional debt to bridge the gap. The result of ongoing investment by Asean companies has weakened their credit profiles since 2011, when growth in revenues and cash flows started to wane.

-Indonesia’s currency the rupiah has already exceeded the 1997 lows or the USD rupiah topped 1997 highs at 12,600.

Like the Philippines, the Indonesian government successfully raised $4 billion in the international bond markets last week according to a report from Bloomberg. But unlike the Philippines, the Indonesian government had to pay for higher rates: 5.95% for 10 year and 6.85% for 30 years compared to the previous 5.684% and 6.85%, respectively.

The $ 4 billion signifies a parcel of the targeted $ 29.2 billion financing requirements for 2015 to be raised at domestic and international markets. The Indonesian government reportedly failed to meet its financing requirement last November but generated a warmer reception last week.

Curiously the Indonesian government has been tapping foreign currency loans as her currency continues to struggle.

Nevertheless like the Philippines, Indonesian stocks have been drifting at record highs in the face of emerging financing strains.

Anyway unless one has used heavy leverage to bet on the stock market or has been part of the institutions that has become totally addicted to perpetually rising asset prices, the break of 7,400 has really been meaningless to any prudent investor.

The past secular tops show that record highs have hardly been accompanied by lasting or sustainable upside moves.

For instance, the nominal gains from the February 3 1997 high over the previous Jan 6 1994 highs has only been 4.68%. If we apply this to the 7,400 would translate 7,746.

During my dad’s stock market cycle, the secular high of January 1979 from its previous high in 1969 was 10.14%. This equates to 8,150 in current terms.

The recent Lehman contagion saw the Phisix rally above the July 5, 2007 highs by only 2.168% in October 2007. In today’s equivalent, this would represent 7,540.

Yet all these tops preceded a collapse.

This implies that at 7,400 the risk reward balance has been heavily tilted towards risk. Betting on a 10% gain in the face of a potential loss of at least 50% will signify a gamble than investments.

Fund manager Dr John Hussman has a pertinent rule for today’s market participants. He calls this the “Exit Rule for Bubbles” or the assumption that “you only get out if you panic before everyone else does” (bold mine): you have to decide whether to look like an idiot before the crash or an idiot after it.[13]

It’s really not just about social desirability bias; one can be seen being an idiot but preserve capital, but the other can be both an idiot and at the same time lose money!

2015: Real Time Crashes Will Spread and Intensify

At the start of 2014 I wrote of potential black swans[14]:

The potential trigger for a black swan event for 2014 may come from various sources, in no pecking order; China, ASEAN, the US, EU (France and the PIGs), Japan and other emerging markets (India, Brazil, Turkey, South Africa). Possibly a trigger will enough to provoke a domino effect.

The black swans have arrived. Crashes have become real time events. But so far they appear as fragmented series of events than a global systemic issue. 2015 will most likely see the spreading and acceleration of this process.

Oil and commodities have been collapsing. Macau’s casino stocks have also been in a tailspin. Casino stocks in Singapore and even the US have also been on a meltdown. US gambling stocks have diverged from her record peers. So applies with US energy stocks which has also been cracking.

Interestingly the common denominator of oil, commodities and casinos has been China.

While Chinese stocks have been melting UP partly on the government’s massaging of the stock markets via the price controlled IPOs and by stimulus, the real economy has been lumbering. Just last week, a Hong Kong listed Shenzhen based property and shopping mall (!) developer, Kaisa Group Holdings Ltd, missed interest payments that could herald the first overseas bond default.

This bombshell from Wall Street Journal[15] (bold added): A default, if confirmed, would be the more shocking because it was so unexpected, investors say. Kaisa was seen as in good financial shape, with a healthy portfolio of commercial and residential projects, strong sales and solid cash flow that had made its bonds popular with investors. Kaisa’s net profit in the first half of 2014—the latest figures available—rose 30% versus the previous year to 1.33 billion yuan ($214 million), with revenue of 6.79 billion yuan. As of June 30, the 16-year-old company, which is listed on the Hong Kong exchange, had cash of 9.38 billion yuan versus short-term debt of 6 billion yuan.

Healthy portfolio, strong sales, solid cash flow and rising net profits all vanished in the face of a missed payment on interest from a $500 million of debt. As I have been saying here, when debt deflation (bubble bust) comes knocking, the illusions of strength from a credit boom can evaporate in an instant. What you see isn’t what really is. To quote the sage of Omaha Warren Buffett again, you only find out who is swimming naked when the tide goes out.

As a refresher, despite so-called statistical growth of the Chinese economy, the government has undertaken many forms of stimulus. As I recently wrote[16],

The drastically slowing highly levered Chinese real (and not statistical) economy has compelled the People’s Bank of China (PBoC) to do a series of easing measures. As I recently pointed out the Chinese government has launched “targeted easing” last June, has resorted to selective bailouts of firms which almost defaulted last July, imposed price controls on stock market IPOs last August, injected $125 billion over the last two months.The much ballyhooed China-Hong Kong connect also went onstream November 17 where the Chinese government also liberalized fund flows on IPOs conducted overseas to ensure money overseas can be repatriated with ease.The Chinese government via the PBoC has also refrained from sterilizing funds injected to system.

Add to this recent action that allows banks to lend more from their deposits.

Recently the Chinese government announced they would be “accelerating 300 infrastructure projects valued at 7 trillion yuan ($1.1 trillion)”, although the Chinese government denies that this represents new stimulus. Whether this has been about fast tracking of projects in the pipeline or stealth injection of new projects, it’s all about frontloading of spending today.

Yet the rudimentary problems would be the funding and implementation of government sponsored spending. Will these be funded by more debt? In the same way soaring stocks have been energized by an explosion of margin debt? Debt problems to be solved by acquiring more debts?

How will all these projects be implemented in the wake of the so-called anti-corruption campaign?

Nonetheless collapsing oil prices along with a strong US dollar has prompted for Middle East stocks to suffer from a series of sharp volatility dominated by crashes.

Many emerging market currencies have been under tremendous currency strains, stock markets of emerging market economies as Russia, Brazil, Nigeria and more have suddenly fallen into in bear markets.

In Southeast Asia, while stock markets of Philippines and Indonesia are at record highs, Thailand SET has been under pressure, punctuated by an intraday 9% collapse last December 15th, which it mostly recovered during the session. The Malaysian ringgit and Malaysian (KLSE) stocks have been seriously weakening. The USD-MYR has reached 2008 levels! Vietnam’s stocks recently landed on the door steps of the bear market before bouncing back to recover some of the recent losses.

Stock markets of developed nations have also began to exhibit increasing signs of stress only to be repeatedly rescued by promises of support by their respective central banks.

Yet Bank for International Settlement warned on this during their Quarterly review last December, from Claudio Borio, Head of the Monetary and Economic Department:

Once again, on the heels of the turbulence, major central banks made soothing statements, suggesting that they might delay normalisation in light of evolving macroeconomic conditions. Recent events, if anything, have highlighted once more the degree to which markets are relying on central banks: the markets' buoyancy hinges on central banks' every word and deed

Increasing pressures on risk assets can’t qualify as black swans anymore. That’s because the element of surprise has been taken away.

The central bank of central banks, the Bank for International Settlements (BIS), the IMF and the OECD has jumped on the bandwagon to sternly warn of risks of a global financial crisis. Many other central banks has also joined the warning chorus but in different degrees most of them sanitized.

Admiringly, the BIS have been the most persistent. They have used every opportunity of late to air concerns of the debt financed mania griping financial markets everywhere.

Markets are a process. The periphery to core that I have been warning about has been spreading. The spreading process will likely intensify in 2015. If the developed markets succumb to forces of asset deflation, the periphery would fall harder. The feedback loop will accelerate.

Like in Middle East or Casino stocks, record highs suddenly transmogrified into bear markets.

Greed will metastasize into fear.

The Phisix bear market in 2007-8 came as a contagion even without systemic problems. Today internal imbalances as revealed by inchoate signs of deflation will mean not just a financial asset meltdown but economic turmoil as well.

My all time favorite quote from the Sage of Omaha has become very relevant:

I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful."

[1] See Phisix: As Mania Rages, BSP Chief Warns on “Complacency” and “Chasing the Market”!! August 24, 2014

[2] See Phisix: 7,400 is not the Technical Hurdle, the BSP Governor Is October 6, 2014

[3] See Phisix: In 2009, the BSP Engineered a Crucial Pivot to a Bubble Economy April 14, 2014

[4] Ludwig von Mises Malinvestment, Not Overinvestment, Causes Booms May 24 2010

[5] See Philippine Bonds Close the Year with a Rally; Flattening Yield Curve as Business Cycle Indicator December 29, 2014

[6] Philipp Bagus and David Howden The Term Structure of Savings, the Yield Curve, and Maturity Mismatching The Quarterly Journal of Austrian Economics 2010

[7] Bangko Sentral ng Pilipinas Domestic Liquidity Growth Decelerates in November December 29, 2014

[8] Bangko Sentral ng Pilipinas 2014 Average Inflation Within Government Target January 6, 2015

[9] See Phisix: The October Syndrome is Back! Philippine Casinos as the Causa Proxima? December 15, 2014

[10] See Phisix Breaks 6,900 as Inflation Risk Becomes a HOT Political Issue! July 6, 2014

[11] Nikkei Asia M&A activity has Southeast Asia lending record amounts January 5, 2015

[12] theNationMultiMedia.com Asean companies' growth hinges on rising debt and credit availability September 11, 2014

[13] John P Hussman Losing Velocity: QE and the Massive Speculative Carry Trade November 3, 2014 Hussman Funds

[14] See Phisix: Will a Black Swan Event Occur in 2014? January 13, 2014

[15] Wall Street Journal Chinese Developer Appears to Default January 8, 2015

[16] See Phisix: Tremors Rock Philippine Casino Stocks, Malaysian Financial Markets December 8 2014

.png)

.png)

.png)

.png)

.png)

.png)

.png)