The Wall Street Journal editorial has a nice and trenchant discourse on Europe’s chosen course of action in working to resolve on their debt and financial crisis. (bold emphasis mine)

European leaders are meeting in Brussels today to craft their third attempt—or is it the sixth?—to end the Continent's debt crisis and avert a deep recession. So it seems an apt moment to review the economic policy record of the leaders seeking to set Europe back on course. It isn't pretty.

A large part of the problem is the state of Europe's intellectual debate, which pits government spending against "austerity" as the only two economic policy choices. The Keynesians are blaming Europe's looming slowdown on belt-tightening governments, as if public spending is the only way to spur economic growth. But the problem across most of Europe isn't a lack of government spending that typically represents about half of GDP. It's the failure to create the conditions for private investment and growth.

When the financial panic hit in 2008, the EU and International Monetary Fund urged governments across the Continent to spend like crazy to avoid recession. So they spent, only to discover that such spending is unsustainable. Now the same wise men are urging governments to raise taxes to offset all that spending and even to spend more "in the short term." The one policy none of these leaders has tried is the Reagan-Thatcher model of cutting taxes to spur growth.

Read the list of tax measures being imposed and or the rest of the article here (subscription required)

The mainstream, as rightly pointed out by the WSJ, offers a false choice where government spending has been portrayed as the elixir or magic wand that would bring about prosperity. So aside from the additional burden of taxation, the alternative option to finance government spending or private sector rescues has been the shrill clamor for the ECB to inflate the system or for peripheral states to leave the core to be able to inflate (allegedly to regain competitiveness, which has hardly been the reality).

There has been little regards towards incentivizing those who generate wealth—the entrepreneurs and the capitalists—or as per the WSJ “conditions for private investment and growth”.

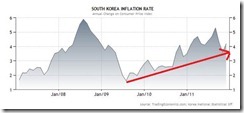

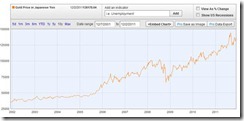

Yet to the contrary, taxation and inflation demotivates or discourages investments.

So far, the direction of policies has been geared towards the preservation of the status quo or the political architecture of the welfare state—central banking—banking cartel at the expense of the wealth creators.

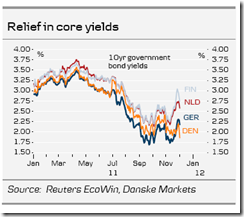

This political preference to redistribute rather than create wealth means that any ‘fiscal union’ risks not only the failure to attain the objective of saving ‘peripheral states’ so as to preserve the EU, but also risks undermining the credit standings of stronger or creditor nations. In other words, every nation that joins in the bailout bandwagon will likely get dragged into economic morass, where eventually there won't be enough resources from which to redistribute and the whole structure falls apart.

Politicians and the bureaucrats, desperately looking for short term nostrums, looks like they are digging themselves deeper into the hole.

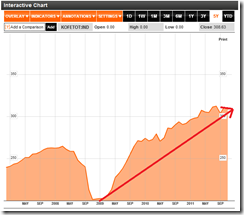

And given such conditions, the crisis should be expected to linger on and that sharp volatilities will continue to be the common feature of the marketplace.