Keynesianism is the

destruction of the middle class. By printing money and bloating deficits and

spending, the size of government in the economy rises faster than the private

and productive sectors. The size of the government increases during recessions

by increasing expenditure to combat them, and it also increases during economic

downturns by hiking taxes and creating inflation, which is a hidden tax—Daniel Lacalle

In this issue

Could the Philippine

Government Implement a 'Marcosnomics' Stimulus Blending BSP Rate Cuts and

Accelerated Deficit Spending?

I. Will the BSP Embark

on the Path of Easing via Rate Cuts Starting in August?

II. Will the BSP’s Rate

Cuts Not Amplify the Balance Sheet Imbalances?

III. Will a Slowdown in

June CPI Reinforce the BSP’s 'Dovish' Position?

IV. Public Spending

Surges to Fourth-Highest Level on Record in May!

V. Will the Government

Introduce a Fiscal Stimulus Package Soon?

VI. Aggressive Deficit

Spending Expected to Increase Public Financing or Debt

VII. "Marcosnomics"

Stimulus: Expanded Spending on Pre-Election, Defense Related and Infrastructure?

VIII. Five-Month Debt

Servicing Costs Hits Record High!

IX. "Marcosnomics"

Stimulus: BSP Easing Plus Accelerated Deficit Spending; Burst of Deficit

Spending to Cap Disinflation

X. The Addiction to

Government Interventions and Stimulus Magnify Systemic Risks

Could the Philippine

Government Implement a 'Marcosnomics' Stimulus Blending BSP Rate Cuts and

Accelerated Deficit Spending?

With the BSP priming the public for a policy

easing this August, and May public spending reaching a non-December all-time

high, could this signify the implementation of a 'Marcosnomics' signature

stimulus?

I. Will the BSP Embark

on the Path of Easing via Rate Cuts Starting August?

Businessworld, June

28,2024: THE BANGKO SENTRAL ng Pilipinas (BSP) kept

interest rates steady for a sixth straight meeting on

Thursday but signaled that a rate cut at its next meeting in August is

“somewhat more likely than before,” with up to 50 basis points (bps) in easing

likely this year…Mr. Remolona said he expects inflation to further ease in the

second semester with the implementation of lower tariffs on rice.

If an increase in rice tariffs will lower the

CPI, why would this require the BSP to cut rates?

Policy rates represent a tool for managing

aggregate demand, largely ignoring the impact on balance

sheets.

By signaling a cut, is the BSP admitting to a worsening

slowdown in demand?

Don’t you see the contradiction? Why would

the BSP use a demand management policy to address a supply-side concern?

For the avoidance of doubt, the results of the

BSP’s latest consumer survey corroborate their implicit worries (bold added): The

consumer sentiment in the Philippines was more pessimistic for Q2 2024

as the overall confidence index (CI) became more negative at -20.5 percent from

-10.9 percent in Q1 2024. The decline in the index is reflective of the

increase in the percentage of pessimists, which outweighed the increase in the

percentage of optimists. The weaker confidence among consumers was mainly due

to their concerns over the: (a) faster increase in the prices of goods

and higher household expenses, (b) lower income, (c) fewer available

jobs, and (d) the effectiveness of government policies and programs on

inflation management, traffic and public transportation, provision of financial

assistance, and labor and employment.

For the next quarter (Q3 2024), the CI turned negative at -0.4

percent from 2.7 percent in Q1 2024. However, the consumer sentiment for the

next 12 months (May 2024-April 2025) remained optimistic as the CI was little

changed at 13.5 percent from 13.4 percent in Q1 2024. (BSP, June 2024)

So, could this be the genuine reason for the

entrenchment of the BSP’s 'dovish' stance?

It does not stop there.

It’s not just consumers; businesses have also

shared this dour sentiment for 2024.

This is according to another BSP survey. (bold

mine): The business sentiment in the Philippines turned less upbeat in Q2

2024 as the overall confidence index (CI) declined to 32.1 percent from

33.1 percent in Q1 2024. This is reflective of the combined decrease in the

percentage of optimists and the increase in the percentage of pessimists. The

Q2 2024 business confidence turned less buoyant due mainly to the firms’

concerns over: (a) softer demand for goods and services such as personal

care, health and other consumer products, construction supplies, city hotels

and restaurants, and manpower services, (b) ongoing international conflicts

that may push oil prices higher, (c) slowdown in business activity due to El

Niño-induced extreme weather conditions, and (d) persistent inflationary

pressures that may weigh down consumer spending. For Q3 2024, the

country’s business confidence weakened as the overall CI also fell to 43.7

percent from 48.1 percent in the Q1 2024 survey result. For the next 12 months,

business outlook was similarly less upbeat as the overall CI decreased

to 56.5 percent from 60.8 percent in the Q1 2024 survey result (BSP, June 2024)

Even before this survey, has the BSP been aware

that the revenue

growth of listed retail chains had been struggling for some time?

Besides, why did the BSP not address the

escalating tensions between the Philippine government and China over the

disputed South China Sea claims?

An outbreak of violence in the region would

not only disrupt global supply chains but also raise the specter of a wider

conflict—a "casus belli"—that could have severe socioeconomic and

financial consequences for the Philippines.

Does this represent another case of an

analytical "blackout?"

In a nutshell, is the BSP concerned about how

the gloomy views of consumers and businesses may translate into weaker GDP

growth?

II. Will the BSP’s Rate

Cuts Not Amplify the Balance Sheet Imbalances?

On the other hand, how would interest rate

cuts boost demand, incomes and jobs if household and business balance sheets

are already heavily leveraged?

Figure 1

Has the BSP not learned from the Bank of

Japan's experience with negative nominal

interest rates, where instead of stoking inflation,

it exacerbated the curtailment of demand that led to its "lost decades?"

(Figure 1, topmost graph)

Further, would the BSP's rate cuts not only

magnify economic imbalances and stoke inflationary pressures but also widen

inequality between those with access to formal credit and those reliant on

shadow banking, such as small and medium enterprises (SMEs)?

Moreover, has the BSP also expressed concerns

over the deteriorating conditions in the banking system, where higher interest

rates have led to the erosion of accounting profits,

potentially worsening financial liquidity conditions and exposing the solvency

issues of bank borrowers and the industry? (Figure 1, middle and lower windows)

Will the BSP’s rate cuts not amplify the

balance sheet imbalances?

III. Will a Slowdown in

June CPI Reinforce the BSP’s 'Dovish' Position?

Along with the above, as previously

noted, May's CPI could represent an interim peak. We arrived at this conclusion

based on several factors:

Figure 21. Slowing month-over-month momentum in the

CPI

2. A bullish flattening of the Philippine

treasury yield curve, which narrowed further in June (Figure 2, topmost graph)

3. Instead of boosting demand, the elevated

leverage in household balance sheets—as revealed by record consumer spending—has

fueled an increase in consumer non-performing loans (NPL)

4. Deteriorating job market conditions

5. The recent bounce in imports may be driven

by substitution effects due to production slack

6. The rising US dollar-Philippine peso

exchange rate, which not only contributes to higher import and financing costs but also puts pressure on local industries to generate more foreign exchange

revenues to fill the widening trade gap. (Prudent Investor, June 2024)

The BSP has published its projected CPI for

June

(3.4%-4.2%)—which seems tilted lower than May

(3.7%-4.5%). The next step will be for the consensus "to pin the tail on

the donkey" by selecting numbers within the BSP’s range.

If the CPI slows, would it validate our view

that the economy has been slowing faster than expected? And would this justify

the BSP’s proposed easing this August?

IV. Public Spending

Surges to Fourth-Highest Level on Record in May!

We also noted peculiar signs of restraint in

government spending in the first four months of 2024.

However, this trend may have reversed in May,

as the enlarged deficit emanated from outsized government spending!

Inquirer.net, June 28, 2024: The

government reverted to a fiscal deficit in May, after posting a P42.7-billion

surplus in April, amid higher public spending fueled by accelerating inflation

and a high-interest environment…Government spending in May amounted to P557

billion, accelerating by 22.24 percent mainly driven by allotments to

government agencies’ projects and budgetary support to local government units

and state-run corporations. For the first five months, disbursement reached

P2.3 trillion, up by 17.65 percent…For this year, the government has set a

budget deficit ceiling of P1.48 trillion, or equivalent to 5.6 percent of

gross domestic product (GDP). It also aims to reduce the deficit-to-GDP

ratio to 3.7 percent by 2028.

May's government spending represented the

fourth largest on record, according to data from the Bureau

of Treasury! (Figure 2, middle chart)

Ironically, this May spending surge was in

line with the biggest spending streams that occurred in December over the last

three years—when the government typically used the final month to meet or

exceed (political) expenditure targets. Yet, it is not even the end of the

second semester. (Figure 2, lowest image)

Or, public spending in May was the highest on

record (excluding the December expenditures)!

Has the government's frontloading of

expenditures last May broken the seasonal December spending cycle?

That’s right. The surge in May’s deficit spending may set

the template for the coming months through the year-end—we can only expect

December spending to surge even more (or hit a fresh milestone)!

Because of the revenue or collection

slowdown, the spending ballooned the fiscal deficit way above 2023’s level.

V. Will the Government

Introduce a Fiscal Stimulus Package Soon?

Figure 3

Remember that government revenues are

dependent on economic, financial, and administrative performance, while

spending is programmed as part of the Congress—approved budget.

For instance, not only does public spending

play a crucial role in shaping economic imbalances that can lead to inflation,

but inflation also has a material influence on revenue collection. Revenues

depend on the declared transacted price levels.

That is to say, a slowdown in private GDP growth would materially widen

the fiscal deficit. (Figure 3, top and middle visuals)

The government has already proposed a 10%

increase in the 2025 budget to Php 6.35 trillion.

A surge in public spending increases a

segment of the private sector’s revenues from Public-Private Partnerships (PPP)

and other direct and indirect linkages via the political bureaucracy—which will

be used for "consumption."

Therefore, as we observed in our early June

post,

Are they saying that

the current weakness in consumer spending growth will reverse with more deficit

spending or more implicit transfers favoring the government and its cronies? Or

how will increasing this reverse the current trend? (Prudent Investor,

May 2024)

Are authorities expecting an economic

downturn? Are they preparing the public for the launch of a grand stimulus

through measures via easing rates, liquidity injections, and deficit spending?

As we concluded from the same note last May,

Once again, when the

economy slows substantially or recession risks mount, monetary authorities will

likely resort to the 2020 pandemic playbook: substantially easing interest

rates, infusing record amounts of liquidity, and deepening the imposition of relief

measures. Alongside this, political authorities are likely to drive deficits to

reach record levels.

VI. Aggressive Deficit

Spending Expected to Increase Public Financing or Debt

The increase in the fiscal budget gap for May

translates to an impending reversal in the four-month deceleration of

public debt issuance. (Figure 3, lowest chart)

Intriguingly, some quarters have praised this

deceleration without fully comprehending the policy "path dependency"

of the authorities.

Subsequent to the April announcement of a Php

2.57 trillion target for 2024, which represents an 8.9% increase from last

year's Php 2.07 trillion, the government has already declared that it proposes

to raise Php 600 billion in Q3, following the projected Php 585 billion

increase in Q2.

As of May, the Bureau of the Treasury (BoTr)

has raised Php 1.038 trillion, which amounts to 40% of the projected Php 2.57

trillion financing.

The increase in the May’s fiscal budget gap translates

to a coming reversal in the four-month deceleration in public debt issuance. Intriguingly, some quarters have exalted this

deceleration with hardly a comprehension of the policy path dependency of authorities.

And subsequent to the April announcement of a

Php

2.57 trillion target in 2024 or an 8.9% increase from last year’s Php

2.07 trillion, the government has already declared that it proposed to

raise Php

630 billion in Q3 following the projected Php 585 billion domestic borrowings

in Q2.

Through May, the BoTr has raised Php 1.038

trillion or 40% of the projected Php 2.57 trillion financing.

This path dependency on deficit spending

would entail increases in systemic leveraging.

VII. "Marcosnomics"

Stimulus: Expanded Spending on Pre-Election, Defense Related and Infrastructure?

How is the government deploying our

anticipated 'stimulus'?

Figure 4

We anticipated

a reversal from the recent slack in LGU allocations, primarily due to the

upcoming 2025 Senate

and local elections.

The 'proxy war' between the US-NATO alliance

and the Russia-China-BRICs alliance is playing out in the domestic political

sphere through an intensifying contest between the incumbent and former

administrations, where LGUs will play a pivotal role in determining the

winners.

The pro-China former

President and his two children plan to run for Senate in 2025 against the

pro-US incumbent.

Facilitated by the BSP's easing and the

banking system's liquidity infusions, the incumbent administration is expected

to disproportionately increase budgets for select and favored LGUs that will

promote their domestic and geopolitical agendas.

Although LGU

allocations increased by 8.54% in May, the 5-month growth surged by 10.6%,

reaching a nominal spending of Php 420.3 billion, the second-highest on record.

(Figure 4, upper graph)

Meanwhile, infrastructure, public

defense-related projects, pre-election expenditures, and bureaucratic spending

were likely funded by the national government, which saw a 22.3% spike in

disbursements in May.

This contributed to a 14.8% surge in national

government spending over the first 5 months, reaching an all-time high nominal

level of Php 1.443 trillion! (Figure 4, lower image)

So if we are not mistaken, "Marcosnomics"

will be heavy on political expenditures but sold to the public as a "stimulus."

VIII. Five-Month Debt

Servicing Costs Hits Record High!

But there is more.

Figure 5Notably, interest payments skyrocketed by

47.8% in May alone! (Figure 5, topmost graph)

Over the 5-month period, interest payments

soared by 40% to a record high of Php 321.6 billion. As it is, the pie of interest

payments rose to 14.24%—its highest level since 2009!

Consequently, 5-month debt

servicing (including interest and amortization) surged by 48.5% to an

unprecedented Php 1.217 trillion, accounting for 91.78% of the full-year debt

servicing in 2023! (Figure 5, middle and lowest windows)

Specifically, amortizations

are just 8.22% below the 2023 levels, while interest payments remain 48.8%

short of last year’s level.

IX. "Marcosnomics"

Stimulus: BSP Easing Plus Accelerated Deficit Spending; Burst of Deficit

Spending to Cap Disinflation

Adding these together, the BSP’s incentive to

ease or cut rates is largely political in nature.

Primarily, it aims to lower financing costs

to support the administration’s pre-election geopolitical and GDP

"stimulus," while mitigating the rising costs of public debt

servicing.

Additionally, it seeks to alleviate liquidity

and solvency challenges affecting the banking industry and its clients.

The banking system operates similarly to a

cartel under the BSP's oversight.

Figure 6 Faced with stepped-up deficit spending, the

BSP could likely bankroll this by increasing its direct liquidity operations (net

claims on the central government—NCoCG); a strategy previously employed in

2020. (Figure 6, topmost chart)

In coordination with the BSP, banks are also expected

to increase

financing of public debt through purchases of government debt (NCoCG).

(Figure 6, middle graph)

The acceleration of the banking system’s historic

NCoCG has mirrored the surge in the record-high in public

debt. May’s data will be reported by BuTr in the first week of July.

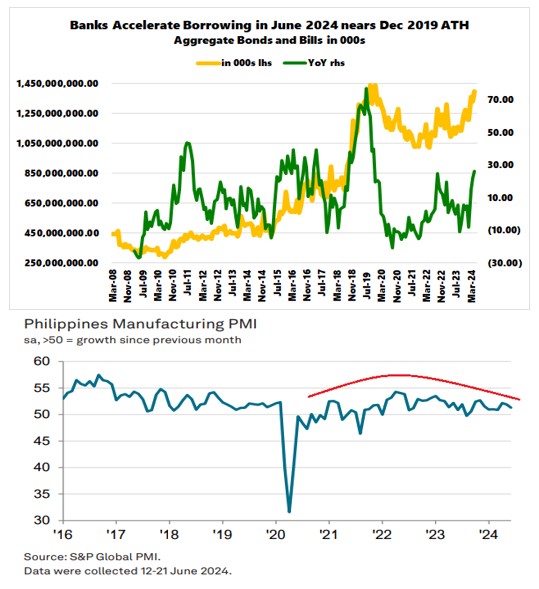

Figure 7

Let's not forget that banks have also been significant

borrowers of local savings to bridge gaps from deposit shortfalls, hidden

non-performing loans (NPLs), substantial mark-to-market losses, and record

Held-to-Maturity (HTM) assets reflected on their balance sheets.

The banking system's bonds and bills payable

have been approaching the Q4 2019 zenith. (Figure 7, topmost image)

Essentially, the banking system is in tight

competition with the government and non-financials for access to the public's

savings.

Not only does this put a floor on

rates, but it also provides an incentive for the BSP to expand liquidity

operations to keep the system afloat. Yet, this entrenches inflation, the

interconnectedness of leverage, and the potential transmission of risks.

As such, while we expect the rebound in the

CPI to have likely climaxed in May—largely due to growing slack in the private

sector—a burst of deficit spending should put a floor under it.

Along with this, the specter of

stagflation rises.

X. The Addiction to

Government Interventions and Stimulus Magnify Systemic Risks

It is no coincidence that the rise in the USD

to Philippine peso exchange rate has closely correlated with public spending.

Put differently, monetary inflation in support

of the “trickle-down” policies that lead to the “twin deficits” emasculates the

purchasing power of the peso against the USD and gold.

So there you have it. The BSP’s ‘dovish’ stance is largely in consonance

with the acceleration of the national government’s intensifying deficit spending.

While intended as a GDP “stimulus,” these

measures also serve other underlying political agendas—facilitating access to

cheaper domestic savings for pre-election financing, geopolitical activities, other

domestic political objectives, and cushioning banks from worsening balance

sheet challenges.

As the above shows, the Philippine government

and the establishment have been so hooked on stimulus in the hope that it will

deliver some form of utopia.

Yet, the more the interventions, the deeper

the imbalances, the greater the probability of risks.

___

References:

Daniel Lacalle, The

U.S. fiscal nightmare. Yellen cannot expect a strong economy with higher

spending and taxes, dlacalle.com May 26, 2024

Bangko Sentral ng Pilipinas, Consumers are

Pessimistic in Q2 and Q3 2024, But Optimistic for the Next 12 Months*, June 28, 2024,

bsp.gov.ph

Bangko Sentral ng Pilipinas, Businesses are Less

Optimistic in Q2 2024, Q3 2024, and the Next 12 Months*, June 28, 2024,

bsp.gov.ph

Prudent Investor, Has the May 3.9% CPI

Peaked? Are Filipinos Really Spending More On Non-Essentials? Credit Card and

Salary Loan NPLs Surged in Q1 2024! June 10, 2024

Prudent Investor, Philippine

Q1 2024 5.7% GDP: Net Exports as Key Driver, The Road to Financialization and

Escalating Consumer Weakness May 12, 2024