Christine Lagarde admits that the International Monetary Fund “got it wrong” when it chastised the British government’s austerity plans. One year ago the IMF’s chief economist Oliver Blanchard claimed the U.K. was “playing with fire” by cutting its budget.With the benefit of hindsight, the IMF has changed its stance. The U.K. economy is set to grow 2.9% this year, the fastest among the G7 nations. Furthermore, the growth is being driven by investment spending, not consumption as the IMF had long thought necessary.Though she stopped short of apologizing for the Fund’s poor recommendations in the past, Lagarde allude to begging for forgiveness. Rather than seeking forgiveness after the IMF makes a mistake, why doesn’t it stop giving out bad advice so that it doesn’t find itself in these embarrassing situations in the future.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, June 10, 2014

Quote of the Day: The IMF Gets It Wrong (again)

Wednesday, February 19, 2014

The IMF Hearts Debt

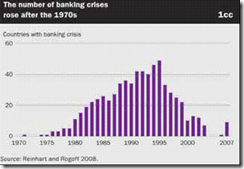

You may recall the case of Harvard professors Ken Rogoff and Carmen Reinhart who wrote the seminal work: “This Time is Different: Eight Centuries of Financial Folly”.The book highlighted dozens of shocking historical patterns where once powerful nations accumulated too much debt and entered into terminal decline.Spain, for example, defaulted on its debt six times between 1500 and 1800, then another seven times in the 19th century alone.France defaulted on its debt EIGHT times between 1500 and 1800, including on the eve of the French Revolution in 1788. And Greece has defaulted five times since 1800.The premise of their book was very simple: debt is bad. And when nations rack up too much of it, they get into serious trouble.This message was not terribly convenient for governments that have racked up unprecedented levels of debt. So critics found some calculation errors in their Excel formulas, and the two professors were very publicly discredited.Afterwards, it was as if the entire idea of debt being bad simply vanished.Not to worry, though, the IMF has now stepped up with a work of its own to fill the void.And surprise, surprise, their new paper “[does] not identify any clear debt threshold above which medium-term growth prospects are dramatically compromised.”Translation: Keep racking up that debt, boys and girls, it’s nothing but smooth sailing ahead.But that’s not all. They go much further, suggesting that once a nation reaches VERY HIGH levels of debt, there is even LESS of a correlation between debt and growth.Clearly this is the problem for Europe and the US: $17 trillion? Pish posh. The economy will really be on fire once the debt hits $20 trillion.There’s just one minor caveat. The IMF admits that they had to invent a completely different method to arrive to their conclusions, and that “caution should be used in the interpretation of our empirical results.”But such details are not important.What is important is that the economic high priests have proven once and for all that there are absolutely no consequences for countries who are deeply in debt.And rather than pontificate what these people are smoking, we should all fall in line with unquestionable belief and devotion to their supreme wisdom.

Wednesday, September 25, 2013

IMF Declares: Philippines Insulated to the Fed's Taper-Exit

The Fed’s eventual exit from easy-money policies will separate the emerging market wheat from the chaff.One country that can handle the Fed exit is the Philippines, says the International Monetary Fund.

But Ms. van Elkan says the country’s strong current account receipts, net creditor status, steady reductions in public debt and low foreign participation in government debt markets have helped insulate the economy against more capital flight. Manila’s own Fed, Bangko Sentral ng Pilipinas, can also release funds from its Special Deposit Account to provide a cushion to growth, she said.

In fact, Ms. van Elkin says risks to the country’s growth are to upside.“Absorbing the ample liquidity into productive sectors may prove challenging,” she says, after an annual review of the country’s economy. “Part of the liquidity could finance credit that is used to fuel demand for real estate, potentially with a strong procyclical effect on the economy,” she added.

I don't think the Fed can get interest rates up very much, because the economy is weak, inflation rates are low. If we were to tighten policy, the economy would tank

The IMF revised their flawed outlook on Greece’s growth several times, as Keep Talking Greece points out: (bold mine)

The IMF’s review on its Greek program was released late last night. The 51-pages document on Greece’s fiscal adjustment program 2010-2013 is more than clear: The IMF screwed Greeks for three consecutive years. The IMF failed to realize the damage austerity would do. The IMF failed to predict the real recession. The IMF applied wrong multipliers. The list in which the IMF officially admits its mistakes and failures in the case of Greece is long and despicable, if one takes into consideration the thousands of impoverished Greeks, the 1.3 million unemployed, the crash of the health care and the social welfare, the practical collapse of the public administration and inhuman austerity measures like taxing the verified poor. -

The estimates made by the staff of the International Monetary Fund, for example, are absolutely undependable. They have no real value, not only in the long run i.e., after several years, but also in the short run i.e., in the same year, as I shall demonstrate.IMF delegates visited Jordan recently. They examined all figures and statistics, listened to officials at the Ministry of Finance and the Central Bank and came up with a set of economic and financial predictions for the current year 2012.They published those predictions on the IMF Internet site dated in April, i.e., after an important part of the year had passed and the trends had become clear.Unfortunately, those predictions were way far from reality.

The IEO has just released its report—and it's a very tough critique of the IMF's performance and internal culture:"The IMF’s ability to detect important vulnerabilities and risks and alert the membership was undermined by a complex interaction of factors, many of which had been flagged before but had not been fully addressed. The IMF’s ability to correctly identify the mounting risks was hindered by a high degree of groupthink, intellectual capture, a general mindset that a major financial crisis in large advanced economies was unlikely, and inadequate analytical approaches. Weak internal governance, lack of incentives to work across units and raise contrarian views, and a review process that did not “connect the dots” or ensure follow-up also played an important role, while political constraints may have also had some impact.One key assertion is that the IMF's staff was intellectually and psychologically unprepared to challenge the regulatory authorities in the most advanced economies."IMF staff felt uncomfortable challenging the views of authorities in advanced economies on monetary and regulatory issues, given the authorities’ greater access to banking data and knowledge of their financial markets, and the large numbers of highly qualified economists working in their central banks. The IMF was overly influenced by (and sometimes in awe of) the authorities’ reputation and expertise; this is perhaps a case of intellectual capture.

this failure of the economists to guide policy more successfully is closely connected with their propensity to imitate as closely as possible the procedures of the brilliantly successful physical sciences — an attempt which in our field may lead to outright error. It is an approach which has come to be described as the "scientistic" attitude — an attitude which, as I defined it some thirty years ago, "is decidedly unscientific in the true sense of the word, since it involves a mechanical and uncritical application of habits of thought to fields different from those in which they have been formed." I want today to begin by explaining how some of the gravest errors of recent economic policy are a direct consequence of this scientistic error.

The United Kingdom, the United States, Singapore, Luxembourg and Hong Kong were the top five (5) investor countries for the month, with combined share of 76.4 percent. The United States continued to be the main beneficiary of outflows from investments, receiving US$1.1 billion (or 77.6 percent of total).

Wednesday, May 01, 2013

CNBC: The Growing Risks from ASEAN’s Asset Bubbles

Here is the CNBC:

The risk of asset bubbles in Southeast Asia's fastest-growing emerging economies is rising, warn economists, pointing to red flags including surging domestic credit growth and rapidly rising property prices."We have long argued that monetary policy has been kept too loose for too long in Indonesia, but the policy authorities in the Philippines, Thailand and Malaysia are in significant danger of making the same mistake. In our view, evidence of overheating is set to become more obvious," said Robert Prior-Wandesforde, head of India & Southeast Asia economics at Credit Suisse.Prior-Wandesforde, who expects central banks in the region will start tightening monetary policy in late 2013 or 2014, says policymakers are getting a false sense of security from benign inflation levels, and ignoring the excesses being built elsewhere in their economies."We expect interest rates to move higher and it is at that point that history suggests we should worry about possible bubbles turning to bust," he said.The mix of U.S. monetary policy and relatively low levels of inflation have led many ASEAN nations to adopt "inappropriately" low interest rates, according to economists.

This means that putting a brake or policy tightening would also expose on the mirage brought about by statistical growth pillared from "strong credit growth". Doing so would effectively takes away the foundations of the “defied” status from which the political class and central bankers have been piggybacking on.In short, reversing the “easy financing conditions” would go against the political and personal interests of those involved, particularly the political class and their cronies, and therefore will most likely be rejected or dismissed or ignored.Easy money conditions will likely be pushed to the limits until the markets expose on them.

The MPC is under pressure from the Finance Ministry and exporters who want it to implement measures to weaken the baht. The Federation of Thai Industries (FTI) chairman Payungsak Chartsutthipol has called on the MPC to cut its policy interest rate from 2.75% by 1% to weaken the baht.He said the central bank will use foreign exchange and capital inflow management as the main instruments to keep the baht from rising too high.

Tuesday, April 30, 2013

IMF to Asia: Put a Brake on Credit Bubbles!

Asian policy makers must be ready to respond “early and decisively” to overheating risks in their economies stemming from rapid credit growth and rising asset prices, the International Monetary Fund said.Growth is set to pick up gradually during the year and inflation is expected to stay within central banks’ comfort zones, the Washington-based lender said in a report today. Greater exchange-rate flexibility in the region would play a “useful role” in curbing overheating pressures and coping with speculative capital inflows.Asian economic growth that the IMF estimates will be almost five times faster than advanced nations this year, and increasing investor appetite for risk have spurred capital inflows into the region. The Bank of Japan this month joined counterparts in the U.S. and Europe in unleashing monetary stimulus, which may fuel further currency gains in developing markets such as the Philippines, where policy makers have stepped up efforts to cool appreciation.

Financial imbalances and rising asset prices, fueled by strong credit growth and easy financing conditions, are building in several Asian economies,” the IMF said. “Policy makers in the region face a delicate balancing act in the near term: guarding against the potential buildup of financial imbalances while delivering appropriate support for growth.

Wednesday, April 10, 2013

IMF to Central Bankers: Keep Blowing Bubbles

Monetary stimulus deployed by advanced countries to spur growth is unlikely to stoke inflation as long as central banks remain free of outside influence to react to challenges, according to a study by the International Monetary Fund.In a chapter of its World Economic Outlook released today, the Washington-based IMF said that inflation has become less responsive to swings in unemployment than in the past. Inflation expectations have also become less volatile, according to the report.“As long as inflation expectations remain firmly anchored, fears about high inflation should not prevent monetary authorities from pursuing highly accommodative monetary policy,” IMF economists wrote in the chapter called “The dog that didn’t bark: Has inflation been muzzled or was it just sleeping?”

The BOJ’s new policy “is something that we hope will lift inflation durably into positive territory, which would help the economy,” said Jorg Decressin, deputy director of the IMF’s research department. “We see in no way the operational independence of the BOJ compromised at all.”

Historically, and across the world, the primary driver of inflation has always been expansion in unproductive government spending (think of Germany paying striking workers in the early 1920s, or the massive increase in Federal spending in the 1960s that resulted in large deficits and eventually inflation in the 1970s). But unproductive fiscal policies are long-run inflationary regardless of how they are financed, because they distort the tradeoff between growing government liabilities and scarce goods and services.

The Central Bank has always had two major roles: (1) to help finance the government's deficit; and (2) to cartelize the private commercial banks in the country, so as to help remove the two great market limits on their expansion of credit, on their propensity to counterfeit: a possible loss of confidence leading to bank runs; and the loss of reserves should any one bank expand its own credit. For cartels on the market, even if they are to each firm's advantage, are very difficult to sustain unless government enforces the cartel. In the area of fractional-reserve banking, the Central Bank can assist cartelization by removing or alleviating these two basic free-market limits on banks' inflationary expansion credit

“The dog did not bark because the combination of anchored expectations and credible central banks has made inflation move much more slowly than caricatures from the 1970s might suggest - - inflation has been muzzled,” the IMF staff wrote. “And, provided central banks remain free to respond appropriately, the dog is likely to remain so.”

When the late Margaret Thatcher warned that "the problem with socialism is that eventually you run out of other people's money [to spend]", this applies to multilateral institutions too.

Wednesday, December 05, 2012

IMF Supports Capital Controls

The International Monetary Fund endorsed nations’ use of capital controls in certain circumstances, making official a shift, which has been in the works for three years, that will guide the fund’s advice.In a reversal of its historic support for unrestricted flows of money across borders, the Washington-based IMF said controls can be useful when countries have little room for economic policies such as lowering interest rates or when surging capital inflows threaten financial stability. Still, it said the measures should be targeted, temporary and not discriminate between residents and non-residents.“Capital flows can have important benefits for individual countries across the fund membership and the global economy,” IMF staff wrote in a report discussed by the board on Nov. 16 and published today. They “also carry risks, however, as they can be volatile and large relative to the size of domestic markets.”Countries from Brazil to the Philippines have sought in recent years to manage inflows of capital that put upward pressure on their currencies and threatened to create asset bubbles. The new guidelines will enable the fund to provide consistent advice, though rules prevent it from imposing views about managing capital flows on its 188 member nations.

Capital controls are part of the grand scheme of financial repression policies designed by bankrupt governments to expropriate private sector resources.Aside from capital controls, other measures include, raising taxes, inflationism, negative interest rates, price controls and various regulatory proscriptions

The idea that capital controls and fixing the external value of a currency can strengthen economic fundamentals is flawed. While capital controls may help boost economic activity in terms of GDP, they cannot lift the real net worth of the economy. On the contrary, capital controls will only add to distortions caused by the monetary pumping and the artificial lowering of interest rates, thereby making the inevitable economic bust much more severe.

Monday, November 19, 2012

Into the Eyes of the Gorgon: IMF’s Endorsement of the Philippines

Humanitarian arguments are always used to justify government mandates related to the economy, monetary policy, foreign policy, and personal liberty. This is on purpose to make it more difficult to challenge. But, initiating violence for humanitarian reasons is still violence. Good intentions are no excuse and are just as harmful as when people use force with bad intentions. The results are always negative.

Friday, October 12, 2012

IMF’s Christine Lagarde Inflationist Delusions

International Monetary Fund Managing Director Christine Lagarde praised monetary stimulus efforts of the world's major central banks Thursday, but said non-monetary authorities in Europe, the United States and elsewhere need to build on those steps to improve growth in a slowing world economy.Lagarde, at a press conference ahead of the annual meetings of the IMF and World Bank, said she "expects courageous, cooperative action" at the meetings.She also aimed criticism at China, whose top economic policymakers declined to attend the meetings because of territorial disputes with host Japan. China needs to be more of a global partner and increase demand for foreign products, not just concentrate on exporting its own products, she said, after pointedly noting its officials' absence.Lagarde vowed the IMF "will spare no time and effort" to help Greece, but said the objective is to ultimately free that country from dependence on outside assistance.Noting that the IMF has downgraded its projections of global growth, Lagarde said, "we are not expecting a very strong recovery." Indeed, she called high unemployment rates in advanced countries "terrifying and unacceptable."The Federal Reserve, the European Central Bank and the Bank of Japan have all adopted additional easing measures, and she praised their moves, but said that by themselves those actions are "not sufficient."The "momentum" imparted by monetary easing "should be seized as an opportunity," she said.

You never let a serious crisis go to waste. And what I mean by that it's an opportunity to do things you think you could not do before.

Emerging market central banks have clearly taken to heart the recent IMF warning that there is “an alarmingly high risk” of a deeper global growth slump.Two central banks have cut interest rates in the past 24 hours: Brazil extended its year-long policy easing campaign with a quarter point cut to bring interest rates to a record low 7.25 percent and the Bank of Korea (BoK) also delivered a 25 basis point cut to 2.75 percent. All eyes now are on Singapore which is expected to ease monetary policy on Friday while Turkey could do so next week and a Polish rate cut is looking a foregone conclusion for November.South Africa, Hungary, Colombia, China and Turkey have eased policy in recent months while India has cut bank reserve ratios to spur lending.The BoK’s explanation for its move shows how alarmed policymakers are becoming by the gloom all around them. Its decision did not surprise markets but its (extremely dovish) post-meeting rhetoric did. The bank said both exports and domestic demand were “lacklustre”. (A change from July when it admitted exports were flagging but said domestic demand was resilient) But consumption has clearly failed to pick up after July’s surprise rate cut — retail sales disappointed even during September’s festival season. BoK clearly expects things to get worse: it noted that ” a cut now is better than later to help the economy”.

It is a delusion to believe that planning and free enterprise can be reconciled. No compromise is possible between the two methods. Where the various enterprises are free to decide what to produce and how, there is capitalism. Where, on the other hand, the government authorities do the directing, there is socialist planning. Then the various firms are no longer capitalist enterprises; they are subordinate state organs bound to obey orders. The former entrepreneur becomes a shop manager like the Betriebsführer in Nazi Germany.

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth.Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become "profiteers," who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

Monday, July 23, 2012

IMF Economist Resigns, Cites Conflict of Interests, Says: “Ashamed to Have Had Any Association with the Fund at all”

Brewing trouble at the IMF.

A renegade IMF economist recently resigned out of alleged conflict of interests. The Wall Street Journal Blog reports,

A senior International Monetary Fund economist is resigning from the Fund, writing a scathing letter to the board blaming management for suppressing staff warnings about the financial crisis and a pro-European bias that he says has exacerbated the euro-zone debt crisis.

“The failure of the fund to issue [warnings] is a failing of the first order, even if such warnings may not have been heeded,” Peter Doyle said in a letter dated June 18 and copied to senior management.

Doyle is formerly a division chief in the IMF’s European Department responsible for non-crisis countries. He currently acts as an adviser to the Fund but is expected to officially leave in the fall.

“The consequences include suffering [and risk of worse to come] for many including Greece, that the second global reserve currency is on the brink, and that the Fund for the past two years has been playing catch-up and reactive roles in the last-ditch efforts to save it,” he said in the letter.

Mr. Doyle’s shift in positions at the fund–from division chief to adviser–occurred around the same time that a new European Department chief was appointed. A senior official at the IMF said the new chief restructured the department, replacing many of its staff from outside the department earlier.

“After twenty years of service, I am ashamed to have had any association with the Fund at all,” he said in the letter. Mr. Doyle wasn’t immediately available for further comment.

IMF is funded by taxpayers from different member nations thus, like all other multilateral agencies, the IMF is a political institution subject to the advancement of the political interests of major contributors (represented through the quota-voting system).

Such distribution of power can already be seen from the appointment of executive directors. From the IMF,

Five Executive Directors are appointed by the member countries holding the five largest quotas (currently the United States, Japan, Germany, France, and the United Kingdom), and 19 are elected by the remaining member countries. Under reforms currently being finalized, all 24 Directors will be elected by the member countries, starting in 2012.

As a political institution, one really cannot expect the IMF to become apolitical and dispense their role in an objective manner, no matter the stated mission or job goals.

This also demonstrates of the web of complicity of the global cartelized tripartite political institutions of the welfare-warfare state, the privileged banking class and central banks whose interests has been promoted or upheld through all the political multilateral agencies.

And the uneven political representations in the IMF adds to the many reasons why bailouts or the redistribution of resources from poor nations (like Philippines) to the crisis stricken rich bankers and political class (whom fall under the umbrella of political interests of the major IMF fund contributors) has not only been financially unviable but immoral.