Have US Federal Reserve officials been indirectly trying to take down gold prices?

In barely 2 weeks of 2013, gold prices attempted twice to move higher (See ellipses). One peaked during New Year just right after the fiscal cliff deal. The second was during Thursday of this week.

However, both gains had been cut short. This appears coincidentally timed with two occasions where Fed communications (FOMC minutes) had been released and when Fed officials went on air expressing doubts over QE 4.0.

The first came with the announcement of the FOMC minutes which revealed of growing dissension over unlimited asset purchases, a day after the fiscal deal. I earlier wrote that this signifies another of the Fed’s serial Poker bluff.

Last night, while switching channel after watching another TV program, I happen to stumble upon Federal Reserve Bank of Philadelphia President Charles Plosser’s Bloomberg interview, where he hinted of his bias against pursuing more balance sheet expansion. If memory serves me right, prices of gold was then trading at $1,669-1,670. Bloomberg seem to have featured this interview in a follow up article

Then I learned today that other Fed officials featured by mainstream outlets also covered the FED hawks.

And in both occasions where hawkish sentiments by FED officials were aired, the earlier gains scored by gold prices had nearly been erased.

Gold has been marginally up this week.

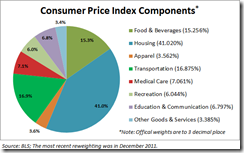

Considering that FED employs communication strategies to influence market behavior called as “signaling channel”, my suspicion is that this has been part of the implicit tactic to mute the public’s inflation expectations, expressed via gold prices.

Nonetheless, I expect such mind manipulation ploys to be ephemeral.

That’s because as I pointed out during my last stock market commentary for 2012

Evidence suggest that gold prices may have departed from real world activities. Sales of physical gold have exploded to record highs. Moreover central bank buying has been gathering steam, which seems on path to hit new highs this year (500 tons), along with record ETF gold holdings at 2,627 tons.

It seems that only after a month, we are getting more proof on this

In the US, sales of physical gold and silver has been exploding: The US mint reports 57,000 gold ounce sales for the first two days of the year and sale of silver coins tripled from December.

In the meantime, India’s gold imports reportedly surged amidst fears that the Indian government may continue to act to suppress demand for gold. According to Mineweb.com, after two earlier hikes of import duties, gold smuggling has also reached new levels. Smuggling is a typical reaction to prohibitions or quasi-prohibitions edicts via tax increases.

In addition, central bank gold buying have also been ramping up. According to International Business Times

In the third quarter, according to the World Gold Council (WGC), the world's central banks bought a total 97.6 metric tons of gold.In six out of the last seven quarters, central bank demand has been around 100 metric tons, which is a sharp increase from as recently as 2010, the bank said in a statement, adding that through the third quarter of this year, total central bank buying was up 9 percent.

Moreover, China's government via the PBoC reportedly will increase gold acquisition to diversify from her foreign exchange holdings.

The China Daily notes,

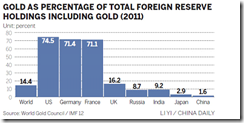

China may decide to increase the percentage of gold holdings in its monetary reserves in the next few years, said the report, an analysis of the world monetary system commissioned by the World Gold Council.Demand for gold is likely to rise amid the uncertainty about the stability of the US dollar and the euro, the main assets held by central banks and sovereign funds, it added.China almost doubled its gold reserves in the last five years. The country had holdings of 1,054metric tons in July 2012 and is now the sixth-largest holder of monetary gold.In 2011, gold accounted for 14.4 percent of the world's total monetary reserves.In a country-by-country comparison, the figure was 1.6 percent in China, while it was 74.5percent in the United States, 71.4 percent in Germany and 71.1 percent in France, according to data from the World Gold Council and the International Monetary Fund.China holds the world's largest foreign exchange reserves, which were worth more than $3.31trillion by the end of 2012, according to figures from the People's Bank of China, the country's central bank.

China has been approaching gold with “talk the talk” as November gold imports have doubled from October.

According to Zero Hedge, (italics original)

at 90.8 tons, this was the second highest gross import number of 2012, double the 47 tons imported in October (which many saw,incorrectly, as an indication of China's waning interest in the yellow metal), and brings the Year to Date total to a massive 720 tons of gold through November. If last year is any indication, the December total will be roughly the same amount, and will bring the total 2012 import amount to over 800 tons, double the 392.6 tons imported in 2011.

Meanwhile, ETF holdings of gold remain at record levels

According to my digital financial chronicle,

Exchange traded funds (ETFs), with gold as the underlying asset, have contributed to its prices. Institutional and retail inflows into global gold ETFs are at record levels. ETF holdings have been a key indicator of price movements in the recent years. Reports suggest that at November end last year ETF holdings were at an all-time high of over $150 billion. Till November, holdings in ETFs had risen by 12 per cent to 2,630 tonnes.

In short, the strings of record highs from various activities such as buying of physical gold, ETF holdings, record imports of China and India (two largest gold consumers) and lastly central bank buying simply doesn’t square with current consolidation phase.

Interventions to suppress gold prices are likely to have short term impact.