Real knowledge is to know the extent of one's ignorance.– Confucius

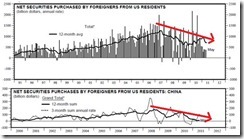

This week’s global market rout puts into perspective the issue of ‘decoupling’ vis-à-vis divergence.

As I previously wrote[1],

So it is unclear whether ASEAN and the Phisix would function as an alternative haven, which if such trend continues or deepens, could lead to a ‘decoupling’ dynamic, or will eventually converge with the rest. The latter means that either global equity markets could recover soon—from the aftermath of the Greece (or PIIGS) bailout and the imminent ratification of the raising the US debt ceiling—or that if the declines become sustained or magnified, the ASEAN region eventually tumbles along with them. My bet is on the former.

Therefore, I would caution any interpretation of the current skewness of global equity market actions to imply ‘decoupling’. As I have been saying, the decoupling thesis can only be validated during a crisis.

The bloody losses of this week had been distinct. On a regional basis they ranged as follows: in the Americas 5-9%, in the Eurozone 8-11% and in Asia 5-9%.

The ASEAN-4 rubric seems to have been likewise influenced by the bloodbath, but on a substantially lesser degree (see lower window).

The Philippine Phisix was down 1.47%, but the bulk the week’s decline was accounted for by Friday’s (-1.42%) loss. In other words, the Phisix traded in the neutral zone prior to the reaction to the global equity market crash on Friday.

While Indonesia’s JCI endured the most losses (-5.06%) in the region, followed by Thailand’s SET (3.54%) [see Bloomberg chart upper window], these two neighboring bourses has outperformed the Phisix and Malaysia’s KLSE when seen from the year to date chart. The KLSE on the other hand, had been on a downside streak since early July.

So the lion’s share of the region’s losses, particularly Indonesia -4.86%, Thailand 2.73% and Malaysia -1.45%, also came during the meltdown contagion on the ASEAN-4 last Friday.

In short, prior to Friday’s meltdown, the region was essentially trading neutral (Malaysia, Philippines) to slightly lower (Thailand, Indonesia).

I construe such actions as mainly profit taking, the degree of which ran parallel to the previous gains. Notice that the pecking order of losses mirrors the ranking of best performers.

And importantly, this week’s regional action can be seen in the light of an expression of sympathy to the world.

While this provides little validation of ‘decoupling’ dynamics in the face of a crisis, this week’s significant outperformance presented some evidence to the alternative haven theme in favor of ASEAN bourses. This will likely hold true in absence of sharp volatility.

I’d further posit that losses weighed more on the region’s currencies than the equity markets in terms of relative market scale. The Peso’s 1.04% fall signifies a much larger loss for the Phisix than last week’s 1.47%.

During the last bear market, for every 1% loss suffered by the Peso, the Phisix fell 2.3%. In addition, during the stated period, the Peso had a 5 month time lag to the cratering Phisix. Of course, this has NOT BEEN an established bear market. So there is no need to freak-out.

One would further note that outflows based on net daily foreign trade (averaged on a weekly basis) has been marginal, despite the global market thrashing. Friday’s activities posted a net Php 99 million pesos of outflows.

The falling Peso in reaction to the selloff could have emanated more from the actions of the locals than from foreigners. Local market participants seem to have been hardwired to the misguided perception that US dollar will continue to serve as a safe haven currency.

The previous bearmarket (2007-2008) saw massive foreign selling. Yet this has not been the case today.

Moreover, Friday’s global meltdown had been broadbased, and featured a bear market breadth where decliners trounced advancers by 134 issues. The last time we had the same magnitude of losses was in January 22, 2008 where declining issues predominated the trading session by 144.

Friday’s action could be representative of an emotionally hijacked market. It may or may not highlight a continuation.

Again computed for the weekly averages, the advance decline spread has not even reached the level of deterioration from the losses which occurred during Arab Spring-Japan Triple Whammy shakeout. And this goes with average total traded issues which also remain significantly above the February-March lows.

Bottom line:

The Phisix and the ASEAN-4 bourses have not been unscathed by the brutal global equity market meltdown.

However, excluding Friday’s emotionally charged fallout and despite the weak performances of developed economy bourses during the week, the Phisix and ASEAN bourses has managed to keep afloat and has even demonstrated significant signs of relative strength, signs that could attract more divergent market activities in a non recessionary setting.

[1] See The Phisix-ASEAN Alpha Play, July 31, 2011