The

riskiest thing in the world is the belief that there is no risk. When

people think there is no risk, they do risky things. By contrast,

when people think there is risk than they behave in a safe manner and

the world becomes a safer place. That’s why I welcome the recent

developments. They remind us that today the risks are substantial and

they should be undertaken only with considerable forethought. My dad

used to tell the story of the gambler who went to the race track and

said: “I hope I break even because I need the money.” The market

is not an accommodating machine. It will not go where you want it to

go just because you need it to go there. So if you’re talking about

money that you can’t afford to lose then you can’t say: “Just

give me the highest yield.” Howard

Marks

In

this issue

Phisix

6,575: Good Bye 2015: Year of Propaganda! Hello 2016: Year of the

Grizzly Bears?

-Happiness:

The Freedom of Choice

-My

Predictions Came True in 2015; Tremors from the Chinese Bubble Fault

Line

-Goodbye

2015: A Year of False Expectations, Propaganda and Manipulations

-False

Expectations, Manipulations and Deceptions

-Government’s

Propaganda Through Statistics

-Media’s

Worship of Bubbles

-Mainstream’s

Peso Babble; My 2016 Target for the USD-PHP 50, Crisis Target Over

56.45

-Technical

and Behavioral Perspective: 2015 The Transition From Overconfidence

to Doubt

-First

Week of 2016: The Shift from Doubt to Nascent Fear; The Story of 2016

-

Will History Rhyme? Will 1979 Serve as Template for Seven Years of

Famine?

Phisix

6,575: Good Bye 2015: Year of Propaganda! Hello 2016: Year of the

Grizzly Bears?

Happiness:

The Freedom of Choice

It

may be late for me to greet you a happy new year. But it is better

late than never.

But

for some, because stock markets have been sinking, they see 2016 as

signs of coming unpleasantness. It shouldn’t. Not even a crisis

should stop anyone from being happy.

Let

me just say that happiness is about one’s expectations of life. And

expectations are shaped by our preferences and values. Yet for as

long as expectations can be adjusted, one can remain happy regardless

of the environment. And changing expectations represents a CHOICE

that is available to everyone.

World

War II holocaust survivor Viktor

Frankl, an Austrian neurologist and psychiatrist, during the

dreariest moments of his incarceration or darkest moments of his life

found the essence to live1:

The FREEDOM to CHOOSE (bold mine)

We

who lived in concentration camps can remember the men who walked

through the huts comforting others, giving away their last piece of

bread. They may have been few in number, but they offer sufficient

proof that everything can be taken from a man but one thing: the

last of the human freedoms—to choose one's attitude in any given

set of circumstances, to choose one's own way.

And

there

were always choices to make. Every day, every hour, offered the

opportunity to make a decision,

a decision which determined whether you would or would not submit to

those powers which threatened to rob you of your very self, your

inner freedom; which determined whether or not you would become the

plaything of circumstance, renouncing freedom and dignity to become

moulded into the form of the typical inmate

Aside

from the suffering from imprisonment, Mr. Frankl lost his mother,

brother and wife in the holocaust.

And

applied to my headline quote above from the Chairman

and co-founder of investment firm Oakwood capital Horward Marks2,

where many have come to think that gambling in the central bank

distorted stock market represents an ENTITLEMENT or an ESCAPE

MECHANISM from their financial, social or personal dilemmas—a

source of rigidity in expectations—then it’s where these people

will find themselves in deep disconsolation. Reason? The markets as

pungently stated by Mr. Marks, are not an accommodating machine. They

will do what they are supposed to do regardless of your desires.

I

hope that my readers will find Mr. Frankl’s enlightening insight as

a guiding light, not only for investments but for facing personal

challenges in 2016 and beyond.

My

Predictions Came True in 2015; Tremors from the Chinese Bubble Fault

Line

Pls

allow me a moment of triumph.

In

going against the populist boom or the one way trade or where every

single mainstream “expert” forecasted the Phisix to zoom or where

nada, zero, zilch, zip among the same “experts” saw a negative

outcome for 2015, here was my prediction at the start of 20153

At

the start of 2014 I wrote of potential black swans

The

potential trigger for a black swan event for 2014 may come from

various sources, in no pecking order; China, ASEAN, the US, EU

(France and the PIGs), Japan and other emerging markets (India,

Brazil, Turkey, South Africa). Possibly a trigger will enough to

provoke a domino effect.

The

black swans have arrived. Crashes have become real time events. But

so far they appear as fragmented series of events than a global

systemic issue. 2015 will most likely see the spreading and

acceleration of this process.

Bingo!

Market

crashes have indeed been spreading, converging and accelerating, the

Phisix

notwithstanding. I warned that the post August 24 crash, one

day crashes have hardly been a one day event. This week’s

actions only fulfilled and validated my admonitions.

2016

will most likely be an extension, and importantly, an escalation and

aggravation of the unraveling of the massive malinvestments that has

manifested itself initially with the taper tantrum, and segued or

transitioned into the intermittent tremors of 2014-15 and now as a

global seismic dynamic.

More.

On

the Chinese yuan’s exposition of the global bubble malaise as

manifested by its depreciation (not purposeful devaluation by the

government), I wrote last December4

Defending

the US dollar soft peg required access to US dollars. Unfortunately,

such window has been closing for the Chinese economy. Moreover,

outflows and or capital flight have been compounding on the supply

conditions of an already scarce US dollar. Finally, domestic credit

expansion to save the stock markets translates to relatively more

money supply vis-a- vis the US dollar (whether the Fed tightens or

keeps policies at current levels). This implies supply side

influences on the yuan’s weakness.

Hence,

inflationism PLUS the scarcity of US dollar supply reveals why the US

CNY soft peg cannot be sustained. Acting

like a relief valve, China’s

central bank, the PBOC, simply relented on the building pressures on

the peg. The PBoC responded by allowing the markets to partially

revalue the yuan. Hence the devaluation! ...

And it may not just be about capital flight but likewise, imploding bubbles should translate to money supply destruction. And this can be seen through the slack in money supply (M2) growth, slumping growth of CPI and deepening deflation in manufacturing input prices or the PPI

Importantly, considering China’s immense US dollar debt exposure, borrowing to pay back debt will only reduce US dollar supply. How much more when highly leverage companies default?

And this compounds on the US dollar dilemma which has now become a global phenomenon.

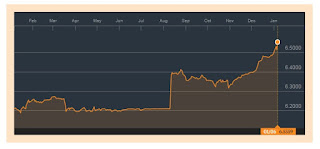

So while the USD CNY’s advance may not have been as steep as last August, the USD-CNY broke out from its allotted bandwidth.

The last time the USD-CNY materially advanced (again last August), the USD Php spiked, and global financial markets tremored.

Despite

the Chinese government’s whac-a-mole policies, financial pressures

have been ventilated somewhere in China’s porous financial markets.

Not

only has the yuan been depreciating, the spread between the less

controlled offshore yuan (CNH)

and tightly controlled onshore yuan (CNY;

+1.56% week on week) has been dramatically widening. The Chinese

government has responded by

imposing tighter capital controls by suspending banks, particularly

DBS and Standard Chartered Bank in conducting foreign exchange

transactions.

Even

more, Hong Kong

Interbank Offered Rate (HIBOR) has

been skyrocketing (lower left chart courtesy of Alhambra

Partners), despite the government effort to facelift the markets last

week.

Further,

Chinese stocks dived 9.97% last week despite heavy

state intervention last Friday January 8.

The

Chinese government’s latest imposition of circuit breaker has even

exacerbated the crash this week. The circuit breaker consisted of a

15 minute trading pause when a decline of 5% have been reached and

adjourned trading for the day when stocks fall to the 7% level. The

result of the new rule was to halt trading activities in just a

stunning 29 minutes (29 minutes includes the 15 minutes hiatus from

5% trigger) after the opening bell last Thursday! The January 7 panic

spawned “chaos

and a race to sell” as the yuan

dived. January 7th was a swift KO of the bulls by the bears.

The

Chinese government quickly

suspended the circuit breaker mechanism. Moreover, the harried

Chinese

government extended the share sale ban on major shareholders last

week.

And

last December, where everything looked calm and placid, the Chinese

government paid a heavy price for cosmetic stability. The Chinese

government drained

a whopping record $108 billion of her much vaunted forex reserves!

The

China’s soft peg regime is being undone, under the cover or

propaganda of “liberalization”. In reality, current market events

have indicated of the intensification of China’s imploding bubble.

Such bubble implosion has mainly been expressed as liquidity

shortages through the USD. Liquidity woes will eventually become

solvency issues.

Simply

put, the Chinese government seems to have lost control in restraining

its colossal bubble from bursting.

The

Chinese bubble fault line continues to and will continue to emit

tremors.

At

the height of the Phisix bubble, I recall that someone in the

internet circle sarcastically labeled me as “the boy/man who cried

wolf”. Apparently, the wolves have arrived.

Goodbye

2015: A Year of False Expectations, Propaganda and Manipulations

While

imprisoned for “political crimes” for mounting a failed putsch in

Munich, Nazi leader Adolf Hitler completed a two series book, Mein

Kampf, which partly dealt with how to successfully implement

propaganda5.

All

propaganda must be presented in a popular form and must fix its

intellectual level so as not to be above the heads of the least

intellectual of those to whom it is directed. Thus its purely

intellectual level will have to be that of the lowest mental common

denominator among the public it is desired to reach. When there is

question of bringing a whole nation within the circle of its

influence, as happens in the case of war propaganda, then too much

attention cannot be paid to the necessity of avoiding a high level,

which presupposes a relatively high degree of intelligence among the

public.

The

more modest the scientific tenor of this propaganda and the more it

is addressed exclusively to public sentiment, the more decisive will

be its success. This is the best test of the value of a propaganda,

and not the approbation of a small group of intellectuals or artistic

people

It

appears that 2015 was characterized by Hitler type of propaganda.

Thus

I bid good riddance to the year of intensive false expectations,

manipulations, propaganda, and deceit

The

story of 2015 can be seen from the charts below.

The

above exhibits on the valuations, in terms of PER and PBV of the 30

issues comprising the headline index, PSEi. The EPS had been based on

PSE’s website as of January 7 and the BV from the second quarter

reports as indicated on the PSE’s November monthly report.

Basically

the above issues represent the PSEi at 6,600. That’s about 8% lower

from the close of 2014, which became the base for 2015.

Even

at today’s 6,600, the numbers above have generally signified

nosebleed levels of valuations. To read high cap rates on such

valuations will be tantamount to committing financial hara kiri.

And

it’s not just the Philippines, the ASEAN majors, Indonesia,

Thailand and Malaysia have all been plagued by massive mispricing,

based on average and median Price to Cash Flows, Price to Book Value,

Price to Sales and Price to Earnings.

All

ASEAN 4 majors have virtually ranked within top 10 as the priciest in

ALL categories among emerging markets based on Gavekal’s

end of the year calculation.

The

Philippines ranked second highest based on average price to cash

flow, and fourth based on average price to sales.

I

warned

in 2014 that valuation levels then were reminiscent

of valuations of pre-Asian crisis levels. Today, valuations of

Philippine and the other major ASEAN equity bellwether have been at

par or have exceeded the 1996 or pre-Asian crisis benchmarks!

As

reminder, the respective denominators for the said ratios have been

calculated during times of the fading artificial boom. How much more

will valuations skyrocket if denominators fall without or with little

accompanying decrease in the numerator?

Yet

the above 6,600 valuations represented much of the story of 2015. A

year that featured false expectations, deceptions, propaganda and

manipulations.

False

Expectations, Manipulations and Deceptions

Coming

off 2014’s 22.76% returns, mainstream ‘experts’ were right to

forecast that the PSEi would hit the 8,000 mark, but went awry when

they predicted 8,000+ as a yearend target for 2015. Media quoted on

the

crystal ball readings of some these experts to justify their

equity market targets with expectations that PSE’s earnings would

zoom to an incredible 16%!

The

PSEi ended the year 2015 at 6,925.08 down 3.85%. Way way off their

targets.

These

‘experts’ hardly provided any economic explanation as to how

these will be attained except to generate wild assumptions predicated

that money grows on trees.

They

have ignored the effects of 10 months of 30%+++ money supply growth

and the subsequent inflation on profits and consumer spending, and

likewise, the effects of a massive flattening of the Philippine yield

curve.

For

these experts, the only prices that mattered were stocks and

property. And rising prices of the principal objects of bubbles, all

premised on statistical G-R-O-W-T-H, have been perceived to travel in

a sustained trajectory.

Hardly

anyone has given any afterthoughts to the possible consequences of

soaring prices of these assets on the real economy or on the

financial system.

Almost

every market participant and economic observer had been enthralled by

rising prices which they associated with a sustainable boom.

Apparently, none have learned from history.

Since

the January breakout from the May 2013 highs, officials of the PSE

celebrated each fresh highs until the “26

record finishes”.

Yet

they have ignored how record highs have been a product of repeated

rampant and massive manipulations, particularly by serial employment

of “marking the closes”. Even the last

three trading days of 2015 had been sullied by brazen headline

price fixing through marking the closes.

The

PSE regaled the public with “this time is different” as the

Phisix sailed to 8,127.48. Yet hardly they or anyone from the

mainstream reported on how record highs had been attained by

rotational

pumps from 10 of the 15 biggest market caps, even when

HALF of the PSE universe had been sliding into the fold of the

bear market!

Some

people love to talk about how the public should avoid scams, but how

about scams perpetuated by the establishment?

The

PSE even hailed that the milestone highs as derivative from political

dynamics that has led to “investor confidence”. Really? Now

at 6,575 where oh where has the politics based “investor

confidence” been? Just what happened to farcical G-R-O-W-T-H and

all the inflation worship?

Palpably,

a deafening silence from the PSE.

And

yet what happened to all those massive price fixing all year round?

What happened to all those third party (depositor, fiduciary or tax)

money used to prop up the index?

And

when events turned against their favor, the PSE’s reports showed of

a startling blackhole on how listed firms of the PSE performed in 2Q.

It

turned out that the PSE

censored the 2Q activities because the NGDP

of listed firms fell by 3%, as profits dived by 7.5%!

Importantly,

1Q

performance already paved way for the 2Q performance. Even when

profits in 1Q jumped 13.9% primarily due to extraordinary gains from

a few issues, 1Q NGDP rose by a measly 1.6%! 1.6% transitioned to -3%

which led to a 1H NGDP of -.85%.

Thus,

the August 24th crash was barely about China’s currency revaluation

but about the deteriorating fundamentals in the face of a one way

trade!

Government’s

Propaganda Through Statistics

The

same dynamic can be seen in the government’s reported GDP.

The

government reported an improvement in 3Q GDP which rose to 6%. It

turned out that

for the past three quarters government statisticians have used

cascading CPI to magnify statistical GDP via

base effects! So even when NGDP has dropped to 4.5% in 3Q,

constant based GDP flew to 6%! Given the record low CPI prior to

November 2015, it would seem the

first time ever for constant based GDP to surpass NGDP!

Constant

GDP technically is called real GDP. But given the statistical

artifice, phony GDP just cannot be reckoned as real. It’s a lie.

Moreover,

statistics can turn stones into bread or negatives have been made

positive by the same statistical alchemy. The negative performances

of manufacturing and exports had remarkably been upgraded into

positives also during the 3Q!

Importantly,

government’s

NGDP and the PSE’s NGDP can’t even square…or even at least

reflect on some consonance, as they appear to be pointing at opposite

directions!

In

addition, government

statisticians declared that employment and unemployment rates rose to

record highs in 2015. Curiously, this comes in the face of a

striking collapse in online job postings for three major online job

platforms.

Just

where has jobs been coming from to fill the record employment levels?

A reversion to the traditional means of advertisement—the

newspaper? Viral or direct ways of recruitment ala multi-level

marketing? Or through mental telepathy? Or has this been another

statistical ruse to keep the façade going?

And

funny how establishment rationalizes online job crash from a slowing

of investments with a prospect of recovery due to the ‘strong

consumer spending’ meme. Yet if there are little jobs and where OFW

remittances growth has been flailing, just where will consumers get

resources for them to spend? Manna from heaven? Or from statistical

Sadako?

Such

represents 2015’s bubble logic.

And

speaking of OFWs, 3Q

GDP has even rendered the contributions by the OFWs as

inconsequential. Government statisticians have essentially

stripped away the glorious role of OFWs as economic heroes.

It’s

bad enough for OFW’s remittance growth to have languished. It’s

even worse when the Saudi-Iran feud may turn into a full scale war.

And it would be the end of the world if and when the proxy wars of US

(Saudi) and Russia (Iran) morphs into a direct confrontation between

them, where both have been armed with nuclear weapons to the teeth.

Bizarrely,

the BSP

sees this brewing Saudi-Iran feud as “some

temporary setback” on remittances, “because of logistical

difficulties and deployment may slow”. If war erupts between Saudi

and Iran, then this will translate to a wide scale turmoil that will

likely spread and wreak havoc on most of Middle East. Such mayhem

will have no precedent.

And

this may even involve direct participation of superpowers. So it

won’t be just logistical difficulties, because since war means

economic dislocation, it means OFWs will be streaming back home. Has

the BSP been blind to how the Syrian civil war (really another proxy

war between US-Russia) has incited a refugee crisis in Europe?

Again,

another outlandish relic of bubble logic.

And

speaking of the BSP, earlier the BSP reported a spike in NPLs

of auto and real estate consumer loans in 1Q 2015. This should

signify a natural consequence to a slowing GDP. However, in the 2Q,

suddenly NPLs of auto and real estate consumer loans vanished even as

statistical GDP hardly improved. These are kinds of twisted logic

being presented to the public as economic facts.

Media’s

Worship of Bubbles

Of

course, bubbles have also been amplified by media.

Mainstream

publishes only information that reinforces biases in favor of the

boom. As explained before that’s because media protects the

interests of their major clients or advertisers.

For

instance, domestic

media virtually censored the warnings of ICT magnate Enrique Razon

that another financial crisis is coming. It took an overseas

media outlet to air Mr. Razon views. Perhaps domestic media believes

that the Philippines will be immune to one.

Yet

the bigger the denial, the greater the risks.

Press

releases masquerading news became a dominant character of news

reporting.

Examples.

An

outrageously

laughable survey commissioned by an insurance company depicted that a

third of the Philippine residents believed that the nation had

attained first world status! Paradoxically, this comes even as

only a third of the population are banked and where a third of the

population reportedly believes that they are self-poor (ironically

this comes from the same pollster)

Celebrity

endorsement of investing in blue chips (regardless of how

expensive they have been).

Endorsement

by buyside experts that the “perfect

time to invest is today” (published August 19, 2015 Phisix

7,344.73)

A

two

week media blitz that simultaneously promoted the property sector

on various media outlets. I suspected that such concerted action

manifested a sign of emerging weakness. Apparently I have been

validated!

Media

kept pontificating that due to G-R-O-W-T-H, Philippine auto sales

growth continues to rip even when the 3Q 17Q report from GTCAP showed

that sales growth of Toyota

Motor Philippines crashed during the quarter!

As

a side note, media has been totally obsessed with everything with a

Philippine tag on them. The recent crowning of Ms Universe to a

Philippine based candidate has prompted them to profusely rave over

her victory. It appears that the question

and answer segment was pivotal in delivering the crown to the

Philippine representative. The Philippine candidate seemed like the

statist exemplar of the five candidates. The winning answer; she says

that she welcomes a US military presence in the country. This was

music to the ears of the neocon and military industrial complex which

has a stranglehold over Washington!

At

the close of December, media also celebrated Rizal’s

Day or the commemoration of the death of the Philippines national

hero. Mr. Rizal was a staunch nationalist who fought and died for

independence of his homeland against Spanish colonialist. If Mr.

Rizal would be alive today, would he cheer over the victory of Ms.

Universe 2015? Or would he condemn or lambaste her for selling out

her country to imperialist? Media appears to be caught in a severe

cognitive dissonance.

For

mainstream media, it’s about any ‘feel good’ thing that sells.

Mainstream’s

Peso Babble; My 2016 Target for the USD-PHP 50, Crisis Target Over

56.45

Media

even swaggered

about how the Philippines will NEVER run out of US dollars due to

BPOs and OFWs. Media’s extremely prejudiced views or bubble

zealotry ignores Saudi Arabia or China or even global

forex reserves conditions which have been in a slump.

Add

to this myth mainstream’s

view that a weakening of the peso would be beneficial to the

economy. In 46 years or from 1959 to 2005, the USD soared from Php 2

to Php 55. Just where exactly can we find prosperity from consumption

spending or from G-R-O-W-T-H driven by a crash of the peso?

Also

if true, then hyperinflation should miraculously transform every

society from poor to rich. Yet empirical evidence or reality tells us

the opposite, the way to poverty is to crash the currency. Modern day

examples: Zimbabwe, Venezuela and Argentina.

The

USD Php closed the year at 47.06 up 5.02% from 44.72 at the close of

December 2014.

I

saw only UBS

as having accurately predicted the peso’s close at Php 47 in

2015. Congrats to them.

In

citing strong macro fundamentals, all the rest of mainstream analysts

substantially underestimated on the peso’s fall. The mainstream

spent the year revising on their outlook as the peso plumbed lower

through the year.

The

BSP forecasted

the peso at Php 43-46 range for 2015, while the Philippine

government’s Development

Budget Coordination Committee (DBCC) saw

the peso at P42-45 “based on the recommendation of the Bangko

Sentral ng Pilipinas (BSP)”.

If

these guys got the forecasting of the peso all so terribly wrong,

then why does everyone seem to think that they can accurately see

where the system’s risks are? Because they say so? Because media

and their bevy of apologists says so?

Moreover,

can government not be subjected to regulatory capture, aside from the

knowledge problem, for them to overlook on balance sheet risks? Or

how about the public working around regulations via legal loopholes?

Now

to my crystal ball.

My

crystal ball portends that the USD PHP in 2016 may hit 50 or may even

jump past 50. USD

Php

50 would be my end of the year target.

At 50, the USD PHP would translate to an annual 6.02% gain.

Should

a crisis (regional or global) surface, then the 56.45 high during

October 13, 2004 will most likely come into picture.

For the USD PHP to reach the 2004 level means that the USD will soar

by 19.95% against peso.

Let

me put a historical context on this.

When

the Asian crisis emerged in 1997, the USD Php vaulted 12.42% or from

Php 26.216 to 29.471 (average BSP data). The following year or in

1998, where crisis went in full motion, the USD skyrocketed to Php

40.893 or by a terrifying 38.76%! Thus, in two years or 1997-8, the

USD spiked by a staggering 55.98%!

Applying

the historical complex to my current projection: an emergence of a

crisis will likely send the peso past 50.

However, it may or may not hit 56.45 this year. This will largely

depend on how the

crisis evolves. Nonetheless, the USD PHP 56.45 threshold will be a

cinch to break should a regional crisis occur. The 56.45 target,

thus, represents my secondary target subject to a crisis in motion

that is not limited to an end of the year target.

And

speaking of crisis, last week billionaire crony and investing savant

George Soros has warned of the likelihood of a China triggered global

crisis

that echoes 2008 this year.

Additionally,

corporate debt downgrades in Korea, according to a report from

Forbes,

have already reached 1998 or the Asian crisis levels.

I

may miss on the timing, but in observation of the economic process, a

(global or regional) crisis seems now inevitable.

And

it’s more than just the risk of economic crisis, 2016 could likely

be the year of a major geopolitical crisis.

Technical

and Behavioral Perspective: 2015 The Transition From Overconfidence

to Doubt

Let

us look at the domestic markets from a behavioral and techical

viewpoint.

2015

was a showcase of radical changes in sentiment.

The

year started with confidence oozing from the establishment.

The

sucessful breakout from the record high set on May 2013 in mid

January led the Phisix to a string of record highs…yes 26 of them

(according to the PSE)…which climaxed at 8,127.48 last April 10

2015.

From

then, events segued from overconfidence to doubt. Sellers began to

reassert their presence as the strenght of the bulls faded. The

Phisix lurched about first by consolidation, then eventually followed

by decline.

Yet

what you see depends on where you stand. For the optimist, a pattern

of alternating returns may yet deliver the goodies for 2016. Since

2010, returns of the Phisix had rotated between outperformance to

underperformance. Nonetheless all underperformances were positive.

Still

for optimist, 2015’s deficit may yet turn out to be a staccato of

resplendence. Hence, the Philippine national elections have become

the fountain of hope for a recovery in the eyes of the mainstream.

Yet

as Alexander Pope observed

of the nature of man, hope springs eternal.

Even

so, the patterns of the rate returns suggests of a dwindling base.

2016 may end the year in positive but it would less likely in the way

that the optimist would want them. Since 2009, the rate of returns

has not only been very volatile, but importantly, these have been in

a decline (see blue trend lines)

Furthermore,

historical numbers of the rate of returns translate to little

significance in projecting future outcome/s. Reason? The myriad and

complex factors that shaped the past are fundmanetally DIFFERENT in

the future.

Although

of course, there are connections between the past and the present.

Connections that are predicated from the action-reaction feedback

mechansim of the millions of moving parts of the economy.

For

instance, a general dearth of investments will mean little income,

earnings or jobs growth in the future.

On

the other hand, overinvestments will lead to excess capacity, which

again will be a prospective drag.

Or

high price inflation (affecting all prices in the economy) will also

mean reduced profits and investments for commercial entities and

disposable income for consumers.

So

if there were fewer investments or overinvestments or high inflation

in 2014-2015 then the effects from these should be manifested today.

Understand

that economic activities signify a process. They do not emerge out of

the TV screens.

Going

back to 2015.

The

negative returns by the headline index was hardly shared by all the

sectors. Reason? Because most of the BUYING activities going into the

April record high had been concentrated to a few heavyweight issues.

So when doubt emerged, the big gains racked up by these during the

first quarter pump were merely clipped.

That’s

unlike most of the issues which were down and hardly participated

during the buying pumps even when the headline index stormed to

landmark highs.

In

particular, the general softening trend at the last half of the year

allowed the the holding and the property sectors to keep some of

their gains.

And

broken down into specifics, the distribution of returns for the

composite members of the headline index largely favored the top 10

largest market cap issues. That’s because as noted above, most of

them had been beneficiaries of targeted or concentrated buying

activities that led to April’s milestone.

So

at the close of 2015, SM’s annual return of +6.01% and AC’s

+8.93% cushioned the index from bigger losses. Both had a combined

market weight share of 16.16% at the close of the year. Yet these two

were supported at the flanks by peers: AEV (+9.96%), GTCAP (+27.91%)

and MPI (+13.04%).

Meanwhile,

SMPH almost had singlehandedly been the force behind the gains of the

property sector in 2015 with a fantastic return of 27.35%, the second

largest next to GTCAP. SMPH closed the year with a market weight

share of 6.2%

On

the other hand, stock prices of its rival, the largest property firm,

ALI, while closing the year still on a positive note with +2.23%, has

sputtered and consumed much of the enormous gains at the early year.

To

top it all for the Phisix 30, in 2015: 12 issues posted gains, 17

issues were in the red while one was unchanged.

First

Week of 2016: The Shift from Doubt to Nascent Fear; The Story of 2016

2016

has signaled a seismic shift from Doubt to Fear.

If

2015 ended with a masive swelling of doubt, the first week of 2016

has evinced that doubt has morphed into nascent

fear.

The

PSEi tailspinned by a shocking 5.42% at the first week of 2016! What

a way to greet the new year.

This

week’s massive loss ranks the third

largest since the 2013 taper tantrum. The 2013 antecedents: August 23

-5.59% and June 14 -6.86%.

In

the last week of August 2015, where the PSEi crashed by 6.7% in a

single day, the PSEi closed down by only 2.48%. This meant that the

bulls fervidly fought to recover more than half of the losses from

the August 24 meltdown.

It’s

a different character last week. Instead of a single day crash, two

sessions combined to deliver the gist (84%) of this week’s loss.

There was little signs of past aggressiveness by the bulls.

Curiously,

in the two days where the bulk of this week’s losses were accrued,

particularly on January

4 (-1.7%) and January

7 (-2.86%), foreign trade registered positive. This meant that

the stampeding sellers came from the locals.

Yet

Friday’s big net foreign selling brought upon an outflow of Php

641.34 million for the week.

Moreover,

last week’s carnage was broad based. From a sectoral performance

perspective, all sectors bled. This was led by the mining (-7.04%)

and property sectors (-6.82%).

For

the property sector, Ayala Land’s entry to the bear market with

this week’s -7.84% crash, spearheaded the property sector’s

decline.

Yet

where ALI goes, the market goes.

This can be seen from the chart of ALI (black candle) and the Phisix

(red line). ALI’s has the second largest market weight share on the

PSEi basket: 8.18% as of Friday.

And

of the 30 component issues of the Phisix, 28 posted deficits while 2

issues; GTCAP and SMC bucked the trend.

Declining

issues walloped advancing issues in all five sessions, to tally the

LARGEST ever (since I began tabulating these in 2011) margin at 366!

And

what’s even more remarkable has been the sustained shrinkage of

peso trading volume (bottom)

Average

daily volume has shrivelled to a mere Php 4.445 billion, the lowest

since January 2014.

January

4th or Monday’s 1.7% loss came with just Php 2.99 billion of peso

trades!

It

would be easy to say that last week’s volume may be due to holiday

hangover. But falling volume has been the overall

trend throughout 2015. (blue trendline)

Volume

during April’s record 8,127.48 temporarily spiked but generally

came amdist a declining trend.

Yet

volume during the first week of January 2013 and 2015 registered Php

6.5 billion and Php 10.3 billion, respectively. Hardly a holiday

issue. That’s largely because performance as seen in volume then

represented a carryover from the upswing of the closing period of the

previous year.

This

shows how the peso volume reflects on du jour investor sentiment.

January

2014’s lethargic volume came during the bottoming phase from the

May 2013 taper tantrum.

Today’s

deepening slack in volume amidst an accelerating price downtrend

simply means that buying support at current levels appear to be

losing ground…fast

In

other words not only has doubt been spreading, doubt appear to be now

accompanied by fear.

Price

actions reinforce such message.

The

two consolidation phases (blue rectangles) during the second half

eventually broke down. All these reinforces the transitional dramatic

time induced changes in the market’s psychology.

This

week’s breakdown has only underscored the shifting behavioral

dynamic balance which has been underpinning actions at the PSE.

And

as noted above, foreigners have hardly been the culprit for the

downcast mood now. Locals have began to question the viability of the

boom. If sustained, eventually headlines will exhibit the same mood

shift.

And

it’s not just the Phisix.

The

strong USD or the USD PHP (blue candle) has only highlighted their

inverse relationship: Strong USD Php translated to weak PSEi, and

alternatively, a strong PSEi extrapolated to a weak USD Php.

The

USD PHP closed this week at 47.165 up by .2%

The

peso, the Phisix and prices/yields of sovereign bonds have been

converging. Philippines financial markets appear to be in symphony.

With

this week’s close at 6,575.43, PSEi is just 73.446 points or 1.1%

from the bear market threshold at 6,501.48 or 6,500.

And

as remindeder: bear

markets in stocks have hardly been an isolated phenomenon too. By

isolated this means ramifications of bear markets will be manifested

on real economic activities, and will likewise have social-political

consequences.

Even

those brazen price fixing actions will have consequences.

This

will be the story of 2016.

Will

History Rhyme? Will 1979 Serve as Template for Seven Years of Famine?

Will

history rhyme?

Remember

this?

In

September 2014, I transposed the generational highs of the previous

market tops into the May 2013 levels to get their contemporary “high”

equivalent.

Then

I wrote6:

The

two generational or secular highs (1969-79 and 1994-97) during the

topping process showed how previous highs had been exceeded. The

cyclical top of 2007 likewise reveals of the same dynamic but at a

more muted dimension.

As

I have been saying the issue is about financial instability rather

than of reaching specific price levels. The two generational/secular

stock market bubble cycles did not only result to a stock market

crash but metastasized into financial crises.

The

cyclical top of 2007 only resulted to a stock market crash but not to

an economic event. But the 2007 top which has been a cyclical

phenomenon has connected with current developments from which

originated in 2003. 2003-2014 marks the secular bull market to the

topping phase.

In

the economic context, 2014 has been associated with 2007 because the

policies implemented then (automatic stabilizers) to forestall a

recession on the formal economy and the ensuing shift to aggregate

demand (monetary easing) paved way for both the 7,400s of 2013 and

2014 undergirded by the property and property related bubbles.

In

short, the higher the price levels, the greater the financial

instability.

Eerily,

the first row seem to have resonated with this year’s milestone

record at 8,127.48 last April

Will

history rhyme with 1979 as template, where the Phisix may fall by

80%?

Will

there be seven years of famine after 7 years of plenty (Genesis

41)? It took about 7 years for the secular stock market crashes

of 1979 and 1997 to bottom out.

___

1

Viktor

E. Frankl Man's

Search for Meaning AN INTRODUCTION TO LOGOTHERAPY, Beacon Press

p.33, http://ir.nmu.org.ua/

2

Mark

Howards, The

Risks Today Are Substantial Finanz and Wircshaft December 28,

2015

3

See

Phisix

at Record 7,400: Be Fearful When Others Are Greedy January 12,

2015

4

See

Phisix

6750: Update on the Seven Reasons Why the PSEi is Headed South! Why

The Popular Clamor for a Strongman Rule is a Bubble December 14,

2015

5

Adolf

Hitler, Mein

Kampf p 156 greatwar.nl