History will not be kind

to central bankers fixated on financial economy and who created serial

speculative booms to sustain the illusion of prosperity. It will also be

critical of governments unwilling to address weaknesses, who deflected shifting

hard policymaking to independent, unelected and largely unaccountable central

banks—Satyajit Das

In this issue

PSE Craters as

Financials’ Share of the PSEi 30 Hits All-Time Highs; A Growing Mismatch

Between Financial Index Performance and Bank Fundamentals

I. PSEi 30 Craters on

Signs of Re-Tightening Amid Rising Dollar and Higher UST Yields

II. Despite the Market

Carnage: Financials Share of the PSEi 30 Zoom to All-time High!

III. Financialization:

The Expanding Role of Banks in Achieving Political Goals

IV. "National Team?"

In Q2, Other Financials Corporations Sold, the PSEi 30 Plunged

V. In Q3, Mismatch Between

Financial Index-Bank Fundamentals Reached a Blow-off Phase!

VI. Worsening Bank

Liquidity Conditions as Cash-to-Deposits Hit Milestone Low

VII. Liquidity and

Collateral Crunch? Bank Borrowings, Focused on Bills, Zoomed to Record Highs in

September, as Repos also Hit All-time Highs!

VIII. Despite Lower

Rates Held to Maturity Assets Near All-time Highs, Record Bank QE

IX. A Snapshot of Q3 and

9-Month Performance of PSE Listed Banks

X. Highlights, Summary

and Conclusion

PSE Craters as

Financials’ Share of the PSEi 30 Hits All-Time Highs; A Growing Mismatch

Between Financial Index Performance and Bank Fundamentals

Even as the PSEi plummeted due to signs of

global and local re-tightening, the Financials outperformed, widening the

mismatch between share prices and fundamentals. Will a reckoning come soon?

I. PSEi 30 Craters on

Signs of Re-Tightening Amid Rising Dollar and Higher UST Yields"

Figure 1The Sage of Omaha, Warren Buffett, once said,

"Only when the tide goes out do you discover who's been swimming

naked."

Have the signs of tightening upended the

dream of easy money’s "goldilocks" economy, or have they exposed

those who have been "swimming naked?"

The surging US dollar index, coupled with

rising 10-year Treasury yields—both largely attributed to Trump's policies— has

sent global risk assets tumbling. Yet, these developments took shape two months

before the US elections. (Figure 1, topmost graph)

This includes the Philippine PSEi 30, which

plunged by 4.31%, marking its largest weekly decline in 2024 and the steepest

drop since the week of September 30, 2022, when it fell by 8.3%.

As of Thursday, November 14, the headline

index broke below the 6,600 level, closing at 6,557.09.

A notable oversold rebound in industrials,

led by Meralco (up by 7.78%) and Monde (up by 7.52%), along with financials

from BPI (up by 3.7%) and CBC (up by 4.58%), contributed to a low-volume rally

of 1.82% on Friday.

Year-to-date, the PSEi 30 is struggling to

maintain its narrowing return of 3.5%.

II. Despite the Market

Carnage: Financials Share of the PSEi 30 Zoom to All-time High!

The Financial Index, down by only 1.86%, was

the least affected in this week’s market carnage. BPI was the only member of

the PSEi 30 component to withstand the foreign-driven selloff, while Jollibee

ended the week unchanged. (Figure 1, middle pane)

Interestingly, this outperformance has

propelled the aggregate free-float market capitalization weighting of the three

major banks of the headline index to an all-time high. (Figure 1, lowest chart)

Figure 2

Furthermore, financials accounted for 41.7%

of the mainboard's volume on Friday—the third-highest share since October. (Figure

2, topmost diagram)

Meanwhile, October’s cumulative 29.92% accounts

for the sector’s highest share since July 2023, which also translates to a 2017

high.

In a related note, the Bangko Sentral ng

Pilipinas (BSP) has suspended

its free publication of non-BSP-generated data, including PSE data on

monthly price-earnings ratios (PER), market capitalization by sector, index

data, and volume distribution by sector. This suspension hampers our ability to

track critical developments in market internals. (Yes, I wrote them)

The point being, the increasing share of

mainboard volume by the financial sector has pillared the rising share of the

sector’s market cap share of the PSEi 30.

However, this dynamic also implies growing

concentration risk in the stock market.

III. Financialization:

The Expanding Role of Banks in Achieving Political Goals

Businessworld, November 13: THE

PHILIPPINE banking system’s net profit jumped by 6.4% at end-September as both

net interest and non-interest income grew, data from the Bangko Sentral ng

Pilipinas (BSP) showed. The combined net income of the banking industry rose to

P290 billion in the first nine months of 2024 from P272.6 billion in the same

period a year ago.

The PHP 290 billion profit and a 6.4% growth

rate represent the Q3 figures year-over-year (YoY).

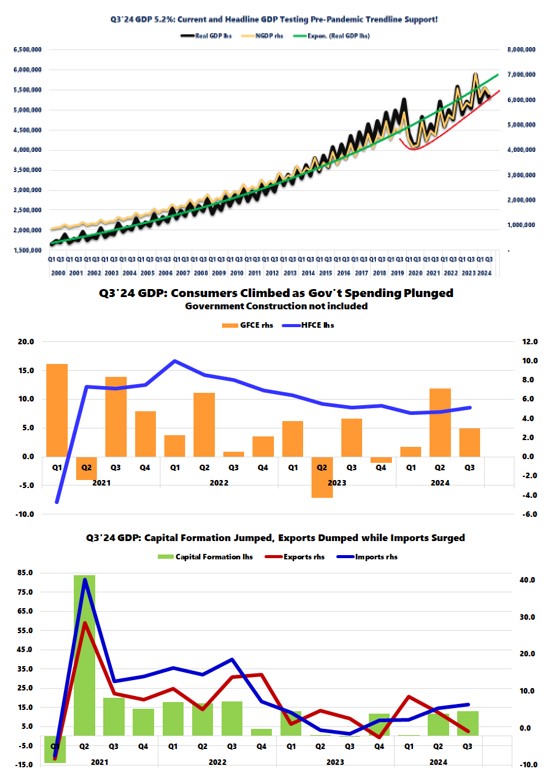

Continuing from last week’s discussion, the

diverging dynamics in the Philippine Stock Exchange (PSE) have also been

reflected in the GDP figures.

Although the financial sector has been on an

upward trajectory since the new millennium, its share of the real GDP has

rapidly deepened during the BSP’s historic rescue of the sector.

This was notably influenced by the BSP

historic intervention to rescue the sector, which included an unprecedented PHP

2.3 trillion quantitative easing package, historic cuts in official and reserve

ratios, as well as unparalleled subsidies and relief measures.

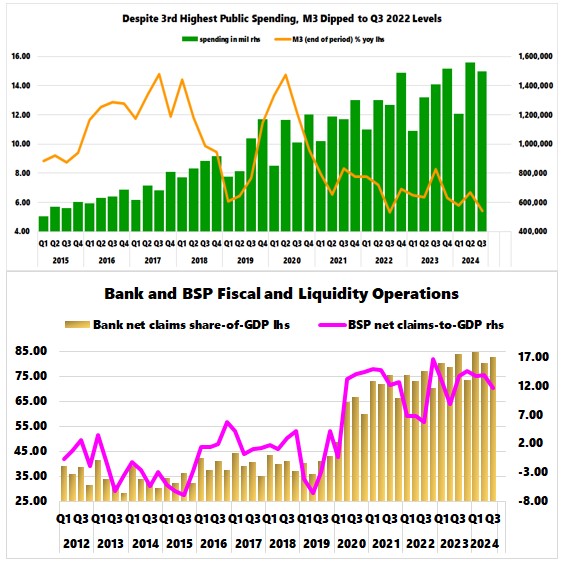

In line with the rising share of money supply-to-GDP,

the financial sector's share of GDP reached its third highest level at 10.8% in

Q3. (Figure 2, middle image)

It even hit an all-time high of 10.9% when

considering the 9-month real GDP data.

While this evolution may be labeled as

"financialization," the essential message is clear: BSP policies

have led to an economy increasingly immersed (or heavily reliant) in credit and

liquidity, primarily channeled through an elite-owned and controlled banking

system.

This deepening dependence comes at the

expense of the development of other competing financial conduits, such as

capital markets.

The underlying reason for this is

political: the bank-led financial sector serves as the primary non-BSP

financier of the government’s deficit spending.

As a result, the government's calls

for improvements in the capital markets appear to be mere lip service.

However, judging by their "demonstrated

preference" in policy choices, it appears that inflating bank shares

may serve to camouflage the adverse consequences of this deepening and complex

political-economic arrangement.

IV. "National Team?"

In Q2, Other Financials Corporations Sold, the PSEi 30 Plunged

The developments in Other Financial

Corporations (OFCs) provide valuable insights.

In Q2, OFCs eased their holdings of equities.

According to the BSP,

"The other financial corporations’ claims on the other sectors dropped as

their holdings of equity shares issued by other nonfinancial corporations

fell."

The Non-bank financial institutions and OFCs "includes

the private and public insurance companies, other financial institutions that

are either affiliates or subsidiaries of the banks that are supervised by the

BSP (i.e., investment houses, financing companies, credit card companies,

securities dealer/broker and trust institutions), pawnshops, government

financial institutions and the rest of private other financial institutions

(not regulated by the BSP) that are supervised by the Securities and Exchange

Commission (SEC)" (Armas, 2014)

In the same quarter, OFC

claims on the private sector decreased by 0.5% quarter-over-quarter (QoQ),

while the PSEi 30 index plunged by 7.1%. (Figure 2, lowest visual)

My guess is that some of these OFCs are part

of what could be considered the Philippine version of the "national

team."

V. In Q3, Mismatch Between

Financial Index-Bank Fundamentals Reached a Blow-off Phase!

Nevertheless, the deviation between the

fundamentals of banks and their share prices has reached "blow-off"

proportions!

Figure 3

In Q3, the banking system reported a modest

growth of 6.4%, slightly higher than Q2’s 4.1%. However, the financial index

skyrocketed by 19.4% quarter-over-quarter (QoQ).

From another angle, 9-month profit growth was

up by 5.07%, even as the financial index surged by a stunning 23.4%

year-on-year in Q3.

Worst of all, profit trends and the financial

index have moved in opposite directions.

Since profit growth peaked in Q3 2022 and

subsequently eased, shares of the seven-member bank stocks (excluding the

eighth member: PSE) within the financial index have continued to accelerate. (Figure

3, topmost window)

Meanwhile, given that universal and

commercial banks account for 93.9% of total bank assets, their profit growth

largely mirrors the entire banking system. In Q3, profit growth was 7.03%, and

on a 9-month basis, it stood at 6%.

These figures underscore the increasing

monopolization of the financial industry by banks validated by the BSP’s Total

Financial Resources (TFR) data.

Total

financial resources grew by 10.07% to a record PHP 33.08 trillion.

The banking sector’s share surged to an

all-time high of 83.3%, driven mainly by universal and commercial banks, whose

contribution reached a record 78.1%. (Figure 3, middle image)

So let us get this straight: banks have

increased their share of trading activities in the PSE, as well as their slice

of both the PSEi 30 and the GDP pie. They now command 83.3% of total

financial resources and are continuing to rise.

This dominance doesn’t even account for their

substantial role in the local bond markets, where they act as issuers,

intermediaries, and holders.

Even without the BSP acknowledging

this, what we are witnessing is the intensifying risks within the Philippine

financial-economic system.

VI. Worsening Bank

Liquidity Conditions as Cash-to-Deposits Hit Milestone Low

Have you ever seen any experts or

establishment analysts address the developing contradiction between the banks'

reported profits and their liquidity conditions?

Cash

and due from banks, or bank cash reserves, plummeted by 13.6% in September

2024, following a brief 4% rebound in August. This decline brought cash

reserves to their lowest level since 2019. (Figure 3, lowest graph)

To address the emerging liquidity shortfall,

the BSP previously reduced the bank

reserve requirement ratio (RRR) from 19% to 14%, implemented

in seven installments from March 2018 to December 2019.

Cash reserves saw a temporary spike in 2020

when the BSP injected Php 2.3 trillion into the system, accompanied by an RRR

cut from 14% to 12% in April 2020.

However, facing diminishing returns, cash

reserves resumed their downward trend.

Once again, doing the same thing and

expecting different results, the BSP reduced the RRR by a larger margin

than in 2020, lowering it from 12% to 9.5% in June 2023.

Despite these efforts, the challenges within

the banking system's cash reserve position have persisted.

Figure 4Moreover, while the growth in peso deposit

rates increased from 6.9% in August to 7.07% in September—the slowest growth

rate since July 2023—the BSP’s cash-to-deposit

ratio plummeted to 12.44%, its lowest ratio since at least 2013! (Figure 4, topmost

and second to the highest graphs)

Yet, with the record bank credit

expansion, why the sluggish growth in deposits? Where did the money flow into?

Even with the recent decline in inflation

rates, have a minority of "banked" households continue to draw from

their savings?

Furthermore, the banks' liquid

asset-to-deposit ratio, which includes both cash reserves and financial assets,

fell to 50.34%, reverting to levels seen during the BSP's rescue efforts in

July 2020.

Incredible.

And this is just one facet of the mounting

liquidity challenges that banks seem to be facing.

VII. Liquidity and

Collateral Crunch? Bank Borrowings, Focused on Bills, Zoomed to Record Highs in

September, as Repos also Hit All-time Highs!

More eye-catching data emerged last

September.

Bank borrowings—primarily in

short-term bills—skyrocketed to an all-time high! Borrowings surged by

49.7%, reaching a record PHP 1.7 trillion, with their share of total

liabilities climbing to 7.3%, the highest since 2021. (Figure 4, second to the

lowest and lowest charts)

The liquidity shortfall is most pronounced

over the short-term, this is why bank’s bills payable zoomed to unscaled

heights.

Figure 5

Not only that, bank short-term repo

(repurchase agreements) or RRP (reverse repurchase) operations with the BSP and

other banks have also launched into the stratosphere!

With record repo operations, the RRP’s 3.72%

share of the bank’s total assets surged to the highest level since at least

2015! (Figure 5, upper image)

Could this rampant use of repurchase

agreements (repos) be underlying growing collateral issues in the financial

system? As banks increasingly depend on repos for short-term liquidity, are

we witnessing a decline in the quality of collateral or a shortage of

high-quality assets available for these transactions?

These developments likely explain the BSP's

abrupt announcement of the latest series of RRR cuts, which took

effect last October.

However, such actions resemble a Hail Mary

pass, with RRR ratios now headed toward zero.

VIII. Despite Lower

Rates Held to Maturity Assets Near All-time Highs, Record Bank QE

Another paradox: banks reported that credit

delinquencies—across the board—marginally declined in September. (Figure 5,

lower diagram)

If this is true, then higher profits

combined with lower non-performing loans (NPLs) should result in more,

not less liquidity

Figure 6Additionally, the easing of interest rates,

as indicated by declining treasury yields, should have reduced banks'

held-to-maturity (HTM) assets. As noted repeatedly, HTM assets drain liquidity

because they lock up funds. (Figure 6, topmost graph)

Yet, there hasn’t been significant

improvement in this area.

Moreover, since authorities aim to meet

year-end spending targets, boost GDP, and finance the upcoming elections, it is

expected that the government will ramp up its deficit spending in Q4.

This increase in public spending will

likely lead to a rise in banks' and the financial sector’s net

claims on central government (NCoCG), which may translate to higher

HTM assets. (Figure 6, middle chart)

Furthermore, if the current trend of

declining inflation reverses, or we experience a third wave of rising

inflation, banks might resort to accounting maneuvers to shield themselves from

potential mark-to-market losses by shifting these assets into HTMs.

That is to say, increases in

debt-financed government spending and rising inflation rates could therefore

result in higher levels of HTM assets.

Above all, banks are not standalone

institutions; they have deep exposure to counterparties. As noted last week,

Led by banks, the

financial sector is the most interconnected with the local economy. Its health

is contingent or dependent upon the activities of its non-

financial

counterparties.

Alternatively, the

sector’s outgrowth relies on political subsidies and is

subject to diminishing returns.

Yet ultimately,

this should reflect on its core operational fundamentals of lending and

investing. (Prudent Investor, October 2024)

The transformational shift in the banking

system’s business model—from production and consumption—could be ominous.

Part of this shift has been motivated by pandemic-era subsidies and relief

measures, as well as a move away from unproductive industry loans.

As a result, the consumer share of total bank

loans (excluding real estate) reached an all-time high of 14.9% in September

2024, while the share of production loans declined to 82.7%. The remaining 2.4%

comes from non-resident loans. (Figure 6, lowest image)

Banks have embraced the government’s

belief that spending drives the economy, neglecting the balance sheet health of

individuals, as well as the potential misallocations as a result of

artificially low rates.

But what happens to the consumer

economy once their balance sheets have been tapped out?

This should not surprise to our readers,

given that the "inverted belly" of the Treasury yield curve has

already been signaling these concerns.

IX. A Snapshot of Q3 and

9-Month Performance of PSE Listed Banks

Finally, here is a snapshot of the micro

aspects of the financials.

Table 7The performance of PSE-listed banks indicates

that while all-bank profits grew by 14% to Php 226 billion in the first nine

months of 2024, bills payable jumped by 79%, or Php 579 billion, reaching Php

1.31 trillion. This increase in bills payable signifies more than double the

net profits generated over the same period. The data excludes the small-scale

Citystate Savings Bank [PSE: CSB]. [Table 7]

PSEi banks accounted for 84% of the

nine-month increase in bills, relative to their 73% share of net income growth.

Metrobank [PSE: MBT] represented the most aggressive borrower, with a 61%

share.

We have yet to reconcile the stark divergence

between the reported BSP bank performance and the aggregate activities of

listed firms.

Nonetheless, through aggressive lending,

banks boosted their top and bottom lines in Q3, positively impacting the

nine-month performance.

Fueled by a 29.7% growth in non-PSEi banks,

the net income growth of all banks soared by 22%.

X. Highlights, Summary

and Conclusion

In the end, we can summarize the banking sector

as having the following attributes: (as of September or Q3)

1. all-time highs in:

-Financial Index

-market cap share of the PSEi 30 (3 biggest

banks)

-turnover of financial sector to mainboard volume

(near)

-nominal or Philippine peso and % share of

total financial resources

-nominal net claims on central government

-nominal Held-to-Maturity assets

-total bank lending in Philippine pesos

-percentage share of consumer bank lending

-nominal bank borrowing (mainly Bills)

-nominal repo operations

- nominal net financial assets

2. Historical lows in:

-cash-to-deposits

-production pie of total bank lending

-reserve requirement ratio

3. Declining trend in:

-cash reserves

-profit growth

-deposit growth

-liquid asset-to-deposit ratio

How is it that the supposedly

"profitable" financial institutions, supported by the recent slowdown

in non-performing loans, have been accompanied by sustained declines in

deposit and savings rates, as well as a massive hemorrhage in liquidity

that compelled them to rapidly access short-term financing via bills and repos?

Have profits been overstated? Have

NPLs been understated?

To what extent have the BSP’s relief

measures and subsidies caused distortions in banks’ reporting of their health

conditions?

Why the flagrant disconnect between

stock prices and the actual conditions of the banks?

Could the "national team" have been

tasked with camouflaging recent developments through a panicked pumping of the

sector’s shares?

Does the ongoing shortfall in

liquidity portend higher rates ahead?

Given all these factors, what could possibly

go wrong?

As we recently pointed out,

To be clear, we

aren’t suggesting that CBC and other record-setting bank shares, such as BPI,

are a simulacrum of Lehman; rather, we are pointing to the distortive

behavior of speculative derbies that may hide impending problems in the sector.

(Prudent Investor, October 2024)

____

References

Satyajit Das, Central

banks: The legacy of monetary mandarins, New

Indian Express, November 15, 2024

Jean Christine A. Armas, Other

Financial Corporations Survey (OFCS): Framework, Policy Implications and

Preliminary Groundwork, BSP-Economic Newsletter, July-August 2014, bsp.gov.ph

Prudent Investor, Q3

2024 5.2% GDP: Consumers Struggle Amid Financial Loosening, PSEi 30 Deviates

from the GDP’s Trajectory, November 10, 2024

Prudent Investor, Important

Insights from the Philippine PSEi 30’s Melt-Up! October 7, 2024